The first month of 2018 saw a strong start for emerging-market equities overall amid a generally solid fundamental backdrop. Stephen Dover, Franklin Templeton’s head of equities, and Chetan Sehgal, director of portfolio management with Templeton Emerging Markets Group, present an overview of emerging-market developments in January, including some events, milestones and data points to offer perspective.

[REITs]Three Things We’re Thinking about Today

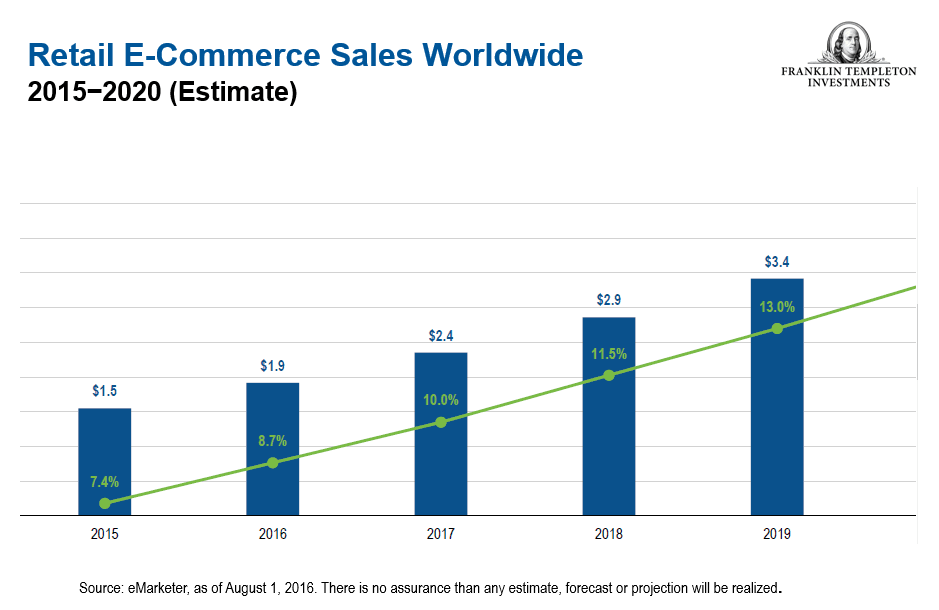

- Information technology (IT) has been reshaping the global economy. One interesting area is e-commerce, which we view as a penetration growth story, as consumers increasingly use multiple devices for online shopping. We favor leading e-retailers as we believe they can gain dominant market share. Traditional ways of doing business are losing ground to the digital revolution, which has introduced innovative ways to improve a shopper’s experience. One way is to employ big data to enhance personalized recommendations for better click-through rates and monetization. Another innovation is integrating online and offline retail models to fully capture consumer data and improve sell-through rates.

- Brazil’s federal court upheld ex-president Luiz Inacio Lula da Silva’s corruption conviction and extended his sentence in late January. Although Lula could appeal the decision, the verdict has changed the country’s presidential election outlook as Lula may be ineligible if he tries to register his candidacy for the October elections. The court’s decision reinforces our view that a pro-market candidate may be elected as the next president, potentially resulting in continued reforms and a supportive business environment. We are positive on the possibilities in Brazil given the continued emphasis on reform.

- Notwithstanding the United States’ exit from the Trans-Pacific Partnership last year, the 11 remaining members (Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam) revived the agreement. Signaling commitment toward greater trade liberalization and regional integration, the new pact, known as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), should be signed in March. Without the United States, the deal may have a reduced impact, but it should still offer significant benefits for its members, including deeper economic ties, growth in exports and a reduction in trade barriers.

Outlook

We expect the global economic environment to remain favorable, driven by pro-business policies, increased investment, high liquidity and emerging-market (EM) growth. The International Monetary Fund raised its global gross domestic product (GDP) growth forecasts for 2018 and 2019 from 3.7% to 3.9%, in part due to improving growth in the US economy and continued solid expansion in China.1 Earnings growth, fund inflows and a rebound in commodity prices also bode well for some emerging markets.

