Berkshire’s stock valuation (BRK) shows how it is currently cheap if you think America will continue to be America. When the situation stabilizes, I would expect the stock to come back to a fair valuation in the current environment. A PE ratio of 20 would give a double in a few year. If interest rates remain close to zero, expect even higher returns. If Warren Buffett deploys the cash in 2020 and invests in cheap buybacks, even better.

Q4 2019 hedge fund letters, conferences and more

2020 Berkshire Stock Valuation - 10% Returns Expected - Stock To Buy - BARGAIN PRICE NOW

Transcript

Good day fellow investors. At current prices Berkshire Hathaway is offering a 10% investment return over infinity and perhaps even more, so that's all you need to know about investing, subscribe to this channel. Click that notification bell to get notified when a new video comes out. Or don't I just told you everything you need to know about investing. No, no, subscribe, because on this channel, I'll keep reminding you what is important.

So when it comes to Berkshire, it is all about the business, the long term return the long term earnings of that business, which we're going to discuss, we're going to discuss why Berkshire stock is down. Perhaps some people are betting against America, which is something Warren says never to do. And now okay, stock prices volatile rebounded, we'll discuss that too. Then we'll discuss really the fundamentals of the business, the likelihood of going bankrupt or losing a Lots of money in whatever crisis comes. The fact that Berkshire is a fortress. And what might be the main point that the market is missing when it comes to Berkshire.

