DoubleLine Commodities webcast slides, titled, “”Commodity Game Plan For 2018″.”

[REITs]TAB I – Macroeconomic Environment

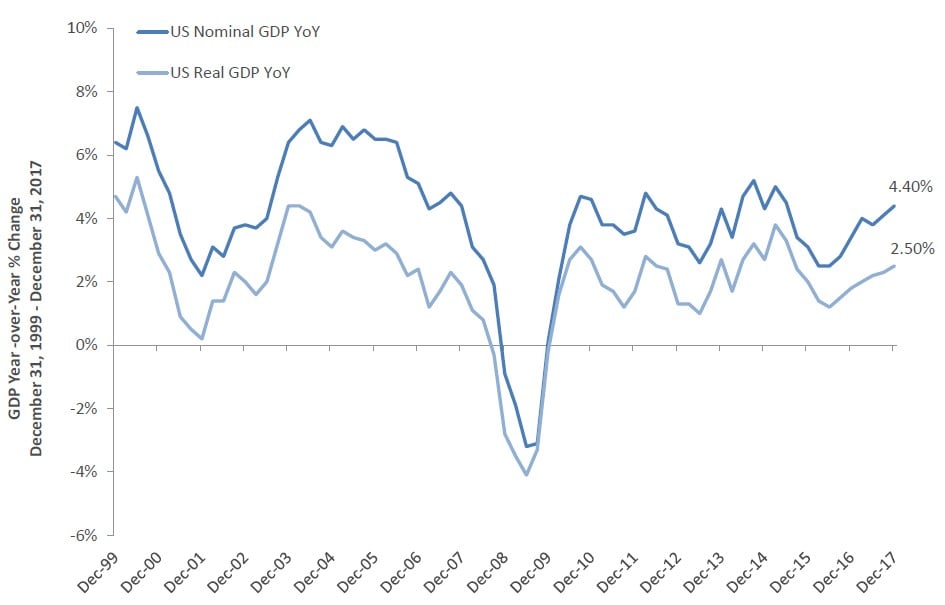

U.S. GDP Accelerating

Source: Bloomberg, DoubleLine

GDP = gross domestic product, YoY = year-over-year

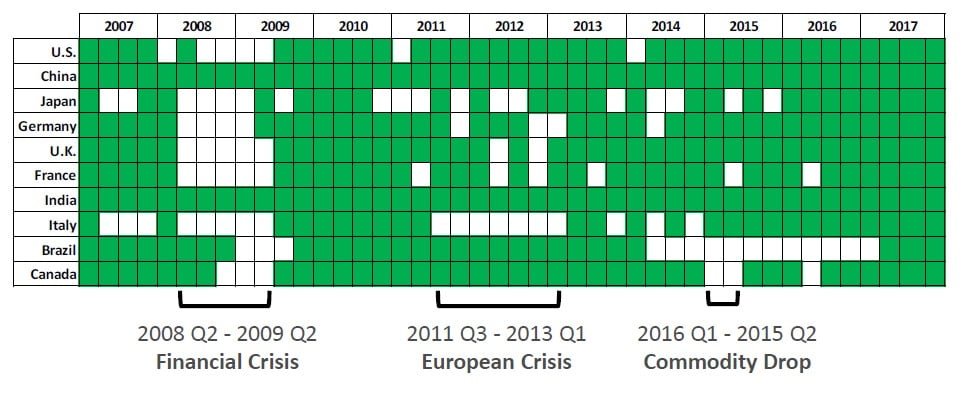

World Growth in Sync

Please see appendix descriptions for further definitions.

Green means positive quarter-over-quarter growth, 4Q2017 = Bloomberg consensus forecast.

Source: DoubleLine, Haver Analytics, Barclays Research

2017 Global Manufacturing PMI Heatmap

Source: Bloomberg, DoubleLine

PMI = Purchase Managers Index is an indicator of the economic health of the manufacturing sector. The PMI is based on five majorindicators: new orders, inventory levels, production, supplier deliveries and the employment environmentwithin the given country.. You cannot invest directly in an index.

Red = below 50.0. Green = above 50.0. Bold/underlined = highest values for the year.

