Costco Wholesale Corporation (NASDAQ:COST) runs one of the highest quality businesses in the world. It has solid fundamentals, stellar management, excellent growth prospects, and most importantly, provides an outstanding service to its members.

Q4 2020 hedge fund letters, conferences and more

If you want a complete breakdown of Costco’s business model, then check out my previous article, where I dive deep into the operations of the company as a whole.

While Costco remains a high-quality business, that doesn’t mean we can just buy the stock at any price. In fact, COST has remained quite overvalued for years now, and I haven’t been able to purchase the stock for that very reason.

So, if Costco is overvalued, then what is its intrinsic value? Let’s do some valuation work to see if we can find a price for this wonderful business.

Overview of Income Statement

Let’s look at Costco’s (COST) income statement. When I am analyzing an income statement, I am looking for consistent growth in revenue, earnings, and margins.

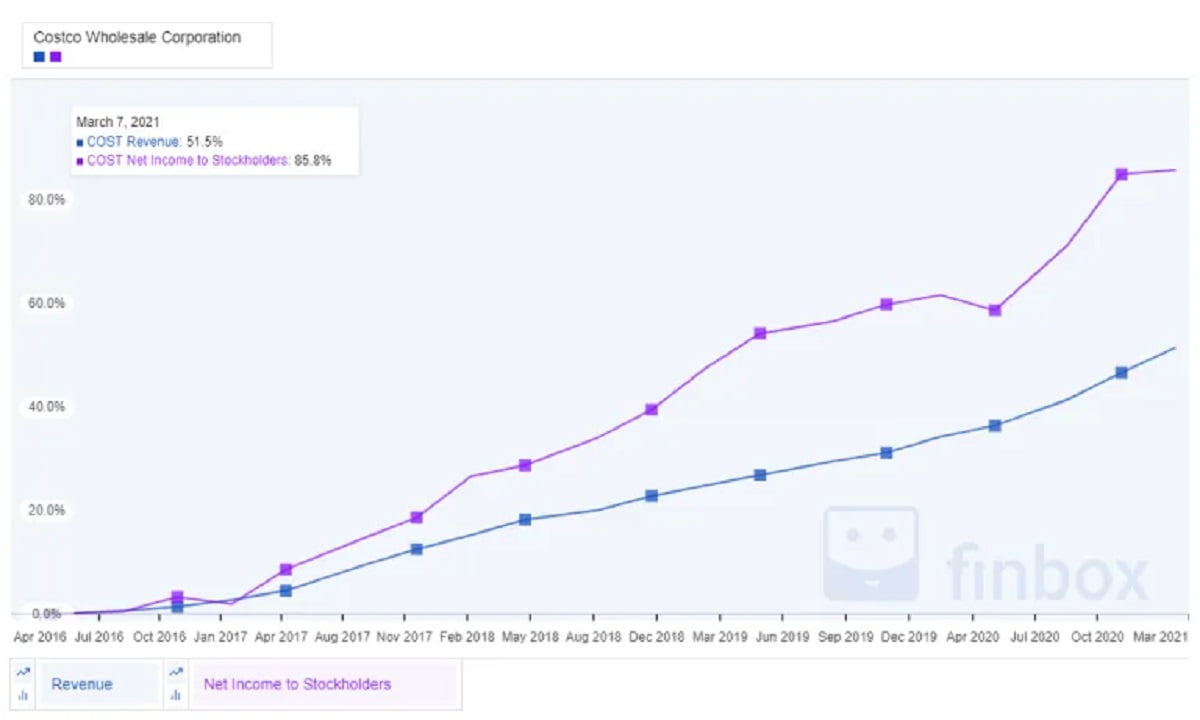

Revenue and Net Income

Source: Finbox

As we can see, COST has a fantastic history of growing revenue and net income to shareholders. Revenues have a Compounded Annual Growth Rate (CAGR) of over 50%, while net income has done even better, 85%.

What continues to drive the revenues for COST? For that, we will have to look at the detailed income statement from the company.

Source: Costco 2020 Annual Report

Over the past five years, COST has grown pretty much every metric. As previously mentioned, revenues and net income have grown consistently, as well as the dividend. Expenses have stayed relatively stable and comparable stores sales are solid.

