Despite the increasing influence of passive strategies, more than a quarter of the biggest institutional investors are planning to increase allocations to active managers and 60 percent are planning to leave allocations unchanged, according to a recent Blackrock study highlighted by the Financial Times.

Check out our H2 hedge fund letters here.

As the search for alpha is driving investors to seek active mandates, performance is often prioritized during the manager selection process. But how good of an indicator is above median performance for future success? We studied the eVestment Global Database to learn what proportion of managers who were above median in the prior three years remained above median in subsequent three years.

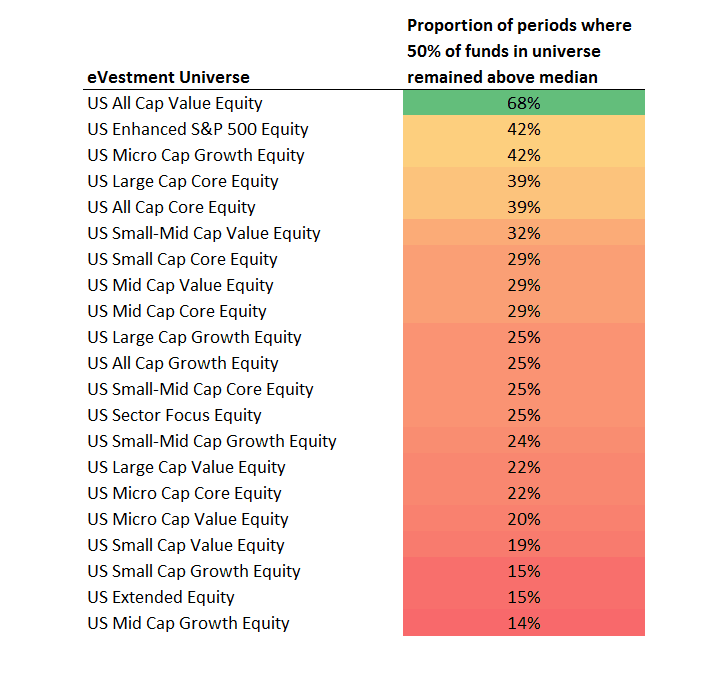

To get a more accurate picture and minimize bias, we looked at products that are actively reporting data to our database as well as those products which no longer regularly report. One observation was that how well funds can replicate their above median three-year performance in the next three years varies from universe to universe. When looking at performance data since 2001 for the U.S. Equity universe, only one out of 21 universes could repeat their outperformance in the following three years (Fig. 1). In Global/International Equity universes, 9 out of 28 universes outperformed (Fig. 2).

Fig 1: U.S. Equity Universes

Fig 2: International & Global Equity Universes

When trying to find the right active manager, institutional investors are often relying on a variety of information. If you are an investor who works with a consultant, their recommendations and approach will influence your manager selection process. You may also meet with managers directly and view their profiles in databases. With so many managers wanting to do business with you, finding ones that fit your need and asset allocation may be a challenging process.

If performance is not a good predictor of future success, what tools should you use to truly understand the difference between a handful similar strategies.

Evaluating a manager’s dedication to style

Most managers compare their performance and holdings to their benchmark index. By understanding how different a manager is from its peers, you may be able to uncover distinct differences. Use peer holdings data to learn if investment decisions are deviating from the stated investment style. Also, if you only compare a portfolio to the benchmark, you may fail to notice that despite high active share, a manager is quite like its peers. This is good to know if your primary objective is to find an active differentiated strategy.

Let’s say you have found U.S. Large Cap Growth manager with a concentrated portfolio of 20-30 holdings. To understand how different they are from competitors, you can ask the manager to explain the unique positioning of their portfolio compared to the index and their peers.

When comparing the strategy to the index, it is evident that the manager’s positions are significantly different (Fig. 3). The PM is clearly taking active bets in the various cap sizes. For instance, the percentages of the portfolio in the Large Cap Growth and Core spaces are significantly smaller compared to the index. It also seems like the manager is actively managing the amount of cash in the portfolio to take advantage of opportunities in the marketplace.

Fig 3: Evaluating Adherence to Stated Investment Style

As you can see, the peer universe looks a lot like the index. Being able to contrast the portfolio to both the index and the peer universe proves the manager you are considering is a truly active player with a unique investment philosophy.

Differentiating holdings compared to peers

The goal of active management is to create excess returns. Being able to analyze a manager’s stock selection compared to others will help distinguish whether or not they have a unique approach. For example, you can identify the ten most invested stocks in the Large Cap Growth universe and compare to the manager’s own holdings. For this example strategy, it is evident that the manager only holds three of the top ten holdings. In those three instances, the manager’s position differs significantly from peers with a significant overweight position in Apple and Visa, while holding a substantial underweight position in Alphabet.

Fig 4: Evaluating Stock Selection Compared to Peers

Article by Maria Simon, eVestment