Stanphyl Capital’s commentary for the month ended February 28, 2023, discussing their short position in Tesla Inc (NASDAQ:TSLA).

Massive Price Cuts

Tesla kicked off 2023 with massive, margin-destroying price cuts worldwide (on top of large cuts in Q4 2022), and while this should generate more unit deliveries (although so far not in China), 2023’s roughly 11% ASP cut vs. Q4 2022, combined with 2023 production (and, we’ll generously assume, delivery) guidance of 1.8 million cars mean 2023’s earnings will be at least 25% lower than Q4 2022’s earnings annualized, and perhaps as much as 40% lower.

Q4 2022 hedge fund letters, conferences and more

(In other words, for the full year 2023 Tesla will be lucky to earn $3/share.) Thus, Tesla is no longer a “growth” company unless you define “growth” as declining earnings.

Most disturbingly for Tesla bulls, despite those 11% average price cuts vs. Q4, at 1.8 million units the company is only guiding to 11% more delivery volume vs. Q4’s 405,000 annualized run-rate of 1.62 million.

It’s also only guiding to 2% more production than Q4’s annualized rate of 1.76 million, so where will the “volume savings” to support price cuts come from? And what will Tesla do for its next “growth trick”? Sell cars at a loss? Sell a tiny subcompact beginning in 2025 with a similarly tiny profit margin?

As Tesla slashes prices it will undoubtedly sell more cars, but the incumbent auto companies can do the same thing on their EVs, and their EV pricing can be cross-subsidized by their 95% of volume that comes from highly-profitable ICE vehicles while Tesla now has nothing that’s “highly profitable.”

So while Tesla may “win” an EV price war against other pureplay EV makers, it will lose that war against the incumbent OEMs. Goodbye “story-stock tech company” and hello “low-margin, cyclical car company” in an industry with single-digit PE ratios, and for Tesla that means 6x $3/share in 2023 earnings = a stock price of $18/share vs. February’s close of $205.71.

(And please don’t lecture me about Tesla’s “battery business,” which nets almost nothing and is in an extremely competitive, low-margin industry for every participant.)

(By the way, in calculating $3/share in 2023 Tesla earnings I generously assume that those earnings will include some combination of quarterly environmental credits equal to Q4’s obscene $467 million, with emission credit sales gradually being replaced by various new battery production and alternative fuel-derived credits.

I also generously credit Tesla for the full $324 million in quarterly so-called “Full Self-Driving” profit it recognized in Q4, even though this is a fraudulently named product that’s in the process of being recalled by the NHTSA, thereby presenting Tesla with a massive multi-billion-dollar liability.)

Loss Of Product Edge

Meanwhile, Tesla has objectively lost its “product edge,” with many competing cars now offering comparable or better real-world range, better interiors, similar or faster charging speeds and much better quality. (Tesla ranks near the bottom of Consumer Reports’ reliability survey while British consumer organization Which? found it to be one of the least reliable cars in existence.)

Thus, due to competitors’ temporary production constraints, waiting times are now longer for nearly all of Tesla’s direct EV competitors than they are for a Tesla. And Tesla is opening its U.S. charging network to everyone (which it already does in much of Europe), eliminating the last reason to buy its now trailing-edge EVs.

In fact, Tesla is likely now the second, third or fourth choice for many EV buyers, and only maintains its volume lead though a short-lived edge in production capacity that will disappear over the next 12 to 36 months as competitors rapidly increase the ability to produce their superior EVs.

Tesla’s poorly-built Model Y faces current (or imminent) competition from the much better made (and often just better) electric Hyundai Ioniq 5, Kia EV6, Ford Mustang Mach E, Cadillac Lyriq, Nissan Ariya, Audi Q4 e-tron, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Chevrolet Blazer EV & Equinox EV and Polestar 3.

And Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful Polestar 2, the great new BMW i4, the upcoming Hyundai Ioniq 6 and Volkswagen ID.7, and multiple local competitors in China.

And in the high-end electric car segment worldwide the Porsche Taycan (the base model of which is now considerably less expensive than Tesla’s Model S) outsells the Model S, while the spectacular new BMW i7, Mercedes EQS, Audi e-Tron GT and Lucid Air make it look like a fast Yugo, and the extremely well reviewed new BMW iX, Mercedes EQS SUV and Audi Q8 eTron (as well as multiple new Chinese models) do the same to the Model X.

