We examine the record-breaking private equity fundraising market in 2017, including analysis of fundraising success, time spent on the road and regional fundraising trends.

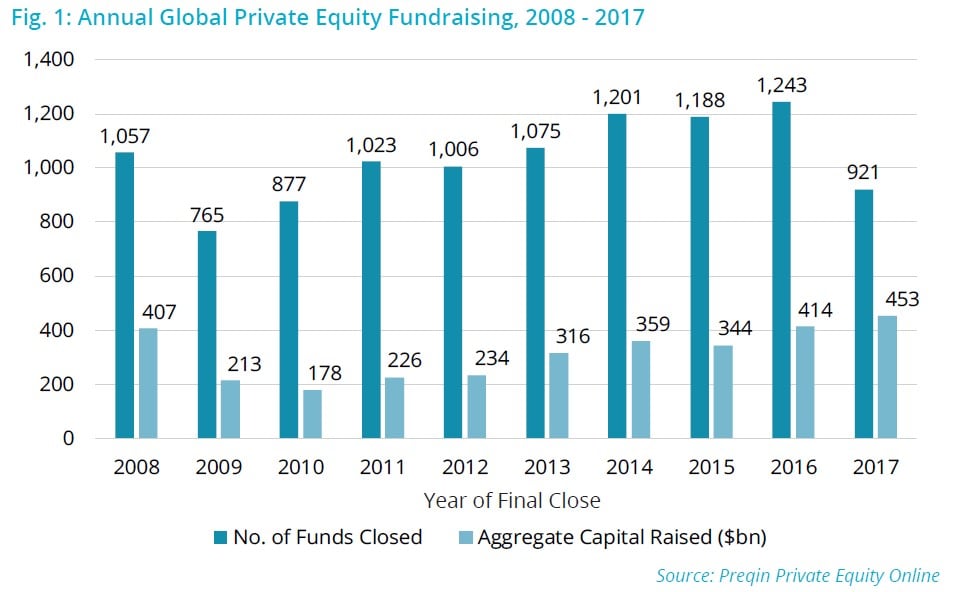

[REITs]In 2017, 921 private equity funds reached a final close, securing just over $453bn, the largest amount of capital raised in any year (Fig. 1). This marks the second consecutive year in which annual fundraising has surpassed $400bn, a landmark that has only been achieved once previously in 2007/2008. Although 26% fewer funds closed in comparison to 2016, $39bn more capital was raised by private equity funds closed in 2017 and this fi gure will increase as more data becomes available.

The positive net distributions that LPs have received since 2011 have driven the stellar fundraising activity seen in recent years. The latest data shows that, while positive net distributions continue, momentum does appear to be slowing: LPs received $66bn in net distributions in H1 2017, compared to $149bn over the whole of 2016. Nonetheless, the results of Preqin’s interviews with investors in December 2017 show that 63% of LPs have a positive perception of private equity, and 53% plan to increase their allocation to private equity in the longer term. As a result, LP capital is likely to continue to fl ow back into the asset class as LPs strive to maintain their allocations.

Capital Concentration

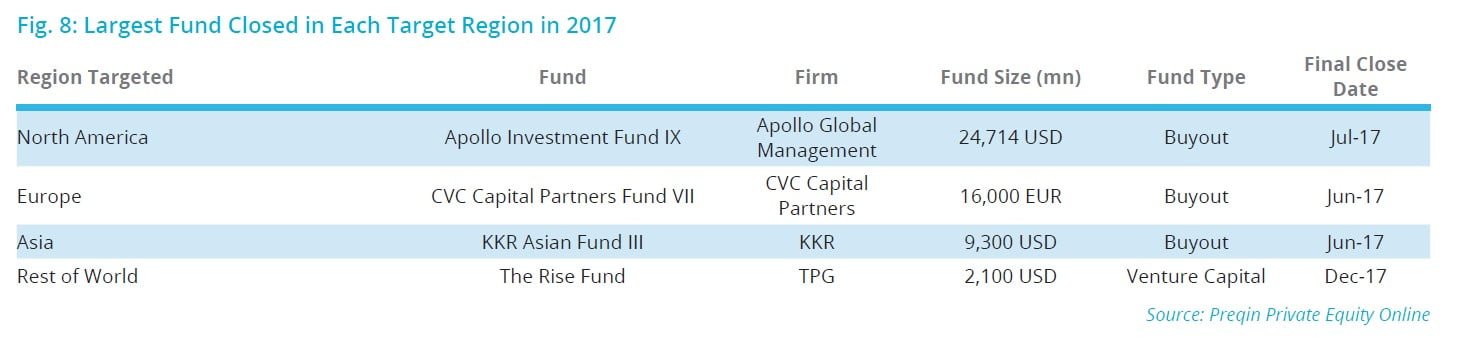

Of the $453bn raised in 2017, 28% ($125bn) was secured by the 10 largest funds closed, and the 20 largest funds accounted for 42% of all private equity capital raised, nine percentage points higher compared to 2016. There were a number of high-profile mega fund (funds >$4.5bn) closures in 2017, including Apollo Investment Fund IX on $24.7bn, the largest fund ever to reach a final close. With greater capital concentration seen in recent years, the average size of private equity funds has grown from $384mn in 2016 to $535mn in 2017.

