Key Metrics

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Overview & Current Events

Middlesex Water Company was formed in 1897. The company is a water and wastewater utility in New Jersey and Delaware. Its market cap is approaching $700M and it produces about $130M in revenue annually. MSEX has paid consecutive dividends since 1912 and has reached its 44th consecutive year of dividend increases.

The company’s recent Q4 saw strong earnings growth despite basically flat revenue; the product of much lower operating expenses owed to lower employee costs. It also accrued benefits from a lower tax rate but growth nonetheless has been hard to come by. Subsequent to the end of the quarter, MSEX did receive approval for a rate increase in New Jersey that should be good for about $4M in additional revenue this year and a $5M run rate annually going forward. Given how well MSEX is controlling expenses, that bodes well for operating margins moving forward.

Growth on a Per-Share Basis

EPS has been rising fairly steadily over the past decade, although gains have been far from linear. The Great Recession saw EPS fall markedly in 2009 but recovery was fairly quick and since 2009, EPS has essentially doubled. We see total EPS growth for the next five years of just 1.9%, which is slightly below is historical rate of growth. However, the only meaningful sources of EPS expansion will be the rate increase in New Jersey and lower taxes. The rate hike will boost revenue by ~3% this year and a lower tax rate will help as well, but starting in 2019, those things will be part of the comparable base. Therefore, growth will look much better in 2018 than in later years, a fact reflected by our estimates. Following this year, EPS growth will have to come primarily from cutting operating expenses and customer growth, both of which have historically contributed small amounts of growth; a recession would put even those estimates at risk.

We are forecasting the dividend to continue its streak of small increases, rising from this year’s payout of 90 cents to $1.10 in five years’ time. MSEX has an impressive streak of dividend increases that will continue to grow but on a percentage basis, the payout will rise rather slowly. The company’s payout ratio was far too high during the Great Recession and management pulled way back on dividend increases to avoid a similar fate down the road.

Valuation Analysis

The company’s P/E multiple has risen sharply in recent years and as a result, the stock looks substantially overvalued today. After spending much of the past decade under 20, MSEX’ current P/E multiple is 27.3. We are forecasting a decline back towards 21 in five years, indicating a meaningful 4.9% annual headwind to total returns. Given MSEX’ growth profile, it simply cannot sustain a P/E multiple where it is currently.

Given this and weak dividend growth, we are forecasting the yield to rise back to more normalized levels in excess of 3% from the current 2.2%. The yield is another way to tell just how overvalued MSEX is today but we see that situation being rectified by a lower stock price and higher payout going forward.

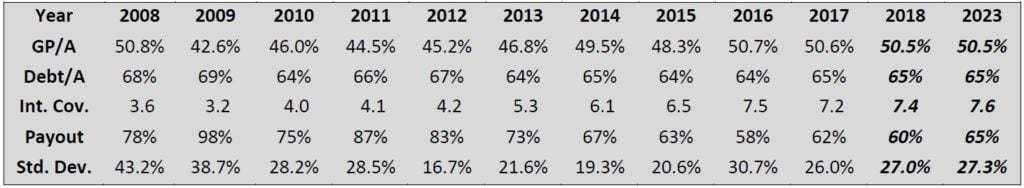

Safety, Quality, Competitive Advantage, & Recession Resiliency

Like many other utilities, MSEX’ quality metrics have remained steady in the past decade. Its margins are right where they were 10 years ago and have remained very stable in the past few years in particular. Its assets are 65% debt-financed, allowing for an excellent interest coverage ratio (for a utility). MSEX has the balance sheet to weather any economic storm so there is no question of safety, but obviously growth remains an issue.

The payout ratio neared 100% in 2009 but slow growth in dividends and better rates of EPS growth have led it back down to 60% today. We see that rising slightly over time but overall, the dividend is very safe.

MSEX’ recession performance is decent given that it sells the most basic staple of all and indeed, its revenue was basically flat in 2009 at the height of the recession. Its earnings didn’t fare quite as well, but it certainly stood up to the Great Recession. Its obvious competitive advantage is in the monopoly it enjoys in its service area.

