“Put into perspective” – the monthly newsletter of Skenderbeg Alternative Investments AG – is an informative, thought-provoking, and entertaining tour around the financial world.

“Interest rates are prices, and the prices convey information. Price control distorts and manipulates and distorts and confounds the natural order of things, and you get unintended and adverse consequences.” – James Grant

Hedge Funds

Why we're in a "new era" for L/S and market neutral funds

We are entering a new era for long/short and market neutral funds as traditional markets come under pressure, Silver Time Partners' Romain Stephan has said. "What's new in the equity space in Europe is that central banks are tightening monetary policies and we are seeing much more dispersion in the equity space," he told Citywire Selector.

Stephan said since September companies disappointed markets creating a large drawdown.

"This hasn't been the case for the last five years," he said. "Every time there has been bad news from the market, central banks have come in and said: "Okay it's fine, we are here". This is over, and we have been witnessing a lot of drawdowns. For example, in the UK we have had companies like Centrica which is down 33%, after very poor numbers and we also have Dixon Carphone, which is down 45%, there is a lot of alpha generation we are now able to do on the short side.

The QE quandary

The most challenging thing at the moment, Stephan said, is the central banks quantitative easing. "It's been very difficult to position in the long-term books and avoid bad companies. With the QE program, the bad companies were really supported by central banks. There is the possibility of a drawdown in the US market which would cause all markets to drop. What we see is that we are coming out of a decade of central bank activism. We are coming back to a time when no central banks are interfering in the market, so for stock pickers in L/S strategies it's a very exciting time."

Stephan said the market has become all about supply and demand, which is highlighted by the fact central banks are no longer interfering as much in markets. He said trends will therefore be much easier to detect in the long term. "There will be stronger leaders in the market be-cause the economy is getting better month after month. There will be bad companies that will no longer have the support of the central banks and they will most likely end up in trouble," he added.

Citywire Selector

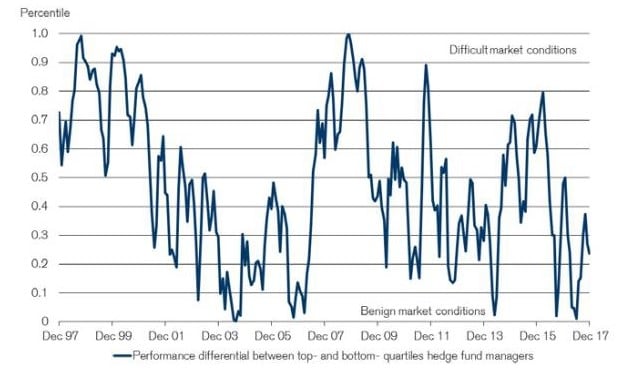

Performance differential between top and bottom quartile managers

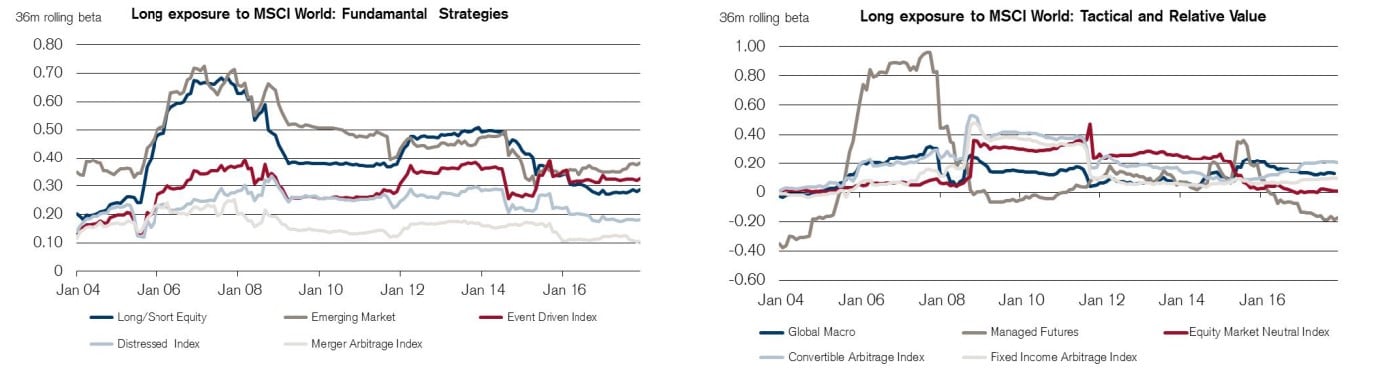

Long exposure to MSCI World

Hedge funds run by women outperform by 20%

Hedge funds run by women have outperformed the industry average by 20% over the last decade, piling more pressure onto a sector fre-quently accused of poor female representation at senior levels. The HFRI Women index, which pulls in the performance of hedge funds run by female managers, showed these funds returned 9.4% on average in 2017, pushing 10-year returns to over 70%. By comparison, hedge funds across all strategies and genders returned an average of 8.5% last year, and have generated returns of 50% since 2007, according to HFR.

The strong showing comes despite women representing just 14% of partner-level positions in global hedge funds, according to recruitment firm DHR International. In total, 47 funds make up HFR's women-only index, accounting for less than 1% of total industry assets. There are around 2,000 funds in HFR's general index.

At investment committee level, a quarter of hedge funds in the UK and Europe have no women-held positions at all, while in North America 44% of hedge funds have no women on their investment boards, according to KPMG's Women in Alternative Investments report published in December 2016. The auditing firm's data also showed female hedge fund managers have to fight harder than their male peers to raise capi-tal. KPMG financial services partner Camille Asaro wrote in the report: "Recent research has found that women fund managers, at least in hedge funds, do not obtain the same assets under management as their male counterparts despite comparable, or in some cases, better performance, when adjusting for all other factors."

Fewer and smaller: New Asia hedge fund starts have fallen in number and gotten smaller in size

Reviving sentiment: Global hedge fund starts outstripped liquidations for first time in two years

New hedge funds will embrace high tech

The hedge fund industry may be getting one step closer to its robot-guided future. Seventy percent of new hedge funds that will start next year will include investment processes that use computer models, including artificial intelligence and machine-learning technologies, accord-ing to a prediction in a Deloitte report released Thursday. That's a jump from 47 percent in 2015.

The new technologies process large, alternative data sets and hedge funds have increasingly turned to them to generate higher returns. That doesn't mean 2018 will be easy for the industry overall. Investment firms will continue to be pressured by regulatory risks and scrutiny on fees, according to the study. Their operating models will also struggle to keep pace with client preferences and technological advancements, it found.

Article by Skenderbeg Alternative Investments

See the full PDF below.