Activist short sellers had to look harder for overvalued companies in 2017, with the number of companies falling 30% on 2016 levels, according to data from The Activist Investing Annual Review 2018, produced by Activist Insight in association with Schulte Roth & Zabel.

The Review, which will be published next week, provides expert commentary on the drop in activist short selling, highlighting the fact that campaigns based on simple overvaluation have reduced and campaigns based on fraud allegations have risen as a proportion of the total.

With hedge fund managers Greenlight Capital and Third Point Partners noting the importance and challenges of short selling in investor letters in recent weeks and with high-profile campaigns such as Steinhoff International dominating the airwaves, activist short selling remains a topic issue.

For more information about activist short selling, see the data below.

Number of short campaigns per year

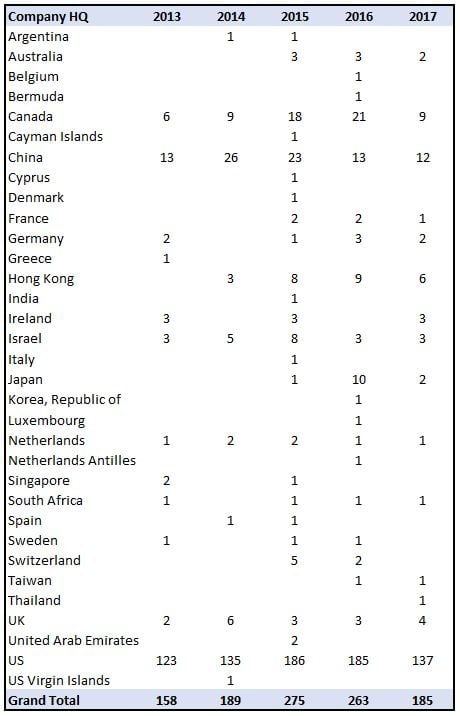

Number of short campaigns per year by company HQ

Global breakdown of campaigns by sector

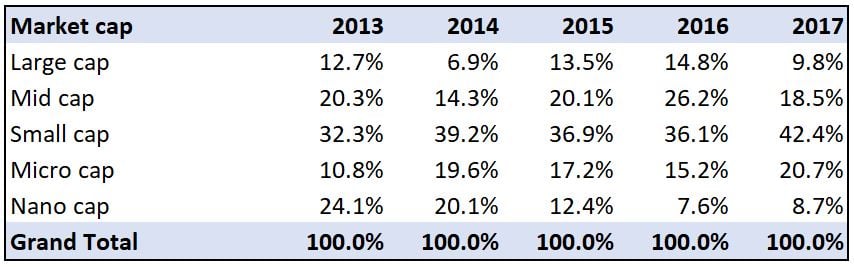

Global breakdown of campaigns by market cap

Nano cap: Less than $50 million

Micro cap: $50 million - $250 million

Small cap: $250 million- $2 billion

Mid cap: $2 billion - $10 billion

Large cap: More than $10 billion

Activist Insight can help with bespoke data requests. Please note that requests may require 24-48 hours to complete, depending on their complexity. For futher information please email [email protected].

Kind regards,

Josh Black

About the Activist Investing Annual Review 2018

The Activist Investing Annual Review, produced by Activist Insight in association with Schulte Roth & Zabel, is the definitive publication on the world of activist investing. Containing expert commentary from professionals in the space, including Schulte Roth & Zabel’s global shareholder activism group, and data from Activist Insight’s market-leading product suite, the Review analyzes all of the most important trends, including activist targets, settlements and proxy contest outcomes.

Article by Activist Insight