For weekend reading, Louis Navellier offers the following commentary:

Quick: What was the worst single year of inflation in U.S. history, and the worst three-year price surge?

The answers are below, but first some hints. The inflation scars of 1778 helped create the sound dollar.

One big reason for the Constitutional Convention of 1787 was the debt problems facing the 13 states. Nobody wanted to pay off their war debts, except Alexander Hamilton, the Man with the Plan.

Q2 2022 hedge fund letters, conferences and more

Hamilton was eventually appointed our first Secretary of the Treasury on September 11, 1789. Two days later, he arranged to borrow $191,600 to have funds on hand to pay the salaries of the new President, Congress and other newly elected officials, because the nation had no assets and bucket loads of debt.

So, on this date, September 13, 1789, the U.S. government took out its first loan, from the Bank of North America, at 6% interest. We were a nation born in debt on this date, 233 years ago. How did Alex do it?

One financial clause in the Constitution said, “No State shall…make anything but gold and silver coin a tender in payment in debts” (Article I, Section 10). Within five years, the Mint Act of 1792 declared nothing but gold and silver for U.S. coins over 1-cent.

That’s because bad memories of wet cardboard currencies were fresh on everyone’s minds, and the new nation did not want to repeat their recent errors.

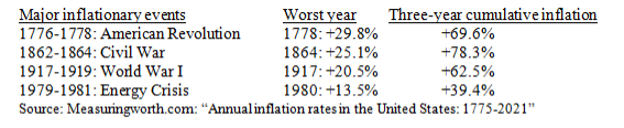

Quiz answer: Our worst inflation year was 1778, at 29.8%, and the worst three years were 1862-1864, at 78%. Here are the four times we had triple-digit inflation for three years in a row in our 246-year history:

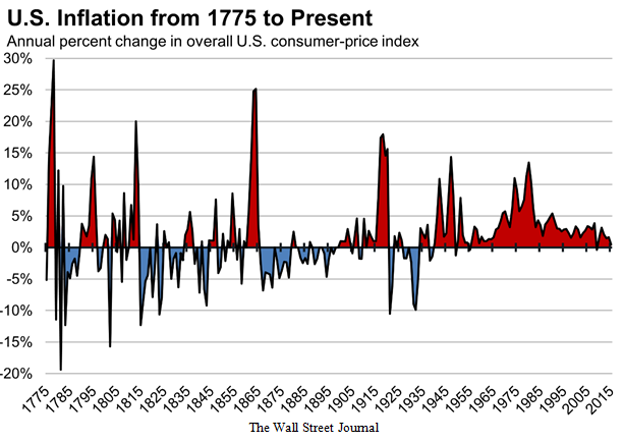

Hyper-inflation during the American Revolution resulted from a failed cardboard currency called “The Continental.” Since the Continental Congress could hardly raise taxes to fund a war against taxation, they printed increasing amounts of cardboard money to fund the war, promising that the states would refund the bills later on (they never did).

The initial print run was $6 million in 1775, then $19 million in 1776. Then they went big in 1778 with $63.5 million and a huge $90,052,380 printed in 1779. All states issued these little (3×4 inch) pasteboards without restraint until General George Washington sighed, “A wagonload of money will scarcely purchase a wagonload of provisions.”

In 1780, Congress devalued Continentals 40-to-1, but nobody respected the face value of the “new” Continentals, either.

Four-score years later, the hyper-inflation in the Civil War came from Lincoln’s Greenbacks, and worse inflation from Confederate currencies.

After that war, paper money traded at a discount to gold, and once again on this date– September 13, 1869 – the leading financiers of the day, Jay Gould (1836-1892) and Jim Fisk (1834-1872) plotted to corner the U.S. gold market by bidding up gold, based on bogus inflation rumors.

By Wednesday, September 15, the “gold pool” held over $90 million in gold contracts – many times the gold supply then available on the market. Even U.S. President Grant was part of the pool. The scam worked until Black Friday, September 24. As it turns out, Gould had secretly sold much of his gold.

In more recent times, following the inflationary 1970s, the U.S. Mint held a morning-after-inflation conversion to gold by striking its first gold coin in 50 years, the Olympic Eagle on September 13, 1983.

It soon (in 1986) gave way to the American Eagle coin series, which is still popular, but back in 1933, President Franklin D. Roosevelt had banned gold, confiscating most U.S. gold coins, under threat of fines and jail. For over 40 years, holding gold bullion or gold coins was punishable by up to 10 years in prison.

The American Revolution Is Now Being Reversed

Today’s inflation cycle is mild. It’s most likely that U.S. inflation peaked in this cycle in June at 9.2%, so we won’t see double-digit inflation for a single 12-month period, much less three years, as in 1979-81, so this run of inflation will be “transitory,” as the Fed promised, but a “longer transitory” than they thought.

