MCB stock regained ground after management responded with details on financial condition

Shares of Metropolitan Bank Holding (NYSE:MCB) fell 27.6% in trading on Thursday after a short report from Vidar Research suggested MCB is a “failed bank” that is taking on too many high risks. Vidar believes MCB will suffer the same fate as SIVB and SBNY.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

By 10 p.m. on Thursday evening, management of the bank holding company for Metropolitan Commercial Bank issued a statement on its financial condition, stressing that "asset quality remains strong." MCB stock clawed back much of that decline, 20.6%, in after hours trading.

Vidar suggested in the report that Metropolitan is bleeding deposits, with a balance sheet that is shockingly comparable to the failed Signature Bank (OTCMKTS:SBNY).

MCB is the issuer of choice for prepaid debit cards of crypto firms, but recently announced a move away from crypto. Vidar questioned what is really happening at the company? MCB's payment product essentially consists of a digital wallet solution tied to prepaid debit cards.

Vidar noted that MCB has followed the footsteps of failed Wirecard, offering crypto debit cards to firms including TenX and Crypto.com.

Vidar pointed out that offering prepaid products to Crypto.com is not illegal or problematic but suggests the move was made to acquire deposits and lend them at high yields to real estate developers.

MCB at the beginning of this year declared that they would discontinue serving cryptocurrency clients following the bankruptcy of one of their customers, Voyager.

Management's Response

MCB's total risk-based capital stood at 13.4% and 13.1% for the company and bank, respectively, well above regulatory minimums at the end of 2022, according to its statement last night.

As of March 29, 2023, its total core deposit verticals increased by 5.4% to $5.04 billion, with insured deposits accounting for 66% of total deposits, up from 60% at the end of 2022.

Liquidity remained strong, with cash on deposit with the Federal Reserve Bank of New York of $3.1 billion which equates to 170% of unsecured deposits.

MCB also highlighted its exit from the crypto vertical, which was not included in the total core deposits mentioned in the update. Crypto deposits reportedly accounted for 4% of total deposits and expects it to be near 0% by the end of the second quarter.

MCB ended the release by highlighting that office properties only accounted for around 10% of the total portfolio and an average loan-to-value rate of 61% across the portfolio which significantly mitigates risk.

Cue Insiders

One positive to come out of the falling MCB share price has been insider buying activity in the stock. There have been 10 net insiders from Metropolitan Bank that have purchased stock in the last 90 days.

These insiders have bought 0.3% of the float’s shares on issue during the period.

Fintel’s insider sentiment score of 88.67 is bullish on the company ranking MCB in 173rd rank, in the top 2%. out of 14,911 globally screened securities for the highest levels of insider buying activity.

It is usually a positive sign when company insiders purchase shares and put their own capital on the line.

Overblown Sell-off

JP Morgan analyst Alex Lau after reviewing the points in the short report and the financial update from MCB thinks the sell-off was substantially overblown today.

Lau maintained his overweight call on the stock, highlighting that he thinks the bank is oversold with its 42% discount to peers. JP Morgan's previously reported target price was $63 per share.

Fintel’s consensus target price of $81.60 suggests the stock could rise more than 130% over the next 12 months.

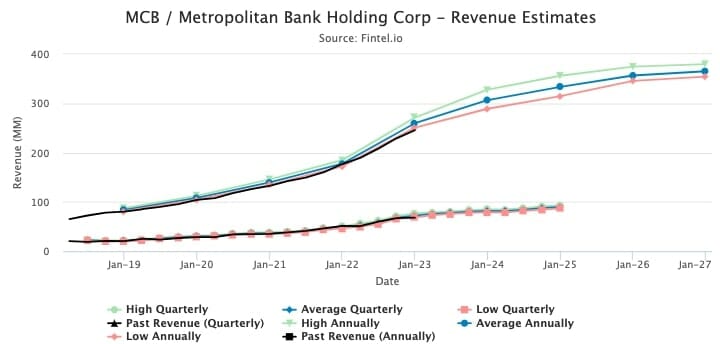

The chart below from MCB’s forward forecast page illustrates revenue estimates for the next five years. Analysts maintain a bullish outlook for the bank to continue growing sales on a medium-term outlook.

Article by Ben Ward, Fintel