Brexit uncertainty biting hard on banks and investment managers

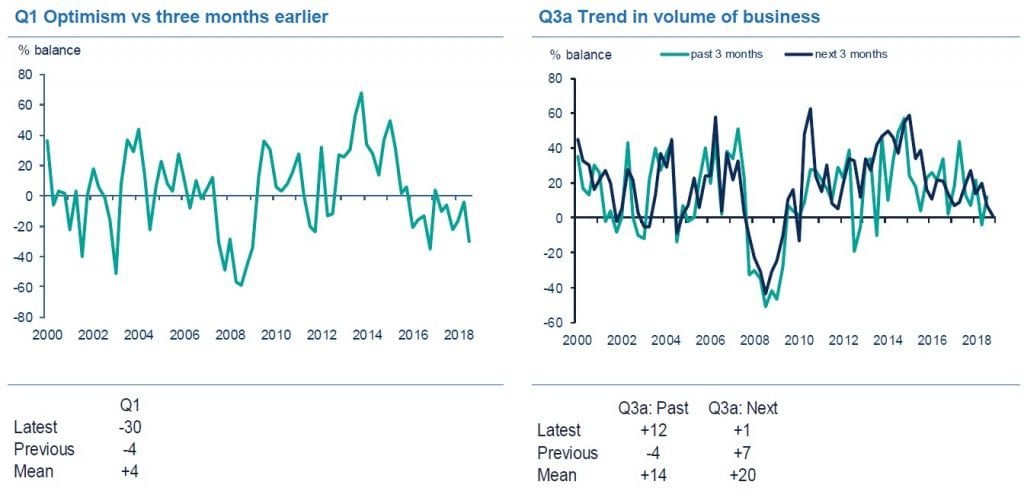

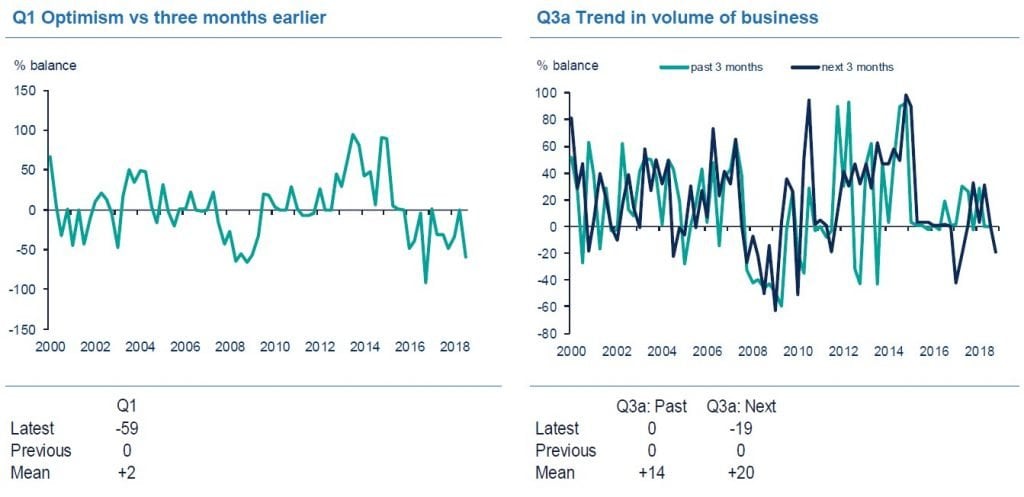

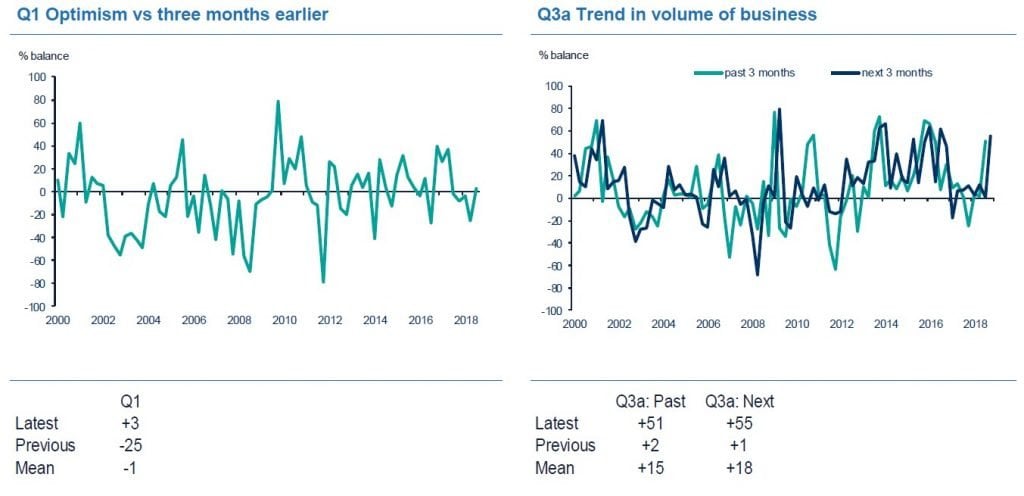

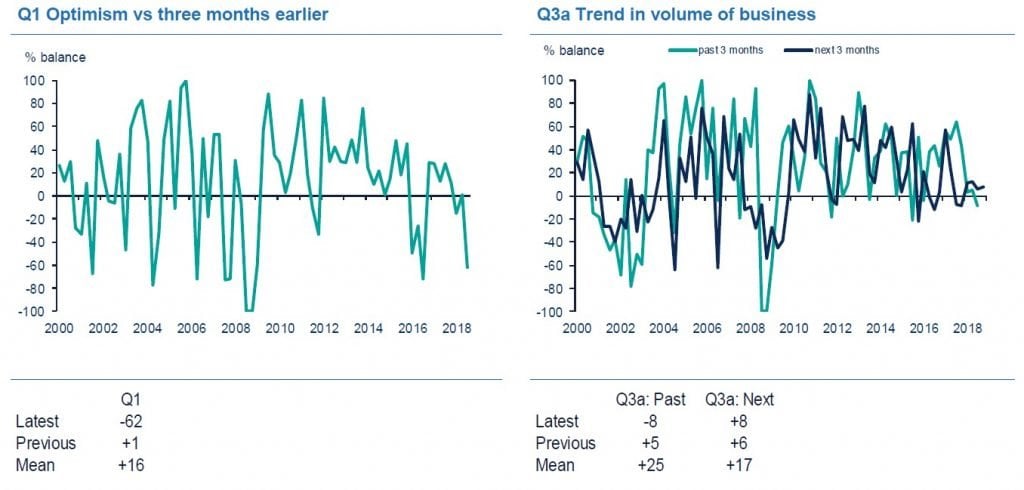

Optimism in the financial services sector fell sharply in the quarter to September, amid signs of a listless operating environment, according to the latest CBI/PwC Financial Services Survey.

