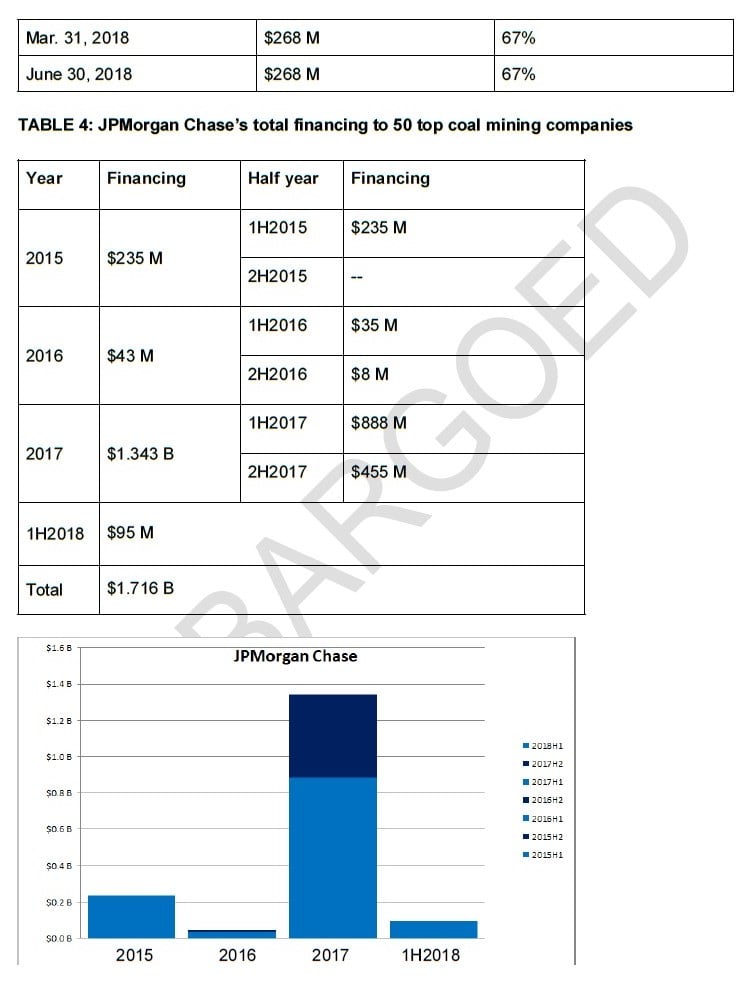

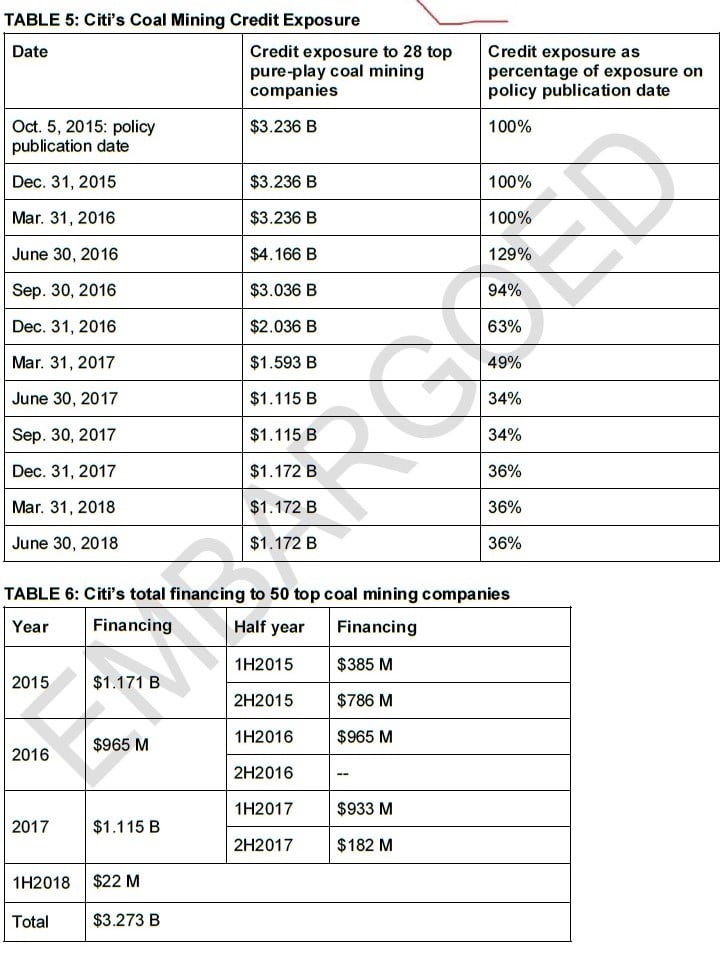

Following Trump’s inauguration, major U.S. banks increased financing for coal, demonstrating loopholes in policies adopted in response to the Paris Agreement. A new report, published by Rainforest Action Network (RAN), analyzes the six biggest U.S. banks and finds that 2017 was a year of major backsliding on coal mining finance, with banks increasing overall financing between 16% (Citi) and an incredible 3,014% (JPMorgan Chase) compared to 2016.

Q2 hedge fund letters, conference, scoops etc

“The numbers show that U.S. banks are in step with Trump’s pro-coal agenda,” said Patrick McCully, Climate and Energy Program Director at Rainforest Action Network. “With an administration that’s pushing us backwards, financial institutions have to do their part to limit warming to 1.5 degrees Celsius.”

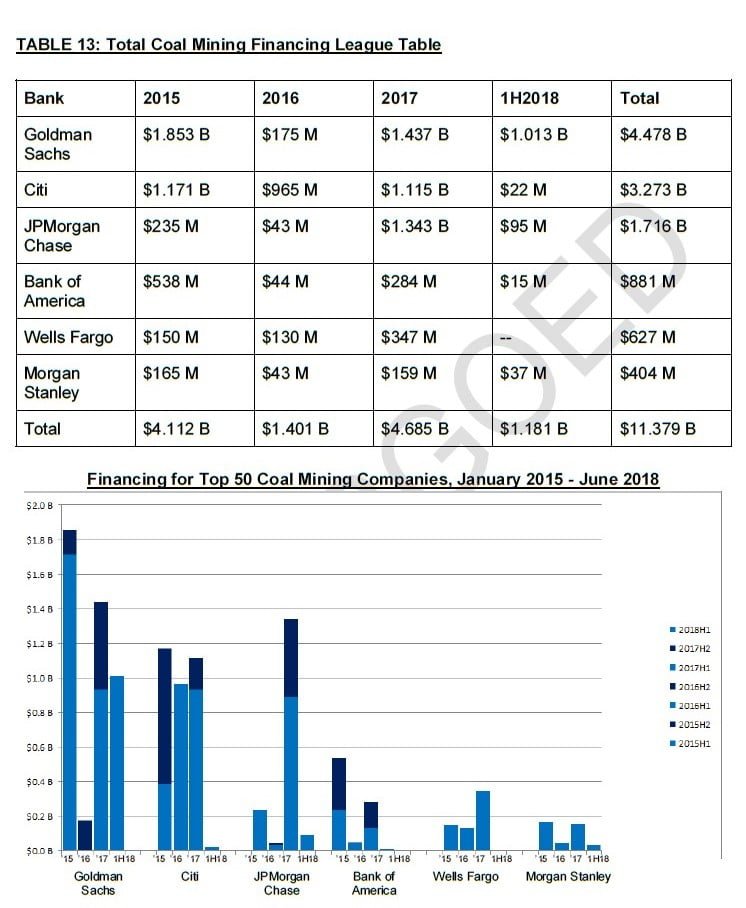

The six banks (Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo) have so far not reported on their performance against their coal mining policies. All of these banks except Goldman Sachs committed to reduce credit exposure to the coal mining industry. The report approximates the banks’ credit exposure to 50 top coal mining companies and calculates overall financing (lending and underwriting) to those companies.

The report also finds that the banks’ policy commitments have significant loopholes. Despite banks’ compliance with credit exposure commitments, they continue providing new financing to the coal industry – even significantly increasing this financing – so long as enough old loans come off the books at the same time. Of the five banks with exposure-reduction commitments, Bank of America, Citi and JPMorgan Chase limit that commitment to pure-play coal companies, which represent just half of production. In addition, policies on credit exposure restrict only certain types of loans. Underwriting and B-term loans account for more overall coal mining financing than on-the-books lending, but all U.S. banks put little to no restrictions on these forms of coal financing.

