“The Merge” is fast approaching completion on the Ethereum network, but this begs the question: what does it mean for network users and their DeFi tokens or NFTs?

For casual users, the jargon and technical detail can be misleading, confusing and opaque.

Hence this crash course and guide to Ethereum 2.0, made simple for all audiences from the most serious of blockchain heads to the retail investors who don’t know what to make of it all.

Q2 2022 hedge fund letters, conferences and more

Why A 'Merge', Not An Upgrade?

Ethereum started with a Proof of Work consensus mechanism – this is essentially the method of confirming transactions.

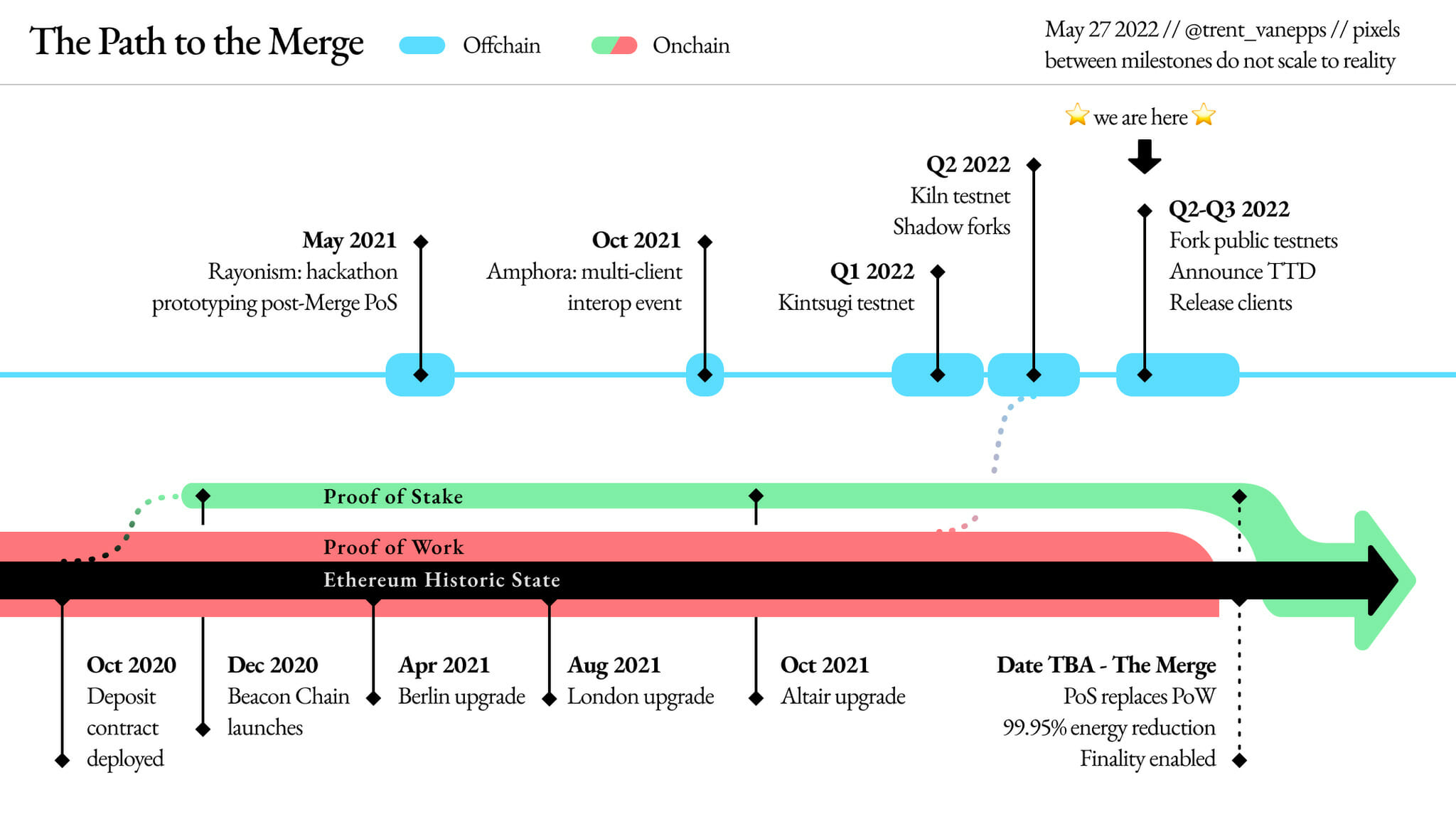

In 2020, the network split into two ‘forks’; one still used Proof of Work, the other a process known as Proof of Stake (named The Beacon Chain) with both working in parallel. When the merge happens, Ethereum will use the Proof of Stake consensus mechanism only.

No blockchain has undergone such a drastic transition in the history of the blockchain space and this has led to excitement in the community though, in some cases, there also exists uncertainty.

