In the world of investing, rebalancing refers to the process of adjusting assets in one’s portfolio in order to maintain a certain level of risk and the desired asset allocation. Rebalancing seeks to keep investors on track to reach their overall investment goals.

Q3 2020 hedge fund letters, conferences and more

Portfolio rebalancing has endured the test of time as a key component of any investor’s long-term investment plan. However, it is generally accepted at face-value and many investors are unsure of the underlying logic behind rebalancing.

- Is the goal to increase returns, reduce risk, or perhaps some combination of the two?

- When is it appropriate to rebalance?

While the answers may not be immediately obvious, in this piece we hope to clarify several of the key points as to why rebalancing is an integral part of any financial plan.

There are two overarching reasons why rebalancing is so important:

-

Table of Contents Show

Rebalancing Your Portfolio Helps Manage Risk

One of the key tenets behind asset allocation is the concept that not all asset classes move in the same direction at the same time. A well-diversified portfolio is crucial, as it helps to mitigate volatility according to an investor’s predetermined goals. However, asymmetric performance of a portfolio's positions can also lead to allocation drift, which will cause a portfolio's risk profile to veer from its strategic plan.

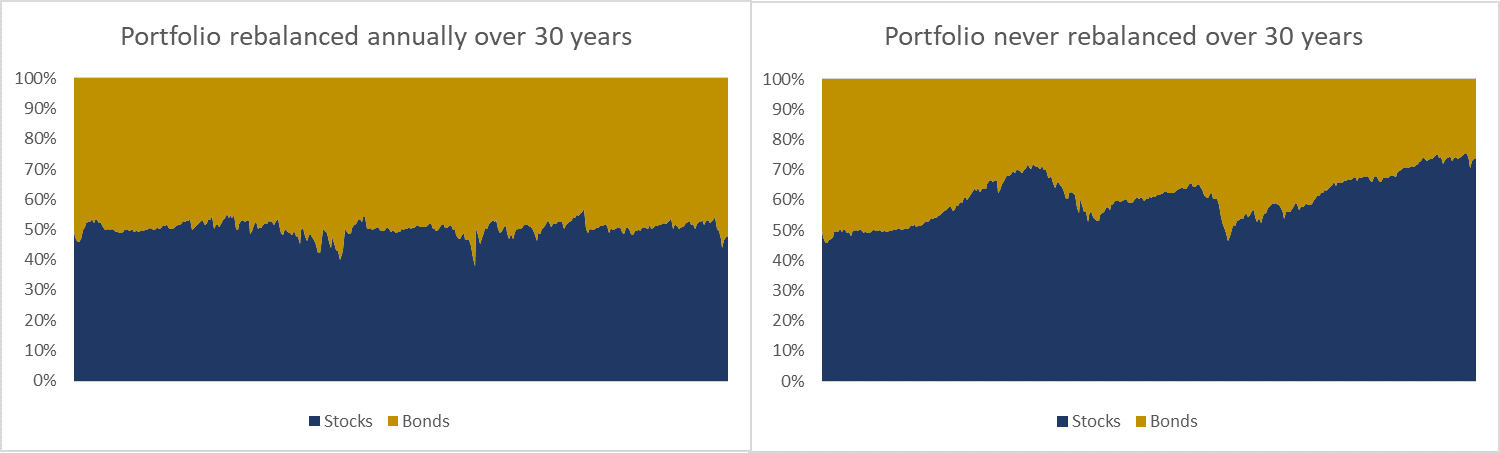

The chart below juxtaposes two portfolios that begin with a simple 50/50 mix of stocks and bonds. The first is rebalanced annually and the other is never rebalanced over a 30-year period. This highlights the "consequences" of allowing a portfolio to drift without rebalancing. If strategic weights are set and then simply ignored, risk is likely to increase over time, as equities play a more dominate role in the portfolio’s allocation. The drift is a direct result of equities having a higher risk premium (and therefore a higher expected return) than bonds. Of course, this is not a certainty, as portfolio risk may decrease over a given time frame. In either scenario, the risk profile of the portfolio becomes incongruent with its intentions.

The data is sourced from Morningstar Direct. For both charts, stocks are represented by the S&P 500, while bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index (USD hedged). Portfolios are initially weighted 50% stocks/50% bonds. The 30-year time period represented ranges from 7/1/1990 to 6/30/2020.