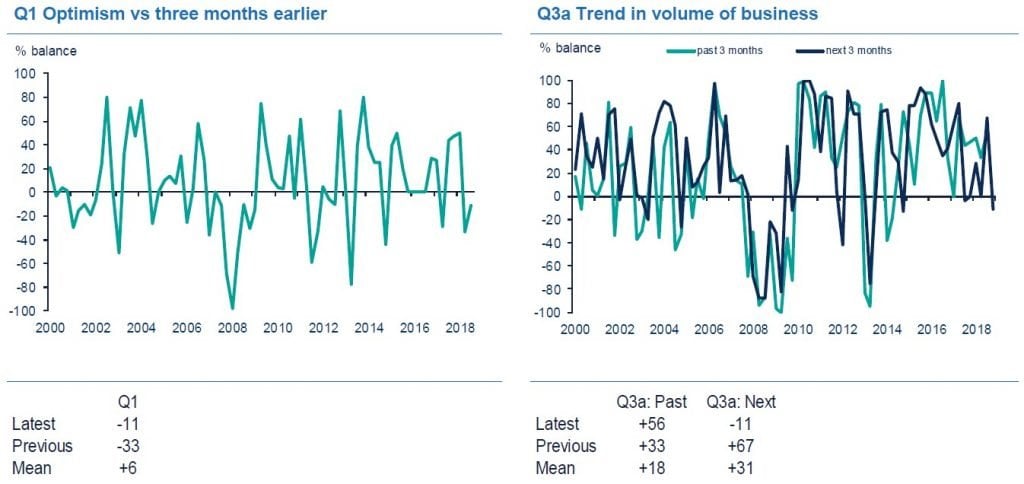

The quarterly survey of 100 firms found that optimism about the overall business situation in the financial services sector fell further, having declined in all but one quarter since the start of 2016. The deterioration of sentiment in banking and investment management was particularly widespread – only finance houses reported an improvement in optimism.

