Del Principe O’Brien Financial Advisors commentary for the month ended September 30 2018.

Dear Fellow Investors,

Whether you have been our valued client for years or you are new to the Del Principe | O’Brien family, allow us to thank you for your interest in our firm. In addition to providing financial advising tailored to your personal goals and needs, we also put a high value on making sure all our clients have insight into how we approach investing and why we operate the way we do.

Q2 hedge fund letters, conference, scoops etc

In this letter, you will find a reflection on what sets us apart from other financial advisory providers, some practical analysis of relevant topics from the world of finance, and news specific to our investment portfolio. As always, feel free to contact us if you would like to discuss any of these topics in greater depth; it’s our pleasure to have these conversations.

Eating Our Own Cooking: Thoughts on Conflicts of Interest

“To be successful in business and investing, you’ve got to have skin in the game.” – Warren Buffett

For a client to receive maximum benefit from financial advising services, it is crucial that the goals of a portfolio manager or investment advisor align with the goals of the client. This may seem like a no-brainer, but it is rare in the financial advising industry. Most advisors are employed by a larger entity that pays the advisor to sell a certain product or products to clients. If they don’t have the best product for your situation, they aren’t likely to refer you to another firm. Many advisors who represent a larger firm are also brokers, so by definition it is in their best interest to make transactions. One way of testing whether your interests and goals align with your investment advisor’s is to ask what percentage of the advisor’s own assets he or she has in the product he or she is trying to sell you.

At D|O, we invest 100% of our investable assets alongside our clients; that is, we have skin in the game. The only product we are selling is one we have already bought ourselves. The only employer we have to answer to is you. Put another way, we eat our own cooking and feel good about sharing it with you.

Advantages of the New Tax Code

“We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.” – Winston S. Churchill

Although individual and partisan disagreement is to be expected on any piece of legislation that affects our country’s tax code, the provisions for corporations in the Tax Cuts and Jobs Act (“the new tax code”) passed in December 2017 should disproportionately help businesses based in the U.S. and incentivize them to remain here. As investors in many American businesses, let us consider that the Internal Revenue Service is our partner in each of our investments, and they have a priority claim on all cash flows. D|O investments have conservative balance sheets by almost any measure, and historically they have been profitable in the U.S. Nevertheless, our investments historically have paid a much higher tax rate than their competitors in other countries. The corporate tax rate dropping from 35% to 21% results in a 22% increase in after-tax income for U.S. corporations.

An example: Our largest holding, Berkshire Hathaway, Inc., saw a $65.3 billion gain in its net worth in 2017, with $29 billion coming from the reduction in the corporate tax rate. Another advantage of the new tax code is that, theoretically, the lower rate will encourage corporations to bring assets back to the U.S. from foreign holdings. We will continue to keep an eye on what the companies in D|O’s portfolio are doing with the tax savings and how those actions may affect our investing strategy.

Chicago Bridge & Iron Merges with McDermott

“Whenever you look at any potential merger or acquisition, you look at the potential to create value for your shareholders.” – Dilip Shanghvi

McDermott International, Inc. (MDR) | Ownership: 1%–7%

In May, one of our portfolio investments, Chicago Bridge & Iron Co (CBI), approved a merger with McDermott International (MDR). In the words of McDermott CEO David Dickson, “The combination of [MDR and CBI] brings together a global upstream and subsea engineering, procurement and construction company with an established downstream provider of industry-leading petrochemical, refining, power, gasification and gas processing technologies and solutions, creating a company that spans the entire value chain from concept to commissioning.” In other words, the company now known simply as McDermott will be fully integrated—able to provide the full gamut of expertise and services from planning and building oil and gas pipelines to processing and refining the raw materials into power.

The merger brought together the companies’ complementary assets, a move that should increase revenues, broaden the new firm’s customer base, encourage operational and financial efficiency, and promote further technological advances. There’s also the potential for significant growth. This is good news for us as shareholders and a good example of why paying close attention to a company’s value—including its potential for advantageous mergers and acquisitions—can yield great investment results down the road.

Gains on Hess

“It is not the man who has too little, but the man who craves more, that is poor.” – Seneca

In June of 2018, we sold our shares of Hess Corporation (HES), a company that was one of our first holdings in the portfolio, for a 36% return on our investment. We chose to sell in June for two reasons. First, at about $65 dollars a share, we believed Hess was fully valued, and we wanted to take advantage of the spike in Brent Crude (crude oil). We are interested in owning Hess again later when they are trading at a discount to their intrinsic value.

In Memoriam: Sergio Marchionne, 1952–2018

“The true value of a CEO should be measured in terms of his or her human impact on the organization, on his or her ability to develop leaders who have the courage to challenge the status quo, to pioneer uncharted paths, to break away from convention and go beyond the tried and the tested.” – Sergio Marchionne

Mr. Marchionne, dynamic and widely admired CEO of Fiat Chrysler, passed away on July 25 after sudden complications from shoulder surgery. In previous letters we have discussed his excellent leadership at the helm of Fiat and then Fiat Chrysler, and we know his loss will be felt not only within his company but throughout the automotive industry. He was 66 years old.

The Cable Cowboy

“A nickel ain’t worth a dime anymore.” – Yogi Berra

…unless you’re Dr. John C. Malone, that is. Malone is an American billionaire businessman and philanthropist who has made an impressive career—and a fortune—out of recognizing value in certain investments and applying shrewd logic and sharp intelligence to all his business dealings. He graduated Phi Beta Kappa with a degree in engineering and economics from Yale and went on to earn a PhD from Johns Hopkins. In 1973 at the age of 29, he became the CEO of media giant Tele-Communications, Inc. (TCI). During his 23-year tenure at TCI, he achieved as much control in the media industry as anyone ever had by controlling distribution. In 1999, he sold TCI to AT&T for $54 billion, walking away with $2.2 billion of AT&T stock himself.

