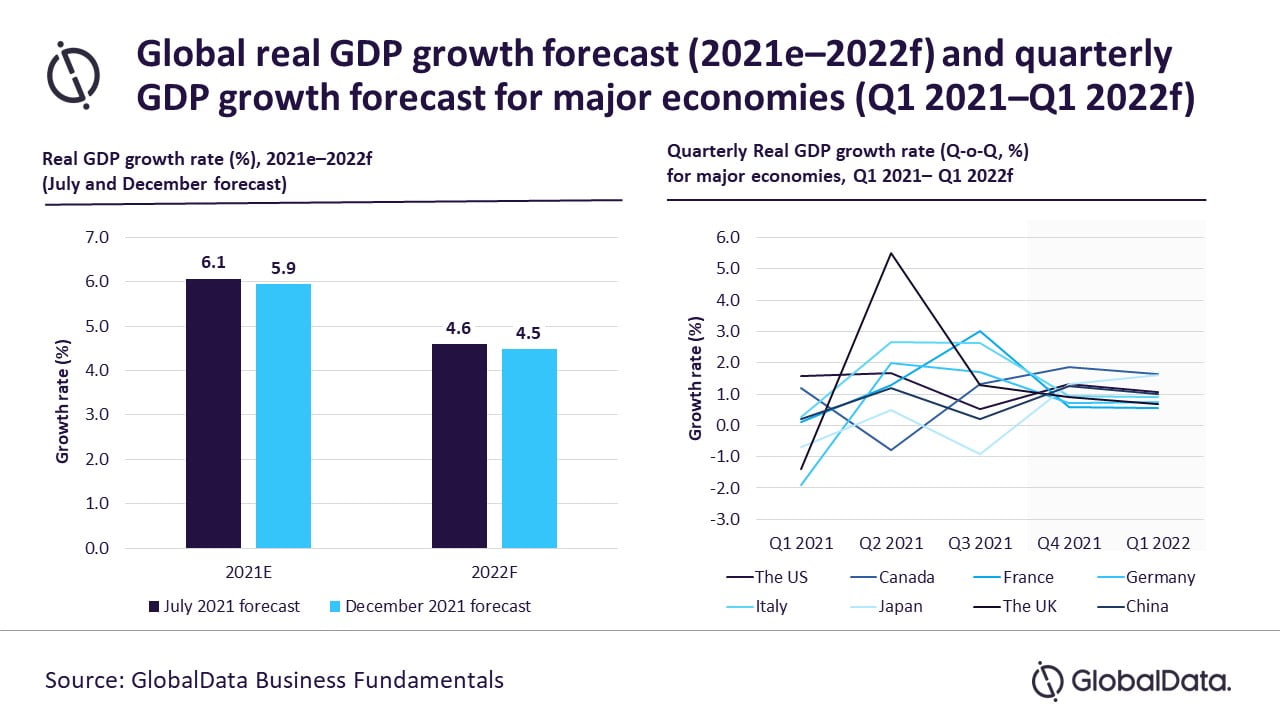

Despite visible green shoots in key macroeconomic indicators in the first half, the emergence of new COVID-19 variant Omicron and its fast spread has made the global economic recovery increasingly uneven towards the tail end of 2021, due to which GlobalData, a leading data and analytics company, has revised down the global economic growth forecast for 2022 from 4.6% in July to 4.5% in December 2021.

Q4 2021 hedge fund letters, conferences and more

Omicron Is A Downside Risk To Global Growth

GlobalData forecasts the US real GDP growth to be 1.1% in Q1 2022 compared to 1.3% in Q4 2021. With challenges to supply chains and high infection rates, the UK’s real GDP growth is forecasted to slow down to 0.7% compared to 0.9% during the same period. On the other hand, with additional support from the government, Japan’s growth is expected to rise from 1.3% to 1.6%.

Gargi Rao, Economic Research Analyst at GlobalData, comments: “The rapid spread of Omicron in more than 100 countries along with rising global inflation rates, energy crisis stemmed out of coal shortages, political tensions and slowdown in manufacturing output amid chips shortage remain the major downside risks to global growth in 2022.”

