Fasanara Capital letter to investors

“Learn how to see. Realize that everything connects to everything else.” – Leonardo da Vinci

Fragile Markets On The 'Edge Of Chaos'

Financial markets are complex adaptive systems, where positive feedback loops undermine resilience and bring to the brink of critical transformation

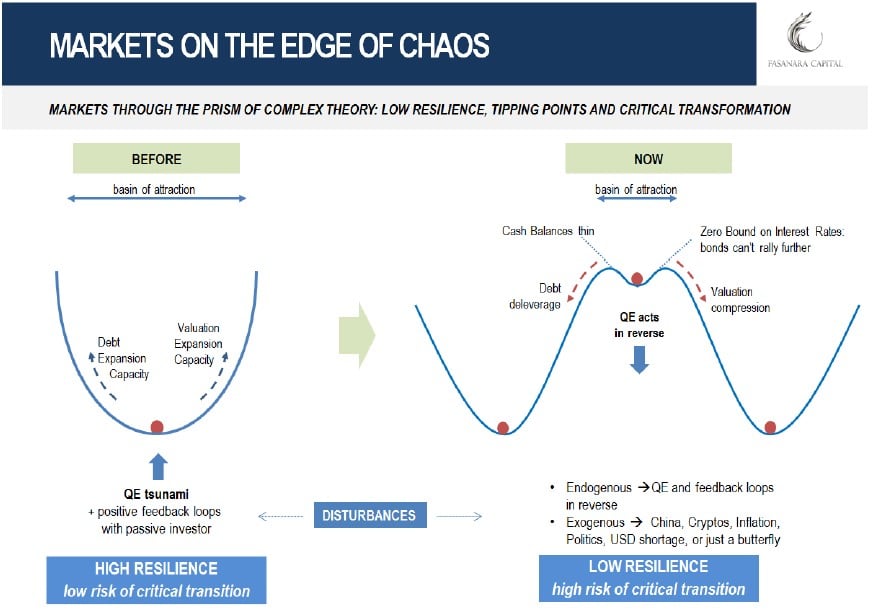

Abstract: this note posits that systemic risk in financial markets should be analyzed through the prism of complexity science, using the analytical tools available to non-linear socio-ecological systems, where a shift in positive loops comes in anticipation of a dramatic transformation. Chaos theory and Catastrophe Theory can then help shed light on the current set-up in markets. Years of monumental Quantitative Easing / Negative Interest Rate monetary policies affected the behavioral patterns of investors and changed the structure itself of the market, in what accounts as self-amplifying positive feedbacks. This is the under-explored unintended consequence of extreme monetary policymaking. A far-from-equilibrium status for markets is reached, where system resilience weakens and market fragility approaches critical tipping points. A small disturbance is then able to provoke a large adjustment, pushing into another basin of attraction, where a whole new equilibrium is found. While it is impossible to determine the threshold for such critical transitioning within a stochastic world, it is very possible to say that we are already in such phase transition zone, where markets got inherently fragile, poised at criticality for small disturbances, and where it is increasingly probable to see severe regime shifts. Fragile markets now sit on the edge of chaos. This is the magic zone where rare events become typical.