Key areas of risk include uncertainty about the US administration’s policies, as well as the ability of China to continue its growth while making structural adjustments. US monetary policy shifts also remain a source of apprehension for many market participants. There may be volatility ahead, but many emerging markets have stronger reserve positions and lower external debt today than historically, which makes them less vulnerable to external shocks. Moreover, emerging countries each have their own idiosyncratic domestic drivers and hence are less correlated to one another and the global market as a whole.

Looking ahead, our core themes of IT and consumerism remain, and we continue to identify opportunities within these areas. We believe that we are still in the early innings of the emerging-market earnings growth upturn, and that valuations and sentiment continue to be conducive to further gains in emerging markets.

Emerging Markets Key Trends and Developments

Global equity markets remained on an upward trend in January, despite some volatility late in the month. Investor sentiment for most of the month was positive, amid continued signs of global economic growth and strong corporate earnings. Emerging-market equities enjoyed a strong start to the year as they gained pace in January and outperformed developed-market stocks. The MSCI Emerging Markets Index returned 8.3%, compared with a 5.3% gain in the MSCI World Index, both in US dollars.2 Strong fund inflows, stronger emerging-market currencies and higher commodity prices continued to drive returns in emerging-market equities.

The Most Important Moves in Emerging Markets in January

Asian equities rose in January but trailed emerging markets as a whole. Thailand, China and Pakistan were among the top performers in the region. In Thailand, the finance ministry raised its 2018 economic growth forecast on the back of a brighter outlook for exports. China gained as its economy grew faster than expected in the fourth quarter and expanded 6.9% in 2017, marking its first annual acceleration in seven years. Indonesia, India and South Korea, however, lagged their peers, while the Philippines finished lower largely due to depreciation in the peso against the US dollar.

Latin America was the best-performing EM region in January driven by a supportive global environment, higher commodity prices and stronger regional currencies. The Brazilian market ended the month with a double-digit return on easing political uncertainty following the Federal Court’s decision to uphold ex-president Lula’s conviction and encouraging macroeconomic data. Higher oil prices further supported outperformance in Colombia, while encouraging fourth-quarter GDP growth buoyed Mexican equities.

In Europe, the Russian market, largely driven by higher oil prices and a strong ruble, led EM performances in Europe. The Greek market also rallied as the parliament approved a package of fiscal, labor and energy reforms, ahead of Greece’s final review under the current bailout program. Turkey, despite recording positive returns, lagged its EM peers in January.

In Africa, despite the continuation of equity inflows following the victory of a more market-friendly candidate as leader of the ruling African National Congress, South Africa was among the weakest EM markets in January. Equity prices in Egypt bucked the trend, recording a decline amid mixed economic news—officials raised their GDP growth forecast for the current fiscal year but also flagged a potential widening of the budget deficit.

Frontier markets underperformed their EM counterparts over the month. Returns within the frontier-market spectrum varied, with Romania, Nigeria, Kazakhstan and Vietnam notable performers, ending January with double-digit gains. Foreign and domestic investor interest continued to support the Vietnamese market, which reached a record high during the month. In contrast, equities in Argentina were pressured by increased inflationary pressures and a depreciation of the local currency.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

The comments, opinions and analyses expressed herein are solely the views of the author(s), are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Important Legal Information

All investments involve risks, including the possible loss of principal. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging markets, of which frontier markets are a subset, involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Because these frameworks are typically even less developed in frontier markets, as well as various factors including the increased potential for extreme price volatility, illiquidity, trade barriers and exchange controls, the risks associated with emerging markets are magnified in frontier markets. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.

______________________________________________________

- Source: IMF January 2018 World Economic Outlook Update. There is no assurance that any estimate, forecast or projection will be realized.

- Source: MSCI. The MSCI Emerging Markets Index captures large- and mid-cap representation across 24 emerging-market countries. The MSCI World Index captures large- and mid-cap performance across 23 developed markets. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenses or sales charges. Past performance is not a guarantee of future results.

Article by Franklin Templeton Investments