Stanphyl Capital letter to investors for the month ended August 31, 2022, discussing their short thesis for Tesla Inc (NASDAQ:TSLA).

It’s becoming increasingly obvious that the Tesla “hypergrowth” story is over. Here are the company’s most recent quarterly deliveries:

Q4 ‘21: 309,000

Q1 ‘22: 310,000

Q2 ‘22 & Q3’s estimate averaged to account for pent-up Q3 demand from Q2’s China factory closing: 312,000.

Q2 2022 hedge fund letters, conferences and more

Tesla's Production Capacity Is Outstripping Incoming Orders

Tesla delivery wait times worldwide are now declining substantially, which by definition means that its newly expanded production capacity is outstripping its rate of incoming orders despite the new German and Texas factories producing at only around 20% of capacity!

This means one thing and one thing only: big, margin-slashing Tesla price cuts are needed to resume meaningful unit delivery growth, and in fact in late August the first such cut happened, with Tesla introducing in Europe a new rear-wheel drive Model Y that sells for as much as $20,000 less than the cheapest model (an all-wheel drive version) available here in the U.S. Sure, if Tesla slashes prices enough it will undoubtedly be able to use its excess capacity, but so can any other car company. Welcome to the auto business, which currently sells for around 5x earnings!

Meanwhile, Elon Musk remains the most vile person ever to head a large-cap U.S. public company, and we remain short Tesla, the biggest bubble-stock in modern market history, because:

- It has a sliding share of the world’s EV market and a share of the overall auto market that’s only around 1.5%, yet a market cap greater than the next 13 largest automakers (by market cap) combined despite selling only around 2% of the cars they do.

- It has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of its electric car technology (which has now been equaled or surpassed by numerous competitors) and its previously proprietary Superchargers are being opened to everyone), while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably.

- Excluding working capital benefits and sunsetting emission credit sales Tesla generates only minimal free cash flow.

- Growth in sequential demand for Tesla’s cars is at a crawl relative to expectations.

- Elon Musk is a pathological liar.

In July Tesla reported a terrible Q2, with deliveries down 26% from Q1 (which itself showed no growth over Q4). However, Q2’s sales decrease was due to a monthlong COVID-related closing of Tesla’s Shanghai factory, and thus that month of pent-up demand will undoubtedly make Q3’s figure significantly better than it otherwise would be (which is why I averaged the two figures a few paragraphs above).

In Q2 Tesla generated only $621 million in stated free cash flow, yet that included a sequential increase in payables (and decrease in receivables) despite a $1.8 billion decrease in revenue! (In other words, Tesla didn’t pay some of its bills!) Additionally, there was a $106M operating cash flow benefit from a Bitcoin sale, so adjusting for the working capital and Bitcoin benefits Tesla was barely free cash flow-positive.

Meanwhile, earnings were just $0.65/share (adjusted for August’s 3:1 split) including roughly .10/share of emission credit sales which will disappear some time next year when competitors have enough EV capacity of their own. If we add back the one-time .03/share loss for the aforementioned Bitcoin sale and deduct the sunsetting credit sales, we get annualized adjusted run-rate earnings of just $2.32, giving Tesla an annualized run-rate PE ratio (as of the end of August) of 119 in an industry with an average current multiple of only around 5!

And even to make that lousy earnings number Tesla (an alleged “technology growth company”) had to slash R&D spending sequentially by almost $200 million while simultaneously claiming a mysterious reduction in SG&A despite opening two brand new factories in the quarter that Musk called “gigantic money furnaces.”

Loss Of Product Edge

Meanwhile, Tesla has objectively lost its “product edge,” with many competing cars now offering comparable or better real-world range, better interiors, similar or faster charging speeds and much better quality. (Tesla ranks second-to-last in Consumer Reports’ reliability survey while British consumer organization Which? found it to be one of the least reliable cars in existence.)

Thus, due to competitors’ temporary production constraints, waiting times are now longer for many of Tesla’s direct EV competitors than they are for a Tesla. (Here’s one example, and here’s another.)