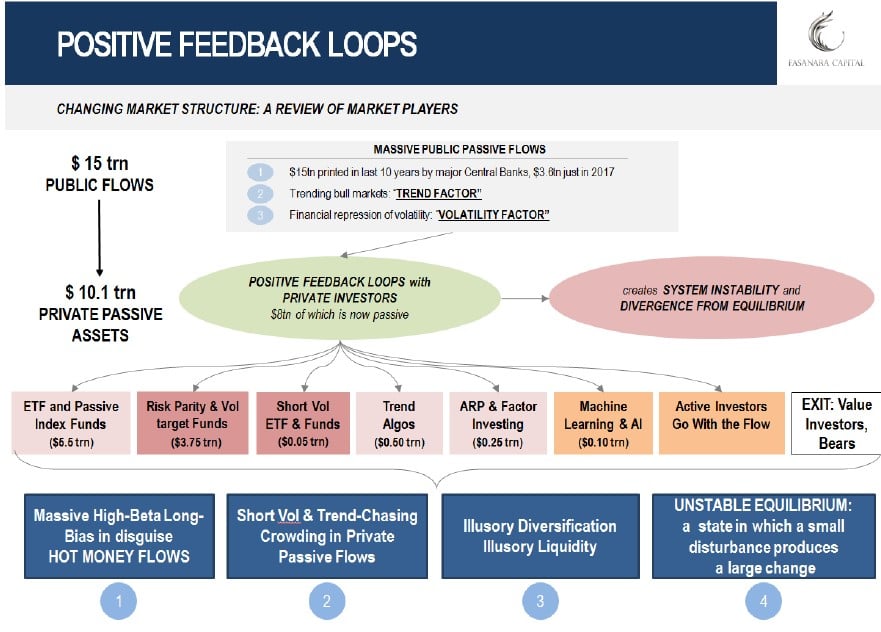

Today’s note is part of our ‘SCENARIOS’ series, and is intended to provide a theoretical conceptual framework around our previous notes on market fragility, where we argued that an unstable equilibrium in financial markets is brought about by positive feedback loops between public and private investors, exposing markets to the risk of a systemic risk escalation. Our upcoming Investor Presentation will discuss to specific points of critical transformation and upcoming regime shift for markets, pointing to the generic early warning signals for chaos outburst.

What It Means To Be On The ‘Edge Of Chaos’

There is a magic space between order and chaos, a phase transition zone where a system reaches criticality, and can suddenly and abruptly morph into a whole new contrasting system. It is a place where its resilience may get weakened to the point where disorder and randomness prevail, and lead into a totally different environment, for an entirely new equilibrium. If the system degrades at the edge of chaos, it can then drift away from an ordered predictable regime into a chaotic unpredictable regime. It is the space, hypothesized to exist by scientists, where snowflakes suddenly accrete to form avalanches at some critical tipping point, where fluid crystallize, where desertification rapidly oversets a green valley, where a volcano breaks into eruption, a forest burns itself out, a pandemic breaks loose.

In an intrinsically inter-disciplinary endeavor, complexity scientists from fields such as mathematics, biology, physics, ecology, psychology theorize of the existence of this mysterious space, a theoretical zone, which sits in between order and disorder, between symmetry and randomness. ‘You’ve got randomness, and you’ve got order. And right between them, you’ve got the phase transition,” in the words of biophysicist John Beggs of Indiana University.

His analogy of a pile of sand is illustrative. It was pointed to us by one of our readers, who we thank for that. ‘Sand grains are dropped one-by-one from a single point. For a long time, nothing much happens: a conical pile slowly accumulates. Eventually, however, it becomes so steep that the addition of just one more grain can trigger a miniature avalanche, though not in a predictable way. Avalanches can be small or large, and sometimes they don’t happen at all. Just before the pile enters its avalanche-prone state, said Beggs, it’s poised at criticality. From a biological perspective, the trick is to harness the capacity for small perturbations to produce large effects without entirely entering that avalanche-prone state, in which perturbations would soon become overwhelming. Researchers studying such behaviors sometimes refer to this as the ‘edge of chaos.’

There is nothing intrinsically negative about stationing at the edge of chaos. Edge of chaos is not to be seen as necessarily a negative zone to be in. If anything, the interaction between chaos and order builds resilience. The criticality of the balance between order and deterministic chaos is an optimal evolutionary solution for systems that need to balance order and stability with flexibility and adaptability, in harmony. Complexity theorists talk of ‘evolvability’, as the capacity of a system for adaptive evolution. Evolution happens at the edge of chaos, the boundary between ordered and

entropic regimes. However, such evolution is sometimes a major jump, a deep discontinuity, when the delicate balance between stability and flexibility is suddenly lost. It happens when feedback loops change in ways in which resilience drops, making it dangerous to be there at the edge, poising for critical transformation, into chaos and then an alternative stable state.

