Alternative Money Fund presentation on S.W.O.T. an update from our favorite hedge fund and more now…

"CRYPTO CRASH" -- JANUARY PROVIDES HUGE OPPORTUNITIES IN THE CRYPTO CURRENCY MARKET

-

- DESPITE HUGE "CRASH" IN MARKET, AMF IS RELATIVELY FLAT FOR THE MONTH WITH -2.25% MTD PERFORMANCE AS OF 1/23/18

- NOVEMBER AND DECEMBER OF 2017 WERE HUGE MONTHS.

NOW IS AN EXCELLENT TIME TO GET INTO CRYPTO CURRENCIES.

CRYPTO FUND MANAGER JOHN CHALEKSON GOES ON BUYING SPREE

-

-

-

DESPITE LARGE DOWNTURN IN THE MARKET, AMF IS DOWN ONLY 2.25% M.T.D. FOR JANUARY 2018

-

-

CURRENT POSITIONING:

2017 UN-AUDITED PROFORMA RESULTS: +11,115%

AMFM is Pleased to Announce 2017 Un-audited Pro-Forma Results of +11,115%

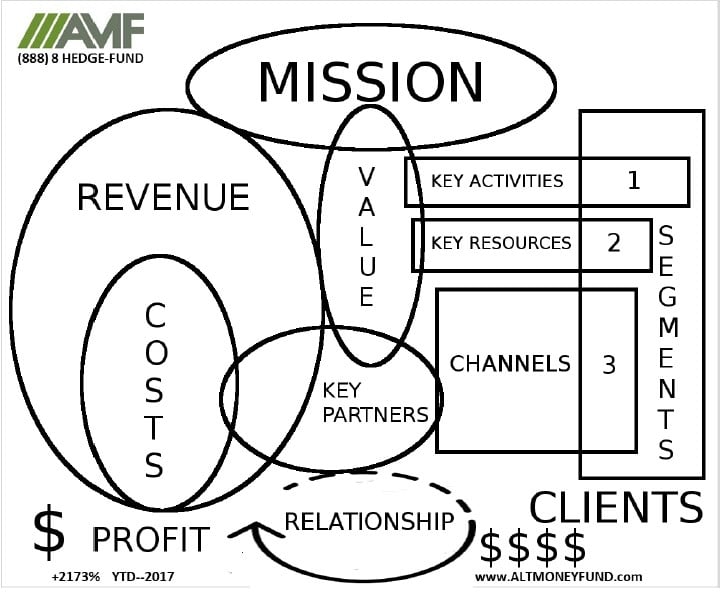

CLICK HERE TO SEE THE NEW BUSINESS PLAN/MODEL:

ALTERNATIVE MONEY FUND LP GENERAL PARTNER: ALTERNATIVE MONEY FUND MANAGEMENT LLC

John Chalekson ([email protected])

Managing Member

Alternative Money Fund Management, LLC

Http://www.AltMoneyFund.com

Alternative Money Fund, LP

(888) 8-HEDGE-FUND / 310-704-1405

Alternative Money Fund, LP® is a crypto currency hedge fund that is committed to provide exceptional returns through an actively managed portfolio of blockchain assets. With the emergence of Bitcoin, Altcoins and this exciting new technology has created a new asset class for investors. The volatility associated with the cryptographic verification and game theoretic equilibrium, these blockchain-based digital assets create valuable opportunities in an actively traded portfolio, Our trading strategy does NOT use leverage or margin. Returns are reported monthly and capital accounts may be increased or redeemed each month.

Blockchain tokens are emerging which add a monetary incentive layer to p2p protocols and facilitate equity crowdfunding that anyone in the world can participate in. This means for the first time, open source software developers can monetize their networks at the protocol level, and users of the network are the equity owners of the network. In this model, disproportionate returns go to holders of the tokens rather than investors in private companies built on top of the protocols.

Statement of Confidentiality

The contents of this e-mail message and any attachments are confidential and are intended solely for addressee. The information may also be legally privileged. This transmission is sent in trust, for the sole purpose of delivery to the intended recipient. If you have received this transmission in error, any use, reproduction or dissemination of this transmission is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by reply e-mail or phone and delete this message and its attachments, if any.

S.W.O.T.

SWOT ANALYSIS -- STRENGTHS:

-

-

- SMALL AND NIMBLE FUND (IN AND OUT OF POSITIONS WITHOUT CAUSING PRICE CHANGES IN MARKET).

- THE FUND DOESN’T HAVE SCALABILITY ISSUES BECAUSE ITS SMALL.

- NEW ASSET CLASS FOR INVESTORS NEVER BEFORE SEEN (JUST 1 OF 50 NEW FUNDS).

- AWESOME RETURNS SO FAR (+2000% YTD 2017, ZERO HEDGE, VALUEWALK, ARTICLES).

