Our DTO short is now working nicely. Yes, I was “early” again but I;ll admit I have no problem being early when I right in the end. Inventory is falling fast…..prices have more upside

[REITs]“Davidson” submits:

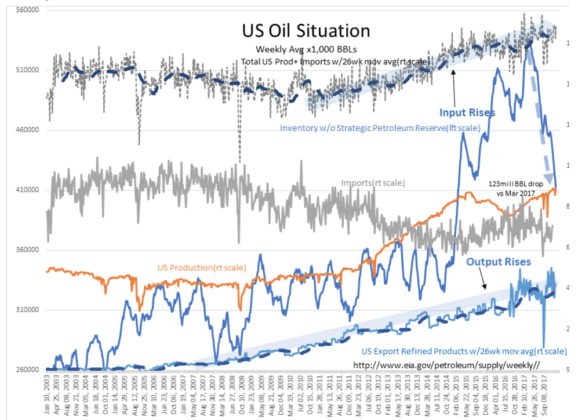

6.8mil BBL drop in US Crude, shut down for spring catalyst/maintenance looms. Total drop in US Crude from peak Mar 2017 123mil BBL-Interesting in the least!!

Article by ValuePlays