Kerrisdale Capital is short shares of Paycom Software Inc (NYSE:PAYC).

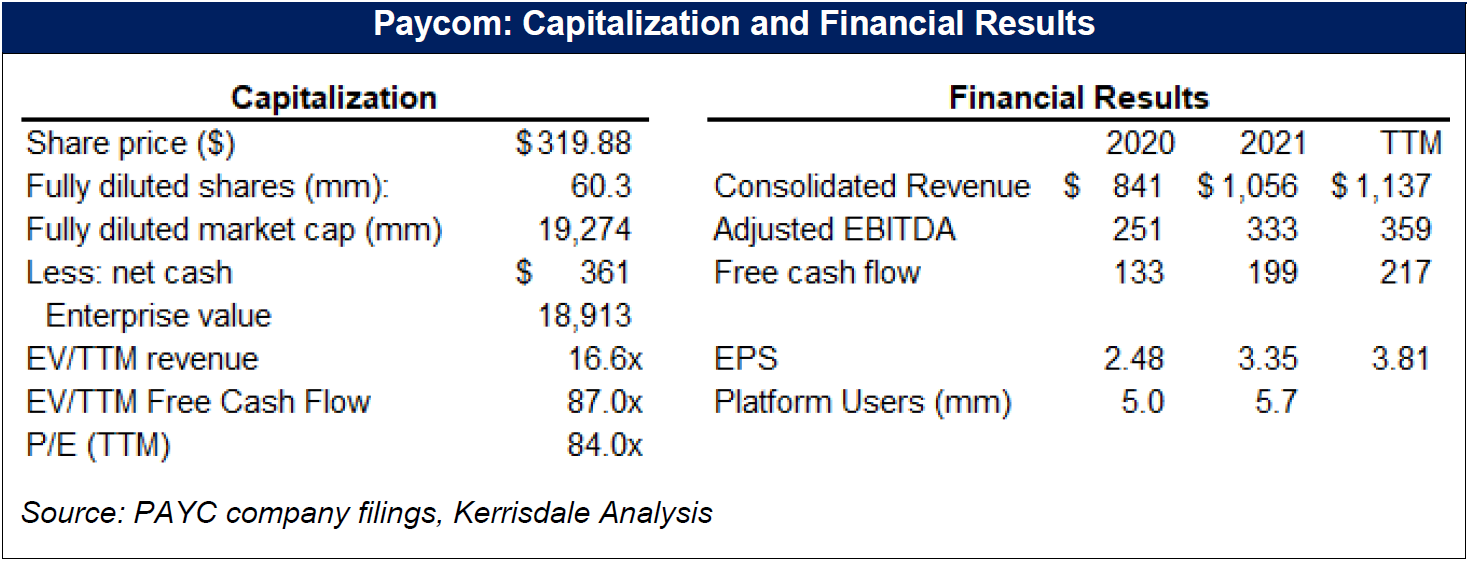

We are short shares of Paycom, a $19 billion SaaS-based payroll services company that has been one of the best performing large capitalization software stocks since it went public in 2014. Even after the market turmoil of this year, Paycom trades at more than 70x the consensus estimate for this year’s free cash flow, a testament to the fact that, while unprofitable tech companies and temporary pandemic winners have been justly punished in the markets, there’s still plenty of froth left in allegedly higher quality fare. Paycom’s valuation, in particular, doesn’t come close to reflecting the near term headwinds of slowing employment growth, meaningful TAM saturation, and increasing competitive intensity.

Q2 2022 hedge fund letters, conferences and more

Paycom’s steady and robust growth over the past decade has come by way of taking market share from payroll industry behemoths ADP and Paychex. Paycom has been accompanied in this quest by high-tech peers Paylocity (PCTY) and closely held BambooHR, and has been buttressed by secular job growth trends in the US small and medium business sector. But Paycom is no longer a $100 million annual revenue upstart, and neither are its peers. At $1.4 billion of run-rate recurring revenue, the company is a scaled business, and combined with Paylocity, Bamboo, and other dynamic tech companies in the sector, the group’s share of the SME payroll market is north of 40%. That’s a lot more than the blue-sky implications of Paycom’s 5% market share claim, and it means that further market share gains will be a lot more difficult going forward.

At the same time, ADP is fighting back, increasing its customer retention rate and growing its employee rolls. Rippling and Gusto, two rapidly growing startups in the space, have also recently raised capital at $10-billion-plus valuations, and are actively fighting for market share. All this means that the competition faced by Paycom is about to get a lot tougher. If that weren’t enough, US employment growth looks to be decelerating at a fairly significant clip, which means that all the payroll players will be fighting in a smaller field. For a SaaS company with an astronomical valuation like Paycom’s, price cutting is probably not something investors are accustomed to thinking about, but they might soon have to.

The corporate culture at Paycom is cutthroat. That’s partly reflected in the aggressive accounting strategies employed by the company that we believe materially overstate the profitability of its business. It’s also apparent in Paycom’s sales culture, which features questionable sales tactics (some of which have led to regulatory settlements), rapid sales rep turnover, and bare-bones customer service. That may have served Paycom well as a small unknown taking on industry giants, but as the pieces of a slowdown come together and competition intensifies, increased customer service costs will likely hamper margins. Yet the stock’s current valuation leaves little room for error. When a bubble pops, as the tech bubble has over the past year, not all stocks crash simultaneously. Some former darlings, like Zoom Video Communications Inc (NASDAQ:ZM), Docusign Inc (NASDAQ:DOCU), Twilio Inc (NYSE:TWLO) and many more, have already seen their multiples decimated as investors transition to more realistic business expectations. Other darlings, like PAYC, still remain in bubble territory. The national job losses that are likely to accelerate over the remainder of the year may very well serve as the catalyst to bring PAYC’s share price back to reality.