What is most important to notice here is the relationship between COST’s membership fees and net income. Their membership fees consistently make up a majority of the net income, which essentially means that COST is making most of its money from its memberships.

This is Costco’s primary business model, and where most of the income for shareholders is derived. Costco strives to provide its members with the most competitive prices. In order to provide the best value to their members, they run very thin operating margins. In fact, Costco has only managed a 3% operating margin for the past decade.

Source: Finbox

Normally, these tight margins would not be desirable in any other business. But since COST relies on growing its memberships to provide shareholder value, they don’t need to focus on maintaining margins like other grocers.

Alright, so we have identified Costco’s main revenue driver. Let’s move on to the balance sheet.

Overview of Balance Sheet

As I mentioned in my previous article about Costco, the fundamentals of any high-quality business lies in its balance sheet. Here is where a lot of investors (including myself) spend a lot of time during analysis.

Let’s start off with the good.

Good

Source: Finbox

COST has increasingly been able to grow its cash pile over the years and are currently sitting on $14 billion in cash. Overall, total assets are increasing over total liabilities which is good to see. Current assets and current liabilities seem to be right in line with each other over the years, which seems mostly manageable.

Costco currently has over 800 warehouses. Costco’s fiscal year ends in August, so the number in their annual report is a little off. They have consistently been able to grow their warehouses considerably, averaging over 20 stores per year over the last decade, and even opened 13 new stores in 2020 (impressive considering COVID-19).

Source: Costco 2020 Annual Report

Warehouse growth is crucial to COST’s growth. Opening new locations increases memberships, which increases net income, and increases shareholder value.

Not So Good

Here’s where we get into the negative portions of COST’s balance sheet.

While COST is able to mostly safely navigate its asset base, it’s debt to equity has steadily increased over the past few years. Increasing debt can really put pressure on a business if not handled well.

Source: Finbox

While a debt-to-equity ratio of 60% is not bad for a company of Costco’s size, I would start to be concerned if the ratio gets above 100%.

Additionally, the added debt has eaten away at the equity value of the company, which has not been very consistent over the years.

Source: Finbox

Nevertheless, these are mostly minor gripes, since Costco has a stellar management team. Their access to cheap debt (with no obligations over 3%) is allowing the business to compound quite nicely.

Overview of Cash Flow

The cash flow statement is where you can find out what the company is doing with the cash they produce from the business. This can give you key insight as to how well the management team is handling the money.

Gushing Cash Flows

Good news for Costco: their cash flows are stable and growing. Operating cash flow has been positive, capital expenditures are kept at a minimum, which allows the business to constantly grow free cash flow every year.

Source: Finbox

Additionally, COST pays a nice and steady dividend to shareholders that has increased over the years. The payout ratio has always been pretty low (with the exception of the special dividend last year), which is what I prefer as a shareholder. A dividend is nice, but I would much rather the company reinvest all of my earnings in order to compound the business.

Source: Finbox

Overall, Costco’s cash management is solid. This is not really surprising, as I expect this kind of work from Costco’s excellent management team.

Growth Factors

So after digging through the statements, we have found that the number certainly backs the amazing story of Costco’s business model. Now we have to identify the growth factors for the company, and how the management team plans to compound shareholder wealth.

E-Commerce

This is a big one for Costco. To be honest, I didn’t even know that Costco had an e-commerce side to their business. To be fair though, they recently started this business segment. No surprise, the e-commerce business is booming, especially with COVID-19 impacts.

Source: Costco 2020 Annual Report

This is all great news to see Costco embracing the future and catering to their members with the e-commerce segment. If Costco can still deliver top tier value to their members with e-commerce, this will allow them to retain even more members, increasing retainability.

What’s more, Costco is investing heavily in this segment by acquiring a company called Innovel. Innovel is a final mile delivery service company that will allow Costco to ship those large bulky items straight to customer’s doors.

Source: Costco 2020 Annual Report

At this point, it is hard to tell if Costco overpaid for the acquisition at just under $1 billion. However, if the e-commerce segment continues to explode, then it will almost certainly be a smart purchase for the company. Management has stated that e-commerce has quickly approached to become 10% of the business, so this will be a large revenue driver for the company as they move forward.

