All-Time Record: Sustainable Finance Bonds Total US$544.3 billion, More Than Double Issuance Levels of FY 2019

Q3 2020 hedge fund letters, conferences and more

Table of Contents

Show

Sustainable Finance Bonds Insuance Reach An All-Time Record

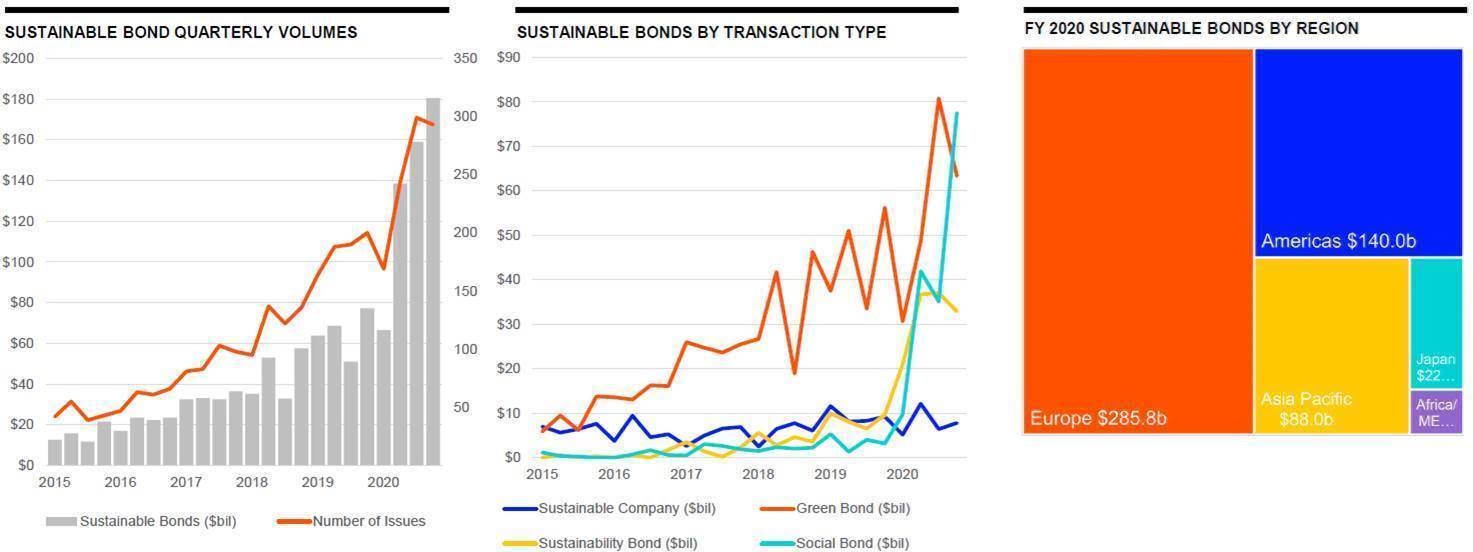

- All-time annual record: Sustainable Finance bonds totalled US$544.3 billion, more than double issuance levels during FY 2019

- Sustainable Finance bonds totalled US$180.4 billion during 20Q4, up 14% compared to 20Q3 and more than double the proceeds registered during 19Q4

- Highest Quarterly Total on Record: 20Q4 marks the highest quarterly total, by proceeds, for Sustainable Finance bonds since our records began in 2015

- All-time annual record: Green bond issuance totalled US$222.6 billion, a 26% increase compared to FY 2019

- Largest quarter for green bonds on record: Green bond issuance pulled back during 20Q4, as US$63.3 billion was raised, marking a decline of 22% compared to 20Q3

- Sustainability and Social bond categories each surpassed US$$100 billion for the first time

- With a record US$77.4 billion of issuance during 20Q4, US$164.2 billion worth of Social bonds were recorded globally during FY 2020, nearly 10 times the total raised during FY2019

- Social bond issuance accounted for 30% of the Sustainable Finance bond market during 2020, compared to 5% during FY 2019

- Sustainability bond issuance reached US$127.6 billion, more than triple the levels of FY 2019

- The number of Sustainability bonds increased 106% compared YoY

- Highest percentage since Sustainable Finance records began in 2015: Agency and Sovereign issuers accounted for 56% of overall activity FY 2020

- Registering a 26% increase compared YoY, Corporate issuers accounted for 43% of issuance, while Agency and Sovereign issuance more than tripled compared to 2019 levels

- Regional markets for Sustainable Finance bonds issuers: Europe, 53% market share, Americas, 26% and Asia Pacific, 16%

- JP Morgan top spot for Sustainable Finance bond underwriting with 6.3% market share, an increase of 2.5 market share points compared YoY

- BNP Paribas and Credit Agricole rounded out the top 3 underwriters

- The top 10 Sustainable Finance bond underwriters comprised 49% of the overall market, up from 38% YoY

Source: Refinitiv

Syndicated Loans

- FY 2020 Sustainable lending totalled US$199.4 billion, a 3% increase YoY

- 20Q4 sustainable lending activities totalled US$75.3 billion, doubling lending during the third of this year and the strongest quarter for the sustainable category since 19Q4

- FY 2020 borrowers of overall sustainable lending: Europe accounted for 64%, led by facilities for France’s Sanofi SA and Airbus SE and Italy’s Enel SpA, Americas, 16% and Asia Pacific, 14%

- BNP Paribas maintained the top spot for sustainable syndicated lending during FY 2020, with 5.9% market share, an increase of 0.1 market share points

- Followed by Mitsubishi UFJ Financial Group with 4.8% and Sumitomo Mitsui Financial Group with 4.5%.

Equity Capital Markets

- All-time record: ECM activity for sustainable companies totalled US$13.8 billion, a 65% increase compared to FY 2019

- 20Q4 sustainable equity issuance totalled US$4.2 billion, a 24% decline compared to 20Q3, which ranked as the largest quarter for sustainable ECM activity on record

- FY 2020 Overall ECM activity: Americas accounted for 62%, Europe, 23% and Asia Pacific, 11%

- FY 2020 Top bookrunners for sustainable equity offerings: Morgan Stanley, Bank of America Securities and JP Morgan topped the list registering a combined market share of 46%.

Mergers & Acquisitions

- 3-Year Low: M&A activity involving sustainable companies totalled US$32.3 billion during FY 2020, 9% decrease compared to FY2019

- 1% Decrease YoY: 497 sustainable deals were announced during FY 2020

- Number of deals: China accounted for 20%, United States, 9%, India and Italy, 7%

- Deal Value: Europe, 43%, Asia Pacific, 33% and Americas, 23%

- Based on deal making involving targets or acquirors operating in sustainable industries:

- Goldman Sachs led the advisory league tables for FY 2020, advising on 8 deals valued at US$6.2 billion

- JP Morgan and Nomura round out the top 3 financial advisors

Source: Refinitiv

Sources: Data/ Charts: Refinitiv

Commentary: Matt Toole, Director of Deals Intelligence, Refinitiv