Also, not all transitions are negative. Some systems tend to order, not disorder. What matters though is the identification and the awareness of criticality, as a state where large swings can follow swiftly, by the very nature of the state. It is an essential element of resilience management.

The sensitivity of a complex system to parameters is well known. Chaos theory focuses on the ‘deterministic chaotic behavior’ of dynamical systems that are highly sensitive to initial conditions: ‘chaos is when the present determines the future, but the approximate present does not approximately determine the future’, in the words of the theory pioneer Edward Lorenz. The butterfly effect describes how a small change in one state of a deterministic nonlinear system can result in large differences in a later state, or as is famously rephrased how ‘a butterfly flapping its wings in Brazil can cause a hurricane in Texas’.

Sensitivity to original conditions is a key characteristic of complex deterministic systems, but a system may change dramatically without a change to initial conditions, but rather as the result of

moving beyond critical tipping points, or points of no return. Within systems theory and complexity science, around the boundaries of chaos theory, the field focusing on dramatic transformations into disorder is catastrophe theory, which attempts at isolating global properties for systems drifting into disorder beyond certain critical thresholds. Tipping point analysis is more relevant to our analysis of financial markets today.

French mathematician René Thom is the father of catastrophe theory; growing beyond certain critical thresholds in a nonlinear system can cause equilibria to appear or disappear, or morph, leading to large and sudden changes of the behaviour of the system. It may lead to abrupt ruptures, such as the unpredictable timing and magnitude of a landslide. The subject is so fascinating that even captured the attention of Salvador Dalí, who would dedicate its last painting to one of the catastrophe-types categorized by Thom, The Swallow's Tail.

The question then becomes one of identification of such critical tipping points, or ‘bifurcation events’. What is the level beyond which a small change can provoke a large swing, a big transformation? What is the last grain of sand on the pile that the system can take in before transformation? How to predict when a system collapses?

The relevance of a tipping point is clear to the human mind when associated to a simple element. Too many people on the side on a boat, at some tipping point the boat flips. Or the pushing of a chair out of balance, at some tipping point the chair flips. However, we struggle with the concept when it comes to complex systems, ecosystems, societies, climate change, forests and fisheries, human immune system and brain, and financial markets.

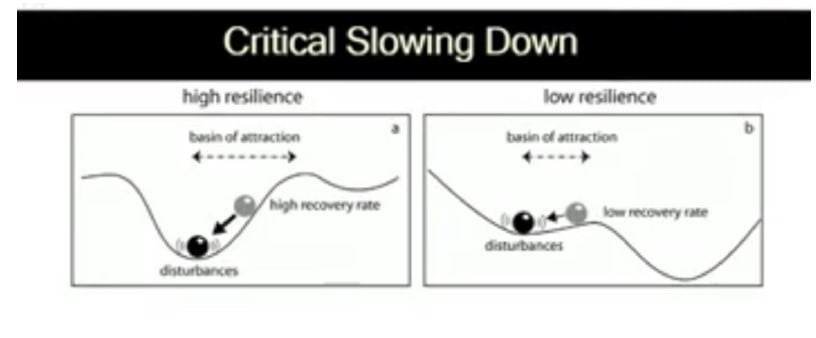

Mathematical biologist Marten Scheffer of Wageningen University studies social-ecological tipping point dynamics. He argues that there may be several critical switching points, not just one, on one key variable. The resilience of the system may degrade to some tipping point where a small perturbation can push it into another state. The loss of resilience makes it snap, eventually, at a point. There are jumps, discontinuities beyond certain tipping points for key variables, where the system snatches to a totally different equilibrium / attractor, into an alternative stable state. The loss of resilience will eventually be reflected in a critical slowing down in getting back to original positions after disturbances. Such critical slowing down has got to do with very fundamental mathematical properties of systems that are close to a tipping point. His analysis focuses on lakes and ecological domains, but can be applied broadly across complex systems.