Fundraising Success And Time On The Road

Even though fewer funds closed in 2017 than in 2016, a larger proportion of funds met or exceeded their original fundraising target, illustrative of the current LP liquidity caused by recent positive net distributions. Half of funds closed in 2017 exceeded their target, with 21% achieving 125% or more of their fundraising goal (Fig. 2). As market conditions have improved, the proportion of funds that fell short of their target has fallen steadily from 53% in 2010 down to just 20% in 2017. On average, funds closed in 2017 reached a final close in 13.4 months, a further illustration of current LP liquidity. Additionally, the proportion of funds that took one year or less to achieve a final close reached an all-time high of 50% in 2017 (Fig. 3).

North American Fundraising

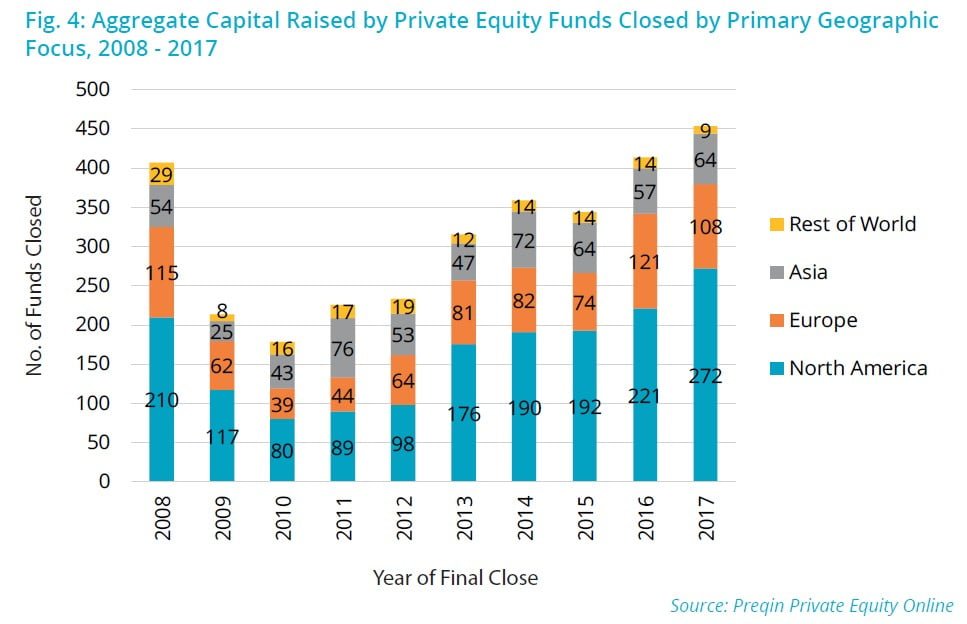

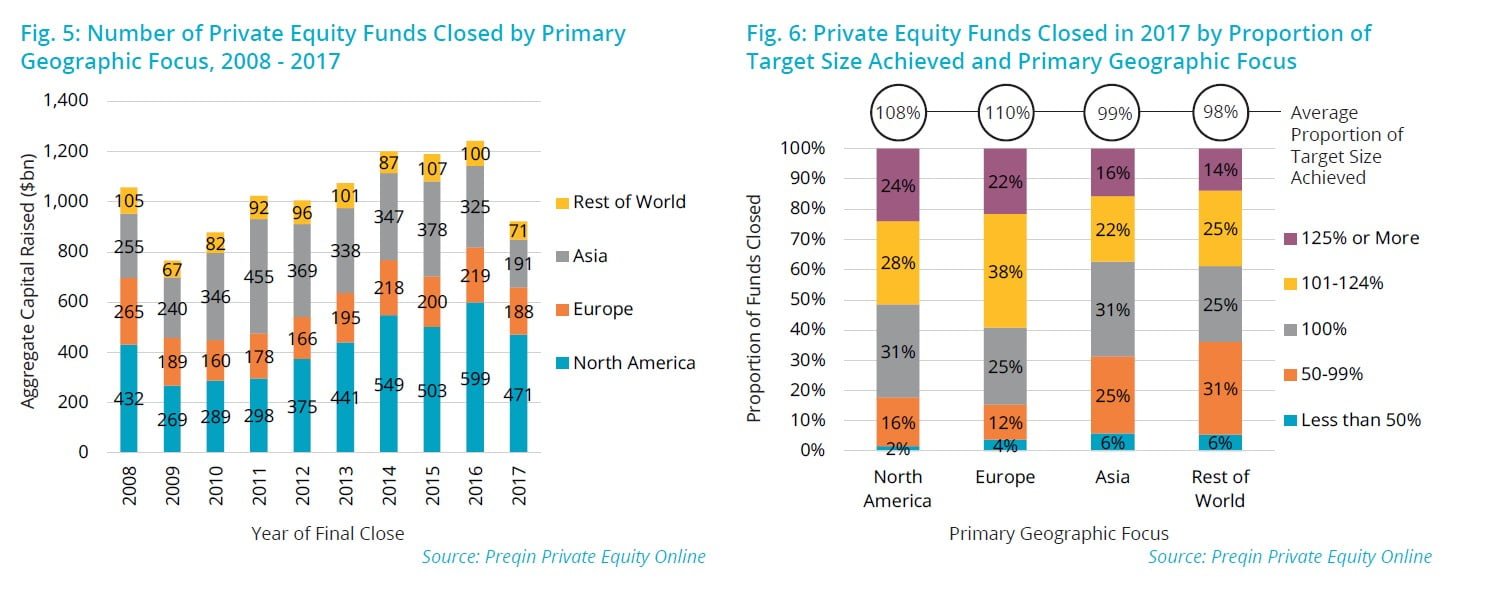

North America-focused private equity funds secured a new 10-year fundraising high in 2017 with $272bn in aggregate capital raised (Fig. 4). This represented a 23% increase in total capital raised from 2016, and the region accounted for a 60% share of all private equity capital secured in 2017, a 13-year high. Capital concentration