I. Investment Highlights

Paycom’s valuation is absurd and fails to reflect the ongoing SaaS retrenchment. Paycom trades at about 75x the consensus estimate for Fiscal 2022 free cash flow, which itself is probably too optimistic. This year has seen the collapse of no-profit tech stocks along with their Covid beneficiary peers, but the relatively predictable and cashflow-positive companies – Paycom included – have been largely spared. We don’t expect that to last, as the slowing economy and tech-stock rout result in decelerating sales growth and operational deleveraging. Additionally, institutional investors that were mocking traditional fundamental valuation methodologies have become much more sober in their optimism, now looking to fundamentals to guide their capital allocation. The companies most at risk in that context are the ones with valuations that are most disconnected from their intrinsic fundamentals, and Paycom tops that list, with its valuation on both free cash flow and EBITDA richer than any of its peers, while its sales growth and profitability metrics are mostly just in line (and that’s before considering aggressive accounting or its overearning).

Paycom faces significant near term challenges including escalating competitive intensity, slowing employment growth, and a butting up against the limits of its TAM. If an unfavorable equity market context isn’t enough, we expect Paycom to face some fundamental challenges in maintaining its revenue growth rate. The first will be slowing employment growth, which is happening as we speak. Given the company’s leverage to payrolls (it does sell SaaS-based payroll processing services after all), we expect the decelerating employment environment to filter through into Paycom’s revenue growth. At the same time, a detailed analysis of Paycom’s customer base and end-market shows that, in contrast to the company’s insistence on a still-long runway for market share gains, a more realistic definition of the company’s TAM implies that the market is a lot more saturated than management has claimed. While management estimates Paycom is just 5% penetrated in its TAM, we think that number is a lot closer to 20%, with Paycom’s rapidly growing SaaS competitors also having captured about 20%. At the same time, the dominant legacy leader in the field, ADP, has retrenched and gone on offense, with early signs indicating that its new client wins and current-client retention are both looking up.

It's also worth noting that several of Paycom’s SaaS competitors – particularly Rippling and Gusto – are privately held companies that recently raised capital at astronomical $10 billion-plus valuations. They are now putting that newly raised money to work, aggressively trying to win customers.

Overall, Paycom finds itself in a field that’s smaller than investors thought, with upstart competitors more aggressively fighting to gain territory, while the legacy giant that just ceded some of its own territory has begun to fight back in earnest. It should be unsettling for Paycom shareholders, especially given the resilience of the consensus estimate trajectory, which looks to be vulnerable to a rapidly worsening jobs backdrop.

Paycom’s corporate culture is aggressive to a fault, resulting in misleading financials and overearning operations. Among its software peers, Paycom converts its EBITDA to free cash flow at the lowest rate. A close look at its accounting methodology reveals that as it relates to management’s discretion to make critical accounting estimates, Paycom takes some very aggressive positions. In particular, we think its accounting for deferred contract costs and capitalized R&D overstate the company’s EBITDA margins by over 10%, making operating profitability seem much better than it actually is. EBITDA itself is overstated by approximately 50%, relative to an EBITDA that would be reported if Paycom employed a more reasonable and industry-standard approach to deferred contract costs and capitalized R&D accounting methodologies. As a result, headline EBITDA multiples for PAYC are misleading, and on a free cash flow multiple basis, the company is much more expensive relative to comparable companies than it is on an EBITDA multiple basis.

It also reflects a clearly uncompromising corporate culture that has sometimes, in our view, come too close to the thin line between questionable practices and something more nefarious. Indeed, the company’s aggressive culture is also manifested in its high-octane sales organization, which, while it has been wildly successful growing the company, has also left behind it a trail of questionable practices, including overbilling, decrepit customer service, and high sales rep turnover. The customer service aspect is interesting because it suggests that Paycom’s real sustainable earnings levels are even lower than they seem because as growth matures, customer service spend will have to increase substantially.

Within a slowing employment growth context, facing increasing competitive intensity, and trading at a precarious valuation, that’s a risk Paycom’s shareholders may become acquainted with sooner rather than later.

II. Company Background

Founded in 1998 by Chad Richison in Oklahoma City, Paycom was one of the first companies in the business of human capital management (HCM) to have accomplished payroll processing entirely online. Richison took Paycom public in April of 2014, and since then Paycom’s revenue has grown from $107 million in 2013 to just over $1 billion in 2021. Over that time, Paycom’s shares have risen by about 20-fold for a compounded annual growth rate of about 45%.

Paycom, and other HCM companies that operate a SaaS business model, have been able to achieve this astounding revenue growth mainly by taking market share from the large payroll service providers, which have historically been dominated by ADP and Paychex. Paycom attributes the success it has had in gaining market share to its user-friendly software, which allows for easy and quick adoption of its solution by its customers’ employees, who can manage their HCM activities seamlessly in the cloud, thereby reducing the administrative burden on employers and increasing employee productivity. The company has also long highlighted its single underlying database as a competitive differentiator as it removes the need to integrate, update or access multiple databases, which are common issues with competitor offerings that are frequently cobbled together from multiple third-party systems in order to link historically disparate HCM offerings.

Paycom’s securities filings have most recently designated its addressable market as US employers with 50-10,000 employees, though management has more realistically quantified its target customer as any employer with 50-2,000 employees. As of the end of 2021, Paycom stored data for approximately 5.7 million employees among 34 thousand clients on its platform, for an average of about 168 employees per client.

Read the full report here by Kerrisdale Capital.