Spruce Point Capital Management, LLC (“Spruce Point” or “we” or “us”), a New York-based investment management firm that focuses on forensic research and short-selling, today released new evidence in a supplemental report entitled “When The Tide Goes Out, What Will Wash Ashore?” that explains why Danimer Scientific Inc (NYSE:DNMR)’s (“Danimer” or the “Company”) production figures, its pricing, and rosy financial projections simply do not add up. We reiterate 65% intermediate and 100% long-term downside risk to Danimer’s share price.

Q1 2021 hedge fund letters, conferences and more

Danimer Scientific: When The Tide Goes Out, What Will Wash Ashore?

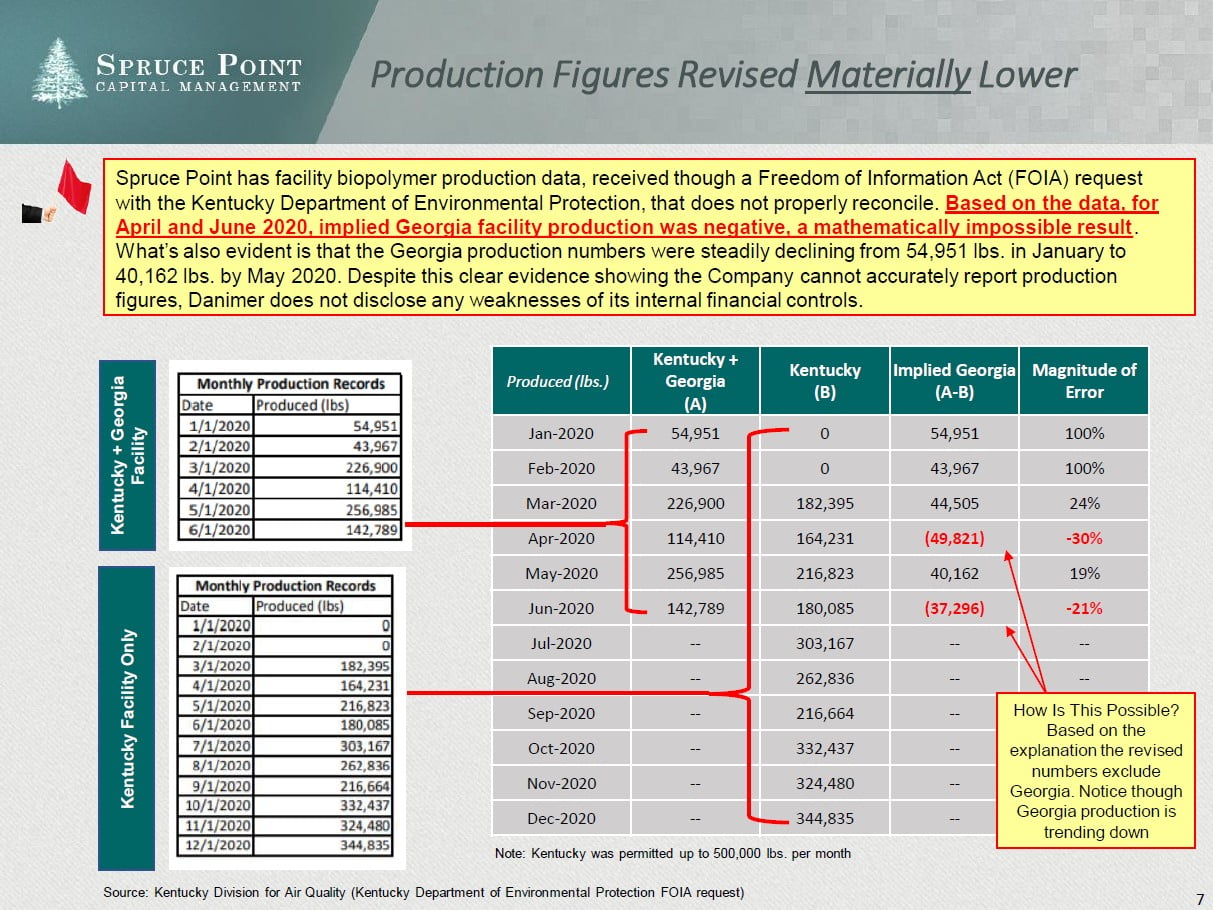

- In our initial report, we warned about capital expenditure and capacity anomalies, as well as Danimer’s history of obscuring failure from current investors. Notably, we pointed out Danimer’s mathematically impossible claim of having more manufacturing square footage than real property in Georgia. Since our report, Danimer has failed, despite promises, to address any of our claims. Now, with the benefit of a recently released Freedom of Information Act (FOIA) request from the Kentucky Department of Environmental Protection, we have evidence that suggests Danimer’s production figures, its pricing, and rosy financial projections are wildly overstated. Monthly Kentucky PHA production figures have been restated by up to 100% after coming public. Danimer’s PHA average selling price appears to be 30% – 42% below management’s claims. Moreover, Danimer’s recently reported production figures are so far below their actual capacity, that it calls into question why is Danimer telling investors it needs hundreds of millions of dollars in capacity expansion?