And oh, the joke of a “pickup truck” Tesla previewed in 2019 (and still hasn’t shown in production-ready form) won’t be much of “growth engine” either, as by the time it’s in mass-production in 2024 it will enter a dogfight of a market vs. Ford’s hot-selling all-electric F-150 Lightning and GM’s fantastic 2023 electric Silverado (which already has nearly 200,000 reservations), while Rivian’s pick-up has gotten excellent reviews and Ram will also be out with a great electric truck in Q4 ‘24.

Tesla Is Netflix

Indeed, for years I’ve said “Tesla is Blackberry”—the maker of a first-generation version of a product that—once the market was proven—would be supplanted into niche obscurity by newer, better versions; now I can provide a much more recent analogy: Tesla is Netflix.

For years Netflix had an absurd valuation based on its pioneering position in streaming media, but once it proved that such a market existed myriad competitors swarmed all over it, and in 2022 the stock collapsed.

I believe Musk knows that Tesla is “the next Netflix” (hence his recent “Twitter buying distraction”), with VW Group, Hyundai/Kia, Ford, GM, Stellantis, BMW, Mercedes, BYD & other Chinese competitors and, in a few years, Toyota & Honda, being the Disney, HBO Max, Amazon Prime, Peacock, Hulu, Paramount+, etc. of the electric car market, stealing Tesla’s share and eventually pounding its stock price into low double-digits, where it would be valued as “just another car company.”

Fraudulent Full Self Driving

Meanwhile, the NHTSA has initiated the first of what will likely be multiple recalls of Tesla’s fraudulently named “Full Self Driving,” and in January it was revealed that Elon Musk personally directed its fake, fraudulent promotional video (something extremely similar to what Theranos did with its blood machines and Nikola with its truck), and that the DOJ is investigating him for it and so is the SEC.

The refund liability potential for Tesla for this is in the billions of dollars, and possibly even the tens of billions if a class action lawsuit proves that the cars involved were purchased solely due to the (fallacious) promise of “full self-driving.”

And, of course, there will be a massive “valuation reappraisal” for Tesla’s stock as the world wakes up to the fact that its so-called “autonomy technology” is deadly, trailing-edge garbage that Consumer Reports now ranks just seventh vs. competitors’ systems (behind Ford, GM, Mercedes, BMW, Toyota and Volkswagen).

Meanwhile, the NHTSA continues to report a slew of Autopilot-related deaths, yet Tesla has sold this trashy software for over six years now:

…and still promotes it on its website via the aforementioned completely fraudulent video! (For all Tesla-related deaths cited in the media—which is likely only a small fraction of those that have occurred—please see TeslaDeaths.com.)

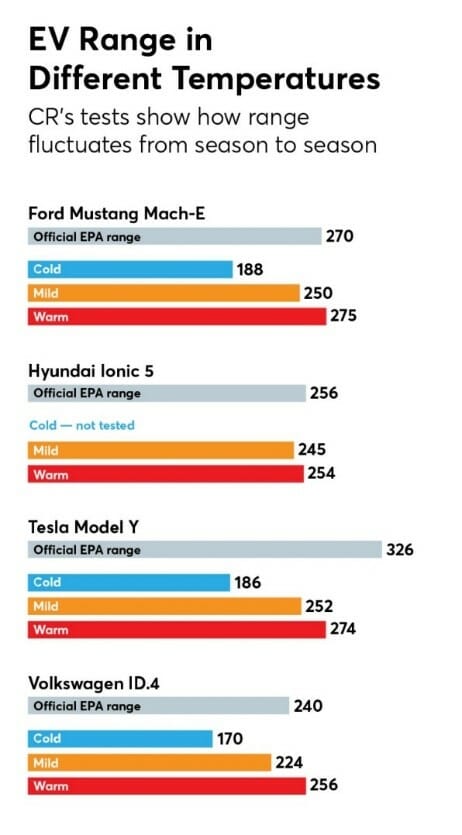

Want to see another Elon Musk/Tesla fraud summarized in a simple bar graph? In this recent Consumer Reports test, note which of these cars never comes close—in any environmental conditions—to meeting its claimed EPA range:

Another favorite Tesla hype story has been built around so-called “proprietary battery technology.” In fact though, Tesla has nothing proprietary there—it doesn’t make them, it buys them from Panasonic, CATL and LG, and it’s the biggest liar in the industry regarding the real-world range of its cars.

And if new-format 4680 cells enter the market, even if Tesla makes some of its own, other manufacturers will gladly sell them to anyone, and BMW has already announced it will buy them from CATL and EVE.

