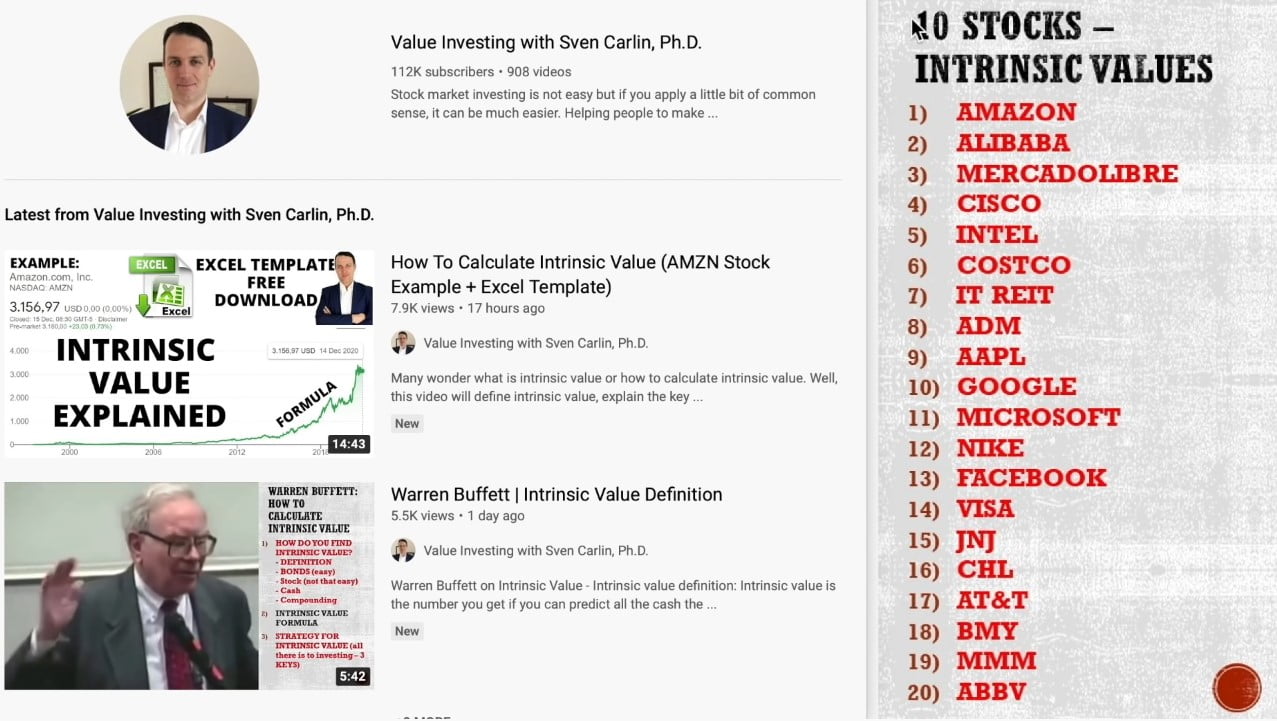

I have applied the intrinsic value template discussed yesterday to a few stocks. This is not a stocks to buy sell recommendation because checking intrinsic value is just a first step. The story is what counts and I’ll do a few stock analyses videos on the interesting ones.

The following is a computer generated transcript and may contain some errors.