“Solely reducing credit exposure is the wrong objective,” said Jason Disterhoft, Climate and Energy Senior Campaigner at RAN. “Instead, banks should commit to year-on-year reductions of their overall financing, including all types of loans and underwriting services for all coal mining companies, with a declared zero date. We need a rapid phase-out of coal and stronger policies to get us there.”

Summary

Between May 2015 and March 2016, the six biggest U.S. banks (Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo1) adopted new policies restricting their financing to the coal mining industry. These policies constituted the U.S. banking industry’s main policy response to the Paris climate conference. For all of these banks except Goldman Sachs, those policies included commitments to reduce credit exposure to coal mining companies.

This report approximates the big six U.S. banks’ credit exposure to 50 top coal mining companies since the banks adopted their policies in 2015-16. These 50 coal mining companies together represent 64% of global annual coal production. Three banks committed to reduce exposure only to pure-play coal mining companies (Bank of America, Citi, and JPMorgan Chase), and the report’s approximation reflects that in those cases. The report also calculates overall financing (lending and underwriting) to those companies since 2015. Findings include:

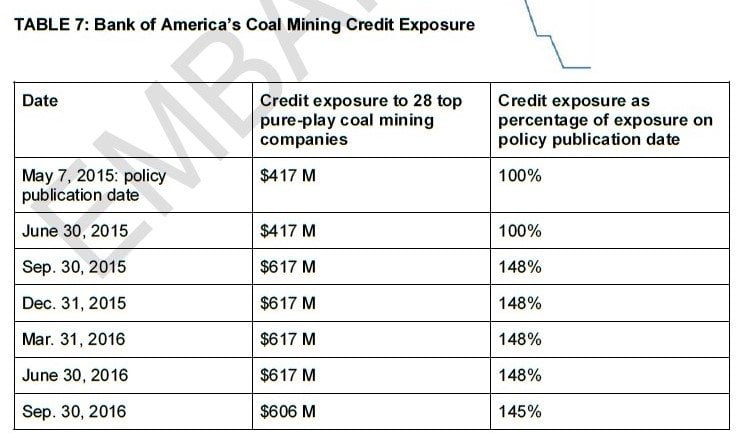

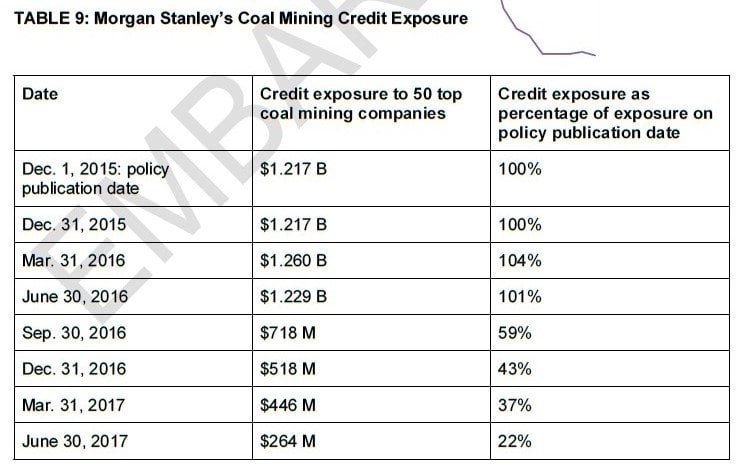

● As of June 30, 2018, the five banks with credit exposure reduction commitments have reduced exposure between 12% (Wells Fargo) and 80% (Bank of America) since their respective date of policy adoption.

● Goldman Sachs does not have an exposure reduction commitment. It increased exposure 84% from the November 2015 date when it put in place a more narrow coalrelated policy, to June 30, 2018.