Regarding safety, as noted earlier in this letter, Tesla continues to deceptively sell its hugely dangerous so-called “Autopilot” system; God only knows how many more people this monstrosity unleashed on public roads will kill.

Elsewhere in safety, the Chinese government forced the recall of tens of thousands of Teslas for a dangerous suspension defect the company spent years trying to cover up, and Tesla has been hit by a class-action lawsuit in the U.S. for the same defect.

Tesla also knowingly sold cars that it knew were a fire hazard and did the same with solar systems, and after initially refusing to do so voluntarily, it was forced to recall a dangerously defective touchscreen.

In other words, when it comes to the safety of customers and innocent bystanders, Tesla is truly one of the most vile companies on Earth. Meanwhile the massive number of lawsuits of all types against the company continues to escalate.

So Here Is Tesla's Competition In Cars...

(note: these links are regularly updated)

- Porsche Taycan

- Porsche Macan Electric Coming in 2024

- Volkswagen ID.3

- Volkswagen ID.4 Electric SUV

- Volkswagen unveils ID.6 SUV EV in China

- Volkswagen ID.Buzz Electric Van

- Volkswagen ID.7 Luxury Sedan

- New sketch of 2025 Volkswagen ID.1 unveiled

- VW’s Cupra Born

- Volkswagen unveils $7.1B commitment to boost product line-up, R&D, mfg in N. America

- Audi Q8 e-tron electric SUV

- Audi e-tron GT

- Audi Q4 e-tron

- Audi Q6 e-tron electric SUV

- Audi A6 e-tron: 2023's new electric Tesla fighter spied

- Audi will expand EV lineup with electric A6 wagon

- Audi TT to be axed in 2023 for 'emotional', electric replacement

- Hyundai Ioniq 5

- Hyundai Ioniq 6

- Hyundai Kona Electric

- Genesis reveals their first EV on the E-GMP platform, the electric GV60 crossover

- Genesis Electrified GV70 Revealed With 483 Horsepower And AWD

- Kia Niro Electric: 239-mile range & $39,000 before subsidies

- Kia EV6: Charging towards the future

- Kia EV9 to land in US in 2023 with 300-miles range, $50,000 price

- Kia EV4 on course to grow electric SUV range

- Jaguar’s All-Electric i-Pace

- Jaguar to become all-electric brand; Land Rover to Get 6 electric models

- Daimler will invest more than $47B in EVs and be all-electric ready by 2030

- Mercedes EQS

- Mercedes EQS SUV

- Mercedes EQE

- Mercedes EQE SUV

- Mercedes EQC electric SUV available in Europe & China

- Mercedes EQV Electric Passenger Van

- Mercedes EQB

- Mercedes EQA SUV

- Ford Mustang Mach-E

- Ford F-150 Lightning

- Ford set to launch ‘mini Mustang Mach-E’ electric SUV in 2023

- Ford to launch 7 EVs in Europe in big electric push

- Ford unveils Lincoln Star electric SUV concept as it readies to add four new EVs by 2026

- Chevrolet Blazer EV

- Chevrolet Equinox EV

- Chevrolet Bolt

- Chevrolet Bolt EUV electric crossover

- Cadillac All-Electric Lyriq

- Cadillac to start making 3 more EVs in 2024

- GMC Electric Hummer Pick-Up and SUV

- GM electric Silverado pickup truck

- GMC Sierra EV Denali

- GM Launches BrightDrop to Electrify the Delivery of Goods and Services

- GM & Honda Will Codevelop Affordable EVs Targeting Most Popular Vehicle Segments

- Two Jeep EVs to make U.S. debuts in 2024

- BMW iX3

- BMW iX

- BMW i4 sedan

- BMW i7

- BMW iX1

- Nissan Ariya: All-Electric Crossover SUV

- Nissan LEAF e+

- Nissan aims to electrify 98% of Europe sales, helped by Renault

- Polestar 2 sedan

- Polestar 3 electric SUV

- Volvo XC40 Recharge electric SUV

- Volvo C40 Recharge electric crossover

- Volvo EX90 electric SUV

- Renault upgrades Zoe electric car as competition intensifies

- Renault Dacia Spring Electric SUV

- Renault to boost low-volume Alpine brand with 3 EVs

- Renault's electric Megane will debut new digital cockpit

- Stellantis promises 'heart-of-the-market SUV' from new, 8-vehicle EV platform

- Ram 1500 Revolution Battery-electric Vehicle Unveiled at CES 2023

- Chrysler to go all-EV by 2028

- Honda, Sony to start premium EV deliveries in 2026

- Honda pours $40 billion into electrification, targets 2 million EV production by 2030