- http://www.zerohedge.com/news/2017-08- 22/cryptocurrency-hedge-fund-returns-2129-ytd

- https://www.valuewalk.com/2017/08/crypto-hedge-fund/

- https://www.valuewalk.com/2017/09/alternative-money- fund/

-

- STRONG DETERMINATION (FOUNDERS).

- MANAGEMENT IS VERY EXPERIENCED AND

-

SWOT ANALYSIS -- WEAKNESSES:

-

-

- BRAND MAY BE CONSIDERED TO BE TOO GENERIC SOUNDING.

- NOT ENOUGH CAPITAL TO ATTRACT LARGER INVESTORS YET.

- REGULATORY COMPLIANCE.

- COSTS ARE HIGH:AUDIT,ADMINISTRATOR, BLUE

- SKY FILINGS, FEES,TAXES.

- NEEDS SEED CAPITAL TO GET OFF GROUND.

- TROUBLE OBTAINING SEED CAPITAL BECAUSE OF VOLATILITY IN RETURNS.

- NOT GOOD AT ANSWERING THE PHONE.

- TROUBLE FOLLOWING THROUGH WITH RELATIONSHIPS OF CLIENTS.

- TROUBLE WITH PROCRASTINATION.

-

SWOT ANALYSIS -- OPPORTUNITIES

-

-

- BRANDING – LOGO PHONE,WEB AND LOOKS AND SOUNDS PROFESSIONAL.

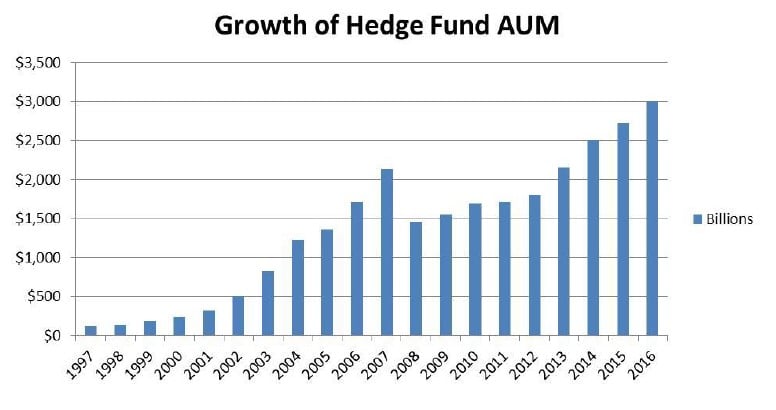

- HUGE GROWING MARKET.

- LOTS OF UPSIDE STANDARD DEVIATION.

- BIGGEST INVENTION IN COMPUTER SCIENCE IN OVER 20 YEARS.

- FEES: 2% AND 20% GREAT POTENTIAL TO MAKE LOTS OF MONEY.

- SETTING OURSELVES TO BE THE “EXPERT.”

- THERE IS $3.2 TRILLION DOLLARS IN AUM FOR HEDGE FUNDS.

- HEDGE FUNDS ARE ON AVERAGE PROVIDING 6% PERCENT RETURNS PER YEAR.

- CRYPTO IS A GROWING COMMUNITY.

-

SWOT ANALYSIS -- THREATS

-

-

- GLOBAL MACROECONOMIC RISKS.

- HACKERS.THEIVES.

- A LARGE EXISTING HEDGEFUND MAY WANT TO START A SIMILAR PROJECT. BRAND-NAME RECOGNITION.

- THEY CAN SMOOTH THEIR RETURNS BETTER AND RAISE MORE CAPITAL QUICKLY.

- AMF “DRAW-DOWNS” ARE LARGE BECAUSE OF SMALL SIZE AND LACK OF MONTHLY CAPITAL INFLOWS.

- UNABLE TO OBTAIN CREDIT OR FINANCING.

- LACK OF A ‘TRACK RECORD.’

- BANKS DON’T WANT TO DEAL WITH HEDGEFUNDS (went to 7 banks to open an account).

- REGULATORS MAY TRY TO SHUT US DOWN IN THE FUTURE (SEC, CFTC, etc).

-

ESTABLISHING “WIN-WIN” RELATIONSHIPS PROFIT SHARING: LLC AND LP

Customer Segments

Family and Friends.

-

-

- High net worth individuals.

- Accredited and Qualified Investors.

- “Fund of Funds” (Funds of Hedge Funds).

- Visionaries.

- Entrepreneurs.

- Consultants.

-

Value Proposition

-

-

- Fight Against Inflation.

- US Dollar is losing rapid value in the short and long term.

- New Money: Newness of the asset class.

- Performance: 2017 has been good.

- Diversification.

- Risk Reduction: USD is a dangerous place to be .

- Access to New Market.

- They do not have time or expertise to do it themselves.

-

See the full slides below.