Warehouse and Membership Growth

As we already identified in the income statement section, COST makes the majority of its income through its memberships. The key strategy to increase memberships is to increase warehouse locations. Costco has been very successful with this strategy, as it has worked for decades.

Costco’s major customer base lies in North America, but it seems to be hitting a saturation point. The company currently has over 500 stores in the US and Puerto Rico and 100 stores in Canada.

The real growth that the company is now pursuing is overseas expansion. In 2019, Costco opened its first location in China, which was a resounding success. It was so popular when it opened that the warehouse had to limit customer entry due to overcrowding!

Also, net sales in international locations are growing at a faster rate than the US/Canada market, which is another reason management has been pursuing overseas markets, particularly in China. In fact, international sales will likely overtake the Canadian market in 2021.

Source: Costco 2020 Annual Report

Source: Costco 2020 Annual Report

Now that we have identified the growth opportunities for COST, let’s get down to valuation.

Valuation

Discounted Cash Flow

The Discounted Cash Flow (DCF) method is the gold standard for valuing companies. If you are unfamiliar with DCF, then check out my Intrinsic Value 101 series so you can learn for yourself.

So, let’s run a DCF on COST. Let me explain my assumptions going forward.

Discount Rate: I am always looking for at least a 15% return on my investment, so my discount rate will be 15%.

Terminal Multiplier: I usually use historical Price/Free Cash Flow, which the average for COST is 25.

Growth Rates: COST has been able to easily compound free cash flow at about a 9% rate over the last five years. 2020 was quite an exceptional year, which saw surges in demand and lots of cash flow generation. I am quite bullish on Costco given the e-commerce explosion and investing in overseas warehouses. I will estimate a FCF growth of 10% for years 1-5, and a slowdown to 8% in years 6-10.

According to my estimates, COST is currently intrinsically valued at 322.88 per share. At the time of writing, COST is trading at 317.32, so it’s undervalued, right? Not so fast. I have not incorporated my margin of safety into the equation.

Again, if you are unfamiliar with the concept of margin of safety, then please check out the concept here. Essentially, we want to ensure that we get a good value for the business in case the market reacts negatively. This way, we are protecting ourselves from downside potential.

Now, a margin of safety is different for every stock, as every business has different risks. I feel that the risks to Costco lies in its ability to manage its debt and successfully expand overseas, which could be costly if either fails. For this risk, I will use a 15% margin of safety.

With a 15% margin of safety, I have a buy price of $274.45; a far cry from the current price of $317.32.

Let’s try a different valuation method.

Earnings Growth

Instead of using FCF, let’s try calculating the earnings per share growth potential of COST. This method allows us to calculate things a bit differently from a DCF. Rather than discount future values back to present values, we are determining the rate of return if we were to buy the stock at today’s value.

Here are my inputs:

EPS Growth: For COST, we are essentially estimating that the growth of the memberships will grow at 9% per year from years 1-5, which is pretty aggressive. EPS will then slow to 7% in years 6-10.

Dividend Payout Ratio: COST has managed quite a conservative dividend payout ratio throughout the year, so I will assess no more than 20% per year.

Estimated P/E: COST has traded at a P/E multiples of over 30 over the past five years. I would feel safer in modeling a multiple that is lower, and also is historically accurate over a decade which is 25.

According to our calculations, if this model was to play out, COST would only offer us an annual return of 5.8%. Not awful, but certainly not at my target of 15%. This would likely be a safe return, but it’s just not substantial enough to put down my capital.

Now What?

I know, it’s bummer that Costco does not meet my requirements. But here’s the thing: these are my assessments. Your analysis could differ from mine. You may be more bullish or bearish on Costco, and therefore would come up with a different conclusion than I did.

There are two things you can do from here.

The safe approach: Wait for the price to fall to an appropriate level where you can buy it to meet your requirements. It’s that simple. It may not happen for some time. You can always look at other options in the meantime.

The risky approach: Lower your expected return rate in order to buy the stock. This is risky because you are essentially willing to pay a higher price for the company, which could backfire badly if the price goes down. If you are ok with a 5.8% return, then you could buy COST. But otherwise, waiting is a far safer option.

Article by Vintage Value Investing