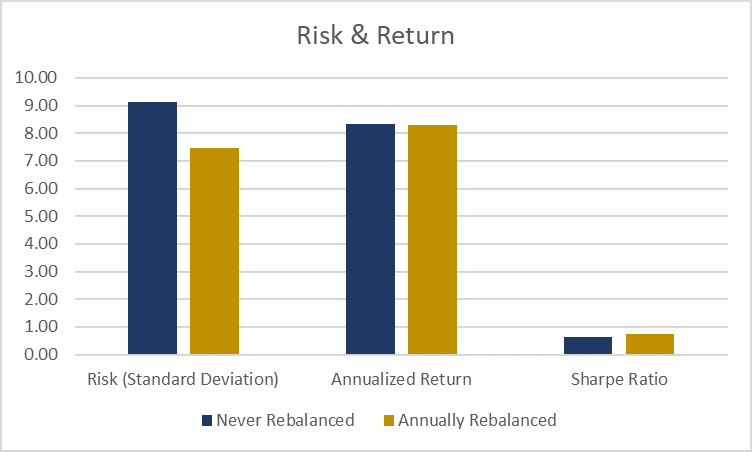

The next chart below shows the risk and return metrics of the same two hypothetical portfolios – one that was rebalanced annually and the other that was allowed to drift. Over the 30-year period analyzed below, rebalancing annually decreased the portfolio volatility (as measured by standard deviation), while giving up little in terms of return. This led to the portfolio that was rebalanced to have a higher Sharpe Ratio, a measure of risk-adjusted-return. We wouldn’t necessarily expect this scenario with little “give-up” in returns to play out across all time periods. As we previously mentioned, equities have a higher expected risk and return profile than fixed income, so there will certainly be scenarios where the drifting portfolio’s returns will exceed the rebalanced portfolio. The scenario chosen below is purely illustrative and excludes a number of real-world frictions, such as transaction costs, taxes, and management fees. Further, we believe in continuously monitoring portfolio rebalancing opportunities (as opposed to periodic evaluations). More on this later.

The data is sourced from Morningstar Direct. For both charts, stocks are represented by the S&P 500, while bonds are represented by the Bloomberg Barclays U.S. Aggregate Bond Index (USD hedged). Portfolios are initially weighted 50% stocks/50% bonds. The 30-year time period represented ranges from 7/1/1990 to 6/30/2020.

-

Rebalancing Helps Avoid Emotional Investment Decisions

Throughout an investor's lifetime, there will inevitably be multiple periods of heightened volatility. Whether this comes in the form of a short-term market shock or a prolonged recession (or even bull-market), oftentimes emotions undermine rationality and may cause clients to veer off their long-term path at the worst possible times. This would include reducing an allocation to risky assets (stocks) just after a steep sell-off, or over-allocating right after a significant run-up in value.

