On February 1, 2023, UBS upgraded their outlook for FinVolution Group (NYSE:FINV) Group from Neutral to Buy.

Analyst Price Forecast Suggests 11.19% Upside

As of February 2, 2023, the average one-year price target for FinVolution Group is $6.42. The forecasts range from a low of $5.74 to a high of $7.21. The average price target represents an increase of 11.19% from its latest reported closing price of $5.77.

Q4 2022 hedge fund letters, conferences and more

The projected annual revenue for FinVolution Group is $13,065MM, an increase of 23.18%. The projected annual EPS is $9.65, an increase of 15.93%.

Gold Dragon Worldwide Asset Management holds 16,548,051 shares representing 5.80% ownership of the company. In it's prior filing, the firm reported owning 17,673,940 shares, representing a decrease of 6.80%. The firm increased its portfolio allocation in FINV by 4.36% over the last quarter.

Susquehanna International Group, Llp holds 16,488,262 shares representing 5.78% ownership of the company. No change in the last quarter.

Allspring Global Investments Holdings holds 10,933,728 shares representing 3.83% ownership of the company. In it's prior filing, the firm reported owning 11,439,728 shares, representing a decrease of 4.63%. The firm decreased its portfolio allocation in FINV by 54.53% over the last quarter.

EMGAX - Wells Fargo Emerging Markets Equity Fund holds 4,401,985 shares representing 1.54% ownership of the company. No change in the last quarter.

VEIEX - Vanguard Emerging Markets Stock Index Fund Investor Shares holds 2,140,019 shares representing 0.75% ownership of the company. No change in the last quarter.

Fund Sentiment

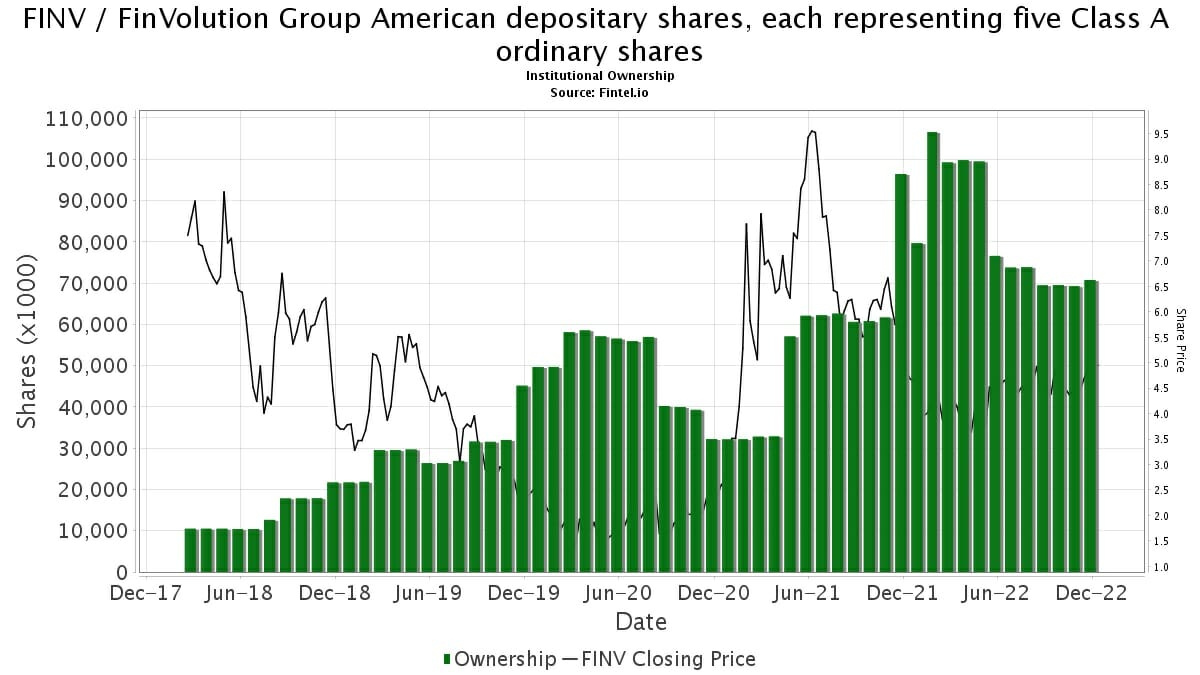

There are 126 funds or institutions reporting positions in FinVolution Group. This is an increase of three owners or 2.44% in the last quarter.

Average portfolio weight of all funds dedicated to US:FINV is 0.4252%, a decrease of 2.9441%. Total shares owned by institutions increased in the last three months by 1.46% to 70,249K shares.

FinVolution Group Background Information

(This description is provided by the company.)

FinVolution Group is a leading fintech platform in China, connecting underserved individual borrowers with financial institutions. Established in 2007, the Company is a pioneer in China's online consumer finance industry and has developed innovative technologies and has accumulated in-depth experience in the core areas of credit risk assessment, fraud detection, big data and artificial intelligence.

The Company's platform features a highly automated loan transaction process, which enables a superior user experience. As of December 31, 2020, the Company had over 116.1 million cumulative registered users.

Article by Fintel