If you’re like many investors, you believe the recent communication from the Fed was a game-changer. In last week’s post, I discussed some of the implications that I believe are inherent in such a policy for banks, insurance companies, and other institutions.

In the face of recent positive data, should we continue to believe Bernanke’s pledge? There’s no shortage of arguments that support Ben living up to his end of the deal: a student of the great depression, recent commentary to Congress that the Labor market is far from healthy, large output gap, anemic wage growth, minimal inflation concerns etc. Look, I get it. That being said, have investors become too complacent and fallen asleep at the wheel in their blind trust of the Fed’s promises? What indicator is best to look at to determine whether doubts are starting to creep in? If you said the 30yr yield I don’t disagree, but IMO there is a much better indicator.

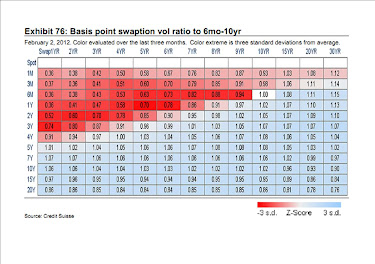

A better view into complacency, in my opinion, is the swaptions market. Investors who want to make a large bet that rates will go up sometime in the future typically gravitate towards the swaption market. Their instrument? Buying payers. This means they buy an option that allows them to pay fixed and receive floating (libor) at some time in the future. A 3×3 swaption, for example, would mean a 3 year swap beginning in 3 years. Like any other option, a large component of the option’s value is volatility. The below chart, from Credit Suisse, shows that the volatility on a number of swaptions are multiple standard deviations cheap.

The more interesting observation to me is not that the longer term options have more volatility than average – but that the shorter term options (essentially the ones within the Fed’s pledge) are priced historically cheap (more than 3std deviations lower than average). Now, there’s great reason to take Bernanke at his word, but it looks as if few are betting/hedging that he could change his mind. Two and a half years is a long time!

The average investor is clearly not in a position to be buying swaptions, but maybe it should prompt you to ask questions about your own approach to this policy and evaluate whether or not any asymmetric risk/reward opportunities might be available.