Berkshire will be okay

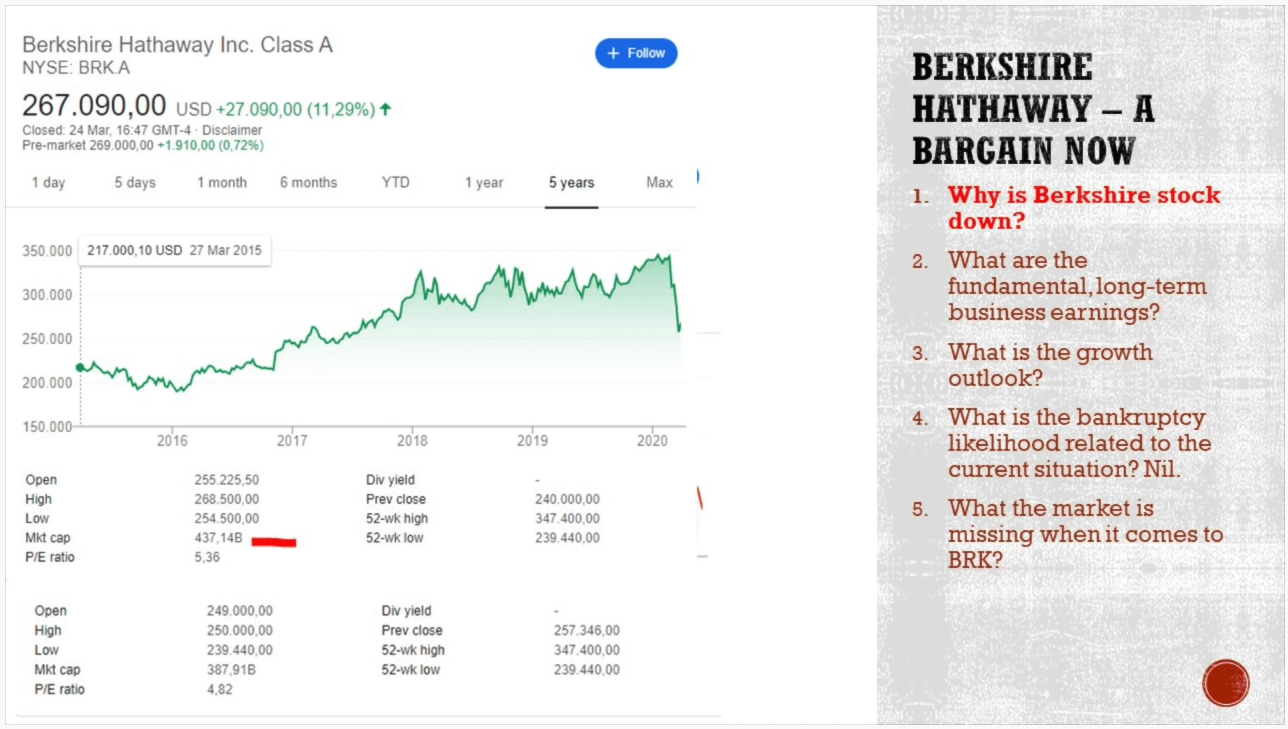

Let's start with Berkshire stock analysis. If we look at the stock price, this was the day when I started writing this so the stock price was down to 240,000. Why is Berkshire stock down? Well, the baby is thrown out with the bathwater in this case, okay, then it rebounded. Yesterday, I'm filming this before the market opens today, you'll see this video after the market closes. But okay, really huge volatility. Nevertheless, as investors, we still focus on fundamentals, but discussing the drop, which is still down a lot. This is the drop so the stock market sold everything, Warren's holdings of stocks are down 80 billion now a little bit less was 70 billion, and therefore also the stock price of Berkshire gets hit as everything is being sold.

Now if we look at the portfolio that Berkshire owns of the stocks, just the stock market portfolio, it was at the end of 2019, around 248 billion, 80-70 billion down and you are at 170. And consequently, also the stock price of Berkshire force. This was still March 23. Now this already looks different, because a lot of the stocks went up but all the holdings all of Berkshires holdings were hit significantly. And then especially the news focus on single names that are hit more or that and that creates a negative scenario in the market and people simply sell off especially because they are in fear that it will go cheaper and that they will lose more but that's not investing that stock price. That's stock price speculation and that never leads to anything. And that's the message Warren Buffett has been telling us since ever.

Berkshire Stock Valuation: Retained Earnings

What is the key are the fundamentals and the long term business earnings, which we are going to discuss now. And you'll see why Berkshire is a great investment, especially at these levels. So let's start with the stock portfolio. These are the top 10, only the top 10 Holdings for Berkshire. And they get they got in 2019 3.7 billion in dividends from those businesses. However, the earnings that the businesses retained were another 8.3 billion. So if we look at those 8.3 billion, that's something we have to add to Berkshires returns on investment, Berkshires earnings. But that's not added because that is accounting and that is not shown in Berkshires accounting, because Berkshire doesn't own the majority of those businesses.

So when you own just some between 20%, that's just accounted for the dividend that comes in and not for the retained earnings, which is again an advantage that Berkshire offers. On top of the stock market portfolio, you have the portfolio of completely owned businesses, that includes insurance, railroad utilities and energy manufacturing service and retailing a whole bunch of businesses that Berkshire owns. And then also in the accounting investment in derivative gains and losses, that depends on the stock price fluctuations that's not included in real earnings.

Berkshire Stock Valuation: A Look At Earnings

Nevertheless, when I add the earnings of the owned businesses, which is was 23.3 billion in 2019, then the total earnings of Berkshire add up to 31.6 billion. This is what the business earned in 2019. So on The market capitalization of I had to readjust everything in a day, or 447 billion. That's a price earnings ratio 14 was 12. Yesterday when I started preparing this, but okay, for a business return of 7.23% was 8% yesterday. Okay. However, if we look at the fact that Berkshire also has 100 billion in cash. 24 billion, let's say is for insurance calamities that Buffett always wants to have as cash, we have another hundred billion. So the real market capitalization minus the free cash that Berkshire has is now 337 billion with 31.6 billion in earnings. That's a price earnings ratio of 10. Approximately 10 was 9 yesterday.