has been more prominent in North America than in any other region: just 471 vehicles reached a final close, down from 599 in the previous year (Fig. 5), resulting in the average fund size increasing 43% from 2016 levels to $614mn.

Key Findings – North America:

- Fundraising was bolstered by a proliferation of mega fund closures, including Apollo Global Management’s Apollo Investment Fund IX on $24.7bn, the largest private equity fund ever raised.

- In 2017, 117 buyout funds closed, accounting for 65% ($176bn) of all North America-focused capital raised, a 12% rise from 2016, with an average fund size of over $1.6bn.

- Nearly half of all North America-focused funds closed in 2017 were venture capital funds: 222 vehicles reached a final close, raising just over $30bn.

- The proportion of total capital raised by secondaries vehicles more than doubled from 2016 to 10% in 2017, thanks largely to fund closures by Strategic Partners Fund Solutions ($7.5bn) and Goldman Sachs’ Vintage Fund VII ($7.1bn).

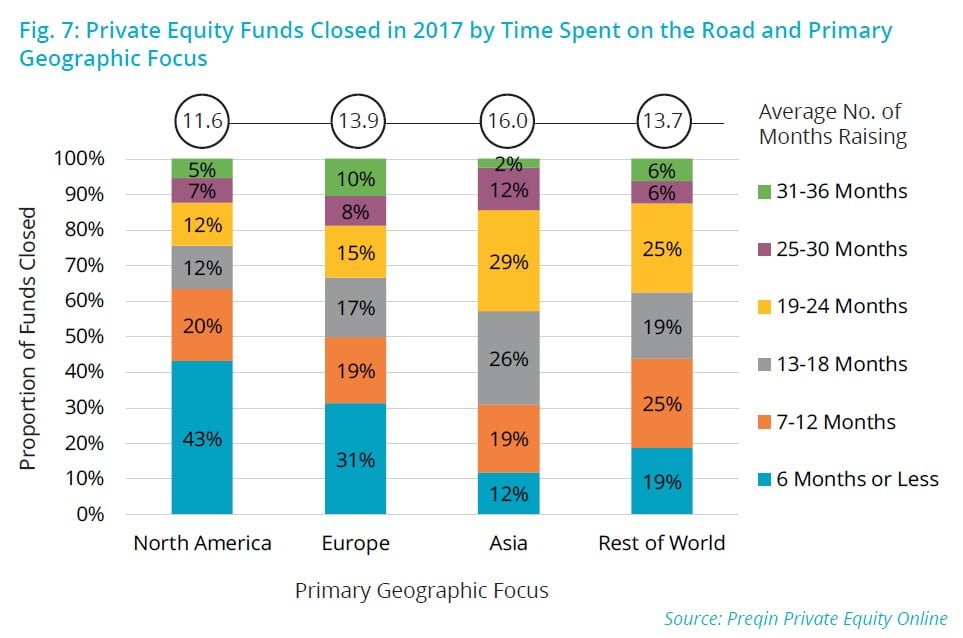

- For the fourth consecutive year, funds, on average, closed above their target size, securing an average of 108% of their target, greater than the 2016 average of 105%.

