Between January 31st and February 6th 2018 close to close, the Dow wiped off near 7% of its value. 1 Although we have already seen some retracement of this deterioration, we have to wonder are widening credit spreads not far behind?

All the more so with the surprisingly strong recent US wage growth data – released at January month end and indicating a 2.9 per cent year-on-year increase in average hourly earnings. 2 Investors would be reasonable in speculating that the higher wages growth will stoke inflationary pressures, prompting accelerated rate rise actions. Thus, the employment report has set ablaze heightened expectations of additional monetary tightening action from the Fed this year and many would argue this has played no small part in the equity sell off.

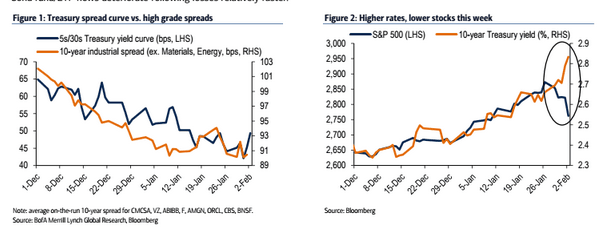

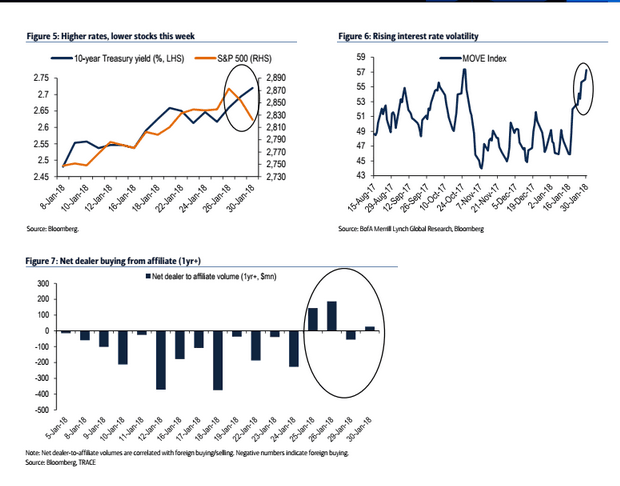

However, when it comes to credit – what are the factors to consider? Higher US inflation provides support to credit spreads by stimulating Treasury curve steepening. The latest employment figures support this relationship, with 10-year Treasury yields gaining 17bps, much to the benefit of high grade credit.3 Specifically, recent research from BAML highlights that inflation pressures have helped credit spreads weather the storm against equity market and interest rate turbulence into the final week of January – rather impressively, remaining close to flat.3

Foreign Inflation – A lurking demand side risk?

However, there are additional, more heavily weighted, factors at play. In large part, high grade bonds have been cushioned by foreign buyers. BAML expects to see rebounding from this buying activity, which cooled off over the past week due to dollar declines. 3The employment report will send a signal of economic strength to these foreign buyers and trigger more buying. However, this leaves the US high grade market exposed – to the risk of rising foreign inflation. Inflation beyond American borders will stymie this source of demand, and subsequent liquidity contractions have the power to drive spreads wider. For the short term, BAML researchers assess this outcome as low likelihood. But for the medium term, given current global economic and market dynamism, foreign inflation cannot be ruled out as a significant risk factor.

Fund Flows – High Grade in Favour

In line with expectations from BAML, high yield did not end January on a positive note. The asset class underperformed and experienced acceleration in bond outflows amounting to $1.40bn up from $0.84bn the previous week. 3Higher interest rates, higher interest rate volatility and further declines in equities are expected to fuel further high yield outflows.

Meanwhile high grade is in favour with investors – achieving an increase in inflows of $4.82bn from $4.46bn the week before. Investors are showing a preference for longer term high grade exposure – with flows to short-term high grade declining to $0.69bn from $1.07bn, whilst inflows outside of short-term gained from $3.40bn to $4.13bn. Investors continue to show preference to passive over active - with ETFs decidedly leading the high- grade charge. ETF inflows swelled by more than double (to $2.14bn from $1.01bn) and fund inflows sloped off to $2.68bn from $3.45bn week on week.3

High grade is certainly the credit segment du Jour, representing the second highest proportion of fund inflows (as a percentage of AUM) into January month end – with a total 0.7%, second only to emerging markets which grabbed an impressive 1.9%. Meanwhile, equities, 2017’s fund-flow darling drew in a lesser, though still respectable, 0.4%.

Sector Analysis

While fund inflows keep liquidity, and the all important spreads, at bay a closer look at sector performance does spark a note of trepidation of things to come. The BAML research presents sector based High Grade Q4 results, and while a number delivered positive earnings surprises the three worst underperformers were Energy (earnings surprise of -15.0%), Autos (-11.6%) and REITs (-0.2%). The fact that these three sectors have underperformed is no small matter. Notoriously and serially cyclical, underperformance from these three sectors hints at a wider and deeper structural downturn, given the high interconnectivity of the fate of today’s capital markets.3

Source:

1. WSJ, http://quotes.wsj.com/index/DJIA/historical-prices

2. Bureau of Labour Statistics, https://data.bls.gov/timeseries/CES0000000001?output_view=net_1mth

3. BAML, Credit Market Strategist, 2nd February 2018