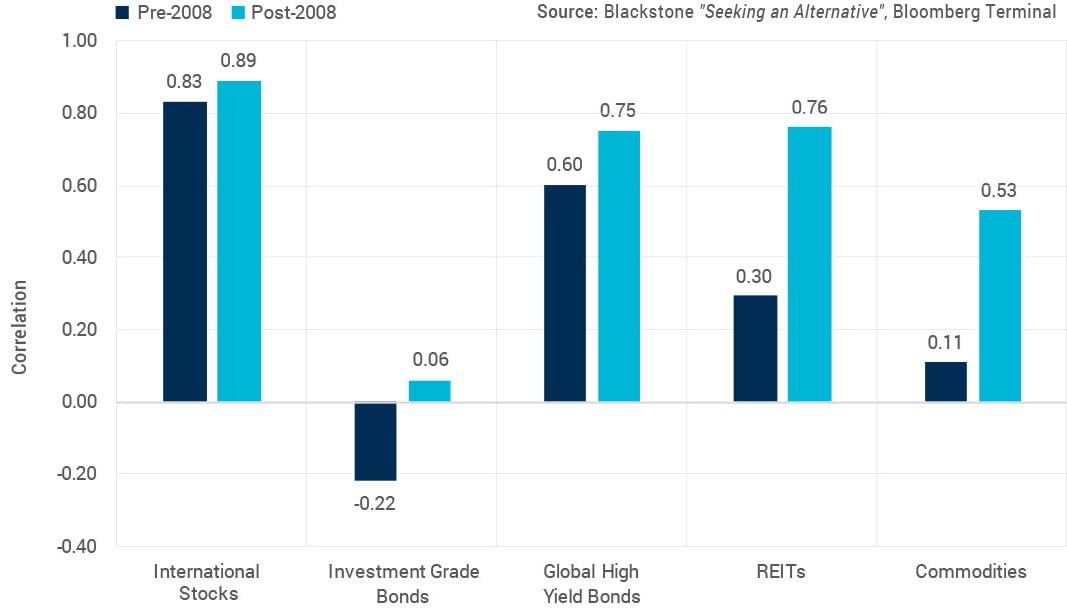

5 out of 6 Have Grown More Correlated to the U.S. stock market

In a post-Financial Crisis world, it is important for investors to carry non-correlated assets in their portfolios. By adding investments that don’t move in tandem with the stock market, investors can diversify returns and limit exposure to drawdowns.

[REITs]That diversification role typically falls to five asset classes: investment grade bonds, global high-yield bonds, international stocks, REITs or commodities. Historically, these assets were a relatively safe bet to reduce correlation to the U.S. stock market and earn a reasonable rate of return.

But something happened after 2008.

As you can see, these asset classes saw their relationship with U.S. stocks grow much tighter following the Financial Crisis.

This is a worrying development for investors seeking to diversify away from U.S. stocks because it leaves fewer shelters if the stock market were to stumble.

Bulls party on

Investors’ attention is understandably elsewhere, as U.S. stocks are on the second-longest bull market run of 107 months. They may even surpass the longest bull market of 117 months.

And for the first time, the S&P 500 finished the year without a single down month.

It may seem counterintuitive, but the bull market run makes the need for non-correlated assets even more acute. As stocks march higher, investors may find their portfolios contain a much higher allocation to stocks than intended. This can leave wealth exposed to a drawdown that is more damaging than expected.

Simply rebalancing at least once per year can help mitigate this risk by returning the portfolio to its original allocation. Investors can further reduce risk by creating a static allocation to non-correlated assets. But as we saw above, there are few attractive options beyond investment-grade bonds.

Opportunity to diversify

For investors seeking to diversify their U.S. stock exposure, consider adding managed futures as part of a diversified portfolio. If we add managed futures into the chart above, we find these strategies retain their pre-2008, non-correlated posture through the Financial Crisis to present day.

With 10 months to go before we see a new bull market record, now may be the time to consider adding non-correlated assets to your portfolio.

Article by Alex Clark, Longboard Funds