Opus Capital Management’s review of the U.S. small caps for the month of February 2018.

Check out our H2 hedge fund letters here.

Key Points

After its strongest start to a year since 1989, the market quickly reversed in February, as the potential of four rate hikes became the easy scapegoat. With this, the VIX catapulted to an intraday high of 50.0, ultimately reverting back to its historical average of 19.0, as investors learned that volatility was being suppressed by inverse VIX ETFs. February ended the S&P 500's streak of closing positive for 15 consecutive months, a statistic not seen since 1981.

At the beginning of 2017, there was a large reversal in themes relative to the prior year. Conversely, this year, has continued to see last year's themes work in both January and February, i.e., U.S. large beating U.S. small and Growth over Value. Common conception is that rising interest rates tend to bode better for small than large, but this did not pan out in February, as the S&P 500 has now outperformed the Russell 2000 Index (R2K) for five straight months. After a dominating performance last year, Growth, which outperformed Value by 14.4%, continued its market leadership, besting Value by 4.7% year-to-date.

With analysts updating estimates to reflect tax-reform, growth expectations have begun to rise, leading to decreasing valuations within small caps. With weaker relative performance and strong revisions, the R2K now trades at a discount to the S&P 500, below its historical 5% valuation premium. The R2K trades at a forward P/E of 17.2x, its lowest level since April 2016.

From a factor basis, the market continued to reward the fastest growing EPS companies, which helped boost Growth over Value. More pronounced, sector performance has also contributed to Growth's relative outperformance. The Russell 2000 Growth Index (R2KG) tends to be overweight in Technology and Health Care, both of which have performed well this year, while being underweight bond proxies, REITs and Utilities, which have significantly underperformed.

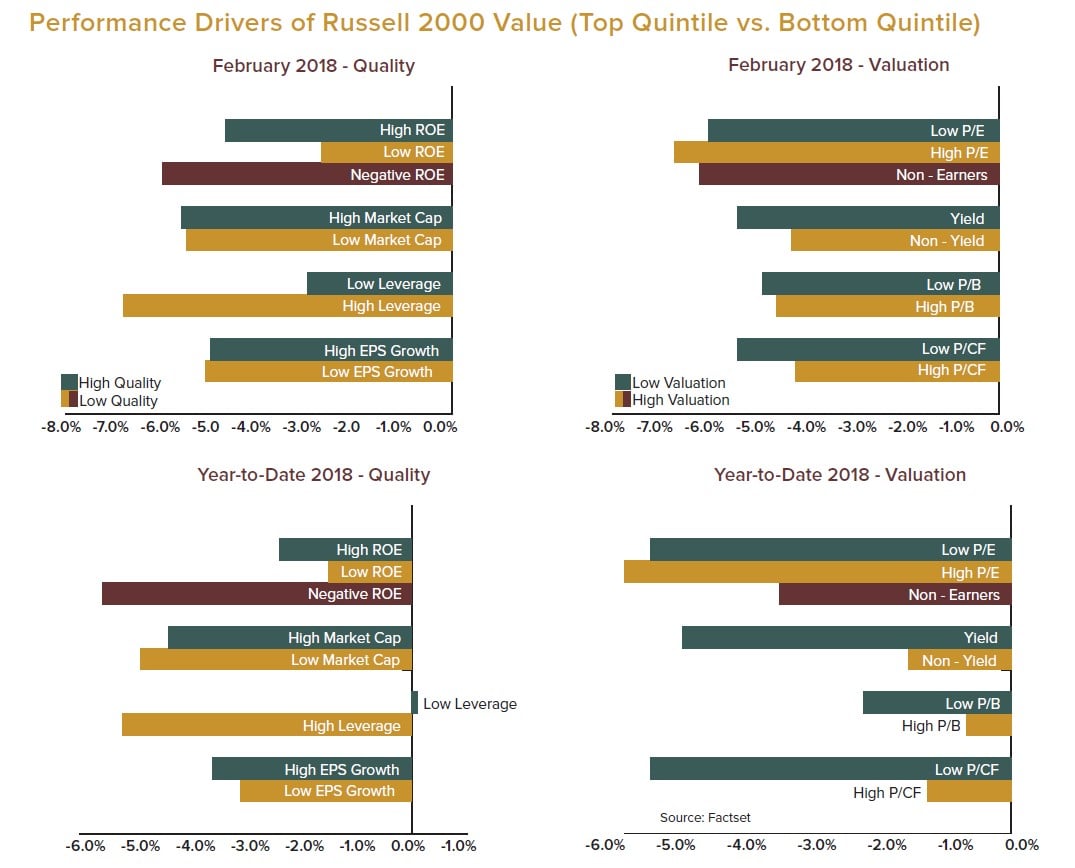

When interest rates rise, companies with lower leverage typically outperform, which was the case during the month. Outside of this factor, the market did not favor any particular style, which can possibly be explained by the spike in ETF trading. Historically, increased volatility tends to lead to increased trading volumes, which occurred in February. However, much of this increase in volume took place across ETFs, not individual securities. January ETF volumes represented 16% of total trading, while in February, on days with increased volatility, this figure surpassed 27%, potentially lowering the tide for all constituents. For the year, low quality continues to outperform, much like 2017, as the market has favored non-earners, non-yielders and the lowest ROE.

With rising rates and increased volatility, active style managers performed well in February. Managers tend to benefit from higher rates as the group is underweight bond-proxies, i.e., Utilities, REITs, and Staples, all of which, underperformed during the month. For the month, 26.9% of small cap core managers outperformed their relative benchmarks, while Value and Growth managers fared better with 48.8% and 62.7% outperforming, respectively.

Review Of U.S. Small Cap Value

About Opus Capital Management

Opus Capital Management, based in Cincinnati, Ohio, is a 100% employee-owned registered investment advisory firm specializing in high-quality investments. Opus offers separate account management for public funds, corporations, endowments, foundations, Taft-Hartley and registered investment companies.

Opus’ investment solutions leverage decades of experience discovering value in high-quality companies and include:

Follow Opus on LinkedIn and Twitter, or subscribe to the Insights Blog, for regular updates and insights from the firm’s portfolio

managers and research analysts.