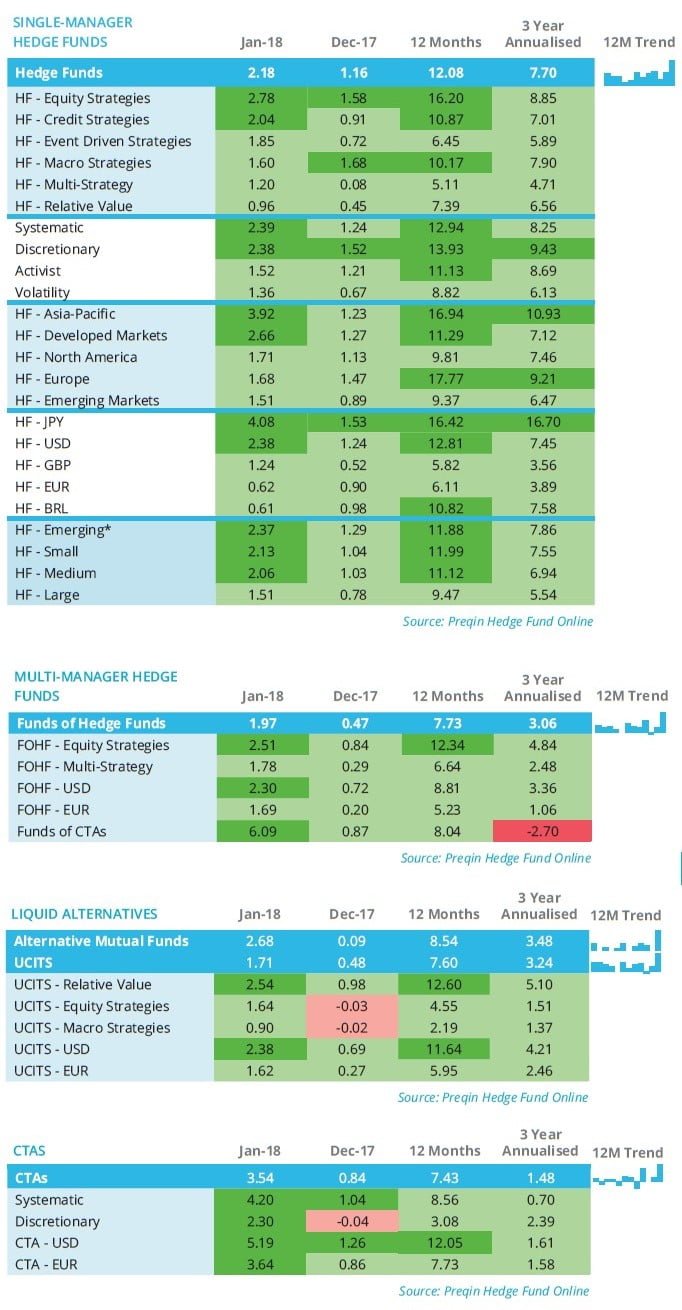

The Preqin All-Strategies Hedge Fund benchmark generated returns of 2.18% in January – the strongest start to a calendar year since 2013. All leading strategies and regions posted positive performance for the month, the sixteenth consecutive one in which the industry has recorded overall gains.

- The Preqin All-Strategies Hedge Fund benchmark generated 2.18% in January. This is the strongest start to a calender year since 2013 (+3.49%) and the highest return in a single calendar month since July 2016 (+2.24%). All top level strategies, trading styles, and geographical focuses posted positive monthly returns, demonstrating a superb month for hedge funds.

- Equity strategies continued to lead the pack in January (+2.78%) taking the 12 month return of the strategy to 16.20%, significantly outstripping that of other top level strategies by over five percentage points.

- Hedge funds with a focus on emerging markets also posted strong returns (+3.92%), and adding 10.93% on 3-year annualised return basis.

- Emerging hedge funds (less than $100mn) added 2.37% in January. This is the benchmark’s 23rd consecutive positive month and their best return in the last 5 years.

Article by Preqin