Whitney Tilson’s email to investors discussing Holon Global Investments’ report on Tesla Inc (NASDAQ:TSLA) – on the road to a US $10 trillion company and beyond.

Q3 2021 hedge fund letters, conferences and more

A Bullish Report On Tesla

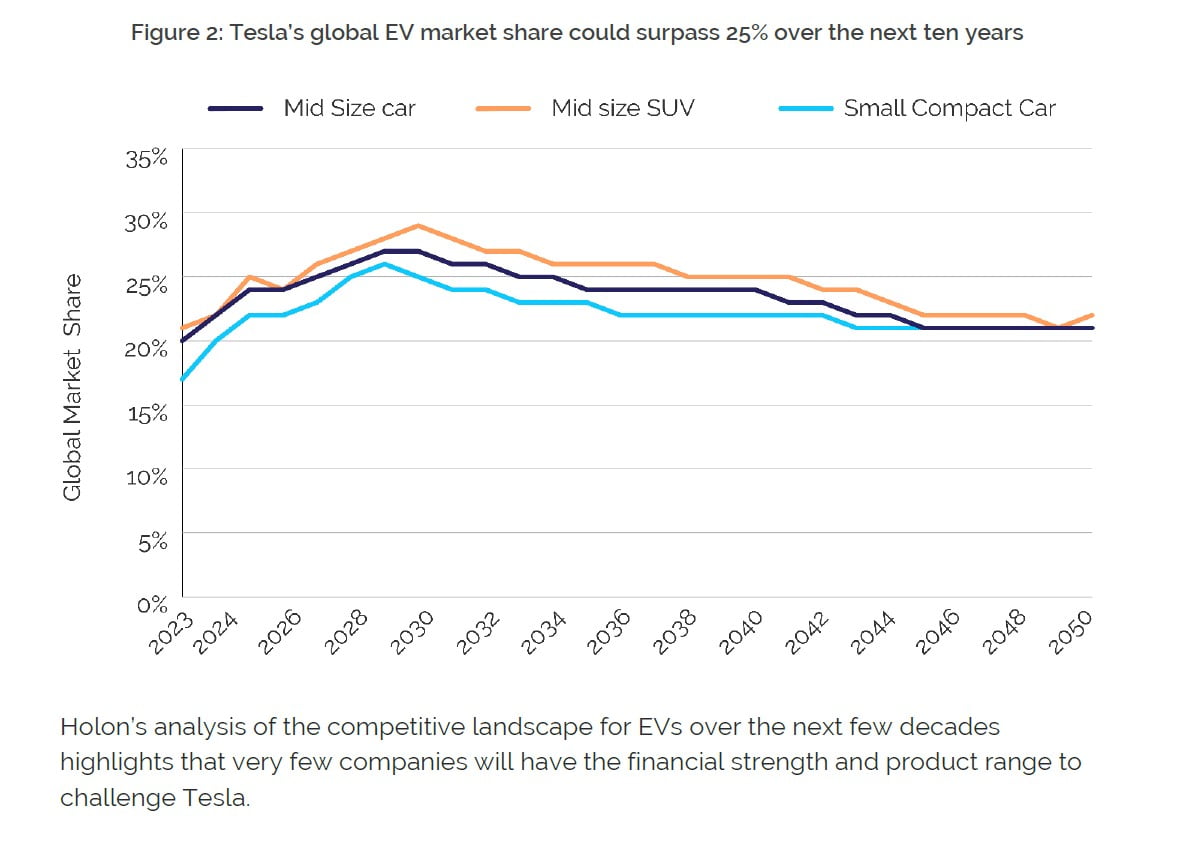

Posted here is a 144-page bullish report on Tesla, which was published recently by Tim Davies of Australian tech-focused $100M fund Holon Global Investments.

I haven’t had a chance to read it, but I asked my analyst Kevin “100-bagger” DeCamp (I think he’s approaching a 150-bagger on TSLA!) to take a look and here’s what he sent me:

I’ve seen much of this data and analysis before, but it’s definitely worth at least reading the executive summary.

The projections and title he chooses are clearly to attract attention (why not one-up Cathie Wood with a $3,369 current value and a $10 trillion target!), but it’s a good overview to understand what’s actually going on in the auto industry, especially the challenges that legacy automakers are facing transitioning to EVs.

Of note is his emphasis on Tesla’s impressive profitability while still producing at a much smaller scale than legacy OEMs (comparing Tesla’s EVs to legacy’s ICE production numbers). This will continue to improve as Tesla grows on average around 50% and its revenue mix continues to shift more towards software.

Tesla reported 28.8% gross margins in 3Q excluding regulatory credits while facing supply chain issues and producing cars well under capacity. As I’ve said before, the myth that Tesla cannot make a profit without regulatory credits will continue to die a slow death. It’s on its way to Apple-like margins with a much bigger total addressable market (TAM).

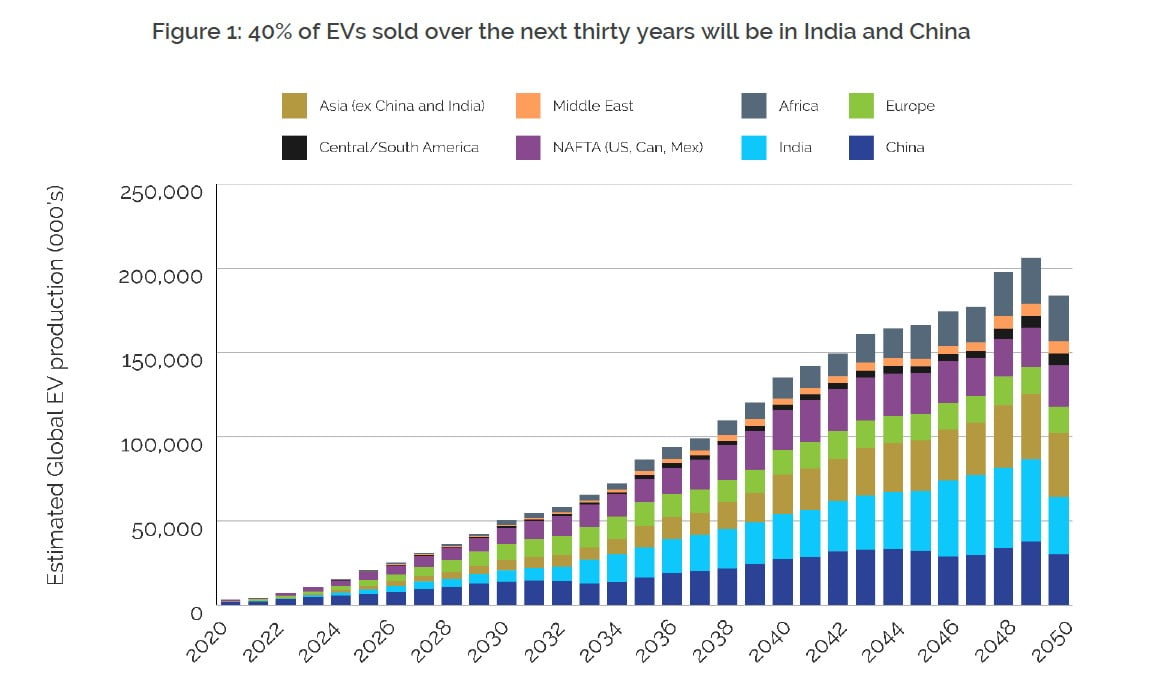

I’m not convinced on his bullish developing market projections, although it’s something to consider.