According to new data from quant asset manager O’Shaughnessy Asset Management (OSAM), value stocks are potentially setting up for an extended run of outperformance.

Value Stocks Set Up For An Extended Run

OSAM Portfolio Manager Ehren Stanhope, CFA, discusses the findings:

Q2 2022 hedge fund letters, conferences and more

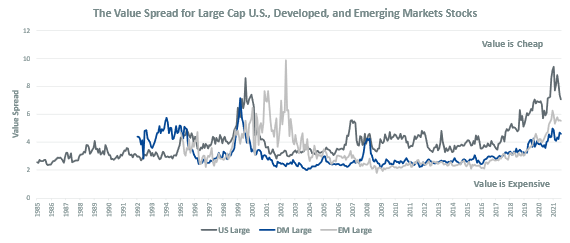

- At the close of 2021, value stocks were cheaper relative to growth stocks than at any point in the past generation

- After a previous period of comparable price dislocation in the late 1990s, value stocks outperformed growth stocks from roughly 2000 to 2007

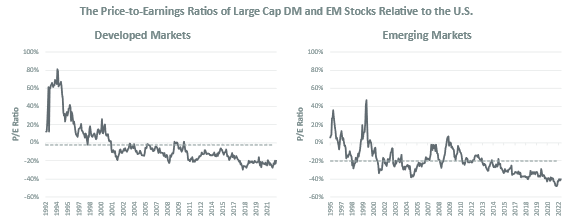

- At present, large cap Developed Markets and Emerging Markets value stocks are historically cheap relative to U.S. value stocks

NOTE: To generate the value spread, OSAM ranked global large cap stocks across the U.S., Developed, and Emerging Markets by sales, cash flow, and earnings relative to price. Next, OSAM compared the rankings to the P/E ratios of the stocks to arrive at the spread between the cheapest and most expensive stocks. A higher spread suggests value stocks are cheap relative to growth stocks.

A subsidiary of Franklin Templeton (BEN), the OSAM team manages the O’Shaughnessy Market Leaders Value Fund (OFVIX).