Critical Transitions in Nature and Society: (Princeton Studies in Complexity) – 26 Jul 2009, Marten Scheffer

Critical Transitions Follow Changes In Feedback Loops

How does the system degrade? How is resilience lost? How does it happen? One such way is with a change in feedbacks. It happens when self-correcting negative feedback loops weaken, and self- amplifying positive feedback loops arise.

Feedback loops are essential forces in the build-up of any ecosystem. They are mutual causal interactions between the elements of the system. The natural world is full of it. Negative feedback loops are the internal stabilizing forces of a system, as they bring the system back into balance early on after small perturbations.

As negative feedback loops get impaired or lose relevance within a system, the system degrades, and the basin of attraction becomes smaller, flatter, less concave, to the point where new small disturbances can push the equilibrium out of the basin. Resilience falls and the system nears a critical transition zone. The system stands at an unstable equilibrium, from where it can flip at any time on closing up to the tipping point.

In the words of Brian Walker of the Stockholm Resilience Centre, ‘if you never burn a forest the species in there who are capable of putting up with fire eventually go out-competed; the only way to make a forest resilient to fire is to burn it. The only way to make children resilient to the environment is to expose them to it (‘sheltered kids do not make for capable adults’ Lythcott-Haims). Resilience is maintained by probing the boundaries of the basin, otherwise the basin becomes smaller and smaller. That’s how the body maintains a body temperature of 38 degrees (at 41 you die). We had 10 million years to develop the feedbacks we needed to adapt. Our earlier versions extinguished/ got extinct.’

Resilience in a system is the ability to absorb shocks and to retain the same structure functions and feedback as before. It implies persistence, adaptability, transformability of the system. It requires a wide basin of attraction, a good balance between order and disorder. Essential to resilience is the presence of negative feedback loops.

Dr. Walker argues that one should manage feedbacks to reach resilience. You lose your feedback, you lose resilience. The essence of resilience is then to understand the feedbacks in the system that keep it self-organized, stable, robust.

On the contrary, positive feedback loops are amplifiers, or amplifying loops, as they exacerbate a particular set of conditions of a system. As such, they can ultimately be harmful, and lead to an unstable balance, towards a critical tipping point.

At the edge of chaos, a shift in feedback loops provokes a proximity to one or more critical tipping points. This is the zone where rare events become typical.

Assessing the probability of critical transformations: early warning signals

We can never predict the exact point at which the system transforms. We live in a stochastic world and the final little push out of equilibrium may happen randomly. But what we can say is when the system has become inherently unstable, fragile, vulnerable, ready for small perturbations to trigger critical transitions, in phase transition zone. If we have reasons to suspect

the possibility of a critical transition, the analysis of generic early warning signals may be a significant step forward when it comes to judging whether the probability of a transition is increasing.

In relation to financial markets, this is the subject of our next thematic research to be presented during our upcoming INVESTOR PRESENTATION. Please get in touch to register.

Edge of Chaos, Positive Feedback Loops and Financial Markets

In conclusion of the theoretical section, it can be argued that the dynamics of positive feedback loops acting on an unstable equilibrium at the edge of chaos are one likely precursor of a regime shift. Sooner or later, at some critical tipping point in close reach.

And this is where we move the attention to today’s financial markets…

Financial Markets Are ‘Complex Adaptive Systems’

The analytical tools of ‘complexity theory’ can be used to understand phenomena as diverse as biological ecosystems, climate change, forests, lakes, brain and ... financial markets. Features typical of complex systems include the broad inter-connectedness of global markets - only increased with globalization, the vast network of factors at play, the flipping correlation between assets over time, the non-linear relationship between the various elements in the system. The endogenous crises, broad discontinuities and sudden ruptures experienced by financial markets over history also do resemble far-from-equilibrium phenomena in complex systems.

‘Complex means non-linear, as there is more in them than purely direct relationships of cause and effect, showcasing deterministic chaos. Adaptive means evolving, dynamical. In ecosystems species evolve, in financial systems people will change their behavior. Systems mean very broad, operating over a range of scales’, in the words of Dr Walker.