In fact, Tesla is likely now the second, third or fourth choice for many EV buyers, and only maintains its volume lead though a short-lived edge in production capacity that will disappear over the next 12 to 36 months as competitors rapidly increase the ability to produce their superior EVs.

Tesla’s poorly-built Model Y faces current (or imminent) competition from the much better made (and often just better) electric Hyundai Ioniq 5, Kia EV6, Ford Mustang Mach E, Cadillac Lyriq, Nissan Ariya, Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Chevrolet Blazer EV and Polestar 3.

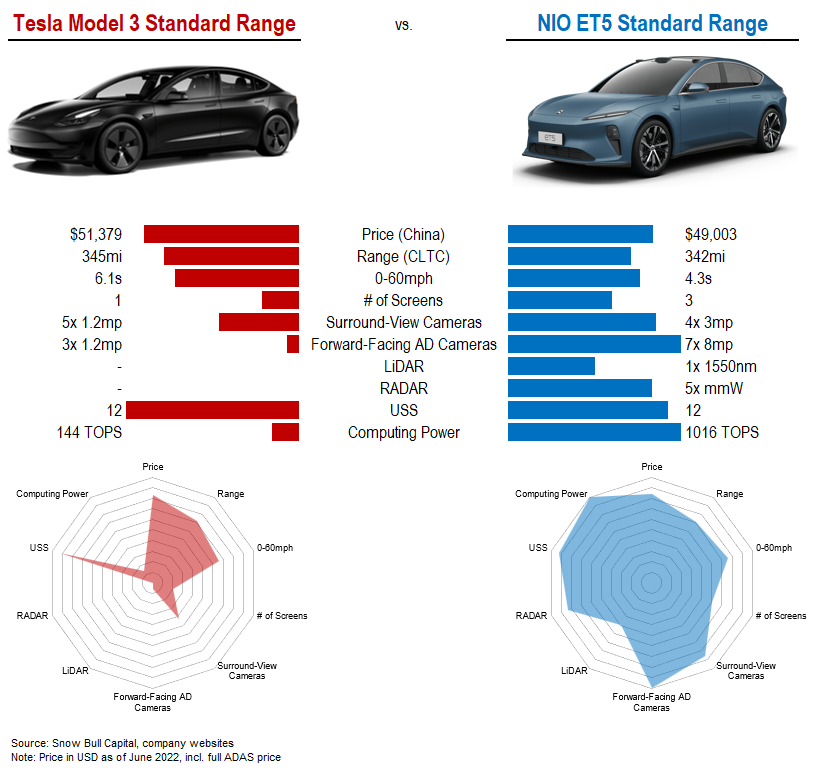

And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, the great new BMW i4, the upcoming Hyundai Ioniq 6 and Volkswagen Aero, and multiple local competitors in China—here, from Snowbull Capital’s @TaylorOgan, is just one example of that Chinese competition:

And in the high-end electric car segment worldwide the Porsche Taycan (the base model of which is now considerably less expensive than Tesla’s Model S) outsells the Model S, while the spectacular Mercedes EQS, Audi e-Tron GT and Lucid Air make it look like a fast Yugo, and the extremely well reviewed new BMW iX and Mercedes EQS SUV do the same to the Model X.

Tesla Is Netflix

Indeed, for years I’ve said “Tesla is Blackberry”—the maker of a first-generation version of a product that—once the market was proven—would be supplanted into niche obscurity by newer, better versions; now I can provide a much more recent analogy: Tesla is Netflix.

For years Netflix had an absurd valuation based on its pioneering position in streaming media, but once it proved that such a market existed myriad competitors swarmed all over it, and this year the stock collapsed when we learned that not only is Netflix no longer in “hypergrowth” mode but for the first time since 2011 (when it transitioned from physical DVDs) it actually lost subscribers.