- North America-focused funds that closed in 2017 spent an average of 11.6 months on the road, four months less than in 2016.

European Fundraising

Europe-focused private equity fundraising experienced another strong year in 2017: 188 funds reached a final close raising a combined $108bn (Figs. 4 and 5). Furthermore, a significant 85% of Europe-focused funds closed in 2017 met or exceeded their target – greater than any other region. However, momentum has slowed: 10% less capital was raised compared to the record $121bn secured in 2016.

Key Findings – Europe:

- Buyout funds accounted for 73% ($79bn) of aggregate capital raised by Europe-focused funds, followed by secondaries funds with 10% ($10bn) and venture capital funds with 7% ($7.1bn).

- UK-based managers continued to dominate fundraising in Europe, securing 53% ($57bn) of the capital raised by Europe-focused funds. Only 2% came from US-based managers, down from 14% in 2016.

- The amount of capital secured by multi-regional funds dropped noticeably from $75bn in 2016 to $55bn in 2017. West Europe-focused funds secured $44bn, a 19% increase on the amount raised in 2016.

- The average proportion of initial target size achieved by Europe-focused funds closed in 2017 was 110%, up four percentage points from 2016 and the highest of any region.

- Europe-focused funds that closed in 2017 spent an average of 13.9 months on the road, a slight increase from 13.5 months for funds closed in 2016.

Asian Fundraising

Asia-focused private equity funds secured $64bn in 2017, increasing for the first time after two consecutive years of decline (Fig.

4). The capital concentration trend seen in both North America and Europe has also been evident in Asia, with just 191 funds reaching a final close, 134 fewer than in 2016 (Fig. 5).

Key Findings – Asia:

- The rise of venture capital continues in Asia: 53% (101) of the Asia-focused funds closed in 2017 were venture capital vehicles, securing $14bn.

- Asia-based managers secured the majority (78%) of capital focused on the region; however, non-Asia-based managers raised $14bn in 2017, up from $7.8bn in 2016.

- China remains a key focus for vehicles targeting the region, yet the total capital secured fell by 18% to $31bn from $38bn in 2016.

- Funds focused on areas other than China and India raised 75% more capital in 2017 than in 2016, securing $28bn via 56 funds.

- Thirty-eight percent of Asia-focused funds closed in 2017 exceeded their target size.

- Asia-focused funds took an average of 16 months to reach a final close in 2017, the slowest of any region.

Rest Of World Fundraising

Fundraising by private equity vehicles focused on investment outside North America, Europe and Asia endured a particularly tough 2017. Just $9.2bn was raised by 71 vehicles (Figs. 4 and 5), marking a decrease of 35% in capital secured and 29% in the number of funds reaching a final close compared to 2016. Funds focused on Australasia and those with a diversified geographic focus collectively accounted for the bulk of Rest of World fundraising ($5.9bn), while Africa-focused fundraising lagged from the recent high of $4.6bn raised in 2015, securing only $708mn in 2017, 67% less than in 2016.

Key Findings – Rest of World:

- Fifty-six percent of the capital raised by Rest of World-focused funds closed in 2017 was raised by domestic GPs (fi rms based in Africa, Latin America, the Middle East, Israel or Australasia).

- Over half (51%) of Rest of World-focused funds closed in 2017 were venture capital vehicles, followed by growth (23%) and buyout (14%).

- Thirty-nine percent of Rest of World-focused funds closed in 2017 exceeded their fundraising targets, compared to 44% in 2016.

- The average length of time spent in market by funds closed in 2017 was 13.7 months, a 34% decrease compared to funds closed in 2016 (20.6 months).