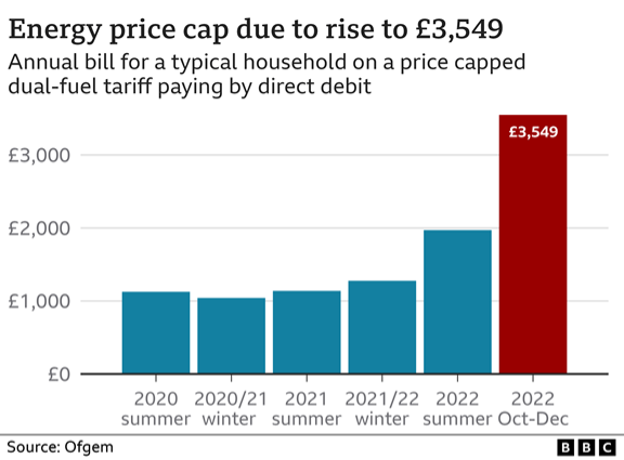

However, our 1770s independence adversary, England, is in a bigger pickle. A typical British family’s gas and electricity bill is expected to nearly double, from £1,971 earlier this year to £3,549 in October.

The British government is promising to subsidize energy bills over £2,500, according to the BBC article that reported this price increase (“Liz Truss to cut energy bills for millions,” September 6, 2022).

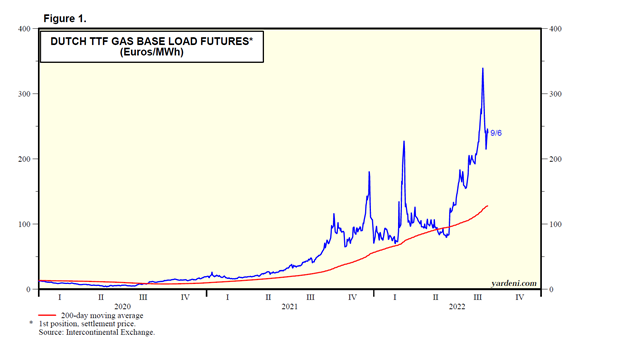

BBC didn’t say how long the government can afford this support, but they said the total package is expected to cost about £100 billion, depending on gas and electricity prices this winter, but gas prices are now double what they were in the spring, even after the recent price correction (see chart of TTF gas prices, below).

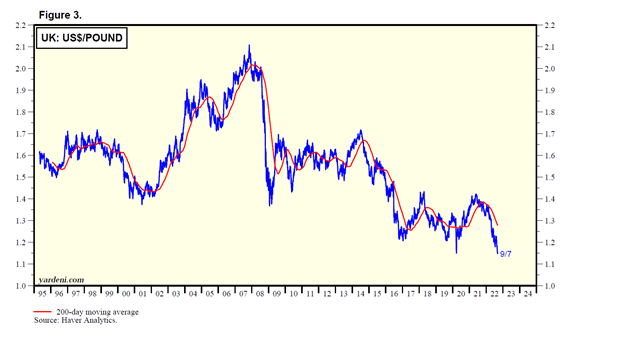

The end result of this deficit spending caused by Russian war sanctions and failed green energy policies is massive inflation and erosion of the British pound. We may see parity between the dollar and the pound this year. Currently, the pound is at its lowest level to the dollar since the Plaza Accords of 1985.

Germany isn’t faring much better and, by extension, neither is the euro. Germany said during our Labor Day weekend that it will spend at least €65 billion ($65 billion) on a package of payments to the most vulnerable citizens, and tax breaks to energy-intensive businesses. This would be Germany’s third round of energy-related support.

According to another BBC News article (“Germany announces €65bn package to curb soaring energy costs, “September 5, 2022), the German government will make one-off payments to pensioners, people on benefits, and students, and cap energy bills, according to German Chancellor Olaf Scholz.

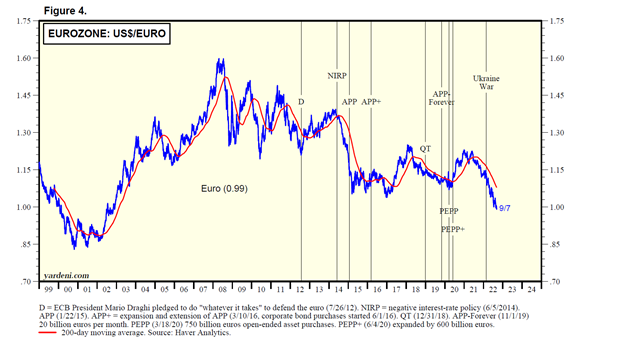

If you add in the package of subsidies and payments to corporations, Germany will spend about €100 billion to give its citizens relief from surging energy prices (after spending €300 billion on Covid relief). All this spending, plus MMT, QE and sub-zero rates pushed the euro to a 20-year low.

The euro was born at $1.18 in 1999, dipped to $0.85 in short order, then soared to $1.60 in our financial crisis of 2008, but it has been downhill for the euro/dollar rate ever since 2008. It is now under $1.

But there is a golden light at the end of this story. Gold may be down over 5% this year in dollar terms, but gold is up fairly briskly in terms of most other currencies.

For instance, the euro has sunk from over $1.13 on January 1 to $1 now, meaning that gold has risen from 1,607 euros per ounce at the start of 2022 to 1,718 euros now, up 7%. Gold is up even more in British pounds (+10%) or Japanese yen (over 15%).

Despite gold’s decline in dollar terms this year, the U.S. Mint is doing bonanza business in the sale of the American Eagle gold coins and the newer American Buffalo (launched in 2006). Sales of these coins this year through August 31 topped 1,168,000 Troy ounces, an 8% gain over 2021’s sales in the same period.

Alexander Hamilton – The Man with the Plan – still lives: On our currency, as a best-seller and a musical.

Long Live the U.S. Dollar – and free choice in currency investments via U.S. Gold from the U.S. Mint.