It is not uncommon for acquirers to suffer short to medium term underperformance after an M&A deal completes. Blinded by lofty goals of capturing greater market share, accessing wider market reach, expanding business range and more, acquirers often overpay for their targets. In more cases than you might think, acquirers fail to take into account the full cost of the many organisational and market frictions that need to be overcome before even nearing profit-making territory on the deal.

Savvy shareholders know this tale all- too-well and vote with their investment dollars. The slightest hint that the acquirer hasn’t got a firm hold of operations can send shareholder faith levels lower and acquirer share prices falling.

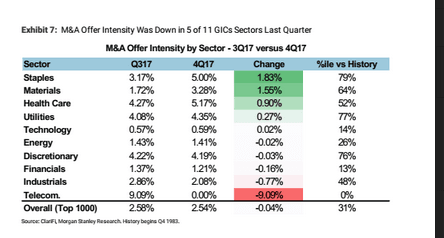

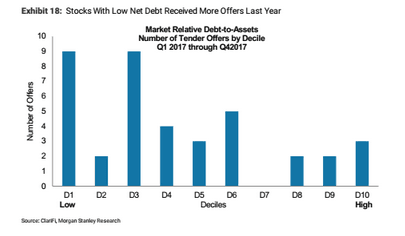

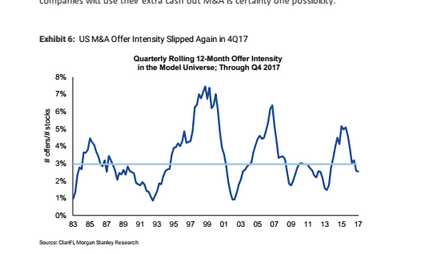

2017 was a year when this short- term souring was particularly prominent in M&A - with acquirers underperforming 2-3 months after announcements and M&A activity plummeting to half of mid-2016 levels. Recent Morgan Stanley research demonstrates that investors were not put off by any identifiable bias or risk exposure from acquirers – rather they placed their money where they felt they had greater reassurances, with cash heavy companies and those investing in R&D. 1

Will 2018 fare any better?

Tax Policy – Dual Front

With the start of the Trump presidency last year, tax policy remained a significant uncertainty in M&A deal structuring. The recently launched tax reform has alleviated this uncertainty factor and this could lead to a pick up in M&A activity. Further to this, the reduced tax burden frees up company cash that could be repatriated into new ventures, also potentially leading to an increased amount of M&A activity. However, investors chose to invest in cash heavy companies in 2017 over dividend paying stocks – with the MS research indicating that investors preferred companies with lower capex-to-sales ratios over growth stocks. 1 This might suggest that companies will refrain from otherwise attractive M&A activity to keep on side with investors.

M&A Forecasts

Given the mix of factors at play, quantitative backtesting from Morgan Stanley forecasts that European stocks with a market capitalisation exceeding 4 Billion USD are the most likely to receive an offer in the next 12 months – based on a combination of fundamental and sector level factors. Meanwhile in the US, Health Care & Consumer names are the most likely to receive an offer in the next 12 months - which will come as little surprise with health care stocks historically performing well as M&A stalwarts. 1

Will 2018 Continue along the Contrarian?

The micro and macro factors pointed to strong M&A activity in 2017. Improved global economic growth and upward, low volatility, equity market performance are key factors that we would sensibly expect to induce increased M&A activity. On top of this, cash balances at companies are high – and offer the potential to unlock opportunities through acquisition-based investment. While there are favourable fiscal conditions materialising, we have to remember that keeping investors happy is likely to remain at the top of the agenda for most companies. This might mean deferring attractive takeover prospects in 2018 despite improving conditions.

1Morgan Stanley, Quantitative Equity Research, Jan 24th, 2018, Will Tax Reform Drive a Rebound in M&A Activity?