Proof of Work (PoW) vs Proof of Stake (PoS)

On a blockchain using Proof of Work as a consensus mechanism, members of the network (miners) are in direct competition with each other for mining rewards.

Simply put, they compete by guessing a long string of letters and numbers out of trillions of possible combinations. More powerful hardware increases the probability you’ll find the winning solution faster than other miners.

When someone submits the right answer, they’re invited to submit their update of the ledger to be checked by the community before it’s added to the blockchain and cryptocurrency is distributed as a payout – this is called a mining reward.

Proof of Stake asks people to put up their own crypto assets as collateral (staking) for the chance to have their record of transactions made official (validating). The staker earns the rewards for doing so – a validator reward. Similarly, anyone trying to cheat the system would lose the assets they’d staked.

What Are The Immediate Benefits of The Transition to PoS?

Environmental, Social, and Governance (ESG)

In layman’s terms, the rewards for maintaining the network will no longer incentivize computing power.

For this reason, Ethereum will become dramatically less energy intensive. According to the Ethereum Foundation, the transition will reduce energy consumption by 99.95% – a common criticism of the technology has been its ravenous energy consumption and this reduction will be seen as a welcome step forward for many would-be skeptics.

PoW Hardware Demands

Running a PoW mining operation is cost intensive, often requiring the purchase of high-spec hardware, power-supply upgrades, and logistical solutions.

Moving to PoS will reduce the dependence of the Ethereum network on already stressed CPU and GPU supply chains and optimistically democratize rewards across an increased number of network participants.

A Lower Risk of Network Centralization

The transition from PoW to PoS will reduce the capital barrier needed to secure Ethereum and as a result allow many new market participants to secure the network.

It takes 32 $ETH for an individual to run a network validator which equates to a cost of approximately $50,000 USD (per current prices). However, retail investors with less capital can pool their $ETH in staking pools like Lido and Rocketpool – it’s highly recommended each user researches the terms of staking thoroughly before committing tokens.

The theory is that a greater number of network validators further decentralizes the Ethereum network which in turn makes it more robust against attacks and state interference.

The Merge Misconceptions

Transaction Fees, Scaling and Throughput

According to the Ethereum team, the Merge update will not result in lower gas fees. A change of consensus mechanism does not represent an expansion of network capacity.

Transaction fees are the result of network demand in relation to network capacity. Although it’s marking a switch from PoW to PoS, the Merge does not dramatically alter any factors that directly affect network throughput or scalability.

A Roadmap to Scalability: Not The Silver Bullet

Ethereum 2.0 is still a long way off, even once The Merge is complete. The complete vision involves a fully scaled blockchain capable of processing 100,000 transactions per second, up from 15 transactions per second currently (yes, that’s right… a 6,666x increase).

