Big Ripple news again this week. Back when Ripple and XRP were getting started they signed a major deal with the R3 banking consortium. R3 includes nearly 40 banking institutions. The deal was that R3 would help get banks signed up with Ripple. The point of contention now is an option in the contract that would allow an R3 partner to nab 5 million XRP for a penny. That, coupled with some other news this week has made for a rather quick downward spiral for the Ripple price chart.

Ripple Price Chart Falling

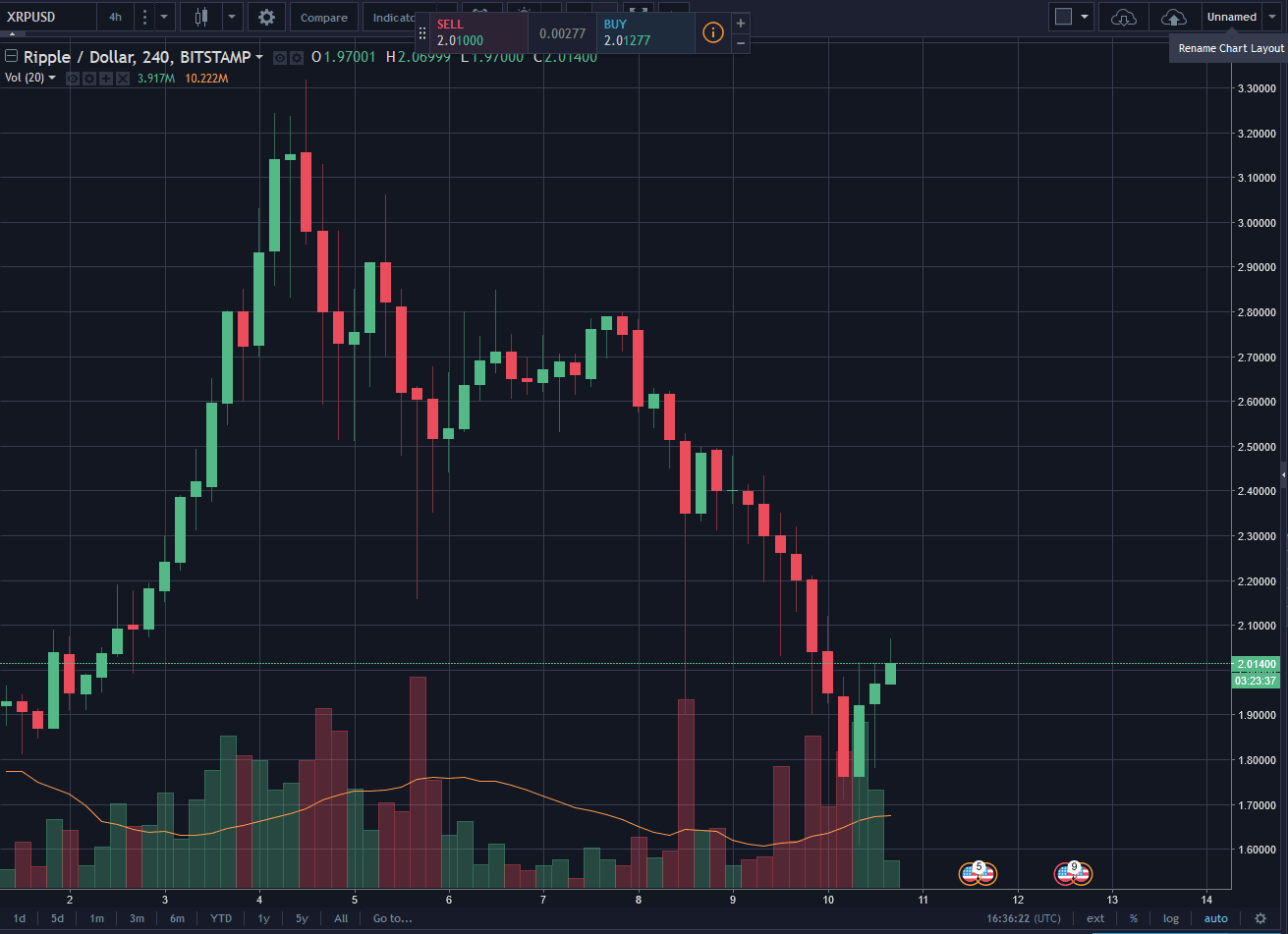

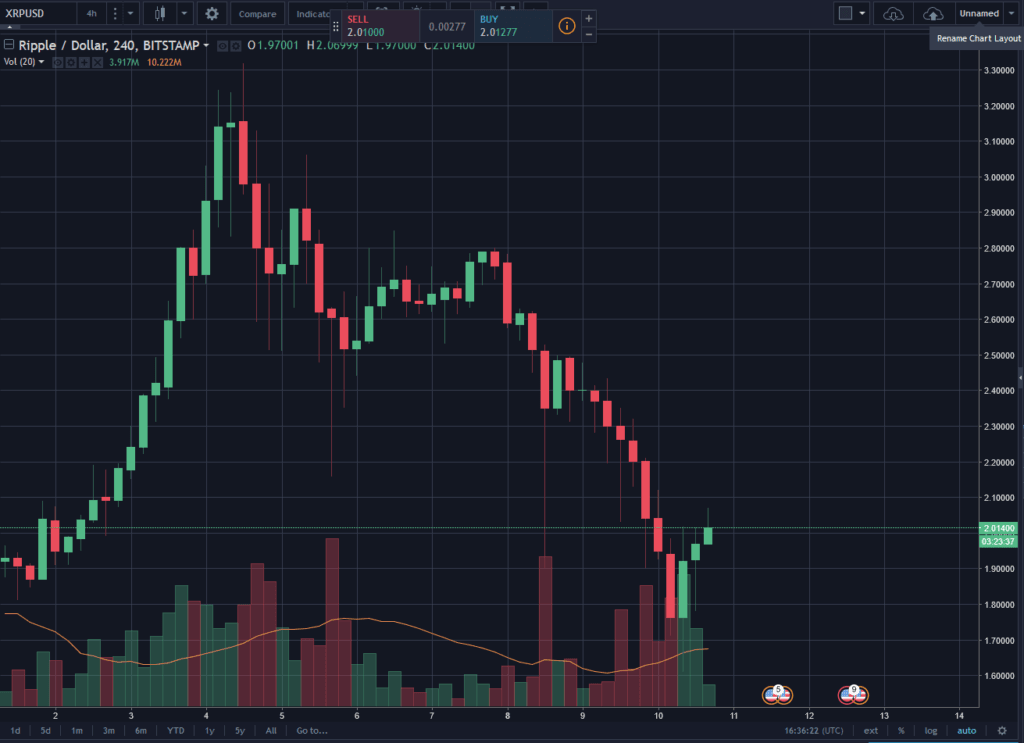

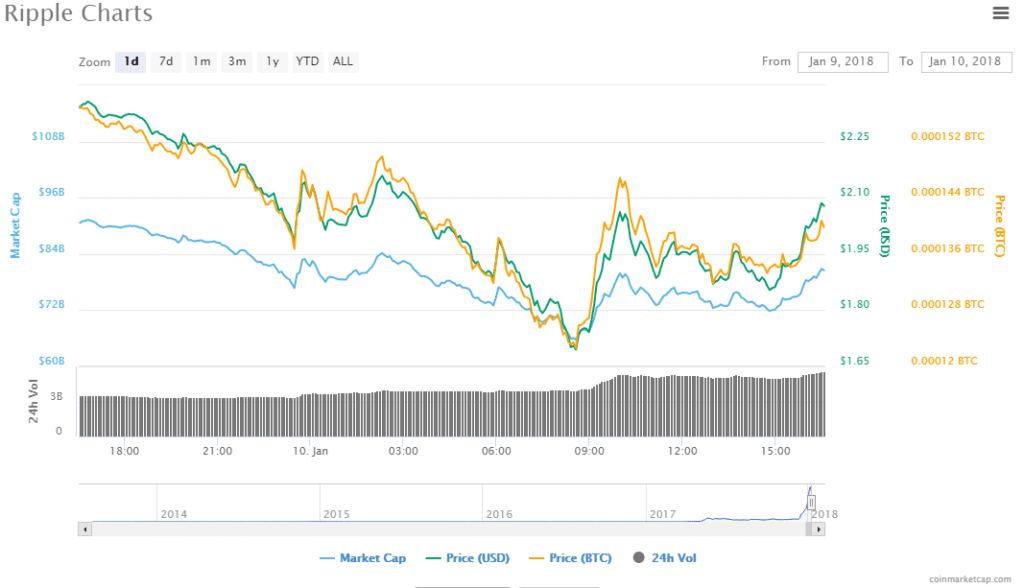

Looking at the Ripple price chart shows it is down again today to just above $2.00 per XRP. This is the sixth day in the Ripple downward trend from a high of $3.84. This is mostly due to a selloff based on CoinMarketCap removing a handful of Korean exchanges from the valuation formula, dropping the market capitalization of many cryptocurrencies. Volume in XRP trading has also dropped about 50%. The Korean exchanges were trading XRP and other cryptocurrencies at a premium, up to 30% more than other exchanges in some cases.

This has moved Ripple from number two in market capitalization to number three. With Bitcoin Cash climbing ($45B market cap) and the Ripple price chart still looking down, it could fall to number four if things don’t turn around. Meanwhile, Ethereum has been rocketing past it riding several days of big gains which have upped its market cap to $132B and a price of almost $1,400.

Ripple Regulation Woes?