Outlook

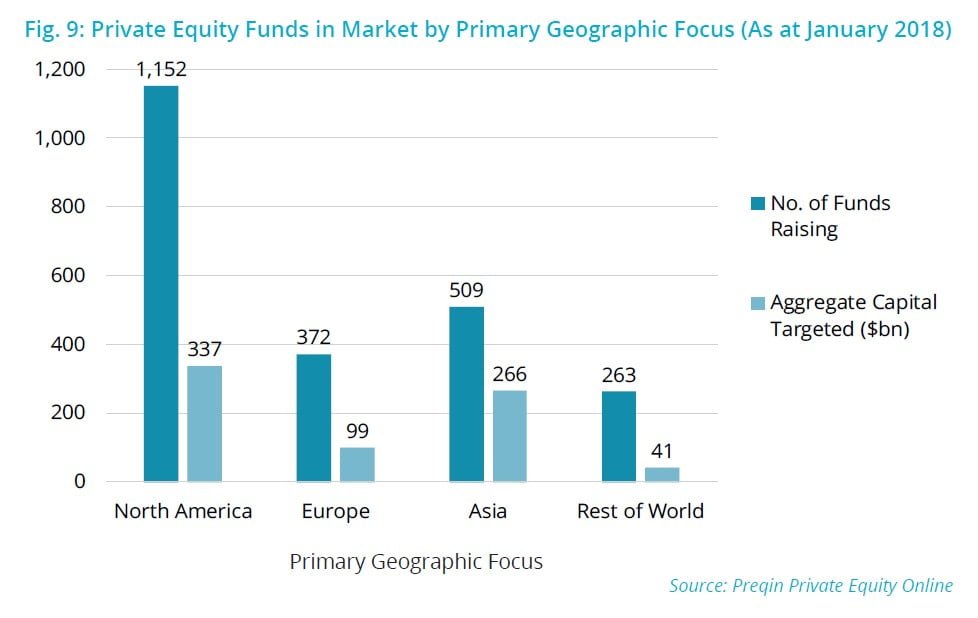

Despite a record-breaking year in 2017, private equity fundraising is unlikely to be any less competitive in 2018. As at January 2018, there are a record 2,296 private equity funds in market seeking an aggregate $744bn in capital – a 25% increase in the number of vehicles compared to January 2017. North America continues to dominate with 1,152 (50%) of the funds in market, and $337bn (45%) of the total capital targeted is focused on the region (Fig. 9). However, Asia-focused funds are seeking over a third ($266bn) of total capital and represent seven of the 10 largest funds currently raising.

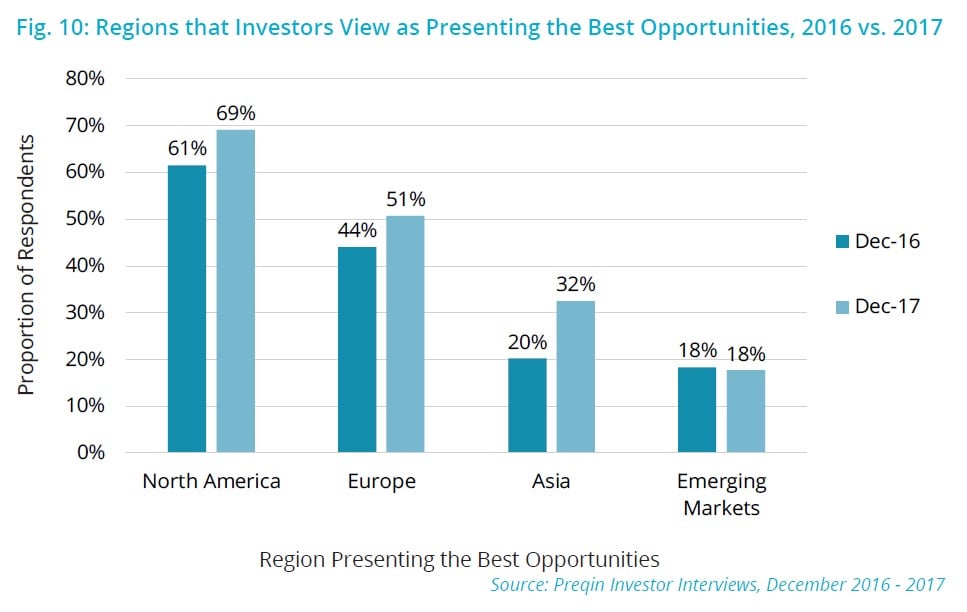

According to Preqin’s latest interviews with investors conducted at the end of 2017, appetite for private equity investments is still strong, with 53% of respondents intending to increase their allocation to the asset class over the longer term – an all-time high. As illustrated in Fig. 10, 69% of investors surveyed believe North America presents the best opportunities, while nearly a third of respondents believe Asia does – a 12-percentage-point increase on 2016. With increased investor liquidity and consequently institutions looking to put their capital to work to maintain their target allocations, there is still significant opportunity in the industry on which fund managers can capitalize.

Article by Preqin

See the full PDF below.