Key Points

- Nano Dimension prereleases record Q1 results, and shares move sideways.

- A deal to acquire Stratasys has been rejected twice.

- Large shareholders and a proxy battle pose the biggest risk at this time.

- 5 stocks we like better than Nano Dimension

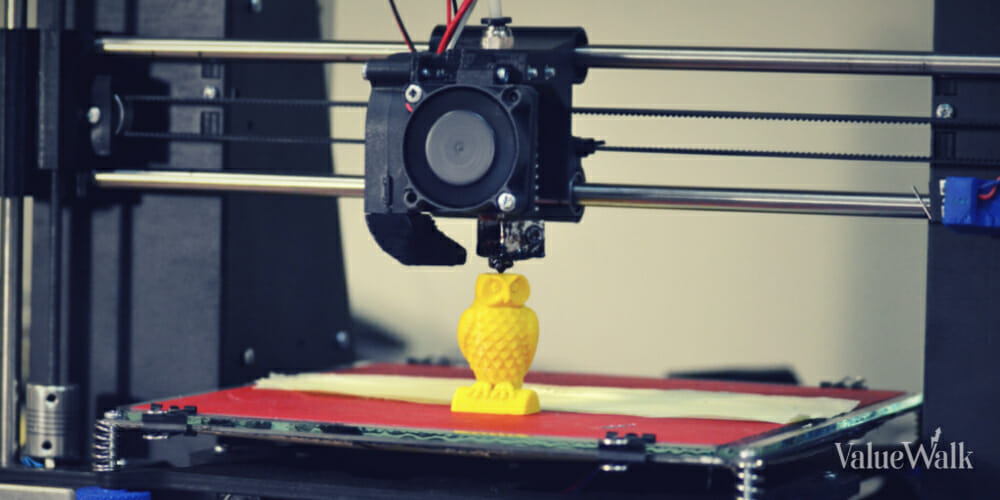

The 3-D printing market has been slow to take hold, but it is taking hold, and Nano Dimension (NASDAQ:NNDM) is capitalizing on the event. The company offers a range of manufacturing solutions based on 3-D technology, including embedded solutions such as microchips and other components.

Q1 2023 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

This means businesses and industries can harness deep learning and AI for manufacturing, and there are multiple benefits. Among the benefits are a cleaner footprint, more uptime, better yield and real-time correction of manufacturing defects.

Micro-Cap Nano Dimension Pre-Releases Q1 Results

Nano Dimension caught the attention of investors when it pre-released results for Q1. While the actual results may vary from the release, management was confident in letting the market know that Q1 revenue is up 40% YOY and 21% sequentially and outperformed expectations.

The quarte will be the strongest on record. Based on the need for next-gen manufacturing capability, growth should continue on a sequential basis indefinitely.

“The last quarter of 2022 was “our best quarter ever” at that time. The first quarter of every year is expected to be, traditionally, weaker than the rest of the quarters. However, due to a record organic growth of our DragonFly IV revenue as well as best quarterly revenue in Additive Electronic and Software and Hardware Ink Management Systems, the first quarter of 2023 is now, “our best quarter in revenue, ever.”

It is a manifestation of our organizational development and our sales and marketing efficiency,” said Yoav Stern, Chairman and Chief Executive Officer of Nano Dimension.

Nano Dimension To Acquire Growth

Nano Dimension is on track to grow organically and via acquisition. The target is Stratasys (NASDAQ:SSYS), a manufacturer of 3-D printing systems and materials. The original and subsequent bids were declined by Stratasys’ board which believes the offer substantially undervalues the company.

Analysts at Stifel concurred with the rejection; they have a Buy rating on SSYS stock, and the consensus target of $21 is a 7.5% premium to Nano Dimension’s offer. No analysts have ratings on NNDM, but the institutional activity is interesting.

The institutions own about 25% of the stock, and holdings are broad. This shows a high level of interest but a low level of conviction that may change as the company grows.

The most significant risk for Nano Dimension is a battle with its largest shareholder Murchinson. Murchinson says it has support to remove 4 board members, including the director and CEO Yoav Stern. Murchinson and another large shareholder, Anson Funds, oppose Stratasys's proposed takeover, among other issues.

One of the concerns is that management would be using most of the company’s cash resources which would put it in danger. Nano Dimension CIO Moez Kassam dismissed the allegations saying the company is over-capitalized for its operating needs.

The Technical Outlook: This Might Be The Bottom For Nano Dimensions

The price action in Nano Dimension popped on the pre-release news but has sold off since. The stock appears to be at a bottom, but a soft bottom that may lead to lower prices if there is no positive change in sentiment or news.

Assuming the company can build on its momentum, it may effect a complete reversal, but until then, investors should expect this stock to trend sideways at best.

Should you invest $1,000 in Nano Dimension right now?

Before you consider Nano Dimension, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nano Dimension wasn't on the list.

While Nano Dimension currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

The post Nano Dimension Prints Growth: Enters Hypergrowth Phase appeared first on MarketBeat.