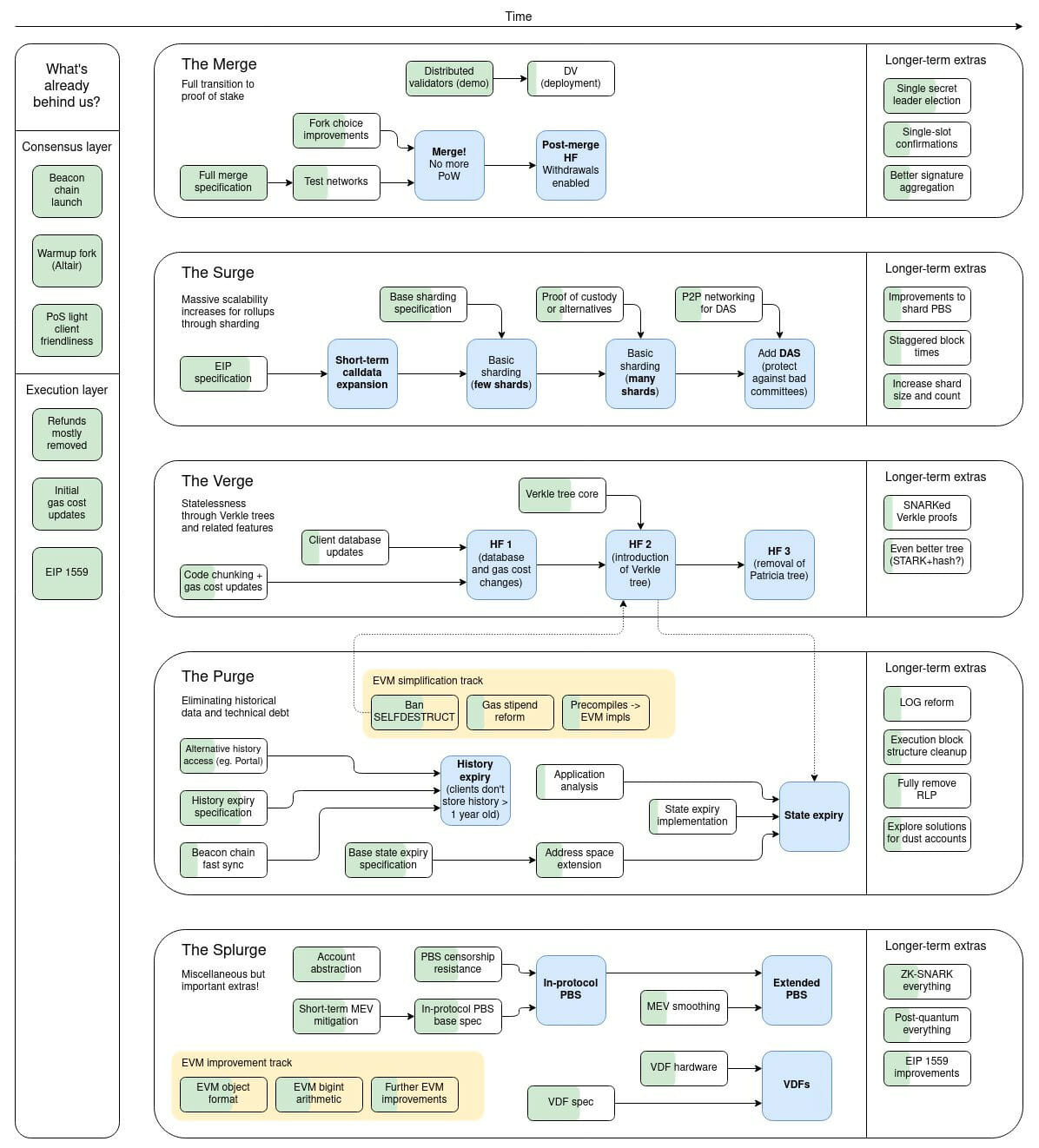

The remaining stages in the roadmap are outlined below, and conveniently all end in ‘erge’.

- The Surge – scaling up Ethereum’s mainchain through sharding. This should increase the network’s throughput up to a theoretical 100,000 tps.

- The Verge – upgrading Merkle trees with experimental Verkle trees for greater storage efficiency within each data block.

- The Purge – purging excess historic data that is no longer needed, so validators can become even more efficient in processing transactions.

- The Splurge – the maintenance era of the Ethereum network, tweaking and adding minor life-quality improvements.

You can find more information on the Ethereum 2.0 roadmap in this thread by @milesdeutscher.

We Promised This Wouldn’t Be Technical… So What Does it all Mean for my Tokens?

Investors will receive the same amount of the ‘forked’ tokens on the new Ethereum PoS chain as the amount they presently own in the PoW chain. Investors will then hold an equal number of Ethereum tokens across two distinct Blockchains.

ERC-20 Tokens

Some centralized exchanges (CEXs) have indicated they will suspend trading of ETH and ERC-20 tokens during The Merge period. However, investors can still access the tokens kept in hot and cold wallets.

Despite assurances, we believe it’s advisable that investors refrain from executing trades through decentralized exchanges (DEXs) over this period to avoid any losses arising out of unforeseen glitches with wallets or exchanges.

Similarly, tokens locked inside smart contracts will also be forked over to the PoS network.

NFTs

Assuming the upcoming Ethereum Merge results in the network being split into two functioning Blockchains, then it could result in duplication of non-fungible tokens (NFTs).

Duplicate NFTs will exist on the ETH proof-of-work chain and other potential forks, and therefore there is a distinct possibility it creates confusion around which assets are ‘authentic.’ Where it gets complicated is that authenticity will ultimately be defined by social sentiment about the value of assets on the chain. If the PoW chain dies as the Ethereum developers predict, there may be little demand for the PoW duplicates which are as a consequence likely to be a fraction of their PoS counterparts in terms of value.

Will Ethereum Users or ETH Holders Need to Take Any Action After the Merge?

No. Your balance will remain exactly the same after the Merge, and you’ll be able to resume using the network as if nothing has changed.

While Ethereum users will not need to take any action after the Merge, Ethereum software providers and node operators (the computers that operate the Ethereum network) will need to update their software.

Scams to Look Out For

- Anyone asking you to ‘claim’ or ‘upgrade’ tokens following the merge

- Buying tokens or NFTs on the ETH PoW chain after the merge completion

- Any kind of ‘action required’ links associated with The Merge

If You’re Unsure…

Sit back and watch on Merge day until you feel confident of the situation.

When Merge?

Around Sept. 15, 2022.

This is an estimate because block difficulty and issuance rate vary over time.

Each block on Ethereum’s PoW network carries a difficulty number representing how hard miners must work to add it to the network. The Merge is scheduled to take effect once mining new blocks hits a “total terminal difficulty” (TTD).

Ethereum’s core developers set the TTD at 58,750,000,000,000,000,000,000, which will likely be reached around September 15th.

How Will This Affect The Price Of $ETH?

We are traversing new ground with the Merge, so it remains to be seen. In the absence of financial advice, this article is concerned only with giving you the knowledge to make informed decisions regarding your existing holdings or future investments.