S&P 500 selloff came – a juicy and profitable one. Bond market posture continues being negative, with no intraday comeback sticking. The pressure on the Fed is raised to the degree of 75bp hike expectation this week – the Fed would have to get more aggressive alongside other central banks if it wants to get some chance at taming inflation. It was precisely this market demand that caused the dollar to rise sharply yesterday as well. At this time, with so many gaps on sharply rising volume, both tech and value are taken to the cleaners – and neither finance nor real estate enjoy that bearish trend. What I‘ve talked about in recent weeks and months, is unfolding in a fastforward way.

Q1 2022 hedge fund letters, conferences and more

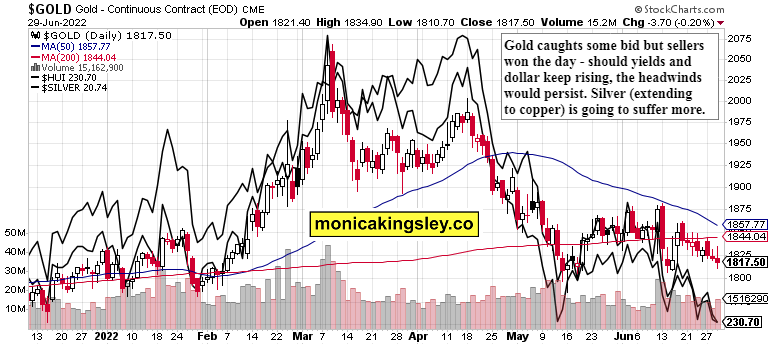

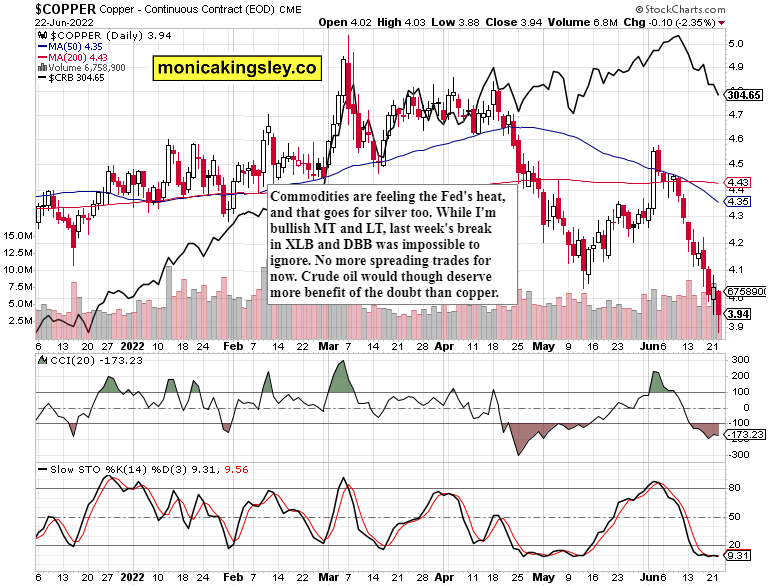

The temporary capitulation can come on the Fed – while I don‘t expect Powell to sugarcoat anything (and I look for him to rather talk a tough inflation game than offer real economy support), the heavy selling is likely to pause. Even precious metals got caught up, and couldn‘t keep up the promising daily outperformance of Friday – this is what happens when everything gets sold indiscriminately, including commodities. Copper with silver are to suffer the most in the current, squeezed hard, environment – reflecting the real economy deterioration and vigorous mainstream denials of an approaching recession...

Let‘s get into the key richly annotated charts for today – precious metals:

and copper:

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.