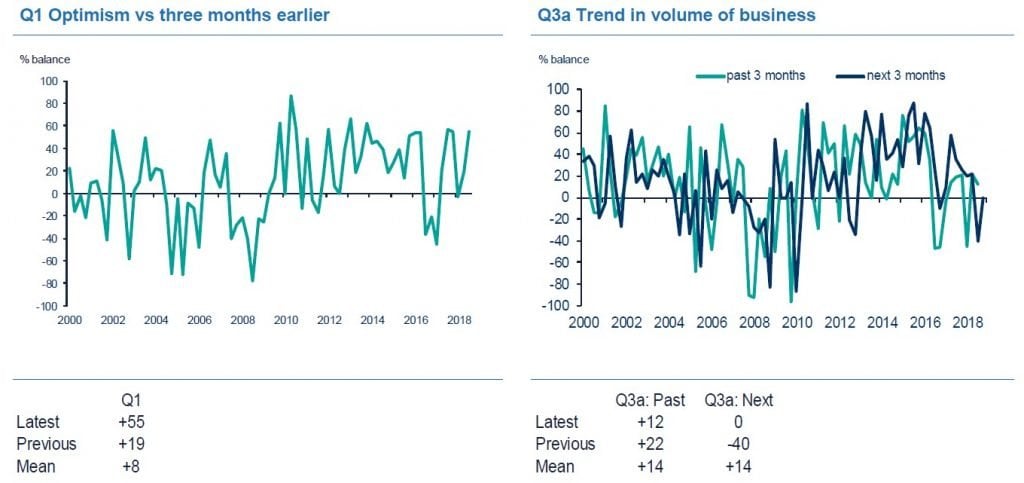

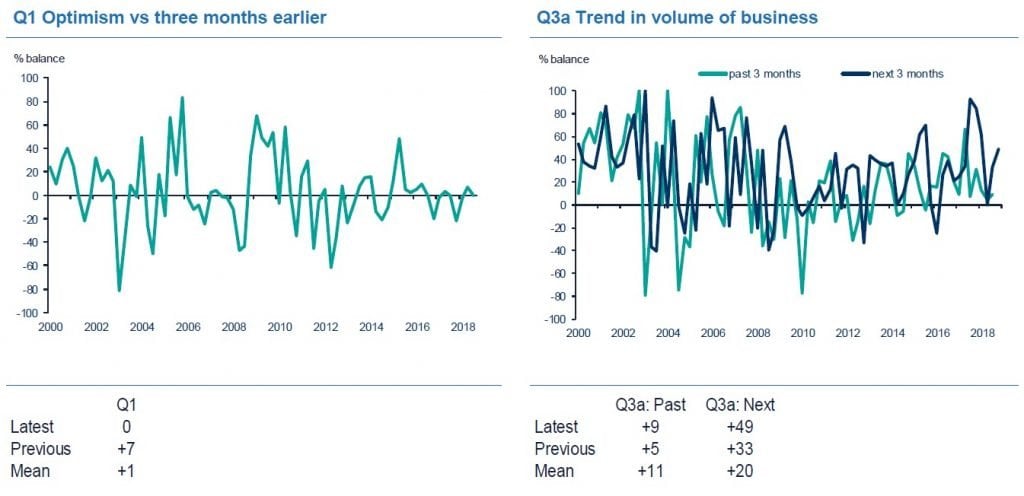

Overall business volumes increased slightly in the three months to September, although the level of business dipped slightly below normal. Conditions varied again across the sector. Whilst many sectors saw business volumes rise – notably insurers – banking volumes were stable for a second successive quarter and investment managers said volumes contracted, confirming a striking loss of momentum during 2018. Looking ahead to the next three months, overall business volumes are expected to be unchanged, marking the weakest growth expectations since 2009.

