Diversification is sometimes described as “the only free lunch” in investing. But is it? Not in the kind of fundamental value investing that I do.

Q1 hedge fund letters, conference, scoops etc

Increased diversification comes with two potential costs:

- At a certain point, new investments are likely to yield increasingly lower returns.

- The time required to underwrite new investments reduces the quality of the underwriting of existing investments.

I will examine these costs in more detail below, but first let’s consider just how concentrated is too concentrated.

If additional investments might lower a portfolio’s expected return, why not invest everything in the security we expect to generate the highest rate of return?

The answer is simple: We can be wrong. Investing, no matter how skillfully implemented, rarely deals with certainties: The best we can accomplish is to heavily skew the odds in our favor. Therefore, building in a margin of safety at the portfolio level, as well as in underwriting each investment, is critical.

So if we can be wrong on any one judgment, then at what point will our portfolio lose this desired margin of safety?

In my view, it is when getting any one decision wrong can permanently damage the value of the portfolio to the degree that the rest of the investments are unlikely to recoup the losses in a year’s time.

Notice that I said decision not investment.

Why? Because the long-term business success of several investments may share the same driver such that being wrong on that one driver could permanently impair the value of multiple investments.

To put some specific estimates behind these ideas, I try to avoid any decision that could permanently damage the portfolio by more than 10%. The rationale is that if that 10% loss, however unlikely, occurs, the other 90% of the portfolio, at a reasonable rate of return, could be expected to offset the damage.

Because of that consideration, I normally have a minimum of 10 investments in the portfolio and limit portfolio at risk (PaR) — defined as position size multiplied by the downside to the worst case intrinsic value estimate — on any one investment to 5% at cost and 10% at market. I also assess the potential correlation of long-term business outcomes among the different investments in order to manage the portfolio’s correlated assets to be consistent with the 10% criteria.

The Costs of Diversification

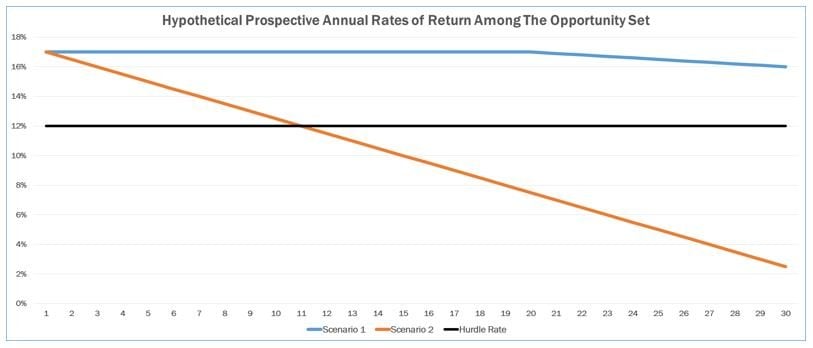

As for diversification’s downsides, let’s consider two very different market environments: one in which many potential investments offer identically high prospective internal rates of return (IRRs), and a second wherein each successive potential investment promises much lower IRRs than the last.

In the first scenario, the cost of diversification is low based on how much it would reduce expected returns, and so a diversified portfolio makes sense. In the second, diversification comes at a high price: The more diverse the portfolio, the lower its expected returns. Such an environment calls for a concentrated portfolio, subject to the lower bound discussed earlier.

But what about the time cost of diversification? Underwriting new investments takes time away from underwriting the existing ones. This might seem like a problem that could be solved by adding resources, say by hiring analysts to process more potential investments. But I don’t buy this approach. In my model, certain aspects of the investment process are too critical to be delegated: To do so might lower the quality of the work or, at the very least, my confidence in the conclusion. On paper a value range is a value range.

In practice, the skill and experience of the analyst matters. Since I will always be the primary capital allocator in my model, adding analysts or other resources cannot resolve all the inherent bottlenecks of assessing potential investments. However, this factor is also environment-dependent. As a professional investor who has been valuing companies for 17 years, I know quite a few firms and industries.

So in an environment in which many industries and companies are deeply undervalued, I would not need much time to value additional companies and add them to the portfolio. On the other hand, when opportunities are scarce and scattered in various pockets of the market, my learning curve on a potential new investment will likely be much steeper.

So diversification is worthwhile in environments where potential investments offer similar prospective returns or where undervaluation is widespread.

On the other hand, increased concentration is the logical course in environments where the opportunity cost — in both returns and time — of adding new investments to the portfolio is high. I set the upper bound for the number of investments at 20 under normal circumstances, which is consistent with my typical “small” position size of 5%.

Thus the portfolio will have between 10 and 20 investments under normal circumstances. The precise level of concentration within that range depends on the environment and the available opportunities.

So to return to the free lunch, the old adage holds true in investing and in life: There is no such thing — not even diversification.

(An earlier version of this article appeared on the CFA Institute's Enterprising Investor.)

Article by Gary Mishuris, Behavioral Value Investor