I believe Musk knows that Tesla is “the next Netflix” (hence his recent “Twitter buying distraction”), with VW, Hyundai/Kia, Ford, GM, BMW, Mercedes, BYD & other Chinese competitors and, in a few years, Toyota & Honda, being the Disney, HBO Max, Amazon Prime, Peacock, Hulu, Paramount +, etc., of the electric car market, stealing Tesla’s share and eventually pounding its stock price down 90% or so from today’s, into the valuation of “just another car company.”

Despite this obvious “writing on the wall,” many Tesla bulls sincerely believe that ten years from now the company will be twice the size of Volkswagen or Toyota, thereby selling around 20 million cars a year (up from the current run-rate of around 1.3 million); in fact in May Musk himself even raised this as a possibility.

Setting aside the absurdity of selling that many cars at Tesla’s high price points, to illustrate the “logistical absurdity” of this, going from 1.3 million cars a year today to 20 million in ten years means that in addition to 2 million cars a year of sold-out existing claimed production capacity (once the German and Texas factories are fully operational), Tesla would have to add 36 more brand new 500,000 car/year factories with sold out production; i.e., a new factory nearly every single quarter for the next ten years!

Meanwhile, in July the head of Tesla’s “self-driving” program quit, while in June the NHTSA announced that its investigation of Tesla’s deadly Autopilot has expanded into “an engineering analysis,” the last required step before (finally!) demanding a full recall. The refund liability potential for Tesla for this is in the billions of dollars, and possibly even the tens of billions if a class action lawsuit proves that the cars involved were purchased solely due to the (fallacious) promise of “full self-driving.”