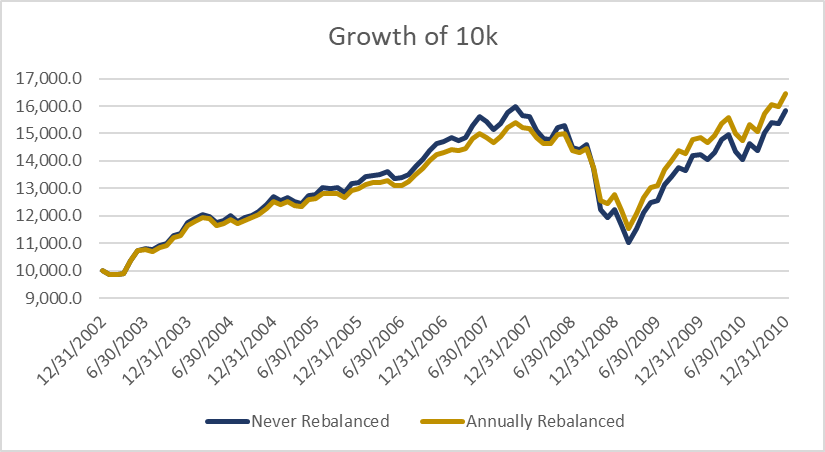

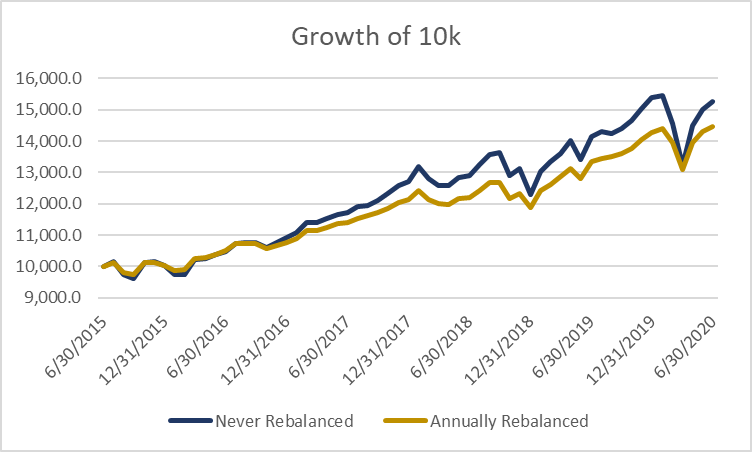

For example, we highlight two time periods below where markets saw steady rises prior to steep declines. In these examples, we see that the portfolio that is not rebalanced will outperform while stocks are rising, however that portfolio will suffer more severe drawdowns during the down markets.

We can see that during 2008, the portfolio that was never rebalanced suffered a severe drawdown that wiped away previous years gains. An investor would have been forced to stomach a much larger portfolio value loss at the time because they had not been periodically rebalancing back to their target weights as the market was rising.

We saw this again during the market selloff in March 2020 during COVID-19. A portfolio that had not been adhering to rebalancing practices would have suffered far greater downside volatility in March, making it that much more difficult for an investor to stay invested. Fortunately, there was that quick bounce back in the stock market, otherwise that downside volatility would have been that much more painful than an investor would expect from a “50/50 portfolio”.

This is not a form of timing the market or making tactical/short-term investment decisions. Rather, it is a rules-based methodology that turns volatility into your friend. Rebalancing, in essence, is simply the codification of the time-honored investment axiom, "buy low and sell high."

The Costs of Rebalancing

Now that we have reviewed the benefits of rebalancing, we must ensure that they outweigh the costs before taking any action. There are two primary costs to consider when rebalancing:

- Taxes – Assuming a security or asset class is held within a taxable account and has increased in value, rebalancing will cause a capital gain, on which taxes must be paid. It is an advisor’s job to mitigate the resulting tax implications to the best of his or her abilities. In order to facilitate this, one should focus on:

- tax-loss harvesting to offset capital gains,

- specific tax-lot trading or tax-lot optimization, which identifies optimal tax-lots that will cause the lowest tax-burden and selling winners from accounts that are tax-deferred to the extent possible.