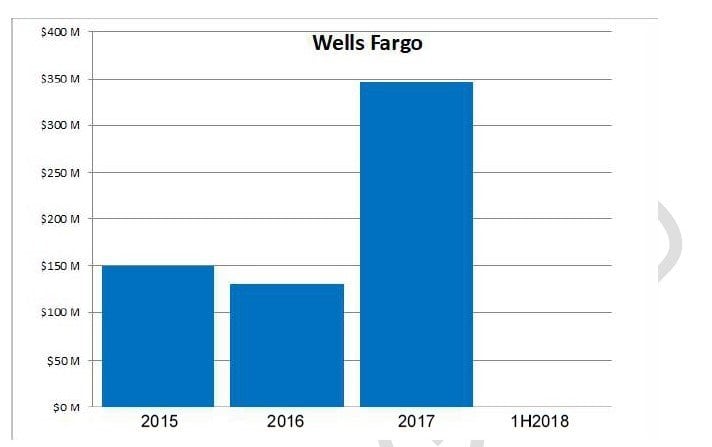

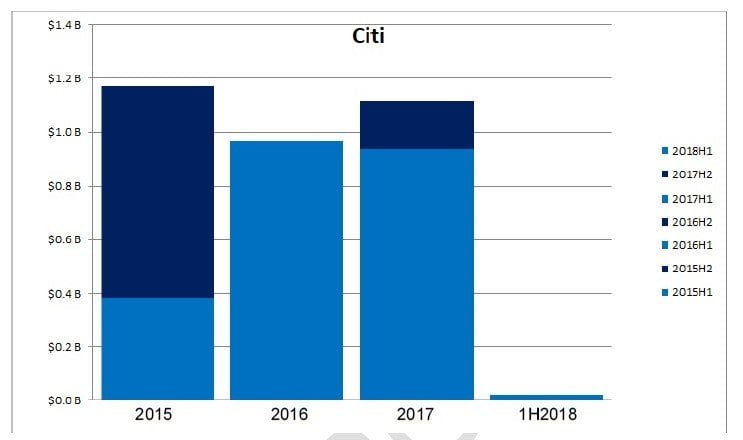

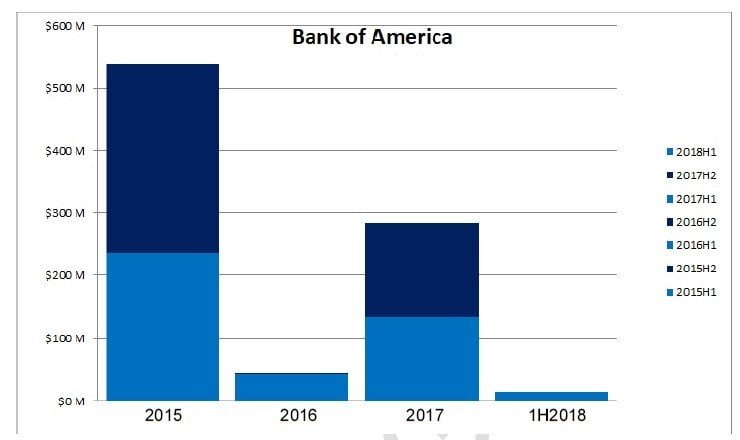

● 2016 was a year of progress on loans issued and debt and equity underwritten to coal mining companies — with banks decreasing financing between 92% (Bank of America) and 13% (Wells Fargo) compared to 2015. However, 2017 was a year of backsliding, with banks increasing this financing between 16% (Citi) and an incredible 3,014% (JPMorgan Chase) compared to 2016.

All of these banks support the Paris Climate Agreement. Continued financing of coal is

incompatible with the agreement’s goal of holding global warming well below 2 degrees Celsius,

with the aim of limiting warming to 1.5 degrees. The report therefore concludes that:

● Banks should strengthen their policies to commit to reducing overall financing, and not

just credit exposure, year on year, with an explicit phase-out date.

Background

Coal mining devastates the health of nearby communities. Every step of the coal lifecycle — not just combustion — is clearly associated with detrimental cardiovascular, pulmonary, and/or neurological health effects.2 In particular, the mining and washing of coal can contaminate drinking water with heavy metals or polymers, with contamination continuing even beyond the abandonment of a mine.3 The effects on waterways are especially concerning in Appalachia, where the practice of mountaintop removal (MTR) mining has destroyed hundreds of mountain summits and buried hundreds of miles of streams.4

A particularly urgent reason to phase out funding for coal is climate change. Of the many human activities that cause climate change, the world’s largest contributor is coal combustion, representing 45% of all energy-related carbon dioxide emissions in 2015.5 A rapid phase-out of coal-fired power is needed in the coming decades in order to meet the goals of the Paris Agreement.6 The Intergovernmental Panel on Climate Change’s data show that the vast majority of fossil fuel reserves, of which coal makes up an outsize share, must stay in the ground if the world is to limit global warming to 2 degrees Celsius, let alone 1.5 degrees Celsius.7

Between 2015 and 2016, five of the six biggest U.S. banks responded to these clear risks with commitments to reduce lending exposure to coal mining companies — albeit not for all forms of financing, and without public reporting on implementation. These coal policies were the main substantive indication of support by U.S. banks to the Paris Climate Agreement in 2015. Ahead of the climate conference in Paris, Bank of America led the way with an exposure reduction policy in May, with Citi following suit in October. Then in December 2015, the month of the Paris climate summit, Wells Fargo and Morgan Stanley announced similar commitments. JPMorgan Chase was the last to commit in March, three months after Paris.

