Despite disappointing Q1 results, insider purchases pushed ZUMZ stock higher in extended trading

In the wake of Zumiez’s (NASDAQ:ZUMZ) lackluster first-quarter financial report, which saw a sizable decline in sales, there is a glimmer of hope for investors.

Two Form 4 filings submitted to the SEC after market close on Tuesday revealed that Zumiez’s CEO, Richard Brooks, and International President, Adam Ellis, made notable stock purchases on market in the approved trading window following the result. This unexpected move by the company’s top executives has piqued the interest of investors and has the potential to turn the tide for Zumiez.

ZUMZ stock is down more than 51% in the last 12 months. They are due to exit the S&P SmallCap 600 index effective June 19..

Tracking Trades

The trades were initially spotted on Fintel’s insider trading tracker later on Tuesday afternoon. The screen is a live filter of trades by insiders of listed public companies.

Zumiez shares tumbled more than 15% following the release of what turned out to be weak Q1 results last week. However, the subsequent insider trades by Brooks and Ellis, which occurred after market hours, have sparked a renewed sense of confidence, with shares rising by 6.1%.

When delivering into the activity, CEO Brooks purchased a whopping 74,930 shares at an average price of $13.57, giving the total transaction a value just above $1 million. The CEO owns a total of 2,647,954 shares of ZUMZ stock following the transaction, extending his ownership of the float to around 13.5%.

Ellis bought 10,000 shares at $14.67 each, with the trade totalling around $150,000. His total share count rose to 34,393 as a result of the trade.

The trades by these insiders speak louder than words and suggest that they believe in the youth fashion retailer’s ability to overcome the current challenges and deliver better results in the future.

Even with these recent purchases, Fintel’s insider sentiment score of 35.46 ranks the activity well below global peers.

Bell Curve of Institutional Interest

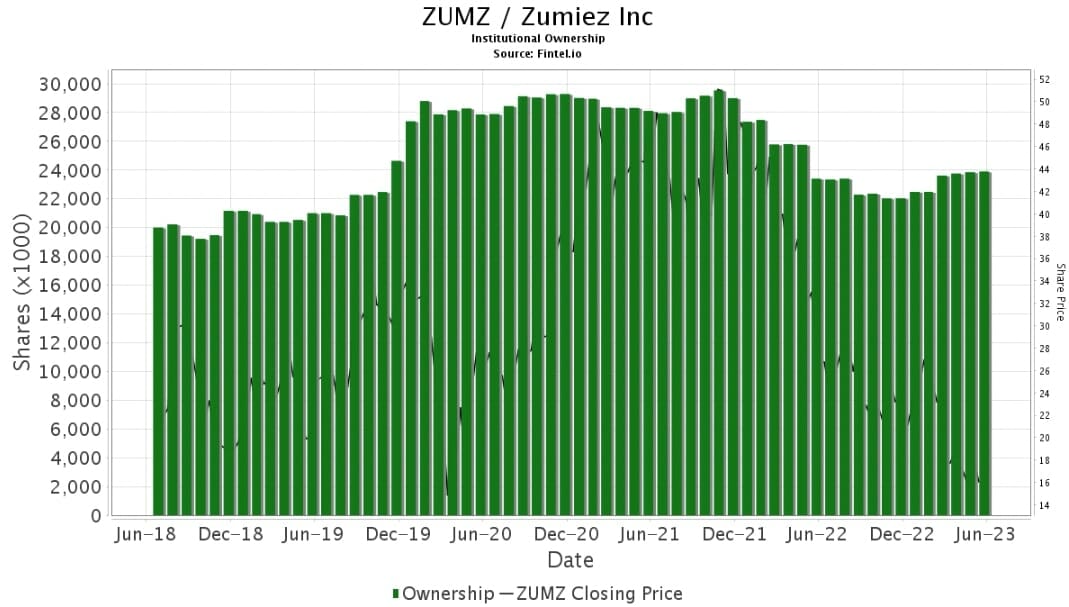

Research on the Fintel platform revealed that institutional interest in the stock has waned in recent months in a similar trend to the declining share price. Fintel’s data on hedge funds investing in ZUMZ could partially explain the decline, with the average portfolio allocation falling by 6.14% during the most recent quarter.

While the number of owners on the register has stayed firm at 433, many of its backers have trimmed exposure to the company.

Fintel’s fund sentiment score of 41.83 ranks ZUMZ in the bottom 30% when screened against 37,181 other global securities for the highest levels of institutional activity.

The chart below shows the ‘bell curve’ like trend in share count ownership by institutions over the last five years.

Bad Results

For the first quarter, Zumiez told investors that net sales declined from $220.7 million in 2022 to $182.9 million during the quarter. The sales figure was broadly within consensus expectations.

Net losses widened significantly from a loss of $397,000 last year to a more significant $18.4 million bottom line loss, or a per share loss of 96 cents. Analysts were forecasting the company to generate an EPS loss of around 85 cents per share.

Zumiez’s management attributed the operating pressure points to lower sales, primarily driven by store wages and costs, as well as the absence of a German government subsidy received in the previous year.

The company also provided guidance for the second quarter of $187 million to $192 million, below Street expectations for around $199 million, reflecting a conservative stance. However, the higher end of the sales guidance indicates some positive sales trends in May, with a decline of 12.8% compared to the 17.1% decline in the first quarter.

While hardgoods has been a challenge for the company in recent years, there are signs of improvement.

Zumiez is capitalizing on the popularity of items such as Adidas Samba shoes, Pit Viper sunglasses, and chunky skate shoes. The company plans to deepen its inventory in these areas as the year progresses, suggesting a potential boost to sales.

Looking ahead, Zumiez anticipates a more favorable sales and margin environment in the second half of the year. Comps will ease, and product margins may stabilize and expand as inventories align and promotional pressures subside.

Analyst Thoughts

B Riley Securities analyst Jeff Van Sinderen thinks that the recent first quarter earnings reflected inflationary pressures coupled with foreign exchange impacts while in a tough operating environment.

Sinderen said that even with Zumiez differentiated culture and merchandise content, headwinds continue to impact the industry and visibility continues to remain opaque.

Following the recent investor update, B Riley lowered its target price for its ‘neutral’ recommendation from $21 to $15.

Fintel’s consensus target price of $21.42 suggests the market is still cautiously optimistic on the stock, suggesting it could rise 58% over the next year. We note that this target is likely to drift lower as analysts remodel expectations for the year ahead.

The post Zumiez Execs’ Insider Trades Signal Optimism Amid Weak Q1 Results appeared first on Fintel.