Brandywine Asset Management commentary for the month of January 2018.

Most major equity, hedge fund and managed futures indexes ended January with strong gains. In the case of global equity markets, this further extends the strong gains earned since the financial crisis lows in 2009. Here are some of the achievements / metrics of this historic bull market:

- 2nd longest bull market (defined as a run-up without a 20% drawdown) since World War II: 8 years, 10 months

- In early November 2017 the S&P 500 broke the record for the longest winning streak without a decline of 3% or more at 371 days

- The VIX, a measure of the volatility of stocks, closed below 10 seven times in January. This is unprecedented. 18 of the 20 lowest VIX closing values since WWII were achieved in 2017 and January 2018.

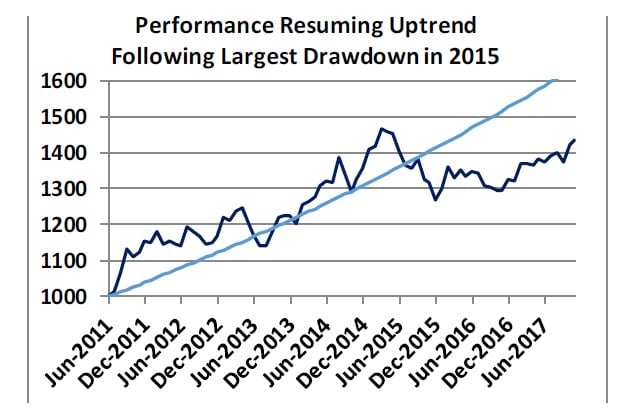

There is a old adage that "bull markets don’t die of old age,” meaning that just because this market is setting records in a variety of ways and is the second longest bull on record, it doesn't mean it is ending. That said, there are substantial risks in owning stocks and portfolio diversification is one way to reduce risk (read "Free Lunch”). While Brandywine will not necessarily profit when stocks fall, over the longer-term we have shown that our performance tends to be uncorrelated with stocks, which provides longer-term diversification value.

Brandywine Extends 2017 Profits Into 2018

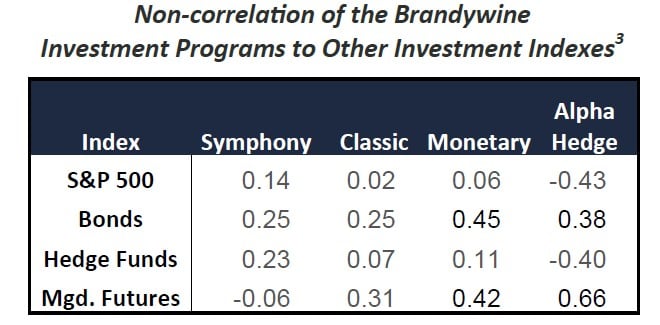

While the dueling headlines in this month’s report may make it look like there’s a strong correlation between the returns from global equity markets and the returns earned by Brandywine, that is not the case. Brandywine’s performance has been uncorrelated to that of global equity markets. As the chart on the next page shows, the highest correlation between one of Brandywine’s investment programs and equities (as represented by the S&P 500) is the 0.14 correlation equities have with Brandywine’s Symphony program. And at a negative correlation of -0.43, Brandywine’s Alpha Hedge program is actually statistically negatively correlated to stocks.

But even negatively-correlated performance will perform in sync some of the time (unless it’s a perfect -1.0 correlation). January is just one example of this. Both stocks and Brandywine (including Brandywine’s negatively-correlated Alpha Hedge program) performed strongly. But over the longer-term, Brandywine should prove to continue to be uncorrelated. This is due to two primary underlying factors:

- Brandywine employs trading strategies based on Return Drivers that are completely independent of those powering stock market performance

- Brandywine trades both long and short in more than 100 global financial and commodity markets. We are not long-long equity owners.

Of course, past performance is not indicative of future performance, and Brandywine has also at times lost alongside stocks. But over the longer-term - based on the differences in the underly-ing Return Drivers - the non-correlated relationship between the performance of Brandywine’s programs and stocks should hold true.

As always, please feel free to email or call us for more information.