- Alfa Romeo's First Electric Car Will Arrive in 2024

- Peugeot e-208

- PEUGEOT E-2008: THE ELECTRIC AND VERSATILE SUV

- Peugeot 308 will get full-electric version

- Peugeot's full-electric 3008 and 5008 SUVs will have up to 700 km range

- Subaru shows off its first electric vehicle, the Solterra SUV

- Citroen compact EV challenges VW ID3 on price

- Rivian electric pickup trucks & SUVs

- Maserati GranTurismo Debuts As Brand’s First EV With Three Motors, AWD

- Mini Cooper SE Electric

- Toyota bZ4X

- Toyota will have lineup of 30 full EVs by 2030; Lexus will be all-electric brand

- Opel Corsa-e

- Opel expands EV lineup with battery-electric Astra

- Vauxhall Mokka electric

- Skoda Enyaq iV electric SUV

- Skoda Enyaq electric coupe

- Skoda plans small EV, cheaper variants to take on French, Korean rivals

- BYD presents three BEVs for European market

- Nio expands into Europe and beyond

- Lucid Motors: Electric Luxury Cars

- Rolls-Royce Electric Spectre, Available 2023

- Bentley will start output of first full EV in 2025

- Aston Martin will build electric vehicles in UK from 2025

- Two new electric cars from Mahindra in India; Global Tesla rival e-car soon

- Sono Sion

- Foxconn aims for 10% of electric car platform market by 2025

And In China, Where Tesla’s EV Market Share Is Now Declining...

- BYD is #1 in Chinese EVs, selling FAR more than Tesla

- Volkswagen to boost Chinese EV capacity to 1m by 2023

- Audi-FAW's $3.3 billion electric vehicle venture

- Nio

- Xpeng Motors

- Hozon/Neta

- Li Auto

- GAC Aion

- Leap Motors

- GM plans to launch over 15 EV models in China by 2025

- Ford Mustang Mach-E Rolls Off Assembly Line in China

- Cheaper than Tesla: Honda takes aim at China's middle class

- BMW i3 Debuts As All-Electric 3 Series Only For China

- Hongqi

- Geely

- Zeekr Premium EVs by Geely

- Baidu and Geely put nearly $400 million more into their electric car venture

- China-made Mercedes-Benz EQE hits market

- BAIC

- Hyundai, BAIC Motor to inject $942 mn in China JV for EVs

- Toyota partners with BYD to build affordable $30,000 electric car

- Lexus RZ 450e Steers For China

- Dongfeng

- SAIC

- Renault launches sales of first EV in China

- Nissan expects 40% of sales in China to be electrified by 2026

- Changan forms subsidiary Avatar Technology to develop smart EVs with Huawei, CATL

- WM Motors/Weimar

- Chery

- Seres

- Enovate

- Singulato

- JAC Motors

- Iconiq Motors

- Aiways

- Skyworth Auto

- Youxia

- Human Horizons

- Xiaomi announces plans for four electric vehicle models

Here's Tesla's Competition In Autonomous Driving; The Independents All Have Deals With Major OEMs…

- Waymo ranked top & Tesla last in Guidehouse leaderboard on automated driving systems

- Tesla has a self-driving strategy other companies abandoned years ago

- Waymo operates robotaxis NOW

- GM’s Cruise operates robotaxis NOW

- Mobileye operates driverless test fleets in Europe and the U.S.

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Ford’s hands-free “Blue Cruise”

- Mercedes Launches SAE Level 3 Drive Pilot System

- Honda Legend Sedan with Level 3 Autonomy Now Available in Japan

- Motional (Hyundai) & Uber Announce Autonomous Ride-hail and Delivery Services

- Stellantis Completes Acquisition of aiMotive to Accelerate Autonomous Driving Journey

- Amazon’s Zoox will test its autonomous vehicles on Seattle’s rainy streets

- Baidu to further deploy 200 driverless vehicles in China in 2023

- Alibaba-backed AutoX unveils first driverless RoboTaxi production line in China

- Pony.ai approved for public driverless robotaxi service in Beijing

- SAIC-backed Xiangdao Chuxing kicks off Robotaxi pilot operation in Shenzhen

- WeRide greenlighted for autonomous road test with empty driver’s seat in Beijing

Here's Where Tesla's Competition Will Get Its Battery Cells...