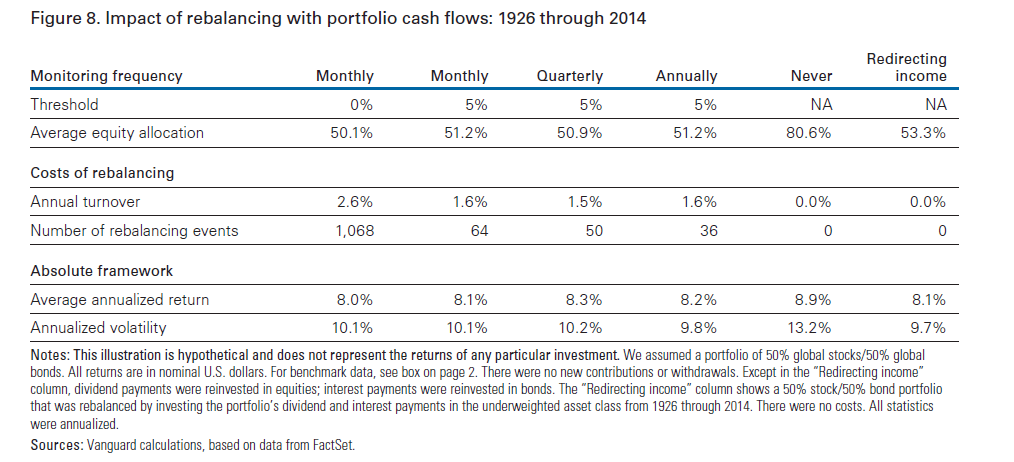

- Transaction costs – Keeping costs and fees low is one of the key tenets of our investment philosophy. As such, one must be highly considerate of turnover due to explicit (commissions) and implicit (spreads & market impact) costs. Even with extremely low commissions, it is necessary to avoid over-trading (also known as “churning”) portfolios, which can materially detract from long-term results. To further minimize transaction costs, we can potentially elect to have mutual fund distributions paid to cash (as opposed to being reinvested), which allows for a "natural" rebalance of portfolios over time. This is because rebalancing with cash flow generated by the portfolio is more cost-efficient than re-investing and then having to sell/buy to rebalance. The chart below from Vanguard highlights this, in the “redirecting income” column which is how they term this strategy.

Best Strategies for Incorporating Rebalancing

- Calendar Based – Predetermined, periodic rebalancing (ex. monthly, quarterly, annually)

The only "benefit" to this type of rebalancing is that portfolios do not have to be monitored for opportunities; they are rebalanced at specific intervals without regard to how much the portfolio has drifted from its strategic allocation. We do not subscribe to this methodology, because it effectively ignores the drift in asset classes. If a portfolio only moves slightly (or worse – not at all) over a year and an advisor rebalances, it is likely that it would leave an investor worse-off after controlling for the aforementioned costs. We consider this to be an "old-school" methodology.

- "Tolerance Band" Based – This approach, also known as "opportunistic rebalancing," "percentage-of-portfolio" or "percent range," rebalances portfolios once they reach a certain deviation threshold.

In our view, this methodology provides a much more favorable outcome, as significant deviations between asset classes are not necessarily dependent on time. To effectively employ this method, it is imperative to leverage technology that allows for continuous monitoring, while only making the decision to rebalance when it makes economic sense.

Unfortunately, there is no "optimal" threshold that can be applied to a rebalancing strategy. When making this decision, one must weigh the delicate balance between allowing an allocation to fluctuate from its strategic weighting by “letting winners run," and the transaction costs (taxes and transaction costs) associated with rebalancing.

In our view, implementing a rebalancing plan and adhering to it is far more important than trying to choose an optimal deviation threshold.

Weighing the Costs and Benefits of Rebalancing

Given that every portfolio has unique qualities, each with its own set of variables to consider, it is exceptionally difficult to quantify the benefits of rebalancing. Even though there are academic studies that attempt to do so within a theoretical framework, we hesitate to place a number on additional value added per year or extrapolating a specific range of "rebalancing alpha."

More importantly, the common denominator throughout the most prestigiously cited research is the overwhelming consensus that rebalancing in a prudent manner improves risk-adjusted returns over time when compared to a drifting portfolio. This does not ensure higher returns, however. It works very well during mean-reverting markets but can hurt during strong trending markets.

Well stated in Plaxco and Arnott's study from 2002, "These results indicate that rebalancing may or may not dominate a drifting portfolio mix in absolute terms, but rebalancing clearly dominates in risk-adjusted terms."

Final Takeaways

Investors are human and prone to emotional and behavioral biases. A sound rebalancing plan helps to ensure that investors stay the course and remain invested throughout volatile market cycles. As an added benefit, it may improve absolute returns, but that would just be a bonus.

During the past 20+ years of advising clients, this fact has become clear: clients do not increase the probability of success of reaching their financial goals by taking on higher risk in their portfolio.

Article By Michael Price, CFA® and Eric Sontag, CFA®

Wealthspire Advisors

Wealthspire Advisors is the common brand and trade name used by Sontag Advisory LLC and Wealthspire Advisors, LP, separate registered investment advisers and subsidiary companies of NFP Corp.

This information should not be construed as a recommendation, offer to sell, or solicitation of an offer to buy a particular security or investment strategy. The commentary provided is for informational purposes only and should not be relied upon for accounting, legal, or tax advice. While the information is deemed reliable, Wealthspire Advisors cannot guarantee its accuracy, completeness, or suitability for any purpose, and makes no warranties with regard to the results to be obtained from its use. © 2020 Wealthspire Advisors