Goldman Sachs instituted a much narrower policy than its peers. In its November 2015 update of its Environmental Policy Framework, instead of an exposure reduction commitment, the bank announced a policy only restricting financing for some mountaintop removal mining (MTR) projects and some companies.8

The big six U.S. banks also have a range of commitments restricting financing for MTR mining, greenfield mining projects, and/or coal-fired power projects. Further information on the mining policies can be found at the end of this report.

These banks have so far not reported on their performance against these coal mining policies. In the absence of such documentation, this report approximates the big six U.S. banks’ credit exposure to top coal mining companies, and calculates overall financing to those companies since 2015. A list of companies, and details on this methodology, can be found at the end of this report.

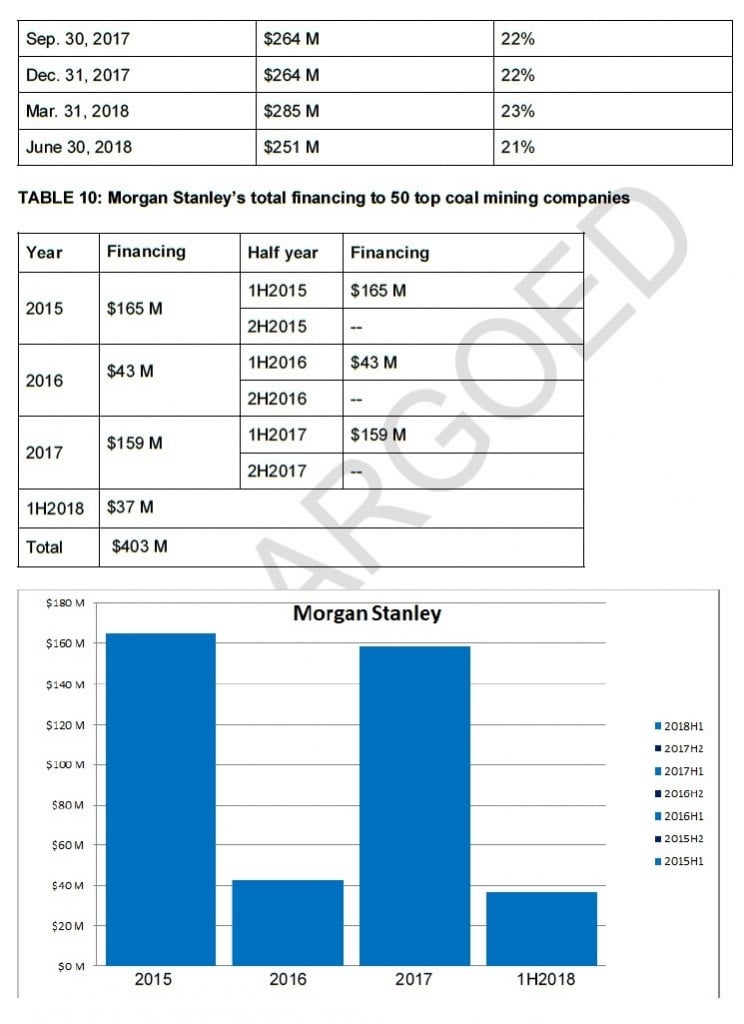

Credit exposure is measured at date of policy announcement and the end of each subsequent quarter. For Morgan Stanley and Wells Fargo, this graph indicates credit exposure to all 50 top coal mining companies included in this analysis. For Bank of America, Citi, and JPMorgan Chase, exposure is measured only to the pure-play coal mining companies in that list (28 of the 50).