Q2 hedge fund letters, conference, scoops etc

Employment growth across financial services stalled in the quarter to September, with cuts to headcount in banking outweighing increases in most other sectors. Overall headcount is expected to remain stable in the three months to December, with the sharpest cuts expected in banking and investment management.

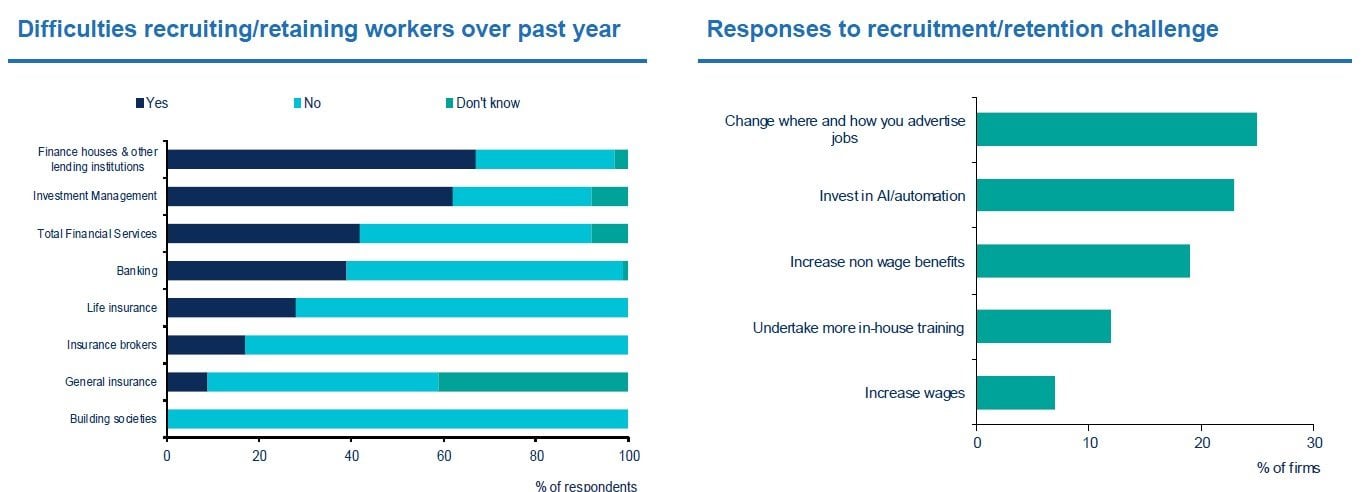

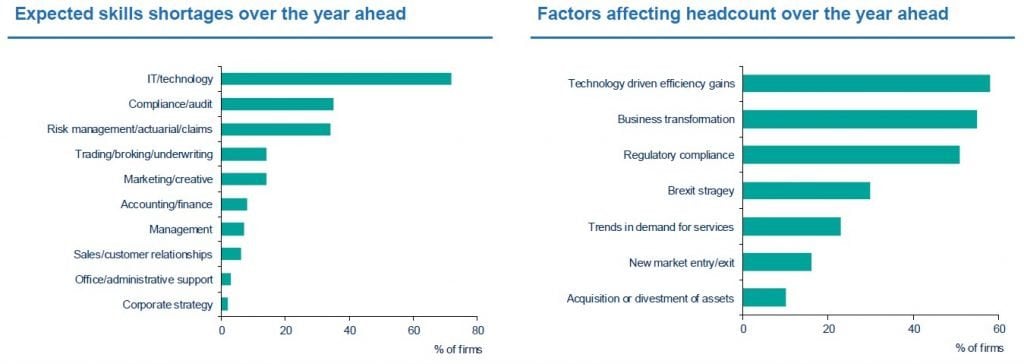

Also asked about recruitment and skills, two fifths of firms said they had found it more difficult to recruit and retain workers over the past year. Almost half of firms said skill shortages could constrain business expansion in the year ahead – the highest share since the start of the survey in 1989. Nearly three quarters of firms expect to find it more difficult to recruit IT workers in the year ahead.