Financial markets share the three characteristics of complex dynamical systems, as defined by the Stockholm Resilience Centre: (i) highly unpredictable, due to their non-linear relationships / interactions, it is hard to say what the state of the system might be some time in the future. (ii) contagio effect, things can spread very quickly and (iii) modularity, although the whole system is well connected parts of the system are more connected within than between, which may help its resilience, or the ability for the system to return to equilibrium after turbulence.

In a military parlance later adopted by the business world, financial markets are typical VUCA (acronym for Volatility, Uncertainty, Complexity, Ambiguity): they are interconnected, interdependent, non-linear and a structurally volatile complex system. In markets is visible the non-linear interactions between the elements in the complex system, as they co-evolve over time to adapt to local events.

Financial Markets Are On The Edge Of Chaos

When analyzed through the prism of complexity theory, today’s markets exhibit the signatures characteristic of criticality, lack of resilience, flipping feedback loops and likely proximity to critical tipping points. In other terms, markets are unstable, while stationing on the edge of chaos.

Such signatures characteristics include:

- Extreme valuations. Asset markets have reached bubble valuations, which are disconnected to fundamentals by a magnitude never seen before in modern financial history, when judged against most valuation metrics ever used: Shiller CAPE, the ‘Buffett Indicator’ market cap on GDP, the median debt on total assets, the corporate debt to GDP, the price on sales, the price to book, enterprise value on sales, enterprise value on EBITDA, financial assets on disposable income (we discussed it recently in this podcast). The disconnect itself is such that the speed of adjustment for valuations may catch investors by violent surprise, when the time

- Extreme valuations for bonds and equities simultaneously, now unable to hedge one another. This is a striking difference to previous big equity market crashes (2008, 2000, 1987, 1929 amongst others). Viewed as different modules within a complex system (modularity of the system), back then the rally in bonds helped healing losses on equities, in a sort of negative feedback loop, offering a form of resilience to investors, mostly exposed through balanced From here, if equities gap down, it will

be a rare moment in history when bonds cannot help, and flight to quality (a self- stabilizing force within the system) is impaired.

- Patterns of correlation between major asset classes. Bonds and equities have been negatively correlated in the last few decades. From here on, they are likely to be positively A change in correlations in major asset classes is worth watching in a complex system held at the edge of chaos.

- Inability for valuations on Bonds to progress much from here, mathematically, due to zero-bound on interest rates. This shows a lack of capacity for the recent trend to advance. Rephrased in the context of complexity theory, the basin of attraction is not as steep as

- A long list of anomalies in valuations globally may point to a limited scope left for the perpetuation of the linear The list includes certain European BBB-rated bonds trading at negative yields, loans being covenant-lite for 70% of the total across Europe and the US, a suppressed volatility in the face of a VUCA world, 2yr Greek bonds, EU Junk Bonds and Russia USD bonds all trading at yields below US Treasuries of comparable maturities, US equity valuations at all-time highs when compared to trend growth (please refer to 'A Long List Of Anomalies', pages 23-52, of our Investor Presentation).

- Extreme indebtedness and closeness to BIS’ debt saturation / Rogoff’s debt tolerance limits / Minsky Moment for several subsets within the system, despite the record-low interest rates available to service such debt (China, Turkey, Italy, Japan). The falling productivity of new credit lending (decreasing marginal effectiveness of lending) is visibly at Rephrased in the context of complexity theory, the basin of attraction is not as steep as before.

- Extreme leverage to buy financial assets. Amongst others, NYSE leverage is at all- time After a long trip up the basin of attraction.

- Extreme monetary policymaking brought the cost of capital close to zero, depriving the system from resilience through preservation of so-called ‘zombie companies’ and other mis-allocation of

- Extreme monetary policymaking created correlation across most investment strategies and concentration of positions. Financial markets are no longer a marketplace where buyers and sellers meet for exchange, but rather a platform where buyers line-up for Value investors and other active players incorporating risk provisions within portfolio underperformed passive / fully invested players, and got out- selected in the evolution of the last decade of market action. With them, the system is losing self-stabilising forces, unwilling to buy without merit and therefore preventing price action from becoming senseless. In complexity theory terms, negative feedback loops flipped into positive feedback loops in recent times, creating a singularity between public and private flows in hovering up assets, price-insensitively, through one-sided regular flows. Examples of positive feedback loops in today’s financial markets are discussed in our previous notes here, here, here, here. The change in feedback loops is the biggest change of recent times, in our opinion, in relation to

systemic risk, and caused the likely nearing of critical thresholds for large transformation.