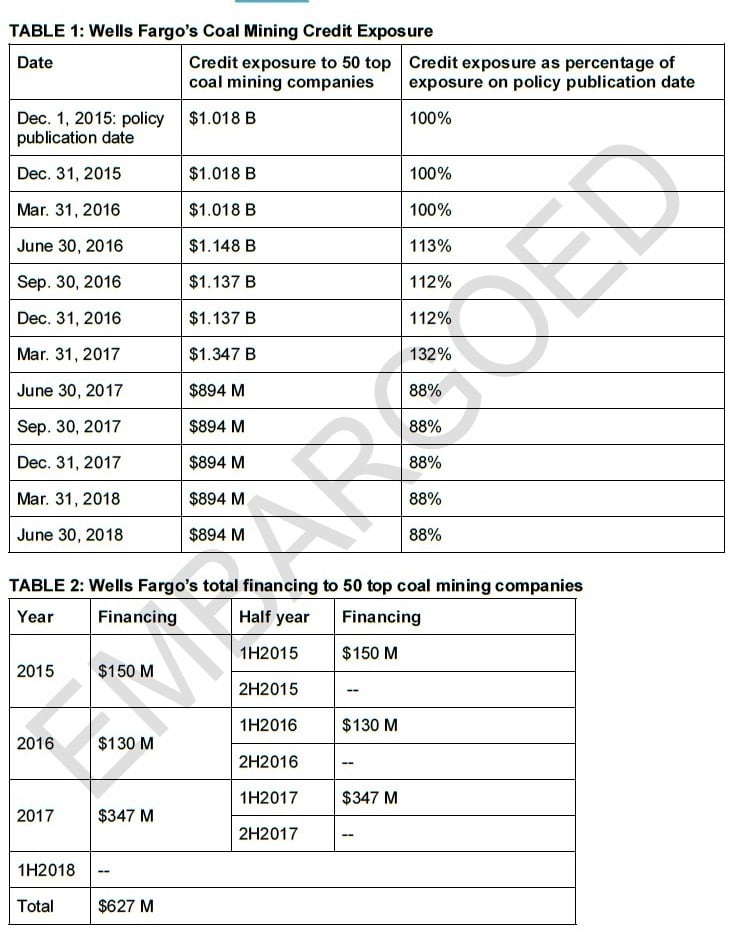

Wells Fargo

JPMorgan Chase

Citi

Bank of America

Morgan Stanley

Goldman Sachs

In November 2015, Goldman Sachs instituted a much narrower policy than its peer banks, restricting financing for some MTR projects and some companies, rather than a broader coal mining exposure reduction commitment. An approximation of its credit exposure is nonetheless included here for comparison.

Analysis

The coal mining policies established by the six biggest U.S. banks in 2015-16 were an important step in those banks aligning their policies and practices with a 1.5 degree world. But with more than two full years of data in hand, we can now assess the impact of these policies, and conclude that they need strengthening.

Banks with coal mining exposure reduction commitments are following those policies, to varying extents

After an initial period of increasing exposure to top coal mining companies after policy adoption, every bank with an exposure-reduction policy now appears to be following the letter of that policy, with varying degrees of reduction. Each of these banks has seen exposure peak, with Bank of America the earliest (at the end of 3Q15, at 148% of their exposure level at policy adoption) and Wells Fargo the latest (at the end of 1Q17, at 132%), and since then either hold steady or decline in each subsequent quarter. The only notable exception to that trend was JPMorgan Chase, which saw an initial peak at the end of 2Q17, at 110%, a drop to 31% at the end of 3Q17, and then a second peak, at 67%, at the end of 4Q17. And Goldman Sachs, the only one of these banks without an exposure reduction commitment, has seen a very different trajectory, with a peak at 248% at the end of 2Q17, a large reduction in the next quarter, and then significant increases in the following two quarters.

But the banks’ policy commitments have significant loopholes

- Of 50 top coal miners, pure-play companies represent just half of production

Of the five banks with exposure-reduction commitments, Bank of America, Citi and JPMorgan Chase limit that commitment to pure-play coal companies. Of the top 50 coal mining companies considered in this report, 28 are pure-play companies and have a combined output of 53% of the 50 companies. Extrapolating this breakdown of output between pure-play and diversified miners to the additional 36% of global production not covered in this report suggests that roughly half of coal production may be outside the scope of these ‘pure-play’ policies.

- Underwriting and B-term loans have been a larger source of support than all other loans

Policies on credit exposure restrict many, but not all, loans. In particular, they effectively place little restriction on B-term loans, which come off banks’ books quickly. And they place no restrictions on underwriting of debt and equity. Overall, and for most individual banks, underwriting and B-term loans have been a larger source of support for coal mining than all other loans since 2015.

See the full article here.