For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

Let’s review the last four weeks – the twilight of summer: At 10 am Eastern time on Friday, August 26, the once-mild-mannered Fed Chair Jerome Powell gave an 8-minute talk in a beautiful Wyoming resort and sent the Dow down over 1,000 points that day and another 1,000 points the next week.

Q2 2022 hedge fund letters, conferences and more

The market struggled to gain back 1,000 points, but when a 0.1% monthly gain in the Consumer Price Index was announced Tuesday, September 13, the Dow lost another 1,200 points that day and 4.13% for the week in a case of one step forward, two steps back, and it all seems based on fear of two more rate increases.

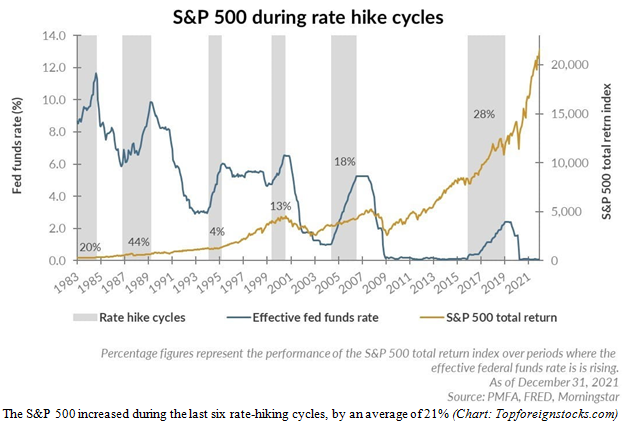

I seldom see analysts look back at the last times we saw multiple rate increases, so let’s take a closer look at the 2004-06 and 2015-18 rate-rising cycles, for an indication of how little we need to fear the Fed.

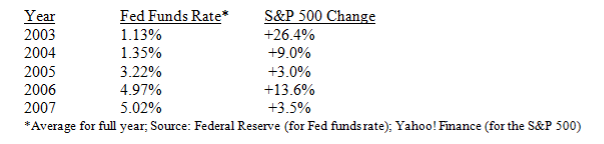

- Starting on June 30, 2004, the Fed raised interest rates 17 times in two years, by 0.25% at each meeting of the FOMC, yet the stock market kept rising. So did gold, despite the warning we keep hearing that “high interest interest rates are bad for gold.” The only market those rising rates killed was real estate, and that led to the 2008 financial crisis, based on some kinky mortgage derivatives. Here is a table listing the average (12-month) Fed funds rate from 2003 to 2007, vs. the market’s reaction – positive each year.

From its March 2003 low of 789, the S&P 500 almost doubled to 1,576 in October 2007. In the middle of that bull run, the Fed funds rate rose from 1% on June 29, 2004, to a peak of 5.25% on June 29, 2006.

- After the 2008-09 financial debacle, the Fed Funds rate was lowered to “zero to 0.25%” for seven full years, December 16, 2008, to December 15, 2015. If retired folks tried to live on $1,000,000 for a year at the going bank CD rate, they would reap maybe $3,000 in interest. Lots of luck with that.

- Then, from December 17, 2015, to December 20, 2018, the Fed raised interest rates nine times by 0.25% each time, to 2.50% – or about where we were before the Fed’s rate increase this week. In those three years, the S&P 500 rose 27%, from 1,978 to 2,507, and that includes a brutal December 2018, when it was clear that Powell had raised rates one time too many in a mid-term election year.

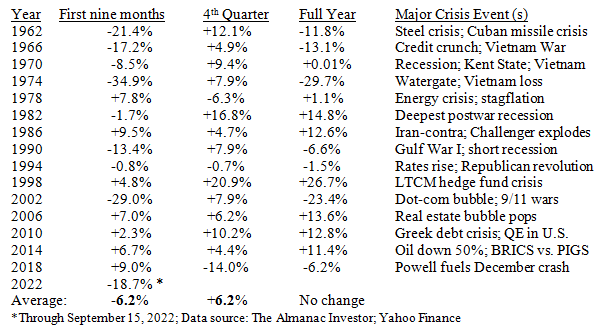

This is a good time to remember the terrible mid-term election years, and their glorious fourth quarters:

So, the last 15 mid-term election cycles have delivered a net zero gain, divided between a 6.2% loss in the first nine months, offset by a 6.2% gain in the last three months – a Christmas bonus for patient investors.

I’d love to omit the 2018 exception, because that would bring the fourth-quarter average up to +7.65%, but 2018 is a cautionary tale of where the Fed can go wrong.