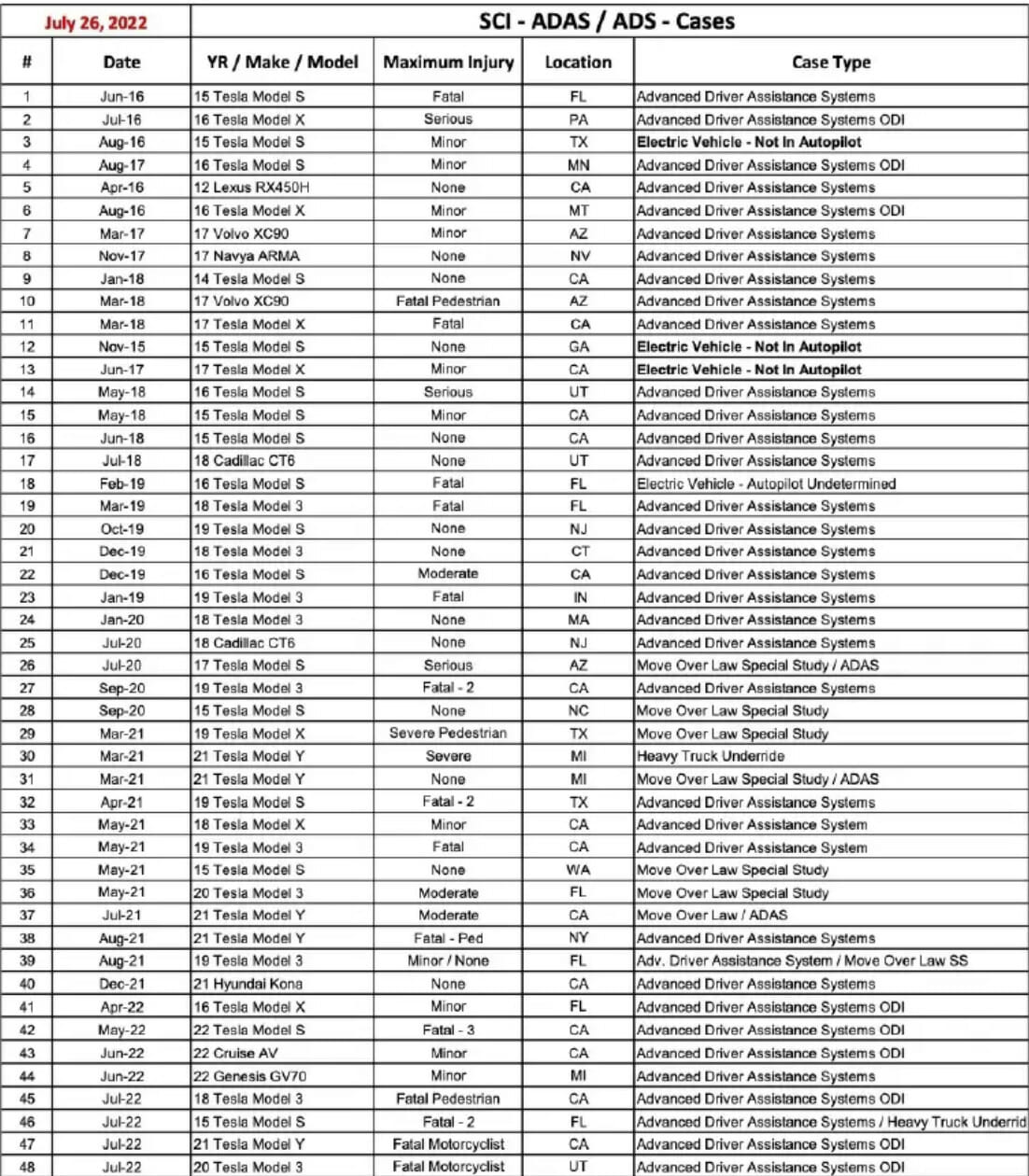

And, of course, there will be a massive “valuation reappraisal” for Tesla’s stock as the world wakes up to the fact that Tesla’s so-called “autonomy technology” is just trailing-edge garbage. As of July the NHTA was investigating 48 crashes involving autonomous driving systems, 39 of which—and all the deaths but one—involve Tesla. (For all Tesla deaths cited in the media—which is likely only a small fraction of those that have occurred—see TeslaDeaths.com.)