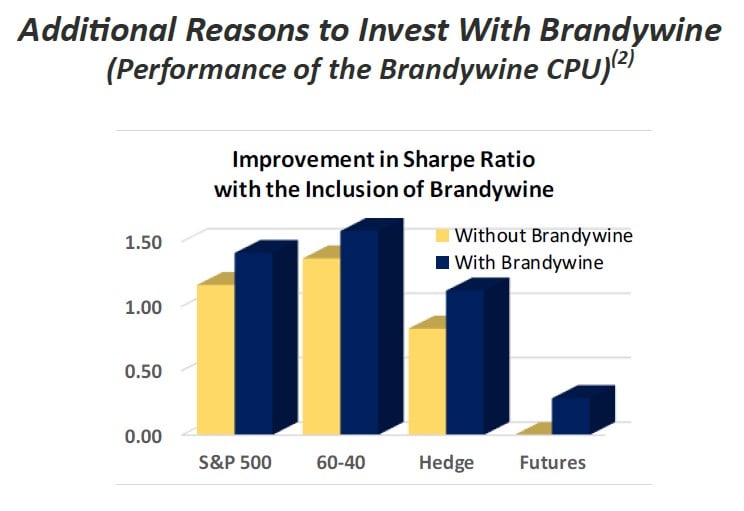

The value of adding Brandywine to a portfolio that contains stocks, bonds, hedge funds or managed futures is due to Brandywine’s non-correlation to those other investments.

This is highlighted in the table to the right It is this non-correlation that makes Brandywine such a positive addition to most investment portfolios and results in the improvement in risk-adjusted returns shown in the chart above.