Overall Financial Services

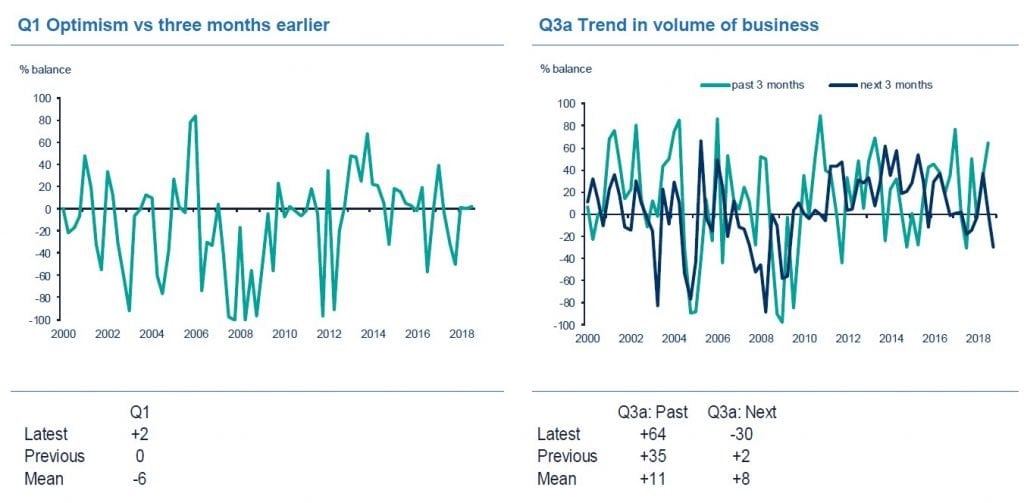

Banking

Building Societies

Rain Newton-Smith, CBI Chief Economist, said:

“While it’s good to see that demand for financial services is holding up, with business volumes edging higher last quarter, it’s simply impossible to ignore the dangerous signs of strain on the sector arising from the combined challenges of a subdued economy, Brexit, regulation and rapid advances in technology.

“For the sector to continue to be one of the UK’s most attractive economic assets, it is fundamental that a Withdrawal Agreement with the EU is agreed. This will provide temporary but essential relief for financial services firms of all sizes. Then attention can turn to the vital task of finalising our future economic relationship with the EU, in which services need to play a pivotal part.

“In the long run, it’s clear the sector needs to think more creatively about recruiting and retaining its skilled staff. Investing in employees with the right skills – especially technological skills – and ensuring the sector offers a more diverse and attractive career path are key.”

Finance Houses

Life Insurance

Andrew Kail, Head of Financial Services at PwC, said:

“The financial services sector is arguably the most internationally competitive industry in the UK. It’s essential that London and the regional centres across the country collectively remain among the pre-eminent international hubs for financial services and global business.

“There are understandable concerns around the shockwaves created by Brexit alongside dealing with the impacts of regulation and technology. Addressing how these issues manifest themselves must be at the heart of firms’ contingency plans over the next six months.

“As the Brexit negotiations continue companies across the sector – who are providing vital services to customers, corporates and governments – have the chance to galvanise themselves and their clients against any potential fallout. This must be underpinned with prudent planning and skilful execution of their plans.”

Amid weak volumes growth and rising costs, profits in the sector as a whole were flat in the quarter to September, for a second successive quarter. Several sectors saw profits fall, with investment managers reporting the steepest drop since the financial crisis. Overall profitability is expected to grow in the three months ahead, but to continue declining for investment managers and building societies.

Investment intentions for the year ahead cooled over the three months to September. Financial services firms plan to raise spending on marketing and IT, although the pace of growth in IT spending is expected to slow, but they also expect to cut back land and buildings and vehicles, plant & machinery.

Firms cited a broad range of reasons to invest, including efficiency improvements, statutory legislation and regulation, and to provide new services. The main brake on investment spending remains uncertainty about demand and inadequate net returns.

Technology is altering recruitment, with over half of firms saying changes in headcount were being driven by technology-driven efficiency gains. Regulatory compliance, business transformation and Brexit were all seen as more important for recruitment strategies than the expected level of demand for services.

Meanwhile, the UK’s broader economic outlook remains fairly subdued, with GDP growth held back by weak household income growth and the impact of Brexit uncertainty on investment. For more detail, see our June economic forecast.

