Warren Buffett has said that even today, he could earn 50% or more a year if he had less money.

Opportunities In Undervalued Small-Cap Stocks

As strange as it may seem, having more than $130 billion of cash to invest at Berkshire Hathaway is actually a disadvantage to Buffett. With so much cash, he has to take big bets on large companies, and just can’t access the market’s best small-cap opportunities.

However, while Buffett has outgrown small caps, there are plenty of other highly experienced investors out there who are still able to hunt for undervalued small-cap stocks.

To find these managers and their ideas, ValueWalk set up the Hidden Value Stocks newsletter.

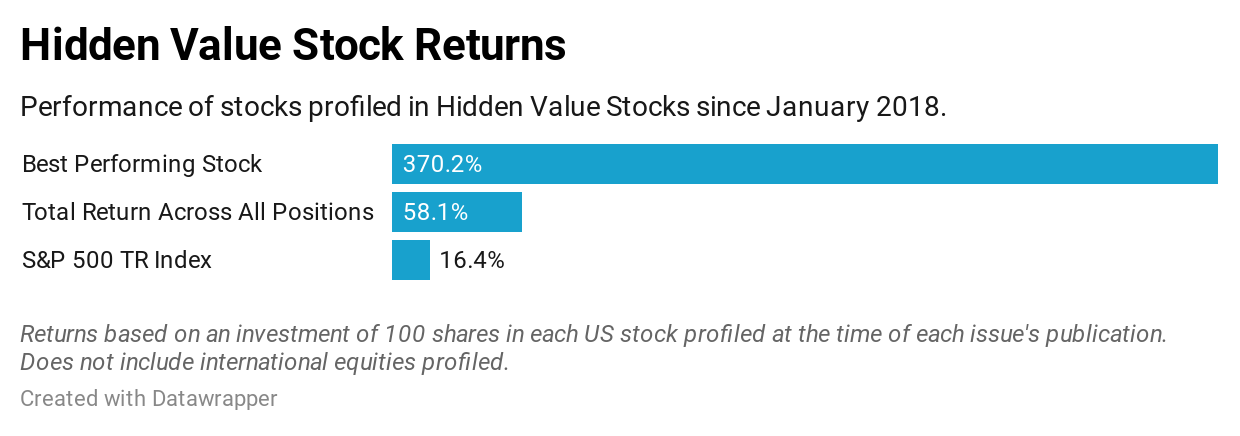

Outperformance Of 41.7% In Just Two Years

Hidden Value Stocks is a quarterly publication which profiles two hedge funds in each issue. Each of the hedge funds has a value slant and seeks to invest along similar lines as Buffett did when he set up his partnership.

Over the past two years the quarterly report has featured some of the best-performing small and mid-cap stocks on the market.

You can see the returns of the stocks profiled in the chart below.

Each newsletter subscriber not only receives a detailed investment thesis on each idea, but we also provide direct access to the funds profiled as well as their quarterly updates.

We have a special offer for new subscribers which expires on July 31..

You can sign up today for our yearly premium membership and cancel ANYTIME after our 5 day trial and pay ZERO also you will get our in depth studies on famous investors (several hundred dollars of value). Get 30% off using code VIP at checkout. Offer valid for next 10 subscribers or July 31, 2020, whichever comes first!

So, if you’re interested in signing up to Hidden Value Stocks, click here.

Have any questions? Contact us at [email protected] and we will be happy to help.

Sincerely,

Jacob Wolinsky and Rupert Hargreaves (both of ValueWalk)

HiddenValueStocks Inc., is jointly owned and operated by Rupert Hargreaves and Jacob Wolinsky in a 50/50 venture. We receive NO money from capital intros, advertisers, funds, etc. we are 100% devoted to finding what we consider among the best managers and profiling them as a win win for all sides. With that said you should see our disclaimer that notes among other things that we are not investment advisors nor is anything here a sell or buy recommendation.