Q3 2020 hedge fund letters, conferences and more

20 Stocks Intrinsic Value Comparison (BABA Is Way Cheaper Than AMZN)

Transcript

Good afternoon investors. Yesterday, we made the video discussing how to calculate intrinsic value, you have a free Excel template download this is in the same playlist. So check that video out. Also, if you want to enjoy Buffett discussing that, check the previous videos, as I promised, I will do the application of the template formula on n stocks. I'm sorry, I lied. But I didn't do 10 stocks, I did 20. And one more. So what I did is simply put in the numbers here, estimate growth rates, and then I compare them and I got the intrinsic value, the price and the key factors for that, enjoy the presentation on the stocks and then I'll finish with a quick market overview. So let's start with the analysis to explain how I came to these numbers, the differences the key factors. And keep in mind this is a starting overview. And then you see okay, which are the stories that you really want to dig deeper in, which are the stocks to avoid because overvalued. Let's start with the top and then go three stocks by three stocks down to the bottom. We have done Amazon already yesterday I have inputted the numbers. And I have decided now to compare Amazon with Baba and Mercado Libra. Let me just show you how I get this data first. So that you will also know to find it yourself. The data comes from Morningstar, you have here all the quotes but I also am a premium member. So I have all the articles too. But you can check the key ratios. And then you see all the trends, also the evolution of the business over the years. And when it comes to Amazon. In this case, I have decided to take earnings per share. Why? Because it's a little bit more conservative, then free cash flows here, even if free cash flows are a little bit higher. So just for conservative reasons, the growth rate is staggering, the revenue has been growing at a staggering rate. And it will likely keep growing like that. And the valuation actually depends on the growth on other companies Alibaba, as we said, key ratios and data. This is all in remember, so we have to divide it by 6.8 to get to US dollars. Here also net income which is lower than free cash flows. So let's focus on net income because the Libra the stock has exploded as also the free cash flows as exploded. So this case as the net income is negative. And they are making positive cash flows and footstep stable investments. So I have taken in this case, the cash flows here and will estimate the growth from here onward. If we go to the Excel file, I have taken the same growth rates for the companies as they are in, let's say equal businesses Latin America, China, Asia, and the US. If I put a terminal multiple for the stock price in end years of 30, on expected future growth of 15% it's all an estimation, I had a lot of comments and questions when how to determine the terminal multiple the terminal price earnings ratio, the price earnings ratio 24 to one. Well, it's just an estimation you don't know. Because it depends on too many factors that you can simply get there. But the surprises that if I compare with equal growth rates and equal valuation, on current earnings per share, and in Mercado Libras case, cash flow, then the intrinsic value for Amazon is 2530, which is below the stock price for Alibaba, it's 551 which is almost twice the stock price. And for Mercado Libre two. So from an equal growth perspective, we could say that Baba and Mercado Libra are twice as cheap as Amazon from an investing intrinsic value perspective, based on the same numbers. This is extremely interesting, because we could say or this is undervalued or this is overvalued, but more about that when we finished all the stocks, and we talk about the market. Let's go to the next batch. The next stocks are a little bit more value stocks, which is again very interesting. Let's discuss Cisco, Intel and Costco. So Cisco, Intel and Costco output also this summer to download in the description below so you can play around if you want to With this Cisco I have taken cash flows and Intel also cash flows. And I think also cash flows. For Costco, Cisco Systems, cash flows are more important because the company is not investing that much is making some acquisitions. But okay, net income and cash flows are higher. So I have taken the cash flows here, which is a higher number higher valuation. But I've made an analysis on the company on my research platform and there are some catalysts. So again, another story for intrinsic value, Intel, we have made the video so you can check that, again, great cash flows of 20 billion. And then we have Costco, the retailer and here we have free cash flows that are much higher. So I took this ones, which are in line with net income, and that's what I took nine earnings per share its net income, not cash flow. So if we look at Cisco slow growth, so we can say value stocks, if we want, I put two and 3%. Over time, this contract stays at 10%, terminal multiple, we can change that to 10, or to 15, depending on what you think or what is your expected return in the long term. Same for Intel, faster growth, I expect a little bit faster growth if their market doesn't get disrupted. But that's something we will have to see. And Intel is then undervalued compared to the stock price. Costco, there has been a boom, but it's a retailer. So expect the growth rate of 4% 2%. Over time, this country rate 10% terminal multiple 25. Sorry, that's wrong 15. And we are at 134. Now, perhaps I don't know the story behind perhaps they are going to do online or something like that. But still, I get to 162. If I compare it to the stock price, it looks like extremely over value then perhaps also the reason why Warren Buffett sold let me know in the comments. What's the reason for this exuberant exuberance in cost costs, price, Intel is the, let's say, undervalued stock compared to intrinsic value if the company keeps growing, Costco fairly priced. Now when I say fairly priced, keep in mind that this is done on a 10% discount rate. So if you buy Cisco now, it might lead to a 10% return over time, which is again, a great investing return, we're talking about double digits compounding, which is amazing. This is even undervalued, which would lead to even higher returns. All right, we go to the next batch of stocks in Italian, read here, ADM, the fourth company, Apple, Google, Microsoft and Nike, let's go to the calculations. So coma, it's an Italian retreated in my lane, I just wanted to show something different. We have no cash flows of about 20 million per year growth as a read slow growth, let's say 2% just to cover for inflation. And intrinsic value is six euros. If I compare this to the stock price, we are there so we are not far away from it. And if you look at it, so again at a 10% return if all goes well. So if you're interested in these kinds of investments, then you look deeper into the story Archer Daniel Midlands, another company that I have made a video on alongside apple. So let's see those two, I have looked at the earnings per share stable food business. So good