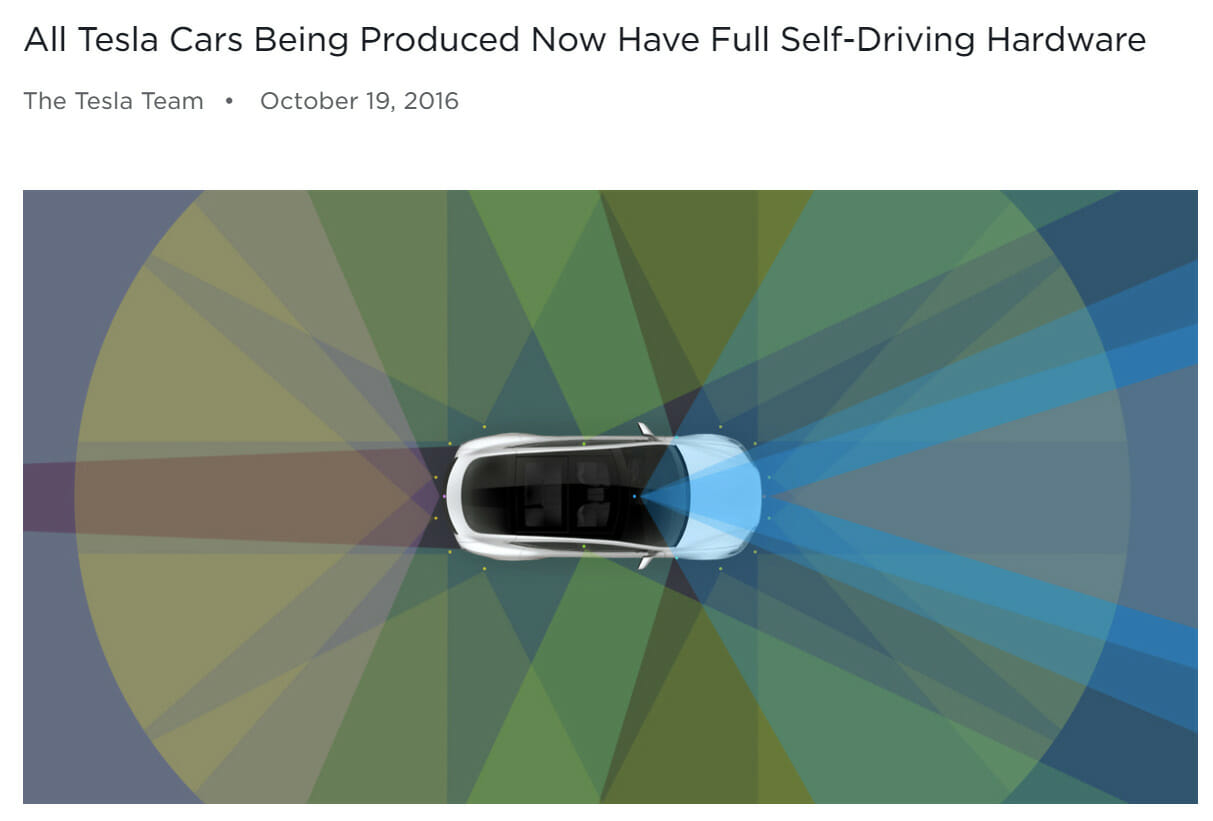

And Tesla has sold this trashy software for almost six years now:

…and still promotes it on its website via a completely fraudulent video!

Nothing Proprietary

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there—it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars.

And if new-format 4680 cells enter the market some time in 2024 (as is now expected), even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone, and BMW has already announced it will buy them from CATL and EVE.

And oh, the joke of a “pickup truck” Tesla previewed in 2019 (and still hasn’t shown in production-ready form) won’t be much of “growth engine” either, as it will enter a dogfight of a market; in fact, Ford’s terrific 2022 all-electric F-150 Lightning now has over 200,000 retail reservations (plus many more fleet reservations), GM has introduced its fantastic 2023 electric Silverado which already has nearly 200,000 reservations and Rivian’s pick-up has gotten excellent early reviews.

Regarding safety, as noted earlier in this letter, Tesla continues to deceptively sell its hugely dangerous so-called “Autopilot” system, which Consumer Reports has completely eviscerated; God only knows how many more people this monstrosity unleashed on public roads will kill despite the NTSB condemning it.

Elsewhere in safety, the Chinese government forced the recall of tens of thousands of Teslas for a dangerous suspension defect the company spent years trying to cover up, and now Tesla has been hit by a class-action lawsuit in the U.S. for the same defect. Tesla also knowingly sold cars that it knew were a fire hazard and did the same with solar systems, and after initially refusing to do so voluntarily, it was forced to recall a dangerously defective touchscreen.

In other words, when it comes to the safety of customers and innocent bystanders, Tesla is truly one of the most vile companies on Earth. Meanwhile the massive number of lawsuits of all types against the company continues to escalate.

So Here Is Tesla’s Competition In Cars...

(note: these links are regularly updated)

- Porsche Taycan

- Porsche Taycan Cross Turismo

- Porsche Macan Electric SUV Officially Coming in 2023

- Volkswagen ID.3

- Volkswagen ID.4 Electric SUV

- Volkswagen unveils ID.6 SUV EV in China

- Volkswagen ID.Buzz Electric Van

- Volkswagen unveils the ID. AERO sedan with 385 miles of range

- New sketch of 2025 Volkswagen ID.1 unveiled

- VW’s Cupra Born

- Volkswagen unveils $7.1B commitment to boost product line-up, R&D, mfg in N. America

- Audi e-tron

- Audi e-tron Sportback

- Audi E-tron GT

- Audi Q4 e-tron

- Audi Q6 e-tron confirmed for 2022 launch

- 2022 Audi A6 e-tron set to take on Tesla

- Audi will expand EV lineup with electric A6 wagon

- Audi TT to be axed in 2023 for 'emotional', electric replacement

- Hyundai Ioniq 5

- Hyundai Ioniq 6

- Hyundai Kona Electric

- Genesis reveals their first EV on the E-GMP platform, the electric GV60 crossover