Another piece of bad news that may be negatively impacting the Ripple price chart came out of South Korea this week when it announced it would start regulating cryptocurrencies. The country put out a release that said they are looking at working with China and Japan to curb investing in cryptocurrencies due to its speculative nature. They are cited as calling it “irrational,” which seems like a very Asian attitude given their conservative nature on many things.

On top of that, the Financial Supervisory Service in South Korea is looking into six of its banks that are connected to Bitcoin exchanges in regards to anti-money laundering policy. If Ripple gets caught up in that, it might be even worse for them. Interestingly, Ripple was originally designed to work with large banks as a way to replace the cross-border money transfer system that is in place now. That system is cumbersome and money can take several days to get from one account to another. With Ripple, that same transaction takes just a matter of seconds which seems like it would be a no-brainer once it has been established that it’s safe and efficient. But that doesn’t necessarily tie directly into the value of XRP.

Ripple Files Suit

Additionally, Ripple is already embattled in a lawsuit with R3, the aforementioned banking consortium. The 5 billion XRP option on that contract is worth around $10B today and would be taken out of the 55B XRP that Ripple still holds in its possession. Ripple has filed a counterclaim against R3 for a bad faith contract, breach of contract, and theft of expertise to create a competitive product. R3 created a platform called Corda which they state is not a blockchain but is a “financial grade distributed ledger that operates in strict privacy in an open, global network .” When you look at the Corda platform and capabilities, it certainly has similarities to a blockchain though it has no currency, and no mining. It utilizes a notary node to prevent double-spends and provides transaction verification as opposed to distributing it across many computers.

