Executive purchases and a $50 million private placement have the potential to turn up LYRA’s stock momentum

Friday’s impressive 13% surge in the shares of Lyra Therapeutics (NASDAQ:LYRA) carried over into the new week as investors pushed the LYRA stock price up a further 8.6% on Monday.

The big gains follow several key insider purchases of the clinical-stage biotechnology stock disclosed in Form 4 filings with the SEC.

The trades were initially spotted later on Friday evening via Fintel’s insider trading tracker, which produces a live rolling feed of transactions being submitted to the regulator.

These insider trades shed light on a recent equity financing deal announced on May 26. The latest developments have helped LYRA shares climb more than 40% from its all-time low in late April around the $2 per share range, as investor confidence has come roaring back in the stock. Even with this latest rally, shares are still down around 85% from the May 2020 initial listing.

Private Placement

Lyra’s management announced on May 26 that it had signed a deal with lead arrangers William Blair and Cantor Fitzgerald to raise $50 million in capital for the company by issuing new shares that were accompanied with pre-funded warrants.

Closing on the deal on June 1, Lyra’s President and CEO, Maria Palasis, was optimistic with the support received from their investors. “This financing strengthens our balance sheet beyond key milestones, including the completion of ENLIGHTEN I, with topline results anticipated in the first half of 2024,” she said in the company’s announcement.

The deal will see Lyra extend its anticipated cash runway through to the first quarter of 2025.

Palasis is slated to present at the Jefferies Healthcare Conference on June 7 at 10:30 am (ET).

Insider Highlights

Let’s take a closer look at which insider trades were highlighted on the Fintel dashboard.

The first insider on the list was North Bridge Venture Management. Lyra’s second-largest shareholder subscribed to 1,805,416 shares in the deal, adding a ~$4.5 million injection to the company. North Bridge extended its total share count ownership to 5.89 million after the transaction.

The second insider on the list was Lyra’s largest shareholder, Perceptive Advisors. The New York-based investment house bought 3.61 million shares, totalling a $9 million investment in the company. Perceptive extended its ownership dominance to 11.47 million shares after the transaction.

These insider purchases have undoubtedly fueled the positive investor sentiment towards Lyra Therapeutics.

Little Institutional Interest

Research on the Fintel platform revealed a lack of interest in LYRA stock from other institutions. The number of institutions on the holdings register declined by 10.5% during the most recent quarter, to 51.

In addition to this, the average portfolio allocation declined by 36.3% to 0.0528% which may be a cause for concern.

The Fintel Fund Sentiment Score of 14.35 ranks LYRA in the bottom decile out of 36,754 globally screened securities.

The chart below shows the largest holders of the group from the platform.

Analysts Impressed

Cantor Fitzgerald analyst Louise Chen said that the financing strengthened Lyra’s balance sheet beyond its anticipated milestones and provided flexibility for the company to advance its late stage candidates.

Chen also highlighted to investors that the next few possible catalysts could be the top-line results for the Phase 2 BEACON trial for LYR-220 in Q4 and top-line data for the Phase 3 ENLIGHTEN I trial for LYR-210 in the first half of 2024.

Fintel’s consensus target price of $12.58 suggests the Street thinks LYRA stock could rise more than three-fold over the next 12 months, back toward initial public offering highs.

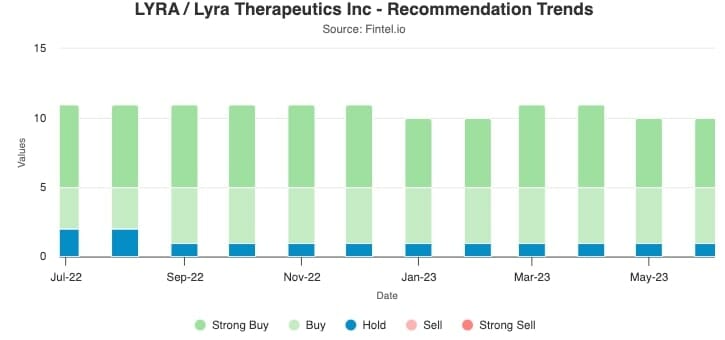

It is interesting to note that almost all firms have positive ‘buy’ recommendations on the stock as shown in the table below:

The post Lyra Therapeutics Extends Gains After Insider Transactions Disclosures appeared first on Fintel.