- Genesis Electrified GV70 Revealed With 483 Horsepower And AWD

- Kia Niro Electric: 239-mile range & $39,000 before subsidies

- Kia EV6: Charging towards the future

- Kia EV9 to land in US in 2023 with 300-miles range, $50,000 price

- Kia EV4 on course to grow electric SUV range

- Jaguar’s All-Electric i-Pace

- Jaguar to become all-electric brand; Land Rover to Get 6 electric models

- Daimler will invest more than $47B in EVs and be all-electric ready by 2030

- Mercedes EQS: the first electric vehicle in the luxury class

- 2023 Mercedes EQS SUV Is a Seven-Seat EV Flagship with up to 536 HP

- 2023 Mercedes EQE Electric Sedan

- Mercedes EQE SUV to rival BMW iX and Tesla Model X

- Mercedes EQC electric SUV available now in Europe & China

- Mercedes-Benz Launches the EQV, its First Fully-Electric Passenger Van

- Mercedes-Benz EQB Makes Its European Debut, US Sales Confirmed

- Mercedes-Benz unveils EQA electric SUV with 265 miles of range and ~$46,000 price

- Ford Mustang Mach-E Available Now

- Ford F-150 Lightning electric pick-up available 2022

- Ford set to launch ‘mini Mustang Mach-E’ electric SUV in 2023

- Ford to launch 7 EVs in Europe in big electric push

- Ford unveils Lincoln Star electric SUV concept as it readies to add four new EVs by 2026

- Polestar 2 sedan

- Polestar 3 SUV With 372-Mile Range Coming Late 2022

- Volvo XC40 Recharge

- Volvo C40 Recharge

- Chevrolet Blazer EV

- Chevrolet Bolt sedan, 259-mile range starting at $31,000

- Chevrolet Bolt EUV electric crossover

- Cadillac All-Electric Lyriq

- GMC Electric Hummer Pick-Up and SUV

- GM electric Silverado pickup truck

- GM Launches BrightDrop to Electrify the Delivery of Goods and Services

- GM & Honda Will Codevelop Affordable EVs Targeting Most Popular Vehicle Segments

- Honda pours $40 billion into electrification, targets 2 million EV production by 2030

- Honda and Sony finalize 50-50 joint venture to build EVs in 2025

- BMW leads off EV offensive with iX3

- BMW expands EV offerings with iX tech flagship and i4 sedan

- BMW i7 EV, with 600 hp, will be most powerful variant of new 7 Series flagship

- BMW iX1 Revealed With 313 HP, 272 Miles WLTP Range

- Renault-Nissan alliance plows $26B into EV blitz- will jointly launch 35 new EVs

- Nissan vows to hop back on EV podium with Ariya

- Nissan LEAF e+ with 226-mile range is available now

- Nissan Unveils $18 Billion Electric-Vehicle Strategy

- Renault upgrades Zoe electric car as competition intensifies

- Renault Dacia Spring Electric SUV

- Renault to boost low-volume Alpine brand with 3 EVs

- Renault's electric Megane will debut new digital cockpit

- Stellantis promises 'heart-of-the-market SUV' from new, 8-vehicle EV platform

- Chrysler to go all-EV by 2028

- Alfa Romeo's First Electric Car Will Arrive in 2024

- Peugeote-208

- PEUGEOT E-2008: THE ELECTRIC AND VERSATILE SUV

- Peugeot 308 will get full-electric version

- Subaru shows off its first electric vehicle, the Solterra SUV

- Citroen compact EV challenges VW ID3 on price

- Rivian R1T Is the Most Remarkable Pickup We’ve Ever Driven

- Maserati going fully electric by 2030 -all vehicles will offer a BEV version by 2025

- Mini Cooper SE Electric

- Toyota’s Electric bZ4X Goes On Sale in Spring 2022

- Toyota will have lineup of 30 full EVs by 2030; Lexus will be all-electric brand