So that leads you to a business return of 10% long term. And when I put this I started on my stock market research platform, I started updating all my holdings all the stocks that I have ever analysed. Here you can see a comparison with Berkshire and food stocks. And I was looking at the business yield and business yield of Berkshire was yesterday 11.15%. Now it's down to 10%. no risk. So it was the best return compared to other businesses, especially as Berkshire is a financial fortress. And therefore I estimate, there is no risk.

Risk Analysis

If you want to check all that I do. If you want to see this table, how it develops over time, perhaps find some interesting investments, check my stock market research platform in the links below. Now, what's the outlook for growth for Berkshire? Well, when it comes to Berkshire, the hundred billion have been there waiting for opportunities. As I said in the recent letter to shareholders, Buffett said if you want to sell more than 20 million of Berkshire stock, give me a call. I will Buy. So he was already happy doing buybacks two months ago. So he must be extremely happy buying back Berkshire stock as much as he can I think he can buy a third of daily volume.

Now, so that's deploying the cash into a business that gives you 10%, which means that $100 billion gives you protection gives you a cash buffer and you know that Buffett is going to reinvest it at 10%, 8-9-10 percent and something that will grow into infinity.

Berkshire Stock Valuation: Cash

So he always says be fearful when others are greedy, be greedy when others are fearful. And now, the last month, others have been fearful and it's time to be greedy new investments return on capital of 10% and higher, of course, looking for growth into infinity. What is the bankruptcy likelihood related to the current situation? I don't think there is any likelihood because they If we go to the 2018 annual letter, we see that Berkshire will forever remain a financial fortress. And he will never risk getting caught short of cash. And in the years ahead, perhaps 2020, we hope to move much of our excess liquidity just 100 billion into businesses that Berkshire will permanently own. The immediate prospects for debt, however, are not good. Now they are much better, prices are sky high for businesses possessing decent long term prospects.

Deploying That Cash

So now he might have deployed part of it. Probably this situation will last still a while so we'll see how he deployed that money. But that's also a cash hedge that you have when you invest in Berkshire. So what's the market missing long term is the long term growth of Berkshire it's likely that Berkshire will grow forever because as the global economy grows Great businesses Berkshire owns will continue continually grow. When there is trouble in the markets, let's say in insurance. It helps that you have 120 billion to recapitalize grow your market share. So that's again, an opportunity for Berkshire.

In Chinese words, risk means or crisis means both risk and opportunity. So when you look at Berkshire think opportunity, Burlington Northern Santa Fe bought in 2009 opportunity or 2008 what it was so when situations like this come, that's an opportunity that increases exponentially Berkshires earnings over the long term.

Berkshire Stock Valuation: 1 Trillion In A Few Years

So we are now at 10% with no risk from a business perspective, however, interest rates have been lowered down which is which means money is free. And if we put that into perspective, a valuation perspective if I compare Berkshires business return of 10% with zero interest Interest rates. What does that mean from an investing perspective?

It means that we could soon see Berkshire giving a 3% yield, which would be a great yield relative, which means that it's a triple ahead for Berkshire stock. It wouldn't be a surprise to see Berkshire at 1 billion, 1 trillion, sorry, trillions. I have to start talking in trillions. 20 years ago, it was millions, then learning billions now trillions. $1 trillion, $1.5 trillion.

So there is the possibility given the zero interest rate environment, that stocks are really cheap and that we're looking at bargains of a lifetime. Especially because no risk businesses like Berkshire can easily triple we don't know what is ahead, but we have a triple If not, we have a business yielding long term 10% when the economy stabilises .Of course earnings are going to get hit this year, but 2021 2022 they will likely Rebound, because those are good businesses and businesses that will take advantage of the situation. So when it comes to me, I'm looking at 15% and higher returns. So I'm comparing Berkshire to all my other holdings, and therefore I'll see if it hits 15%. If we are in such a situation that the stock continues to decline, I'll really consider also buying Berkshire for my portfolios.

Thank you for watching, look forward to the comments, subscribe, click that notification bell and I'll see you in the next video.