The portion of TCI that AT&T did not purchase in the deal became Liberty Media. As CEO of the company, Malone was granted options on $25 million in Liberty stock at $256 per share. He believed in himself and in Liberty Media, and his belief was not misplaced. Indeed, the bulk of Liberty Media’s assets were made up of equity stakes in other companies that were not fully valued. Less than two years after the rights offering, Liberty split its stock 20 for 1, then 4 for 1, and then 2 for 1. In just two years’ time, shares that initially sold for $256 apiece appreciated and were worth $3,700, sending Malone’s investment of $42.1 million—most of it borrowed from Liberty on a personal note—climbing to more than $600 million.

With dozens of spinoffs in media and production, Dr. John Malone owns over 5% of more than 25 publicly-traded companies. In some cases, he owns well over 50% of the company and/or is the majority shareholder. Consider that $1 invested at the beginning of the Malone era in 1973 was by 1998 worth more than $900, for a compound annual growth rate (CAGR) of 30%. Compare that to the entire S&P, which had a CAGR of 14% during the same time period. In February 2018, Malone became the largest individual landowner in the U.S.—with 2.2 million acres.

Now Batting…

“It took me seventeen years to get three thousand hits in baseball. It took one afternoon on the golf course.” – Hank Aaron

Liberty Braves Group (BATRA) | Ownership: 1%– 8%

We have recently decided to add one of John C. Malone’s companies to our investment portfolio. Liberty Media has a history of creating tracking stocks for its individual businesses to allow investors to isolate the valuation of each component of its media portfolio. We have been watching one of these businesses, Liberty Braves Group (BATRA), and we believe it is currently undervalued and thus a wise investment. When you opened this letter, you probably didn’t expect to hear that you are now part owners of the Atlanta Braves and The Battery Atlanta!

The current Market Value of BATRA is about $1.3 billion. This includes SunTrust Park, the 41,000-seat baseball stadium built in 2017. The new park features more premium seating, which creates an average revenue increase of $590,000 per game ($48 million per year). But the stadium is just one part of The Battery Atlanta. The dining, shopping, and entertainment complex has the feel of a master planned community and spans 60 contiguous acres. To put that in perspective, think of 60 football fields without the end zones. When you compare it to the development around the Chicago Cubs’ Wrigley Field and the Saint Louis Cardinals’ Ballpark Village, multiply that times five.

The Battery Atlanta employs more than 5,200 people throughout the year and is the site for anchor tenant Comcast, whose new regional headquarters provides office space for 1,000 employees. The Battery has established a 50-50 partnership with luxury hotel company Omni Hotels & Resorts, whose 236-room hotel is steps from the ballpark. In addition, The Battery has 531 upscale apartment homes and around 30 shops, restaurants, bars, and a movie theater. With a capacity of 4,000, Live Nation Music Venue (also owned by Liberty Media) will feature acts throughout the year. Larger musical acts will play at SunTrust Park when the Braves are on the road. Those concerts have the potential to be another sizable revenue generator, as approximately 90 million fans will attend Live Nation Entertainment concerts in 2018, with SunTrust Park among its venues.

Broadcasting is another source of revenue for Liberty Braves Group. The current national broadcasting contract pays each Major League Baseball team around $52 million per year. Since 1966, MLB broadcasting revenues have increased steadily by 12% annually and only declined during labor strike years (1995 most recently). In addition, former Braves owner Ted Turner conveniently locked the Braves into a local broadcasting deal with TBS (the T stands for Turner, of course) below market value for 20 years. The deal pays the club around $36 million a year and expires in 2027. Did we even mention that, at the time this letter was written, the Braves are in first place in the National League East and have the number one or two minor league system according to every national scouting report available? After evaluating the Liberty Braves Group over the last month, we believe they are trading well below their intrinsic value.

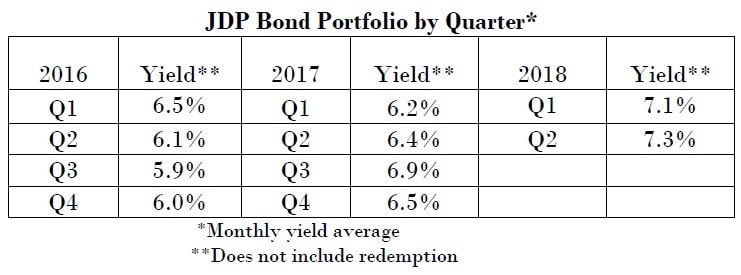

JDP Bond Portfolio

The following table provides a brief summary of how the JDP Bond Portfolio has performed on average over the last two years:

Working Together

“Teamwork is the ability to work together toward a common vision, the ability to direct individual accomplishments toward organizational objectives. It is the fuel that allows common people to attain uncommon results.” – Andrew Carnegie

Allow us to restate what drives the success of our firm: our focus on your wellbeing and our practice of always putting your interests ahead of the firm’s short-term financial gain. Over time, this philosophy has proven to be both effective and mutually beneficial. It is our honor and privilege to be managing money for friends, family members, estates, not-for-profits, charitable organizations, and business entities. We continue to be very selective with those we add to our growing family. Selfishly, we only want to work with like-minded people whom we admire, respect, and love. We are grateful to have your trust and will always work diligently to remain worthy of it.

Cordially,

Joseph Del Principe