Sound Financial Bancorp Inc (NASDAQ:SFBC) said on January 27, 2023 that its board of directors declared a regular quarterly dividend of $0.17 per share ($0.68 annualized). Shareholders of record as of February 8, 2023 will receive the payment on February 23, 2023. Previously, the company paid $0.17 per share.

At the current share price of $39.80 / share, the stock’s dividend yield is 1.71%. Looking back five years and taking a sample every week, the average dividend yield has been 1.80%, the lowest has been 1.30%, and the highest has been 3.33%. The standard deviation of yields is 0.35 (n=205).

Q4 2022 hedge fund letters, conferences and more

The current dividend yield is 0.27 standard deviations below the historical average.

Additionally, the company's dividend payout ratio is 0.23. The payout ratio tells us how much of a company's income is paid out in dividends. A payout ratio of one (1.0) means 100% of the company's income is paid in a dividend. A payout ratio greater than one means the company is dipping into savings in order to maintain its dividend - not a healthy situation.

Companies with few growth prospects are expected to pay out most of their income in dividends, which typically means a payout ratio between 0.5 and 1.0. Companies with good growth prospects are expected to retain some earnings in order to invest in those growth prospects, which translates to a payout ratio of zero to 0.5.

The company's 3-Year dividend growth rate is 0.30%, demonstrating that it has increased its dividend over time.

Fund Sentiment

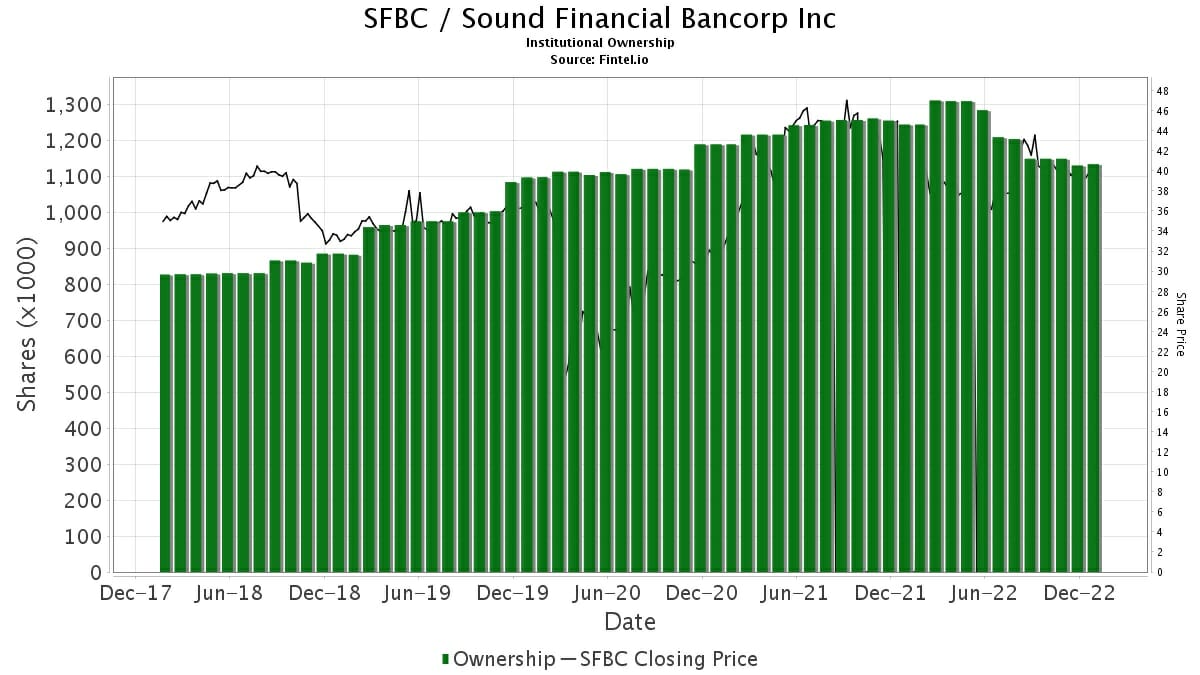

There are 50 funds or institutions reporting positions in Sound Financial Bancorp. This is unchanged over the last quarter.

Average portfolio weight of all funds dedicated to US:SFBC is 0.3283%, an increase of 3.6214%. Total shares owned by institutions decreased in the last three months by 0.87% to 1,139K shares.

Stilwell Value holds 317,936 shares representing 12.36% ownership of the company. No change in the last quarter.

FJ Capital Management holds 204,000 shares representing 7.93% ownership of the company. No change in the last quarter.

M3F holds 163,297 shares representing 6.35% ownership of the company. In it's prior filing, the firm reported owning 175,940 shares, representing a decrease of 7.74%. The firm increased its portfolio allocation in SFBC by 7.06% over the last quarter.

Alliancebernstein holds 111,736 shares representing 4.34% ownership of the company. In it's prior filing, the firm reported owning 114,669 shares, representing a decrease of 2.62%. The firm decreased its portfolio allocation in SFBC by 6.61% over the last quarter.

VTSMX - Vanguard Total Stock Market Index Fund Investor Shares holds 53,437 shares representing 2.08% ownership of the company. No change in the last quarter.

Sound Financial Bancorp Background Information

(This description is provided by the company.)

Sound Financial Bancorp, Inc., a bank holding company, is the parent company of Sound Community Bank, and is headquartered in Seattle, Washington with full-service branches in Seattle, Tacoma, Mountlake Terrace, Sequim, Port Angeles, Port Ludlow and University Place. Sound Community Bank is a Fannie Mae Approved Lender and Seller/Servicer with one Loan Production Office located in the Madison Park neighborhood of Seattle, Washington.

Article by Fintel