A new report from the Citco group of companies (Citco), the asset servicer with $1.8 trillion in assets under administration, analysing the carried interest rates of private equity funds.

Analysis by Citco reveals that the largest private equity funds deliver the highest returns to partners

Private Equity Funds: Size Matters

Private equity funds with more than $5B of commitments are delivering higher average carried interest rates to partners, according to a new study based on Waterfall data from the Citco group of companies (Citco).

Q1 2022 hedge fund letters, conferences and more

A comparative analysis of representative industry data from Citco WaterfallTM, the proprietary application, has found a correlation between fund commitment size and carried interest rates.

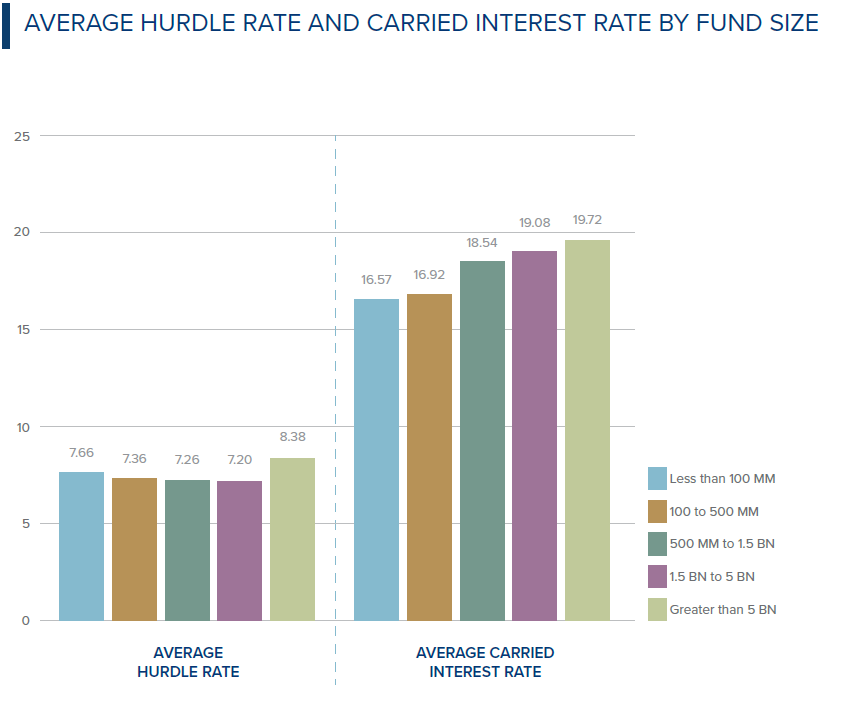

Breaking funds into five size categories ranging from funds with less than $100m of commitments to those with more than $5B, the analysis found that the average rate of carried interest paid to General Partners (GPs) increases with size.

The analysis showed a jump in average carried interest rate from 16.57% for the smallest funds to 19.72% for the largest, suggesting that the performance associated with the largest Private Equity funds returns higher carried interest rates to GPs.

The analysis also revealed that, on average, funds tend to have a lower hurdle rate as they grow in size but only up to a point. Above $5B, the trend ends with the average hurdle rate jumping.

However, despite large funds having higher carried interest rates, the analysis shows that the higher fees charged by the funds’ managers will be offset by higher returns to the Limited Partners (LPs), specifically when measured as an IRR or multiplier on contributed capital.

While this suggests that higher fee rates associated with the largest Private Equity funds do not present a significant deterrent to commitment from LPs, it should be noted that the increased carry charged by fund managers is increasingly the result of “premium carry” provisions, where carried interest terms exceeds the traditional industry norm of 20%.

Premium carry provisions (as well as additional waterfall provisions designed to further align LP and GP interests, including clawback guarantees and post-carry fair value tests) is an emerging trend in top-tier funds and one we see continuing as increased LP capital flows into private markets.

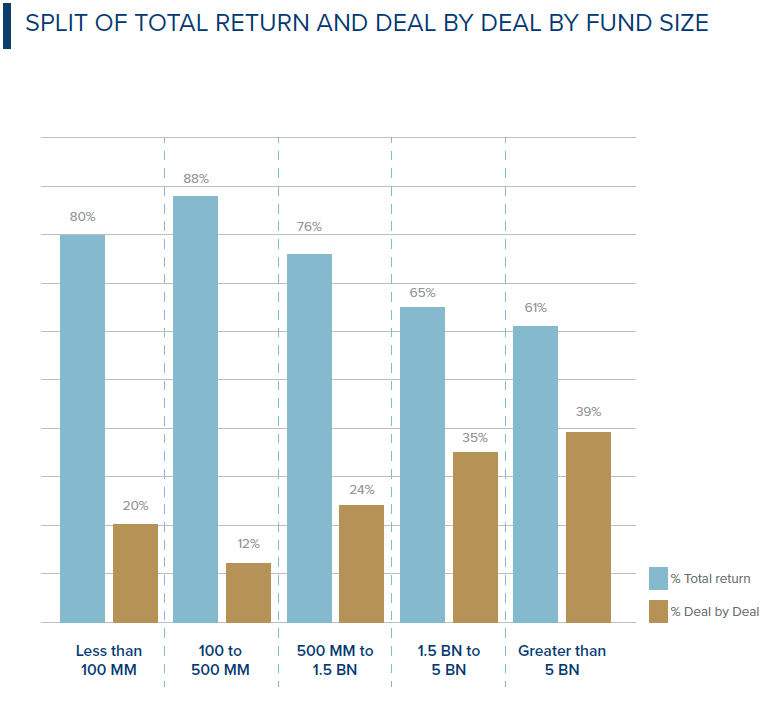

Finally, the analysis also showed that the proportion of Deal-by-Deal style waterfalls increases with fund size, which allows fund managers to take carry on profitable realizations prior to the recoupment of total capital contributions by the LPs. This is particularly prevalent in US-based private equity funds when compared to their European counterparts regardless of fund size.

The increased carry charged by the managers of the funds is increasingly the result of “premium carry” provisions.”