Final Thoughts & Recommendation

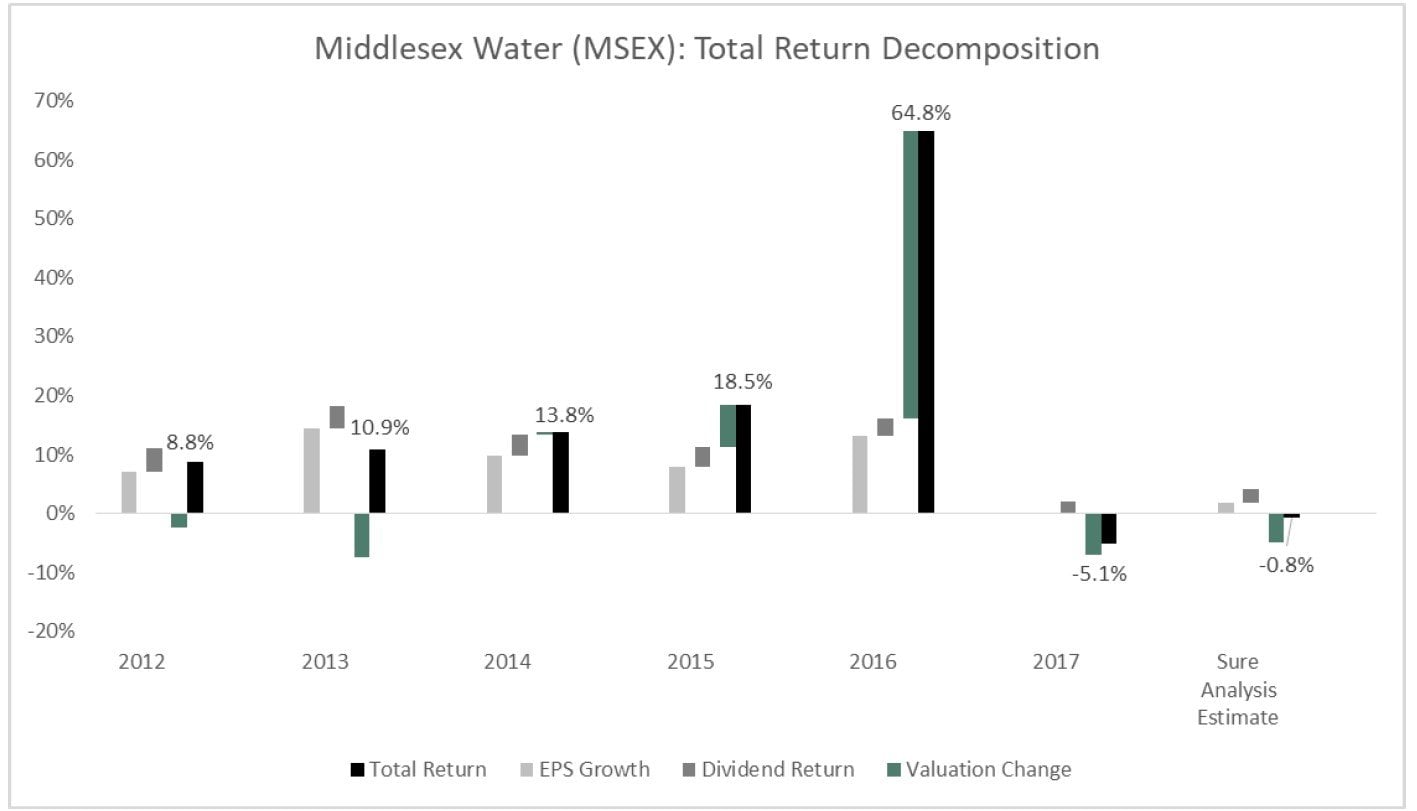

MSEX looks to be overvalued here as the stock has had an impressive run in the past several years. We see total annual returns of -0.8% going forward, consisting of the current 2.2% yield, 1.9% EPS growth and a 4.9% headwind from the valuation reset. MSEX’ impressive dividend history is certainly worth noting but the current yield is too low to attract income investors. MSEX would also be unattractive for those seeking growth or value, given the low potential for the former and very high current valuation. We recommend selling MSEX at current prices and investing the proceeds elsewhere due its -0.8% expected total returns over the next 5 years.

Total Return Breakdown by Year

Article by Josh Arnold, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.