Verizon Communications Inc. (NYSE:VZ), through its subsidiaries, offers communications, information, and entertainment products and services to consumers, businesses, and governmental agencies worldwide.

Q3 2021 hedge fund letters, conferences and more

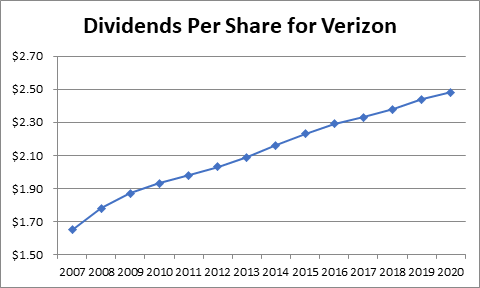

The company is a dividend achiever, which has managed to grow dividends for 16 years in a row.

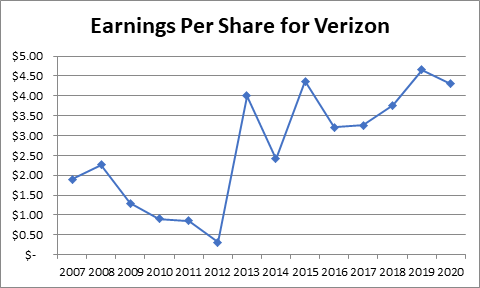

Verizon's EPS Growth

Between 2007 and 2020, earnings per share grew from $1.90 to $4.30. The company is expected to earn an adjusted $5.28/share in 2021.

The volatility in earnings per share these days is related to accounting pronouncements that require the company to recognize fair value market changes related to the investments of company’s pension plan. This actually makes it harder for investors like me and you to analyze the business performance, because those pension investments will ebb and flow with the ebb and flow of financial markets.

Verizon is a telecommunications company with a stable revenue stream, generated by over 100 million customers. The churn rate is below 1% ( the rate at which customers leave), and the company offers a service that is perceived to be of good quality. Both Verizon and AT&T have good scale of operations, due to the fact that they control large portions of the market. This makes the capital spending per customer lower than that for the next competitors. There is a constant need for investment in the network, and for upgrades. However, customers need the service and are likely to stick as long as their basic needs are met. Verizon has been allocating money wisely. This is a slow and steady investment that will pay a good starting yield, which will likely grow at the rate of inflation over time. The risk behind this dividend includes competition from the likes of T-Mobile, especially as it gets larger after its acquisition of Sprint. Other risks include making acquisitions that could increase debt amounts.

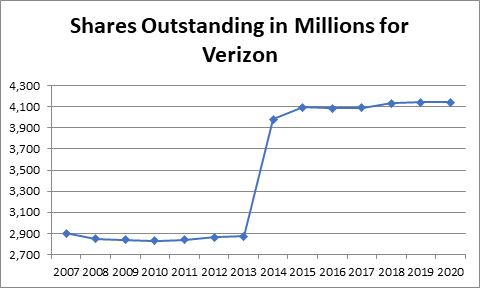

Shares outstanding have increased over the past decade, but this was mostly due to the fact that in 2013 Verizon acquired the remaining Verizon Wireless stake it didn’t already own from Vodafone. The number of shares outstanding increased in 2018, due to the acquisition of StraightPath Communication.

Dividends per share rose from $1.65 in 2007 to $2.48 in 2020. At the last rate of 62.75 cents/share, the annualized dividend is $2.51/share. I expect another dividend hike in the 2% - 3% range in September 2021.

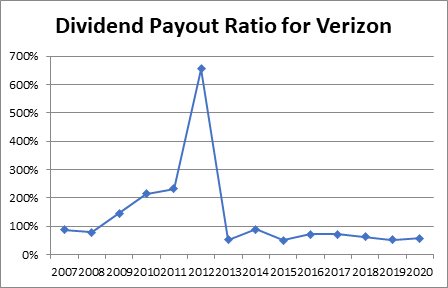

Dividend payout ratio looks like it is all over the place. Again, this is due to the fluctuations in earnings per share due to one time items. While it is at 49% today, I believe that this is ok, given the stability of cashflows from the company’s business model. Based on forward earnings expectations, the forward payout ratio comes out to be an even more sustainable 50%.

Right now Verizon sells for 9.72 times forward earnings and yields 4.99%.

Relevant Articles:

- Should I invest in AT&T and Verizon for high dividend income?

- World's Largest Dividend Payers

- Warren Buffett's Latest Three New Investments

Article by Dividend Growth Investor