earnings, stable earnings over time, a little bit fluctuating depending on the prices of commodities, food, grain, whatever you eat, so I have taken free dollars as an average, earning their slow growth, put it into the valuation and I get to an intrinsic value. Keep in mind for a 10% return of 42. The stock price is 49. So again, that's a good investment. And ADM. It's a good company so always looked like a great investment. Apple cash flows three point 28 per share. I have taken the earnings. If you look at Apple here So we have earnings per share, those are growing as the company did, okay, but the net income is stable. And they're using most of the money to do buybacks to lower the number of shares outstanding, don't get confused by the split. Nevertheless, we are at, let's say, growth three to 5%. As they work on the ecosystem, the services, this country's terminal multiple, I have put 20 here, and I get to an intrinsic value of 58, the stock price is much higher. So I would consider apple in this situation over value. The year ago, it was fairly valued. This is the current situation then a good bad batch of companies, let's say value plus growth companies like Apple is Nike who kept Facebook here, visa. Very interesting. Also jnJ, we can also already skip to the final. If I look at Google taken the earnings, ad revenue is expected to grow we'll use Google you are now watching this on YouTube. So let's say 12% and 8%. In the subsequent five years, the growth rate and terminal multiple let's say 25, trinsic, value 1600. Then for Microsoft, I have put similar growth rates for as Google 195. Same Theron, on multiple Nike did a little bit slower growth rates, because if we look at the business of Nike, it's growing at a much slower rate then comparatively to Google and Microsoft. So I have put the smaller growth rates here, but still the same terminal multiple, and I get to an intrinsic value of 56. If we look at this, compared to the stock prices, fairly valued for Google, Microsoft also fairly valued Nikes overvalued, even made the video but the stock keeps going up. That's the current market we are living in. Next we have Facebook visa, J and J sorry, here we go. Facebook, the stock is capped at the fair value if they keep growing at 15% 8% subsequent growth terminal multiple 2018 then we are kept by all the regulations issues and everything. And you know also if you have been following the channel we have been long Facebook for a while when it was a real value bark and now it's fairly valued. Visa taken earnings, slow growth company. If you look at visas, financials visas growth, it's really slow growth, it's even hit by COVID. Its people use their credit cards less, but they are working a lot on buying back shares stopped a little bit now. But good cash flow strong cash flows more business. And that is why the market gives it the high multiple However, with the slow growth rate. And with the financial and everything competition that is coming in the forms of crypto and who knows, payable wallets and everything I have put it at the 15 terminal multiple. So my intrinsic value is much lower than the stock price j&j. slow growth rate depending on prices, regulatory prices, terminal multiple 15. Like for these I in this case. And when we compare this to the stock price via visa is overvalued, j&j is also overvalued. And Facebook is fairly then the next batch China Mobile. So this is a very interesting company because the growth rate is zero, or even negative the same as with at&t. And we have to see, okay, how are they going to work this out in the future. So where we are China Mobile key ratios, so we see stable numbers here, declining net income, but here I look at free cash flows. And those are actually terrible. They have net income, yes, but the free cash flows are very, very low. And I get to an average free cash flows here of what 40 billion renminbi and that's what I have taken to make a calculus calculation here. Assuming the business will continue with the current situation for longer than I get to an intrinsic value of 23 point 54 which is below the current stock price. at&t growth rate let's put it a declining growth rate because revenues have declined. But what's staggering with at&t is the free cash flow. So it's very important to understand the story there, the moat, the terminal date of the businesses, as people switch to other technologies. That's what the market might be pricing in wrongly. So I might make a video on at&t. And that's things you discover when you make such valuations. Because if the growth rate is terribly negative, and the terminal is just then I still come to the present value, if I change the growth rate to zero, and zero, so they keep stable, then we could say that at&t is undervalued. And if we put a 15% multiple, due to the high dividend, then at&t is undervalued by 33%, or 50%. upside, which is very, very interesting. Bristol Myers, doing acquisitions taken the earnings there slow growth hope in the future, but they will do who knows what and intrinsic value 61. The stock price is there, three m are the next ones. So we have free M. slow growth company, great mode company also made a video a while ago. So you can check that out, put all the videos in the link in the description below. overvalued, currently another pharma company. And for those that have been staking here, this is a very interesting company, even if they did have declining rates, terminal valuation of just 10, then we are still below the current stock price with the intrinsic value on a, again, conservative cash flows, estimations for lumen technology, because the cash flows are really staggering, comparing to earnings, former CenturyLink that has merged. So this is something that I'll write up a report. Let's say I'll make a video for at&t and whoever sends me an email for lumen technologies. I'll reply with the report when I write it just put lumen technologies in the title of the email you sent me. So all in all, a lot of discrepancies on the market. And that's extremely interesting. When it comes to discussing values and markets. There is something very important here and I'll dedicate a special video to that so please subscribe because this is so important. When you look at the key factors impacting stocks, its growth, growth, high valuations, but also value so there is a big discrepancy when it comes to what is the reason for the price there that might be sometimes severely different than the intrinsic value or for similar companies. similar situations. One company is priced extremely high while the other is fairly priced. This is because perhaps just index funds were was the initial start of the company and then everything goes up as the tide moves in. But we'll see who sleeps naked when the tide moves out. So I think that for the retail investor who likes to think use common sense, there are plenty of opportunities to create a portfolio so that you are not the one sleeping naked when the tide moves out. But more about this starting with this preposition in a new video. Thank you for watching. I look forward to the comments, and I'll see you really in the next video.