In his Daily Market Notes report to investors, while commenting on the housing boom, Louis Navellier wrote:

Skirting a Recession

The Fed may raise key interest rates by 0.5% at its next Federal Open Market Committee (FOMC) meeting due to the inversion of the Treasury yield curve. Furthermore, an inverted yield curve often precedes a recession, so U.S. economic growth is teetering. The best way to describe what is going on is that Modern Monetary Theory (MMT), is coming back to haunt central banks, especially the European Central Bank (ECB) and the Fed.

Q4 2021 hedge fund letters, conferences and more

Turning to Stocks

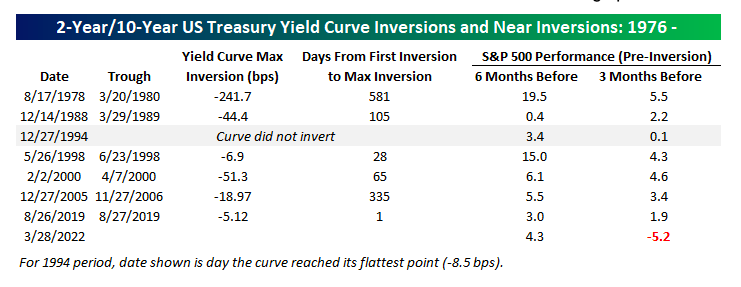

Bespoke Investment Group reported that since 1978, the 2-year and 10-year Treasury yields have inverted six times. It's interesting to note that in all six of the periods where the curve inverted, as well as in 1994 when the curve came close to inverting, the S&P 500 was higher in the six and three months leading up to the inversion (or near inversion) each time. Ironically enough, if the curve does invert in the near future, it will mark the first time that the S&P 500 declined in the three months leading up to an inversion. Despite the fact that a Treasury yield curve inversion often precedes a recession, the stock market remains an oasis, probably because frustrated bond investors turn to stocks during the inversion.

It is very hard for the Fed to engineer a “soft economic” landing as intermediate Treasury yields soar. In fact, I cannot remember the last time the Fed successfully engineered a soft economic landing. So that essentially means that businesses that do not have big order backlogs will likely be increasingly teetering in a recent recession in the upcoming months. Eventually, a weaker U.S. and global economy will impact crude oil prices and other commodities, which in turn, will “prick the current inflation bubble.”

Housing Boom Fizzles

So that is the current path the U.S. economy is on. If the Fed can avert a recession and engineer a soft landing, I will give them full credit for their actions, but right now, the tail (e.g., intermediate Treasury yields) is wagging the dog (our Fed), so we have a series of interest rate hikes to look forward to until the Fed is more in line with market rates.

As an example of how higher interest rates are impacting economic growth, the National Association of Realtors recently announced that pending home sales declined 4.1% in February compared to January, which represents the fourth straight weekly decline in pending home sales and mortgage rates have steadily risen. In the past 12 months, pending home sales have declined 5.4%, so the housing boom is fizzling.

The S&P CoreLogic Case-Shiller National Home Price Index reported on Tuesday that median home prices rose 19.1% in the past 12 months through January as the inventory of existing homes declined to an all-time low of a 1.6-month supply. In the 20 major metropolitan areas surveyed, median home prices rose in 16 of the 20 metropolitan areas. As interest rates rise, I expect that the annual pace of home appreciation will moderate.

The supply chain glitches are expected to get worse, since Chinese authorities imposed a two-stage “lockdown” on 26 million people in Shanghai in response to Covid-19. As a result, Tesla had to suspend its vehicle production for four days. Disney in Shanghai also closed. The largest container port in the world is in Shanghai, so I suspect that the container ship prices will remain high due to possible suspensions at the port as well as diversions to other Chinese ports.

The Shanghai Covid lockdown, plus renewed hopes for peace talks between Russia and Ukraine, cause a bit of a “commodity crunch” this week. In my opinion, the energy, natural gas, LNG, fertilizer and shipping stocks all remain great buys on any pullback, since they are all expected to post strong second-quarter results in the upcoming weeks.

The big surprise this week was that the Conference Board reported that its consumer confidence index rose to 107.2 in March. The present situations component rose to 153 in March. However, the expectations component declined to 76.6 in March. Overall, consumers are in much better shape than I anticipated, so it is still possible that the U.S. economy could skirt a recession if consumer spending remains strong.

Coffee Beans

The world generates nearly two billion tons of municipal solid waste (MSW) each year, enough to fit into 822,000 Olympic-sized swimming pools. MSW includes trash from companies, buildings, houses, yards, and small businesses. China produced the most municipal solid waste of any country in the World Bank’s database at 395 million tons per year, followed by the U.S. with 265 million tons. Source: Statista. See the full story here.