- Honda and Sony to build, sell EVs by 2025

- Opel sees electric Corsa as key EV entry

- 2021 Vauxhall Mokka revealed as EV with sharp looks, massive changes

- Skoda Enyaq iV electric SUV offers range of power, battery sizes

- Electric Skoda Enyaq coupe to muscle-in on Tesla Model 3

- Skoda plans small EV, cheaper variants to take on French, Korean rivals

- Nio to launch in five more European countries after Norway

- BYD will launch electric SUV in Europe

- The Lucid Air Achieves an Estimated EPA Range of 517 Miles on a Single Charge

- Bentley will start output of first full EV in 2025

- All-electric Rolls-Royce Spectre to launch in 2023 – firm to be EV-only by 2030

- Aston Martin will build electric vehicles in UK from 2025

- Meet the Canoo, a Subscription-Only EV Pod Coming in 2021

- Two new electric cars from Mahindra in India; Global Tesla rival e-car soon

- Former Saab factory gets new life building solar-powered Sono Sion electric cars

- Foxconn aims for 10% of electric car platform market by 2025

- BYD is #1 in Chinese EVs, selling FAR more than Tesla

- Volkswagen to boost Chinese EV capacity to 1m by 2023

- Audi-FAW's $3.3 billion electric vehicle venture

- Nio

- Xpeng Motors

- Hozon/Neta

- Li Auto

- GAC Aion

- Leap Motors

- GM launches Ultium EV production platform in China

- Ford Mustang Mach-E Rolls Off Assembly Line in China

- Cheaper than Tesla: Honda takes aim at China's middle class

- BMW i3 Debuts As All-Electric 3 Series Only For China

- Hongqi

- Geely

- Zeekr Premium EVs by Geely

- Baidu and Geely put nearly $400 million more into their electric car venture

- China-made Mercedes-Benz EQE hits market

- BAIC

- Hyundai, BAIC Motor to inject $942 mn in China JV for EVs

- Toyota partners with BYD to build affordable $30,000 electric car

- Lexus RZ 450e Steers For China

- Dongfeng

- SAIC

- Renault launches sales of first EV in China

- Nissan expects 40% of sales in China to be electrified by 2026

- Changan forms subsidiary Avatar Technology to develop smart EVs with Huawei, CATL

- WM Motors/Weimar

- Chery

- Seres

- Enovate

- Singulato

- JAC Motors

- Iconiq Motors

- Aiways

- Skyworth Auto

- Youxia

- Human Horizons

- Xiaomi announces plans for four electric vehicle models

Here’s Tesla’s Competition In Autonomous Driving; The Independents All Have Deals With Major OEMs...

- Waymo ranked top & Tesla last in Guidehouse leaderboard on automated driving systems

- Tesla has a self-driving strategy other companies abandoned years ago

- Waymo operates robotaxis NOW

- GM’s Cruise operates robotaxis NOW

- Argo AI (owned by Ford & VW) Begins Driverless Vehicle Operations in Miami & Austin

- Mobileye operates driverless test fleets in Europe and the U.S.

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Ford’s hands-free “Blue Cruise”

- Mercedes Launches SAE Level 3 Drive Pilot System

- Honda Legend Sedan with Level 3 Autonomy Now Available in Japan

- Hyundai + Motional Bringing IONIQ 5 robotaxis to the streets from 2023

- Amazon’s Zoox will test its autonomous vehicles on Seattle’s rainy streets

- Baidu greenlighted for China's first-ever commercial driverless Robotaxi service

- Alibaba-backed AutoX unveils first driverless RoboTaxi production line in China

- Pony.ai approved for public driverless robotaxi service in Beijing

Here’s Where Tesla’s Competition Will Get Its Battery Cells...

