As an investor, you can control what you invest in, how much you invest in, and what your costs are.

The Coffee Can Portfolio

A very appealing concept along those lines is the idea of The Coffee Can Portfolio. It is a powerful idea, that can help you become a better investor, if implemented correctly.

The Coffee Can portfolio concept harkens back to the Old West, when people put their valuable possessions in a coffee can and kept it under-the mattress. That coffee can involved no transaction costs, administrative costs, or any other costs. The success of the program depended entirely on the wisdom and foresight used to select the objects to be placed in the coffee can to begin with.

Q2 2022 hedge fund letters, conferences and more

The idea is that you invest in a number of good companies, and then leave the portfolio alone. This means no tinkering with the portfolio, trading around, or selling.

For example, if I had a portfolio worth $100,000, I could allocate $2,000 each to 50 individual companies. I’d then leave it alone for years, if not decades.

In the worst case scenario, I would lose $2,000 per company. In the best case scenario, my total returns ( capital gains and dividends) are unlimited. There would be no transaction costs and presumably less taxes.

The less in transaction costs and fees, the more you have working for you. This of course assumes that I left the portfolio alone. Cue the narrative that the best investors are dead or forgot about their portfolio.

After a period of time, this portfolio would look lopsided. It would have a lot of small positions, but a few large positions, which would have been a result of companies becoming too successful.

These holdings would have propelled the portfolio forward. For an investor who tinkers with their portfolio, the risk is that they sell these future great performers early, because of some silly reason.

You can see that selling early is more dangerous than buying a value trap. That’s because a great performer can pay for a handful of mistakes, and still result in an overall net profit for the portfolio.

Of course, this exercise assumes that the investor is selecting quality companies.

This idea can help you become a better investor due to a variety of factors.

First, it focuses your mind on companies that you can just buy and hold and forget. In the words of Warren Buffett, only buy a stock with the intention to hold it even if the market closed for a decade. Buffett also says that if you are not willing to own a stock for a decade, you should not even think about owning it for ten minutes.

There is a lot of wisdom in these quotes. There are not that many businesses that can be bought and forgotten about.

This forces you to look for businesses with strong competitive advantages and tailwinds, which are likely to continue their dominant economic position for a long period of time, while growing earnings and dividends along the way. This means that there won’t be much in terms of disruption to the business.

A lot of such businesses can be found on the Dividend Aristocrats list. However, not all businesses on the Dividend Aristocrats list are buy and hold without looking types. But I have a healthy dose of conviction that they would likely do well as a group over the next decade.

By focusing on quality, investors can narrow down the list of great long-term holds substantially.

Second, the coffee can portfolio forces you to have lower costs.

Turnover is expensive. You can have transaction costs, taxes, and fees. In addition, there is opportunity cost, because the companies you sold may end up doing much better than the companies you replace them with. In my observations, I have seen first hand that investors are their own worst enemies.

They lack patience, and get frustrated if they have to wait for a company to deliver. Very often, investors end up capitulating right before things turn around; only to replace with another investment that has done very well recently. Those recency and activity biases can be expensive.

A portfolio is like a bar of soap, the more you handle if, the smaller it gets. I like that this coffee can approach reduces costs, and focuses you to be more patient and long-term oriented.

Even if you have a small amount of turnover every year, your portfolio would look very differently in a decade, provided you do selling/pruning/rebalancing. This is costly.

Third, this portfolio rewards patience.

Buy buying and holding, you let the power of compounding do the heavy lifting for you. You give companies maximum amount of time to shine. Total returns do not come at predictable intervals (only the dividend component does).

This type of a passive portfolio lets you maximize the full potential of your investments to your benefit.

You do that by letting winners run, and keeping your losers at the minimum.

You can only lose $2,000 in a 50 stock portfolio per each position. But the amount you can make is unlimited.

In other words, you are following the wisdom of Peter Lynch, where “you are watering the flowers and pruning the weeds”

The author of the “Coffee Can Portfolio” discusses the portfolio of a husband and wife. The husband bought shares in companies, but sold when his broker advised him to. His wife bought the stocks in her portfolio, but never sold it. As a result, she did much better than her husband:

The potential impact of this process was brought home to me dramatically as the result of an experience with one client. Her husband, a lawyer, handled her financial affairs and was our primary contact.

I had worked with the client for about ten years, when her husband suddenly died. She inherited his estate and called us to say that she would be adding his securities to the portfolio under our management.

When we received the list of assets, I was amused to find that he had secretly been piggybacking our recommendations for his wife‘s portfolio. Then, when I looked at the total value of the estate, 1 was also shocked.

The husband had applied a small twist of his own to our advice: He paid no attention whatsoever to the sale recommendations. He simply put about $5,000 in every purchase recommendation. Then he would toss the certificate in his safe-deposit box and forget it.

Needless to say, he had an odd-looking portfolio. He owned a number of small holdings with values of less than $2,000. He had several large holdings with values in excess of $100,000.

There was one jumbo holding worth over $800,000 that exceeded the total value of his wife’s portfolio and came from a small commitment in a company called Haloid; this later turned out to be a zillion shares of Xerox.

This idea really reminds me of Jeremy Siegel paper on the performance of the original members of S&P 500. It also reinforces the lessons from the Corporate Leaders Trust and Changes in Dow Jones Industrials Average.

The idea of Coffee Can portfolio is not popular on Wall Street. That’s because if you buy such a portfolio, you do not need an expensive mutual fund manager or a financial advisor. Hence, it is not going to be sold to you. I believe this is an idea worth exploring for my money.