On September 27 and December 20 of 2018, Mr. Powell clearly raised interest rates one (maybe two) times too many, perhaps as part of a personal spat with President Trump, who couldn’t contain his tweeting thumbs from spraying out unkind challenges to the Fed Chairman.

Mr. Biden, for all his faults, is not at war with the Fed Chair, so maybe Powell has learned the lesson not to raise interest rates too far, too fast, this time. If he stops in time, this market should recover well.

Happy 235th Birthday to the U.S. Constitution - That Glorious Template for Blessed Gridlock

“The U.S. Constitutions is the most wonderful work ever struck off by the brain and purpose of man.” - British Prime Minister William Gladstone, 1878

Have you ever heard of Constitution Day? How about “Citizenship Day,” or “I Am an American Day”? By whatever name, all fall on September 17, the anniversary of our Constitution’s signing date in 1787.

Very few schools mention Constitution Day, but maybe We the People should take time to read “the most wonderful work ever struck off by the brain and purpose of man” once a year, maybe around now, since any unbiased reading of the Constitution reveals that it prohibits most of what our federal government is doing today.

When I campaigned for the Virginia House of Delegates in 1997, my punch line was: “The Constitution may not be perfect, but it beats the type of government we have in Washington, DC today.”

The U.S. Constitution demands great nobility of the human spirit. It requires compromise and debate. Most people prefer to wield power, not to be in a committee meeting late at night, debating compromises.

The Founders sought a balance of power – or “gridlock” in today’s terminology. They were more concerned with what our federal government did NOT do than what it DID do.

The French philosopher Montesquieu (1689-1755) influenced many of our Founders. He wrote that “When legislative power is united with executive power in a single person or in a single body of the magistracy, there is no liberty.”

Echoing Montesquieu, James Madison said “The accumulation of all powers, legislative, executive and the judiciary, in the same hands, whether of one, a few, or many, and whether hereditary, self-appointed, or elective, may justly be pronounced the very definition of tyranny.”

When one political party or the other controls all the levers of government, the concentration of power has often come close to tyranny.

The Democrats are currently displaying the swagger of controlling all levers of power in Washington, and if you are a Republican, you may remember that when the Republicans controlled the White House and both houses of Congress from 2000 to 2006.

They started two long and costly wars, ran up the deficits and launched more spending programs. As I told Karl Rove in a panel in 2010, “Karl, you broke our hearts.”

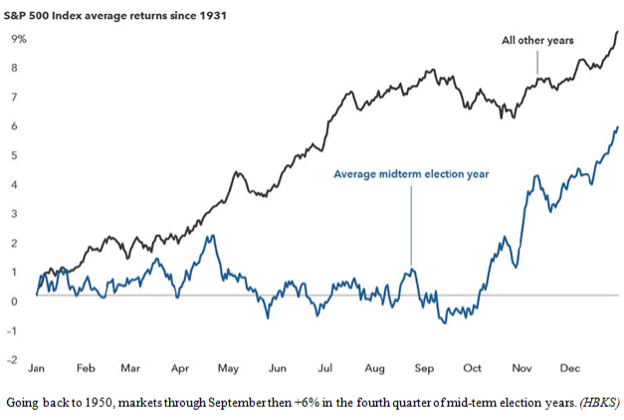

Perhaps that’s why stocks tend to do better when we see more gridlock and less “unity” in Washington. And that’s why all four of the last four Presidents have been chastened by voters at mid-term elections, and so will Mr. Biden, in all likelihood, as his Party’s plurality is lighter, and his popularity is lower.

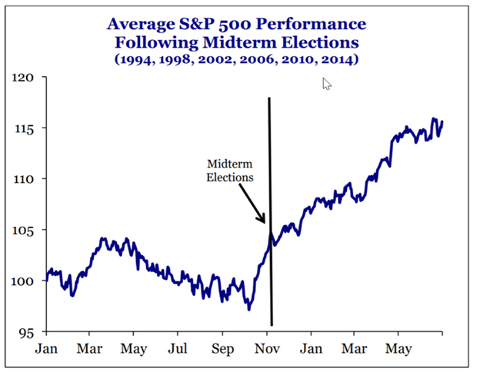

The current odds in Vegas are about 9-to-2 that the Republicans will take the House and 13-to-4 (a little over 3-to-1) for the Senate. This expected return to gridlock in seven weeks should lift the market soon. The best news is that this market boost usually continues through June of the following year.