Recent insider buying reveals a stock trading at an attractive valuation.

Insider Buying: Revolution Lighting

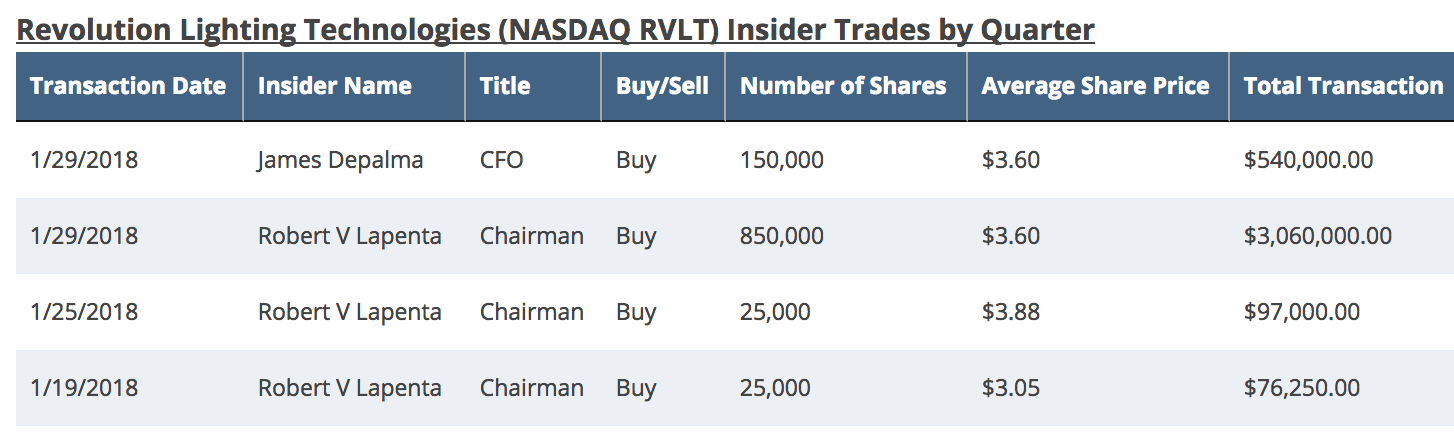

Two top executives have been buying shares of Revolution Lighting Technologies Inc (Nasdaq: RVLT) according to MarketBeat: Robert Lapenta (Chairman, CEO and President) and James Depalma (CFO). Total insider buying from these two individuals has totaled $3.8 million since mid-January which is approximately 4.6% of Revolution Lighting's total market capitalization.

Revolution Lighting manufactures and sells lighting solutions focusing on the industrial, commercial, and government markets in the United States, Canada, and internationally. The company was founded in 1991 and is headquartered in Stamford, Connecticut.

The company's shares last traded at $4.30 as of Thursday, down -45.3% over the last year. While the stock has lost significant value, the recent insider transactions could signal a promising road ahead for shareholders

In addition, finbox.io's average fair value estimate of $5.18 implies 20.6% upside which is calculated from 2 valuation models as shown in the table below.

| Analysis | Model Fair Value | Upside (Downside) |

|---|---|---|

| Peer Revenue Multiples | $5.86 | 36.2% |

| Earnings Power Value | $4.51 | 4.9% |

| Average | $5.18 | 20.6% |

What's interesting is that the Earnings Power Value analysis offers nearly 5% upside relative to its current trading price. This model is typically used as a quick way to get a sense of the risk of investing in a company at the current price. It was popularized by Professor Bruce Greenwald in the book Value Investing. The approach is most often used as a "downside case" because it assumes no growth in the subject company's current earnings.

It appears the market may be undervaluing shares of Revolution Lighting. The company's top executives certainly believe this is the case.

Note that while insider activity on its own is not necessarily a buy or sell signal, it may offer insight into how ownership and management feel about a company's future prospects. Keeping an eye on the activities of insiders and institutions can help investors make more informed investment decisions.

As of this writing, I did not hold a position in any of the aforementioned securities and this is not a buy or sell recommendation on any security mentioned.

Author: Matt Hogan

Expertise: Valuation, financial statement analysis

Matt Hogan is a co-founder of finbox.io. His expertise is in investment decision making. Prior to finbox.io, Matt worked for an investment banking group providing fairness opinions in connection to stock acquisitions. He spent much of his time building valuation models to help clients determine an asset’s fair value. He believes that these same valuation models should be used by all investors before buying or selling a stock.

His work is frequently published at InvestorPlace, Benzinga, ValueWalk, AAII, Barron's, Seeking Alpha and investing.com.

Article By Matt Hogan, Finbox.io