Naturally, the question would come as to what companies can I invest in?

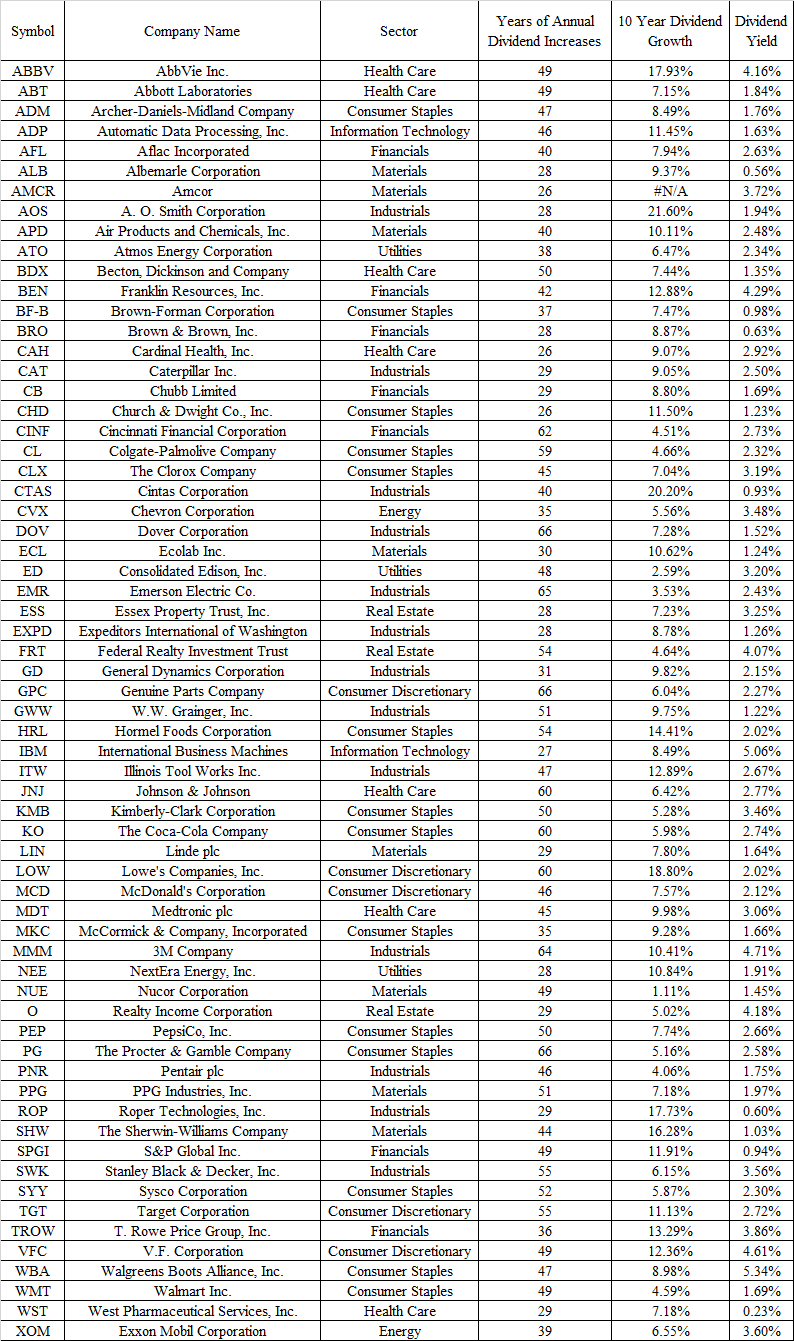

In my opinion, the list of Dividend Aristocrats includes 64 quality companies. Enterprising dividend investors may be able to narrow down the list using various criteria of their own; or even expand by including dividend champions etc.

Note: Data is as of Aug 31, 2022

Either way, a portfolio that is equally divided between the companies, and then left unattended for 10 – 20 – 30 years, would likely do better than most investors.

I assume the DRIP is turned on. I also assume that the portfolio owner makes no active decisions, so they would keep all spin-offs, splits, and acquisitions if any. The only active decision would likely be when a company is acquired for cash.

If I wanted to narrow the list down, I'd do the following:

- Focus on companies that have raised dividends for at least 25 years in a row (already done)

- Review trends in earnings per share over the past decade, and focus on companies that have managed to grow earnings per share.

- Review the trend in dividends per share

- Review trends in dividend payout ratio and focus on the ones with sustainable dividends. Safety first.

- Try to understand the business, and determine the likelihood of future earnings and dividend growth

- Review valuation. This is tricky, because it involves a lot of trade offs between yield and growth, dividend safety and likelihood for how long a company can keep growing on its own.

Check my analysis of Air Products & Chemicals (APD) in order to put things in perspective.

Conclusion:

I have been fascinated by the concept of the Coffee Can Portfolio ever since I learned about it several years ago. In a way, it makes sense that keeping costs, turnover and fees low can result in a good result over time.

This should not be a surprise to readers, as I have previously discussed how Investing in the Dividend Aristocrats from 2011 did, or investing in the 2007 Aristocrats List did.

Relevant Articles:

- Time in the market is your greatest ally in investing

- The Perfect Dividend Portfolio

- Where are the 2007 Dividend Aristocrats today?

- Dividend Aristocrats for 2022

Article by Dividend Growth Investor