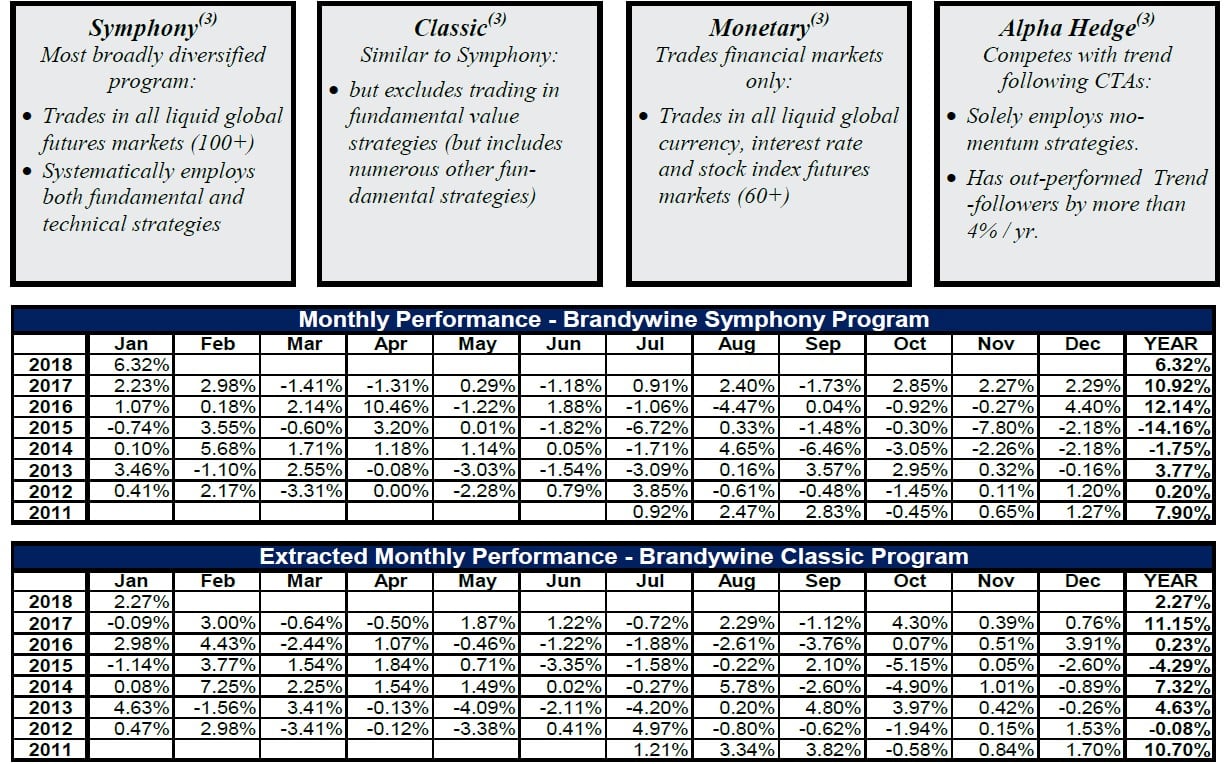

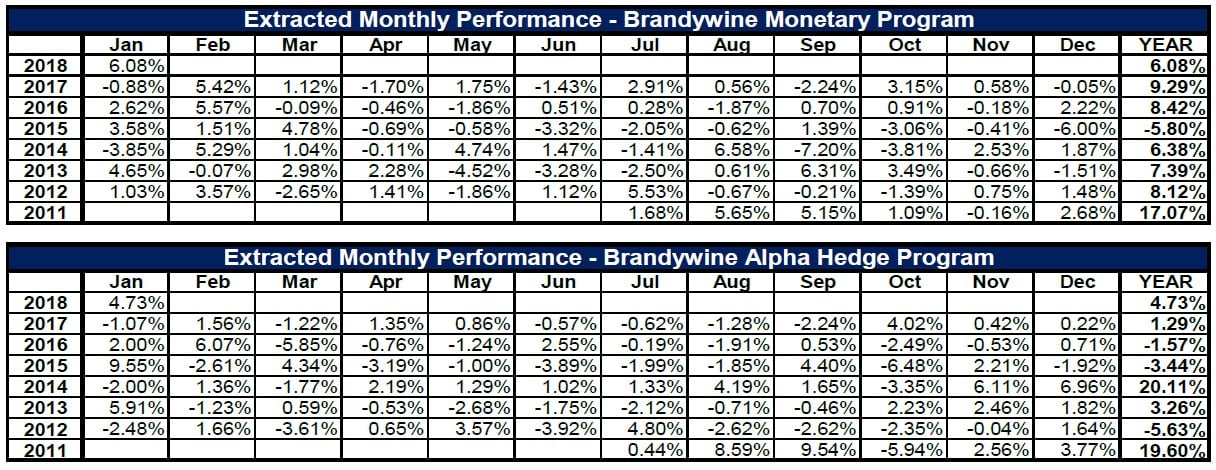

Descriptions & Performances of Brandywine’s Investment Programs1,4

Brandywine trades pursuant to a fully-systematic model that incorporates a wide range of both fundamental and technical trading strategies. Brandywine’s Symphony Program began trading in July 2011 and the performance of the other programs isextracted from the actual performance of trades executed within the Brandywine Symphony Program.

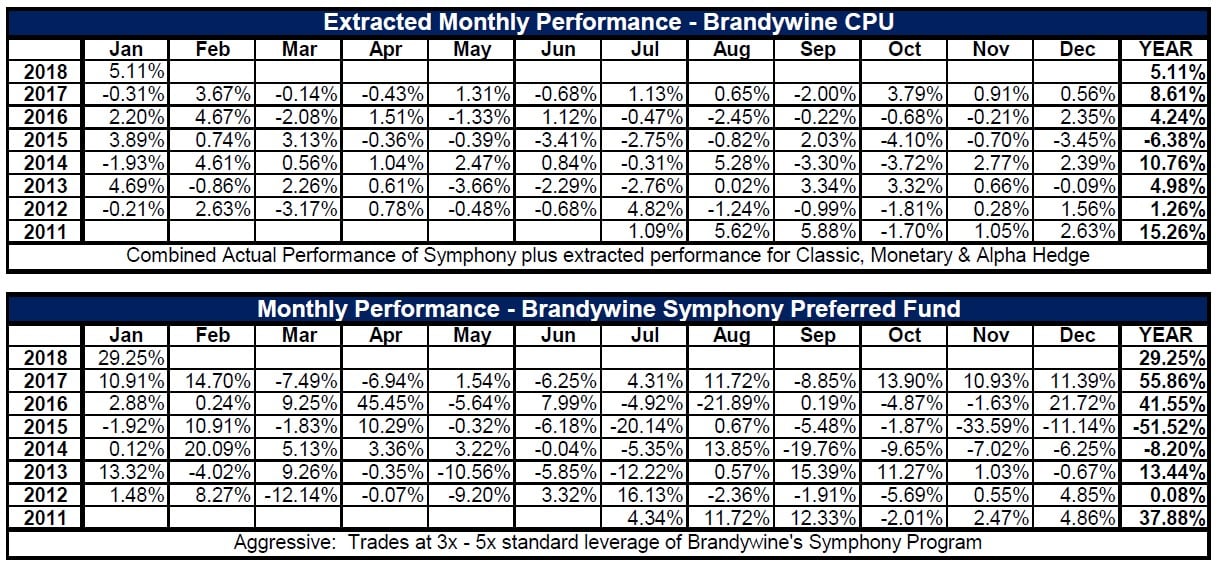

“Brandywine CPU” is the composite performance that could have been achieved by allocating 1/3 to Brandywine’s Diversified Programs (split equally between Symphony and Classic) and 1/3 each to Monetary and Alpha Hedge, reallocating monthly.

Brandywine Symphony Preferred Fund began actual trading in July 2011 and is managed pursuant to Brandywine’s Symphony program at between 3x and 5x the standard risk of that program. As a result, the Fund is cash efficient (a $1 million allocation

provides the returns that would be earned on a $3 million to $5 million investment in Brandywine’s Symphony program) butextremely high risk relative to the potential and actual losses relative to the actual cash invested.

See the full PDF below.