- Changing structure of The rise of passive strategies / ETFs relates to the price-insensitivity of today’s markets. The correlation amongst investment strategies created crowding around two main style factors: ‘trend factor’ and ‘volatility factor’. The effects of a loss of momentum or a spike in volatility would then quickly disseminate across the industry. No diversification means no resilience.

- Cash balances running thin. Most institutional investors are all-in, invested between 90% and 100%. Limited scope for further valuation Rephrased in the context of complexity theory, the basin of attraction is not as steep as before.

- Examples of frothiness in pockets within the system: cryptocurrencies at 750 billions US Dollar in total market cap. Given the combination of sheer size and hefty volatility, any crash is now capable of sending tremors across the system.

Source: Fasanara Capital ltd

The list can be longer, but it does not need to be any longer to draw conclusions on the sustainability of the current setting. If unsustainable and unstable, a transformation may loom ahead. How severe a transformation depends on how big an anomaly was built beforehand. From the look of things, the

anomaly is bigger than at any point in history, thus making the potential shift potentially large and disruptive.

As we learn in complexity theory, resilience is lost when positive feedback loops arise and are held constant for long enough, while at the edge of chaos. Then, it becomes more probable to be nearing critical thresholds for transformation. The biggest change in markets over the last few years has been exactly that: the formation of positive feedback loops between QE/NIRP policies and the private investment community. Private flows followed public flows, exacerbating valuations, leverage, debt levels, concentration of positions, correlation amongst strategies, life-dependence on low levels of volatility. Economic narratives built at the margin helped the shift (chasing yields, chasing growth, chasing reflation, chasing earning, chasing global synchronized growth, chasing 4th Industrial Revolution), but flows were the real key driver. The structure of the market itself morphed, and is now dominated by passive or quasi-passive investors, that incorporated the ‘trend factor’ or the ‘volatility factor’ within their constructs.

Source: Fasanara Presentations | Market Fragility - How to Position for Twin Bubbles Bust, 16th October 2017. Updated with new data on 6th January 2018.

The aspect of today’s markets that worries us the most, and for which we positioned our funds, is the one-sided risk of the investor community, long-only, fully invested, short volatility, short convexity ("It’s All One Single, Giant $22 Trillion Position": How Market Risk Became Systemic Risk). Years of monumental monetary printing rescued markets at every minor turn and ingrained a buy- the-dip mentality in the investment community which is now reflected in the structure of the market itself. The shift from active managers to passive managed ETFs in past years (for over $3trn now) is only the tip of the iceberg, and encapsulates the boundary between risk-conscious and risk- insensitive investing, resulting in the clash between under-weighted longs (active managers) and over-performing longs (passive vehicles). Beyond ETFs, other quasi-passive players prosper as they mechanically go long with leverage, follow the trend or sell vol: the end result is that today it’s all one single giant position, and market risk became systemic risk.

The structure of markets resembles that of a pressure cooker, owing to the synchronicity of three elements: massive concentration of passive or quasi-passive players (90% of US daily equity flows), massive concentration in few fund players (top 4 Asset Management shops account for almost $15trn in AUM), massive concentration/correlation of investment strategies (90% are either volatility-linked or trend-linked).

In many ways, positive feedback loops are synonyms to market complacency and help asset volatility go lower. The loss in resilience for the system is then a similar concept to what hypothesized by economist Hyman Minsky: ‘stability is destabilizing’. In his "Financial Instability Hypothesis’’ in 1977, he analyzed the behavioral changes induced by a reduction of volatility, postulating that economic agents observing a low risk are induced to increase risk taking, which may in turn lead to a crisis: “the more stable things become and the longer things are stable, the more unstable they will be when the crisis hits.”