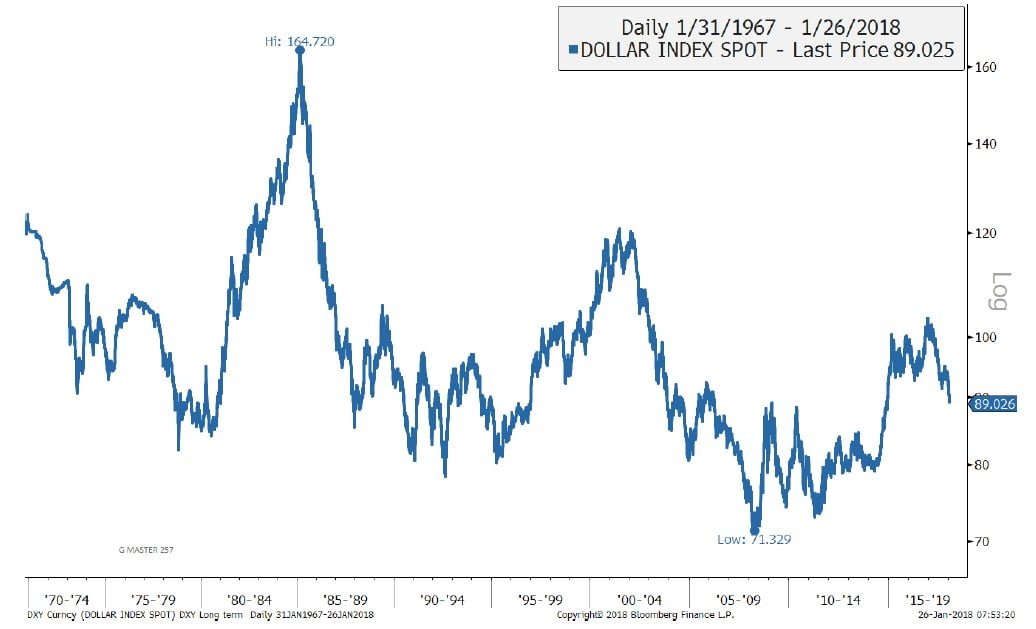

U.S. Dollar Index Spot(DXY) Long Term

Source: Bloomberg Financial Services

DXY = DXY is the US Dollar Index (USDX) indicates the general value of the US dollar. Average exchange rates between the US dollar and six major world currencies. An investment cannot be made directly in an index.

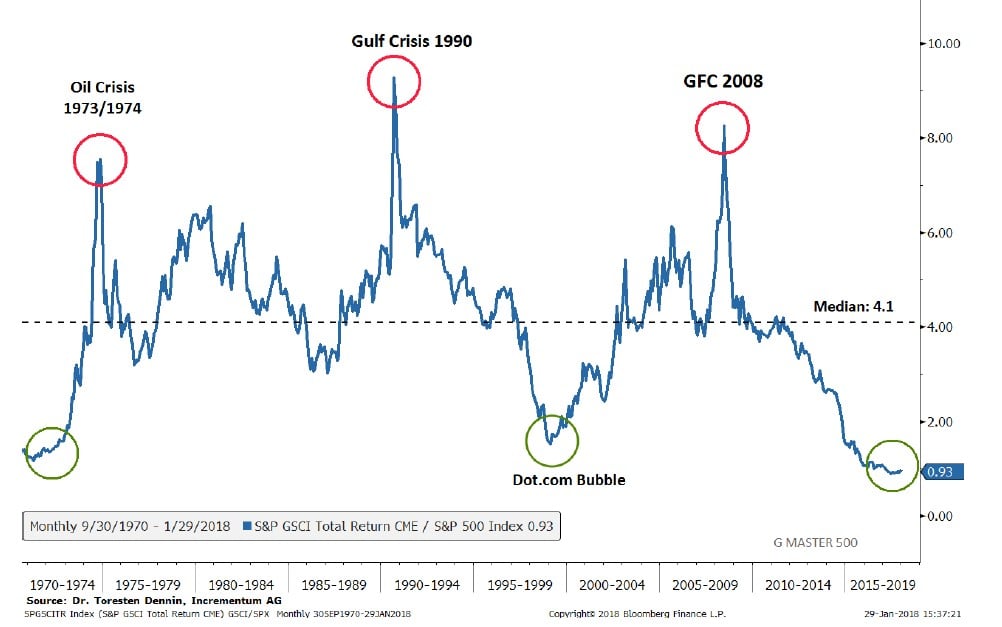

Equities vs. Commodities

GSCI Commodity Index = Is a widely recognized leading measure of general price movements and inflation in the world economy.GFC = Global Financial Crisis. S&P 500 Index is the American stocks market index based on market capitalizations of 500 largest companies having common stocks listed on NYSE and NASDAQ. Youcannot invest directly in an index.

Bloomberg Commodity Index (BCOM)

Source: Bloomberg

BCOM Index= Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movementswith monthly rebalancing. SMAVG = Moving average. You cannot invest directly in an index.

Growth Rate of Bloomberg Commodity Index

Source: Bloomberg

BCOMTR Index= Bloomberg Commodity Index is calculated on an total return basis and reflects commodity futures price movements with monthly rebalancing. Sigma means standard deviation. You cannot invest directly in an index.

Commodity Prices vs. Recessions

Source: Bloomberg, DoubleLine

S&P GSCI Total Return CME Index = Is an index widely recognized as a leading measure of general commodity price movements and inflation in the world economy. You cannot invest directly in an index.

See the full slides below.