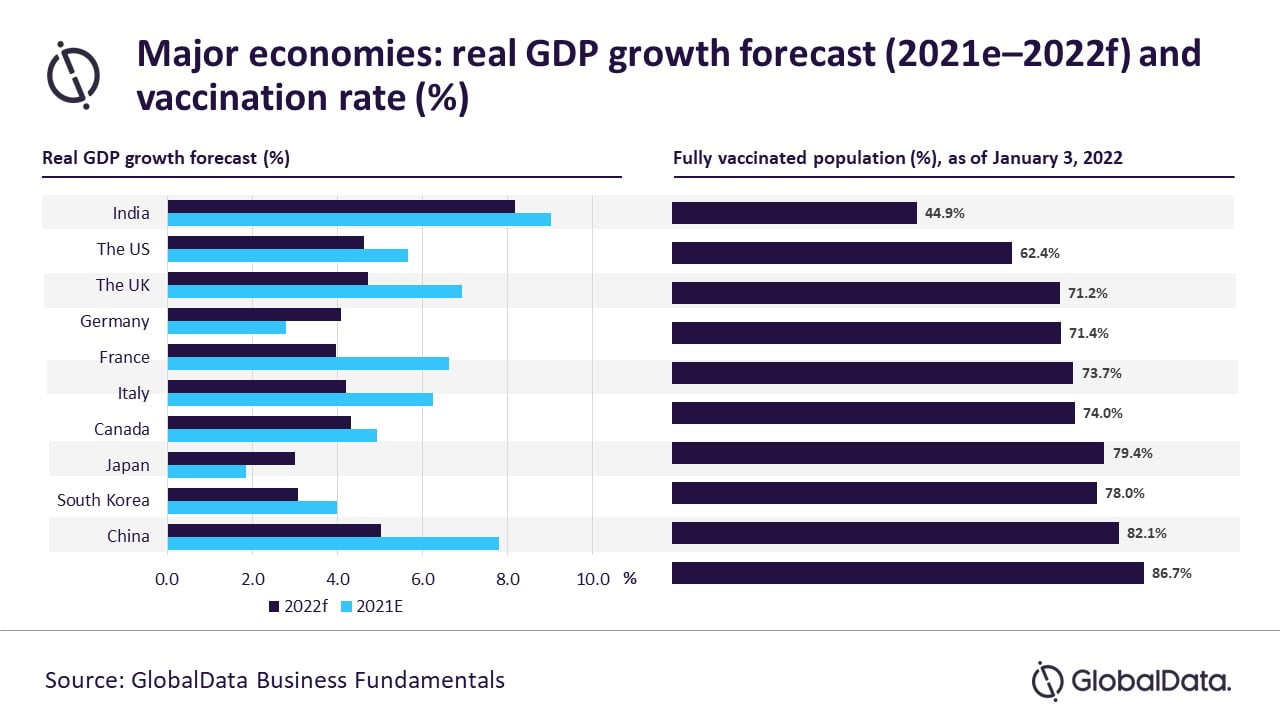

Advanced economies including the US, the UK and other European countries are losing momentum in terms of economic activity, which strongly picked up in H1 2021. Emerging markets continue to underperform due to uneven vaccination drive, less room to maneuver for additional policy support, as well as the Chinese economic slowdown.

Rao continues: “Despite the risks and the expected slowdown in economic growth, India and China are expected to drive the global growth in 2022. On the other hand, the Federal Reserve is expected to tighten monetary policy measures to tame high inflation levels may result in capital outflows from emerging nations.”

Flight Cancellation

During December 2021, around 12,000 flights were cancelled globally owing to surge in Omicron variant cases and staffing issues. Tourism dependent economies are expected to face major headwinds to growth prospects in early 2022 with re-imposition of restrictions. However, the disruption will be short lived as travel plans are postponed. GlobalData travel and tourism database forecasts the number of air passengers globally for long haul and short haul to grow by 44% and 48%, respectively, in 2022.

As we progress to 2022, supply chain bottlenecks are expected to ease with production picking up. The overall business outlook remains positive, but Omicron scare, and tight monetary policy might cloud investments. In addition, a premature withdrawal of policy support could undermine the global recovery and increase private and public sector vulnerabilities in early 2022. The pull back of public spending in 2022 in most of the countries might put brakes on economic activity.

Rao concludes: “The risk to global economic recovery in 2022 seem balanced. Globally, households have accumulated huge savings, which once invested will drive up economic activity. Moreover, countries like China and India are investing in green energy, which could attract more investments from the West. The approval of The Regional Comprehensive Economic Partnership (RCEP) deal is expected to bolster trade opportunities in the Asia-Pacific region. The need of the hour is to have clear supervision by fiscal and monetary authorities on their policy strategies, which will be crucial to maintain market confidence and public support.”

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.