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Northvolt

- Volkswagen to Build Six Electric-Vehicle Battery Factories in Europe

- GM’s Ultium

- GM to develop lithium-metal batteries with SolidEnergy Systems

- SK On and Ford form BlueOval SK, an EV battery joint venture

- BMW & Ford Invest in Solid Power to Secure All Solid-State Batteries for Future Electric Vehicles

- Stellantis affirms commitment to build battery factory in Italy with Mercedes, TotalEnergies

- Stellantis and Samsung SDI to Invest Over $2.5B in Battery Production Plant in United States

- Stellantis and LG to Invest Over $5 Billion CAD in Joint Venture for Li-Ion Battery Plant in Canada

- Stellantis and Factorial Energy to Jointly Develop Solid-State Batteries for Electric Vehicles

- Mercedes-Benz to build 8 battery factories in push to become electric-only automaker

- Mercedes-Benz and Sila achieve breakthrough with high silicon automotive battery

- Toyota to invest $5.3bn to make EV batteries in U.S. and Japan

- Toyota Outlines Solid-State Battery Tech, $13.6 Billion Investment

- Honda Motor, LG Energy to build $4.4 bln U.S. EV battery plant

- Daimler joins Stellantis as partner in European battery cell venture ACC

- Renault signs EV battery deals with Envision, Verkor for French plants

- Nissan to build $1.4bn EV battery plant in UK with Chinese partner

- Nissan Announces Proprietary Solid-State Batteries

- UK companies AMTE Power and Britishvolt plan $4.9 billion investment in battery plants

- Foxconn breaks ground on first EV battery plant

- Envision

- EVE

- Freyr

- Verkor

- Farasis

- Microvast

- Akasol

- Cenat

- Wanxiang

- Eve Energy

- Svolt

- Romeo Power

- ProLogium

- Hyundai Motor developing solid-state EV batteries

- Morrow

Here’s Tesla’s Competition In Charging Networks...

- Infrastructure Bill: $7.5 billion Towards Nationwide Network of 500,000 EV Chargers

- Electrify America

- EVgo

- Chargepoint

- Ionity Europe

- Shell

- 51 U.S. electric companies commit to build nationwide EV fast charging network by end of 2023

- GM, EVgo, and Pilot will install 2,000 fast chargers at travel centers

- GM to Expand Access to EV Charging with More than 40,000 Charging Stations

Volkswagen powers up the grid to take on Tesla - Volkswagen-backed CAMS eyes deployment of 17,000 charging points in China by 2025

- Circle K begins North American EV fast charger rollout, plans 200-site network by 2024

- Porsche to build out its own network of EV charging stations

- Petro-Canada Coast-to-Coast Canadian Charging Network

- Volta

- E.On

- BP

- Volkswagen and BP partner to deploy up to 8,000 EV chargers across EU/UK

- Smatric

- Allego

- Podpoint

- Instavolt

- Fastned

- Total

- Nio Battery Swap Stations

- BMW to Build 360,000 Charging Points in China to Juice Electric Car Sales

- Evie

And Here’s Tesla’s Competition In Storage Batteries...

- Panasonic

- Samsung

- LG Energy Solutions

- CATL

- BYD

- AES + Siemens (Fluence)

- GE

- Hitachi ABB

- Toshiba

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Sonnen

- Generac

- Kokam

- Eaton

- Tesvolt

- Leclanche

- Lockheed Martin

- Honeywell

- EOS Energy Storage

- ESS

- Electriq Power

- Redflow

- Primus Power

- Simpliphi Power

- Invinity

- Murata

- Bollore

- Adara

- Blue Planet

- Aggreko

- Orison

- Powin Energy

- Nidec

- Powervault

- Kore Power

- Shanghai Electric

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

- Voltstorage

- Cadenza Innovation

- Morrow

- Gridtential

- Villara

- Elestor

- SolarEdge

- Q-Cells

- Huawei

- Toyota

- ADS-TEC

- Form Energy

- Enphase

- Sumitomo Electric

- Stryten Energy

- Freyr

- Growatt

- Polarium

Thanks,

Mark Spiegel

Stanphyl Capital