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Northvolt

- Volkswagen to Build Six Electric-Vehicle Battery Factories in Europe

- GM’s Ultium

- GM to develop lithium-metal batteries with SolidEnergy Systems

- SK On and Ford form BlueOval SK, an EV battery joint venture

- Hyundai teams with SK to make batteries for U.S.-built EVs

- Hyundai Motor developing solid-state EV batteries

- BMW & Ford Invest in Solid Power to Secure All Solid-State Batteries for Future Electric Vehicles

- Stellantis affirms commitment to build battery factory in Italy with Mercedes, TotalEnergies

- Stellantis and Samsung SDI to Invest Over $2.5B in Battery Production Plant in United States

- Stellantis and LG to Invest Over $5 Billion CAD in Joint Venture for Li-Ion Battery Plant in Canada

- Stellantis and Factorial Energy to Jointly Develop Solid-State Batteries for Electric Vehicles

- Mercedes-Benz to build 8 battery factories in push to become electric-only automaker

- Mercedes-Benz and Sila achieve breakthrough with high silicon automotive battery

- Toyota to invest $5.3bn to make EV batteries in U.S. and Japan

- Toyota Outlines Solid-State Battery Tech, $13.6 Billion Investment

- Honda and LG Energy Formally Establish Battery Production Joint Venture

- Honda, GS Yuasa agree to collaborate in lithium-ion batteries

- Daimler joins Stellantis as partner in European battery cell venture ACC

- Renault signs EV battery deals with Envision, Verkor for French plants

- Nissan to build $1.4bn EV battery plant in UK with Chinese partner

- Nissan Announces Proprietary Solid-State Batteries

- Foxconn breaks ground on first EV battery plant

- Envision-AESC

- ONE

- EVE

- Freyr

- Verkor

- Farasis

- Microvast

- Akasol

- Cenat

- Wanxiang

- Eve Energy

- Svolt

- Romeo Power

- ProLogium

- Morrow

Here's Tesla's Competition In Charging Networks...

- Tesla will open charging network to other EVs

- Infrastructure Bill: $7.5 billion Towards Nationwide Network of 500,000 EV Chargers

- Electrify America

- EVgo

- Chargepoint

- Ionity Europe

- Shell

- 51 U.S. electric companies commit to build nationwide EV fast charging network by end of 2023

- GM, EVgo, and Pilot will install 2,000 fast chargers at travel centers

- GM to Expand Access to EV Charging with More than 40,000 Charging Stations

- Mercedes will build its own EV charging network

- Ford To Have One Of The Largest DC Fast-Charging Networks In US

Volkswagen powers up the grid to take on Tesla - Volkswagen-backed CAMS eyes deployment of 17,000 charging points in China by 2025

- Circle K begins North American EV fast charger rollout, plans 200-site network by 2024

- Porsche to build out its own network of EV charging stations

- Petro-Canada Coast-to-Coast Canadian Charging Network

- Volta

- E.On

- BP

- Volkswagen and BP partner to deploy up to 8,000 EV chargers across EU/UK

- Smatric

- Allego

- Podpoint

- Instavolt

- Fastned

- Total

- Nio Battery Swap Stations

- BMW to Build 360,000 Charging Points in China to Juice Electric Car Sales

- Evie

- Tritium, DC-America Join Forces to Provide coast-to-coast EV charging network

And Here's Tesla's Competition In Storage Batteries...

- Panasonic

- Samsung

- LG Energy Solutions

- CATL

- BYD

- AES + Siemens (Fluence)

- GE

- Hitachi ABB

- Toshiba

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Sonnen

- Generac

- GM Energy

- Canadian Solar

- Kokam

- Eaton

- Tesvolt

- Leclanche

- Lockheed Martin

- Honeywell

- EOS Energy Storage

- ESS

- Electriq Power

- Redflow

- Primus Power

- Simpliphi Power

- Invinity

- Murata

- Bollore

- Adara

- Blue Planet

- Aggreko

- Orison

- Powin Energy

- Nidec

- Powervault

- Kore Power

- Shanghai Electric

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

- Voltstorage

- Cadenza Innovation

- Morrow

- Gridtential

- Villara

- Elestor

- SolarEdge

- Q-Cells

- Huawei

- Toyota

- ADS-TEC

- Form Energy

- Enphase

- Sumitomo Electric

- Stryten Energy

- Freyr

- Growatt

- Polarium

- Alfen

- Quino Energy

- Gotion

- ZincFive

- Dragonfly Energy

Thanks,

Mark Spiegel

Stanphyl Capital