Complexity theorists speak of the possibility of several tipping points within a system. Looking at financial markets, we can easily imagine different tipping points for each of the sub-sets listed above.

- Valuations may go higher, ‘melt-up’ is a possible scenario making the rounds in markets in recent days, but at some point a threshold may be reached when they stop, and If reversion becomes warranted, for any or no reason, then any previous advance should be fuel in the tanks of the retracement.

- Cash balances are thin, while leverage is already Most investors classed are now close to full investment, between 90% and 100% of disposable assets: private clients, pension funds, insurance companies, sovereign wealth funds, mutual funds, hedge funds. Marginal buyers go scarce.

In a recent note, Jim Grant noted that the $346 billion California Public Employees' Retirement System’s (CalPERS) investment committee voted to trim its cash allocation to 1% from 4%: the only dissenter in the vote, board member JJ Jelincic “has advocated for a higher risk portfolio,” while board member Richard Costigan concurred “I am concerned, we’re leaving money on the table.’’

- Debt metrics are beyond classic measures of tolerance in several countries, surely in China and Turkey, when analyzed by metrics such as Reinhart and Rogoff’s ‘debt intolerance’ levels, the ‘credit-to-GDP gap’ of the BIS, the proverbial Minsky point or the marginal effectiveness of new

- Quantitative Easing has just passed its peak, which was in mid-2017, and is now expected to go in It is believed to be an active tool in the hands of Central Banks, although capacity constraints are known (capital key in Europe, negative rates on Bunds etc.), unintended consequences (zombie companies let to live and saturate the system blocking the rise of newcomers), political instability and populism (critical income inequality). A tipping point may be already in. Surely, they just rolled over from peak. Although it is not widely perceived, year 2017 marked the peak in Quantitative Easing, at $3.7trn of asset purchases, for a monthly average of approx. $300bn. Such money printing will fast descend over the course of 2018, to go below $20bn per month by December 2018. As this liquidity tide goes off, we expect markets to face their first real crash test in 10 years. Only then will we know what is real and what is not in today’s markets, only then will we be able to assess how sustainable is the global synchronized GDP growth spurred by global synchronized monetary printing.

- Volatility: both a tipping point and a domino effect are in reach. It can’t go negative; most of the move is past Meanwhile, lower Value-at-Risk metrics pulled swathes of risk-averse investors in, like fisheries in the net, at the mercy of the next turbulence in markets. Vast amounts of capital are either directly or indirectly linked to volatility. A rise in volatility would push through de-leverage and de-risking for VAR-based investors. In addition, certain strategies are in close proximity of being wiped-out for minor moves higher in volatility.

Endogenous Tipping Point: The Market Itself

Every element of today’s markets has potential tipping points in close reach, not one of them seems in its early innings. Which one will bump into a dead-end first? Now that Central Banks step away from QE, the ‘momentum factor’ losing steam or the ‘volatility factor’ entering turbulent waters are the first suspects. If those two pillars hold everything else together in markets these days, what when they fail? Or perhaps, a ‘quant quake’ type event, similar to what happened in the summer of 2007, as passive and quasi-passive investors battle one another in a race to the bottom. A sudden rupture can be endogenous, and come from within. In the words of Claudio Borio ‘financial booms can't go on indefinitely, they can fall under their own weight.’

Obviously, as always, there can be exogenous triggers too, tipping the balance and leading to a rapidly changing state.

Exogenous Triggers

It is because we are the edge of chaos and feedback loops are broken, system is degrading and at risk of deep transformations that triggers matter. In normal circumstances they would matter less and you may expect policymakers to have more of a control upon intervention.

May the trigger be Cryptocurrencies? Left unchecked by regulators, they have grown to a level where they must matter for global systemic risks, at 750 billion dollars, with emphasis on its volatility.