General Insurance

Insurance Brokers

Investment Management

Key findings:

- Optimism in the financial services sector dropped sharply (-30%), the tenth quarter of declining sentiment in the last eleven quarters (the exception was the first quarter of 2017). This marks the longest period of flat or falling sentiment since the global financial crisis of 2008

- 6% of firms said they were more optimistic about the overall business situation compared with three months ago, whilst 36% were less optimistic, giving a balance of -30% (compared with -4% in the quarter to June). Barring December 2016 (-35%), this was the steepest drop since the financial crisis (-34% in March 2009)

- 23% of firms said that business volumes were up, while 11% said they were down, giving a balance of +12% (up from -4% in the quarter to June)

- Looking ahead to the quarter to December, business volumes are expected to be flat: 15% of firms expect volumes to rise next quarter, and 14% expect them to fall, giving a balance of +1%, the weakest since December 2009 (-13%)

Incomes, costs and profits:

- Overall profitability was flat in the three months to September, with 20% of firms reporting that profits had increased and 21% saying they fell, giving a balance of -1%. This followed a similar picture in the previous quarter (+4%), but profits are expected to improve in the next three months (+16%)

- Income from fees, commissions and premiums was largely unchanged (+1%), but income is expected to fall in the quarter ahead (-13%)

- Income from net interest, investment and trading fell (-13%), with a slight increase expected in the next three months (+5%)

- Total operating costs rose (+17%) and average costs increased at the fastest pace in four years (+21%). Both total costs and average costs are expected to rise next quarter (+16% and +15% respectively).

Employment:

- 20% of financial services firms said they had increased employment, while 17% said that headcount fell, giving a balance of +3%, disappointing expectations (+15%)

- Numbers employed are expected to hold steady (0%) next quarter.

Investment over the next 12 months:

In the year ahead, financial services firms expect to increase spending on IT and marketing, but to cut back on other forms of capital spending:

- IT: +49% (a drop from +70% in the quarter to June)

- Marketing: +31% (a rise from +20% in the quarter to June)

- Vehicles, plant and machinery: -15% (down from -9%)

- Land and buildings: -18% (down from +5%)

The main reasons for authorising investment are cited as:

- To increase efficiency/speed (75% of respondents)

- For replacement (68%)

- Statutory legislation and regulation (66%)

The main factors likely to limit investment are cited as:

- Uncertainty about demand or business prospects (60% of respondents)

- Inadequate net return (55%)

- Shortage of labour, including managerial & supervisory staff (26%).

Business expansion over the next 12 months:

The most significant potential constraints on business growth over the coming year are:

- Level of demand (58% of respondents)

- Statutory legislation & regulation (52%)

- Availability of professional staff (48% - a survey record high).

Recruitment and skills in Financial Services:

- Over two-fifths (42%) of firms had found it more difficult to recruit and retain workers over the past year, but half had not (50%). In response, various actions are being taken:

- Change advertising (25%)

- Invest in artificial intelligence and automation (21%)

- Provide training (12%)

- Increase wages (7%)

- The most acute skills shortages in the year ahead will be felt in the recruitment of workers in:

- IT (72%)

- Compliance/audit (35%)

- Risk management/actuarial/claims (34%)

- Firms said changes in headcount were being driven by:

- Technology driven efficiency gains (58%)

- Business transformation (55%)

- Regulatory compliance (51%)

- Brexit (30%).

Notes to Editors:

The September 2018 Financial Services Survey was conducted between 15th August and 10th September. 100 firms replied.

A ‘balance’ is the difference in percentage points between the weighted percentage of firms answering that output is “up” and the percentage answering “down” (for example, if 30% of firms say that output is up, 60% that it is unchanged, and 10% that it is down, the balance statistic is +20%).

Across the UK, the CBI speaks on behalf of 190,000 businesses of all sizes and sectors. The CBI’s corporate members together employ nearly 7 million people, about one third of private sector-employees. With offices in the UK as well as representation in Brussels, Washington, Beijing and Delhi, the CBI communicates the British business voice around the world.

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 158 countries with more than 236,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com.

PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

Media Contact:

CBI Press Office is available 24 hours a day on 0207 395 8239, or email: [email protected]. Follow the CBI (@CBItweets) and CBI Economics (CBI_Economics) on Twitter.

PwC press contact: [email protected] / 07841 468678 and [email protected] / 07525 925830.