Danimer’s SEC disclosures on revenue drivers are insufficient in our view. As a manufacturer of essentially two products in two locations, Danimer fails to provide clear and transparent information on the following to investors:

- Production by location

- Total volumes sold of PHA and PLA

- Average sales price of PHA and PLA

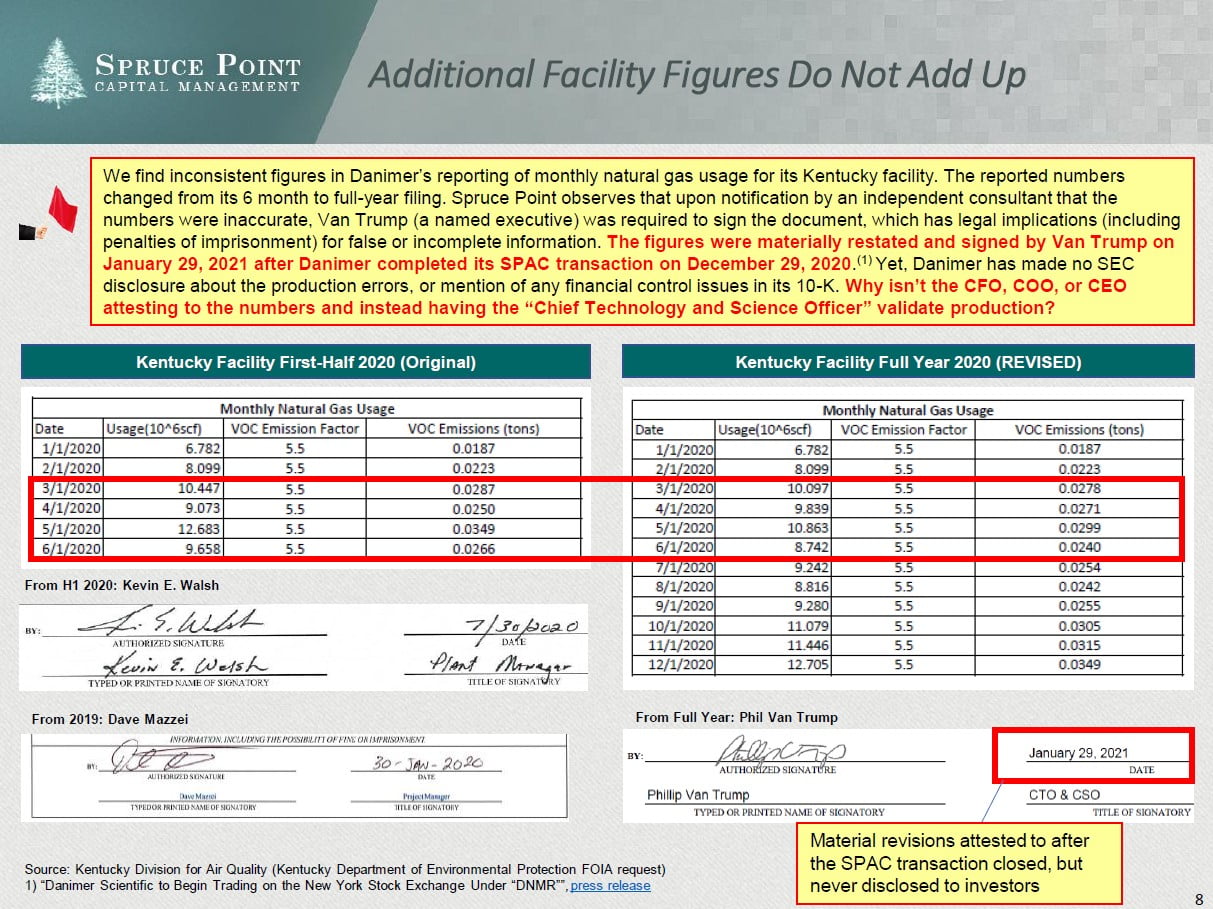

Newly released FOIA provides actual biopolymer production figures by location. We find that Danimer’s monthly PHA biopolymer production and natural gas usage for its Kentucky facility have been materially misreported, in some months by 100%

- By law, Danimer most provide semi-annual and annual production figures in Kentucky

- In its 2020 annual filing, signed in Jan 2021 after closing its SPAC deal on the NYSE in December 2020, we observe it reported material errors that overstated Kentucky’s figures in some months by up to 100% by including Georgia’s production

- We are able to extrapolate Georgia’s monthly production in H1 2020 and find mathematically impossible results, implying negative monthly production in April and June 2020. What’s clear is that Georgia production was trending negative in H1 2020

- Warning: The compliance reports are produced by an independent environmental consultant. We find the reports have been signed off on by three different Danimer employees, The “corrected” filing was signed by CTO Phil Van Trump, after previously being signed by Plant Manager Kevin Walsh (Plant Manager: H1 2020) and David Mazzei (Project Manager: 2019). Why hasn’t the CFO or COO signed off on these figures? There are legal implications, including potential imprisonment, for filing false information

Now with certified production figures from Danimer, we estimate PHA Average Selling Prices (ASPs) are overstated by 30% – 42%

- Danimer’s October 2020 Investor Presentation implied PHA ASPs of $3.00/lb. and the CEO alluded to pricing in the $2.50-$2.70/lb. range on the year end conference call in March 2021

- However, based on Danimer’s 2.5m lbs. of certified actual production, and $4.4m of reported PHA sales, we estimate PHA ASPs were closer to $1.74/lb, or 30% – 42% lower than discussed by management. Danimer’s Investor Presentation said it was in a “Fully Sold-Out” position. Even if we assume a one-month lag between production and shipment, ASP would still be $2.01/lb. or 20% – 33% below management’s claims

- Warning: Bullish analyst equity models assume ASPs of $2.50/lb, falling to $2.20/lb. in 2025, and $2.00/lb. by 2030 vs. our evidence that ASPs are closer to $1.74/lb. today. We believe Danimer is set to vastly disappoint investors and suffer severe price target cuts

Read the full report here by Spruce Point Capital Management