R3 filed suit last summer when Ripple canceled the option on the 5B XRP. Ripple’s suit rests on the fact that R3 allegedly knew and did not inform Ripple that three major institutions were leaving; Goldman Sachs, J.P. Morgan, and Morgan Stanley and that R3 used Ripple expertise to create Corda.

Ripple Riding High

Even without the help of R3, Ripple has been riding a wave of success that has sent the Ripple prices up, up and away. On December 21st, the Ripple price chart first crossed the $1 mark, and it has stayed above that mark since. The Ripple price then started an upward climb that would nearly reach $3.85 before this week’s woes.

Ripple Sinking Low

The tumultuous week that Ripple is having has definitely impacted the speculation on its value and it looks like they may not be off the downward slide yet. Trading has been seriously depressed on XRP since January 6th. For the week so far, Ripple is down around 40% since last Thurs when it reached an all time high of $3.84 and a market capitalization of almost $149M.

Will Ripple Rebound?

Today Ripple’s XRP is seeing some increased trading volume. It might be that the uncertainty about Ripple’s value has finally been overcome and it could be back on the upswing. Taking a look at the latest Ripple price chart shows an elevated trading volume compared to the past several days and a slight uptick in its price.

Is Ripple’s Chris Larsen back on track to once again be the fifth richest man on the planet? He holds an estimated 5.19B XRP which gives him just around $11B today, on top of his 17% stake in Ripple itself. It may all depend on whether Ripple loses that lawsuit, or gets caught up in some serious regulation entanglements.