May the trigger be China? The extreme credit expansion of recent years seems a textbook case study to prove wrong the theories of a Minsky Moment. A total on- and off-balance sheet bank credit of 40trn, at almost 4 times GDP, a credit expansion well above trend (in danger zone according to BIS credit-to-GDP ratio gap measures), Corporate China at above 250% debt on GDP in only few years, a budget deficit at 13% of GDP (including local authorities) are classic recipes for overdue system failure.

May the trigger be inflation? Presumed by most to be dead, it is showing signs of resurrection, all the while as wages started to react to a tight job market in the US. US rates are stationing right at multi-decades downward trend-lines, the break of which would wreak havoc.

May the trigger be a ‘USD shortage’? MacroVoices’ Erik Townsend analyzes the issue in depth in a recent podcast, titled ‘Anatomy of the U.S. Dollar End Game’.

May the trigger be political risk, the ‘Marx brothers’ factor? The political framework itself may be on the verge of a regime shift under the weight of ever rising ‘income inequality’. The ‘wealth effect’ of QE failed, and resulted in a ‘inequality effect’ (we referred to it in a recent Fasanara Presentation, slide 56, and in this video). Despite rising wealth for the ‘top 1%’ the world over, the middle and lower-middle classes were further squeezed over the course of 2017, leading to ever rising income inequality. The populism in political circles that was visible in 2016 (Trump, Brexit, Italian Referendum) and 2017 (Germany, Catalonia, Eastern Europe) is therefore expected to play an even bigger role in 2018/2019. We do not know if the ‘bifurcation event’ will take place upon Italian elections on March the 4th, or after Brexit becomes effective and new elections may be held in the UK, or during mid-term elections in the US, or others, but surely an higher probability is there to see the equivalents of a Grillo, Corbyn and Sanders grab power. The historical parallel would be Leon Blum’s Front Populaire in 1936 France. A political regime shift – market-unfriendly - would then be accelerated. We are amongst those who think that the current magnitude of ‘income inequality’ is unstable, unsustainable and therefore destined for inevitable critical transformation, sooner or later. In the words of Will Durrant: “in progressive societies the concentration [of wealth] may reach a point where the strength of number in the many poor rivals the strength of ability in the few rich; then the unstable equilibrium generates a critical

situation, which history has diversely met by legislation redistributing wealth or by revolution distributing poverty.” Rephrased by Justice Louis Brandeis, ‘’we can have vast wealth in the hands of a few or we can have democracy. But we cannot have both.’’

A tipping point and subsequent inflection in any of those endogenous or exogenous subsets would clearly impact other subsets, and their own tipping points. What you need is just one of them to move first, and others may follow swiftly. Deterministic chaos then opens up, or even randomness, in finding a new general equilibrium for the system, where such subset can co-exist at some other parameters in some harmony.

On the edge of chaos, it does not take much to flip, no need for a major catalyst. The flapping of a butterfly’s wings may do. As we heard in a recent show: ‘remember: it was not Holyfield or Lewis to knock Tyson out in 1990, but Buster Douglas. A mostly unknown, to remain unknown, second-tier boxer. It doesn’t take much to take you down when your time is up.’

If this analysis is correct, and tipping points are near, markets are in an uncomfortable spot, where not much escape is available via new lending, not much escape via higher valuations, not much escape with new QE, not much escape with more leverage, not much escape with more cash to deploy. No escape, no further rise does not necessarily imply a crash. However, treading water on the edge of chaos is dangerous, as any small perturbations can trigger a critical transformation. An exogenous or endogenous trigger can easily push the equilibrium out of its small basin of attraction. A new equilibrium may be waiting to assert itself, nearby, through chaos.

At the edge of chaos, a shift in feedback loops provokes a proximity to one or more critical tipping points. This is the magic zone where rare events become typical.

------

Thanks for reading us today! We remain at your disposal for data, questions and feedback. If you have contrasting or confirming data or arguments please get in touch, would be great to compare notes. Portfolio-wise, a list of shorts, convex-rich, long vol instruments is locked and loaded for deployment. Our time is currently spent on closely monitoring critical tipping points and evaluating the merit of different general early warning signals for each.

Article by Fasanara Capital

See the full PDF below.